From being the preserve of large hedge funds and sophisticated traders, options have come into the mainstream. Many retail traders now use them to generate consistent income or to hedge their positions (as a risk management tool).

While the knowledge of options (especially stock options) is growing, thanks to platforms making them accessible to retail traders, many still don’t understand some crucial fine distinctions that are essential to successfully trading them.

One such distinction is call option vs put option. Ignorance about how they differ and which one is appropriate for a particular outlook on the stock market can lead to terrible mistakes that can result in significant losses.

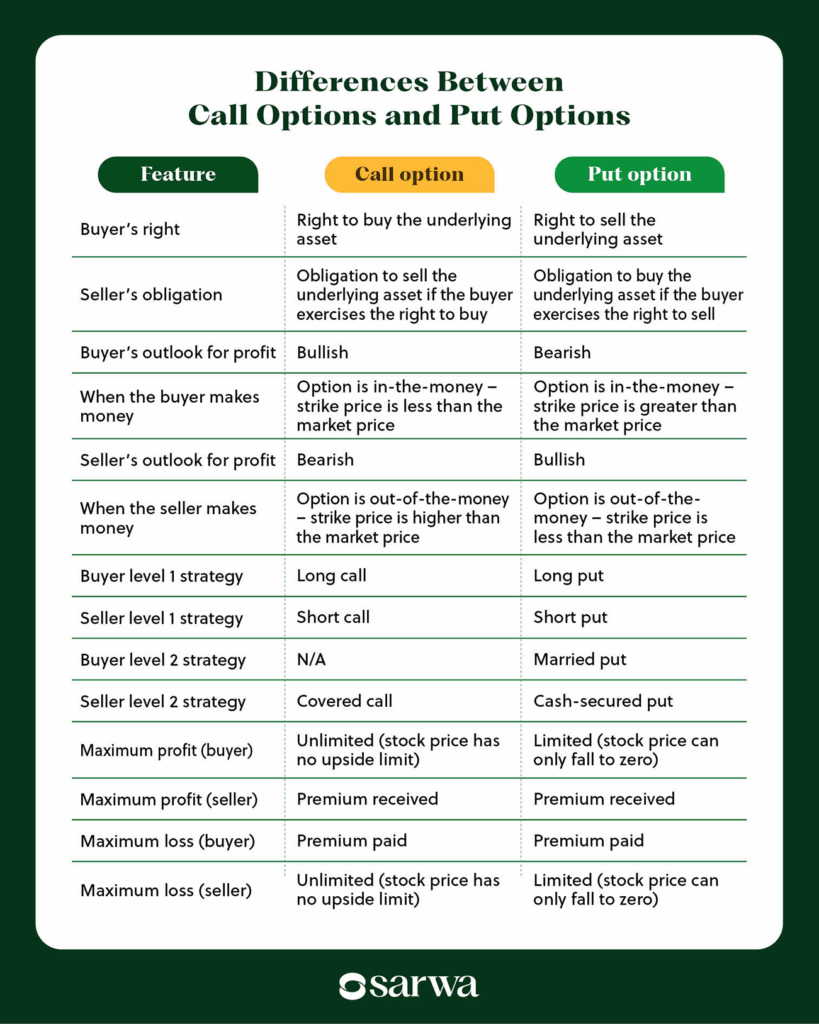

As the table below shows, there are at least 14 differences between call and put options. Some of these relate to the rights and obligations of buyers and sellers, how they make money, their outlook on the stock or ETF, and the appropriate strategies under each.

The rest of this article will explain each of these differences step-by-step in a logical order that will make it easy for you to understand each item on the table. At the end of the article, you will be ready to profitably trade call and put options.

We’ll cover:

- Call option vs put option: Introduction

- Put vs call option examples

- Call option vs put option: When to use them

- Call option vs put option: The strategies available with them

- Call option vs put option: Which is better for you?

Do you want to learn more about options (and other derivatives) and how to trade them in the UAE? Subscribe now to Sarwa’s Fully Invested newsletter for regular updates delivered straight to your inbox.

1. Call option vs put option: Introduction

To begin with, what are puts and calls?

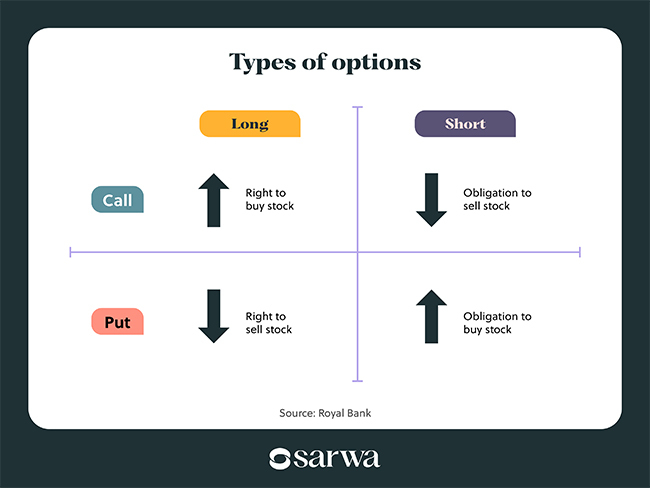

Puts (or put options) are contracts that confer on the buyer (option buyer) the right to sell an underlying asset (stocks and ETFs, for our purpose) at a predetermined price (the option’s strike price) on or before a particular date (the expiry date).

The option seller (who confers the right) will receive a premium (the option premium) as compensation.

When the buyer decides to sell the underlying asset (exercise the right or exercise the option), then the seller has an obligation to buy (act as the counterparty).

If the buyer does not exercise the right and the option expires worthless on the expiration date, the seller gets to keep the premium already received. This means the obligation of the seller is contingent on the buyer’s decision to exercise or not.

On the other hand, calls (or call options) are contracts that confer on the option buyer the right to buy an underlying security at the strike price (set price) on or before the expiry date.

As with puts, the option seller (also called the option writer) will receive the option premium as compensation.

When the buyer decides to exercise the right to buy, the seller must act as the counterparty by selling.

However, if the buyer does not exercise the right and the option expires worthless, the seller gets to keep the premium already received. This means the obligation of the seller is contingent on the buyer’s decision to exercise or not.

It is worth mentioning that a single option contract equals 100 shares of the underlying security. For example, one option contract for NVDA (Nvidia’s stock) equals 100 shares of NVDA. If the buyer wants the right to sell (puts) or buy (calls) 500 shares of NVDA, then he must buy 5 option contracts.

The major differences between a call option vs put option

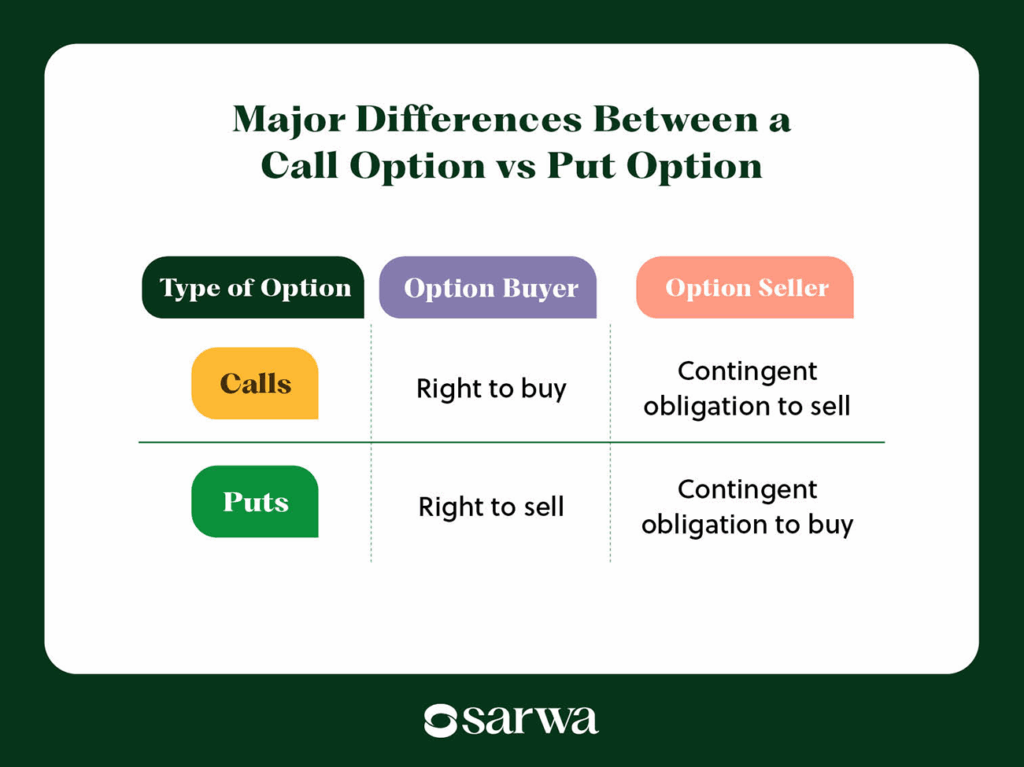

The first major distinction you need to know at this point is that while a call option gives the buyer the right to buy the underlying security, a put option gives him the right to sell it.

Secondly, from the perspective of the seller, a call option can result in an obligation to sell an underlying asset to the option buyer if the option buyer exercises the right to buy. On the other hand, a put option can result in an obligation to buy the underlying asset from the option buyer if the option buyer exercises the right to sell.

For a basic introduction to options, read “What is Options Trading in the Stock Market?”

2. Put vs call option examples

To clarify this distinction, let’s consider some put vs call option examples.

(Disclaimer: All the examples used are for informational purposes only and do not constitute investment advice about what stock options to buy or sell.)

Suppose Mariam and Zainab enter into a contract where Zainab confers on Mariam the right to sell 4 option contracts of NVDA with a strike price of $150 and an expiration date of July 30. The premium on this contract (the price of the option) is $2 per share.

Can you guess what type of option this is?

It’s a put option. You deserve a round of applause if you got it. Take a closer look at the table above if you didn’t.

This is a put option because it confers on the buyer (Mariam) the right to sell the underlying asset. If Mariam decides to exercise the right, Zainab will then have an obligation to buy from her.

Let’s consider a second example.

Suppose Abdul and Omar enter into a contract where Abdul confers on Omar the right to buy 2 option contracts of GOOGL (Alphabet’s stock) with a strike price of $200 and an expiration date of July 25. The premium amount is $2 per share.

This is an example of a call option. Omar has the right to buy, and if he exercises this right, Abdul will have an obligation to sell to him.

With the basic option put vs call distinctions out of the way, let’s consider how they are used. This will help us see more secondary distinctions between the two.

3. Call option vs put option: When to use them

Now that we know how calls and put options work, let’s focus on when to use them. In other words, when do buyers and sellers make money from using each of them?

When does a buyer make money from a call option?

Hope you still remember Mariam and Zainab?

To briefly recap, Mariam has purchased 4 call option contracts of NVDA with a strike price of $150 per share, a premium of $2, and an expiration date of July 30.

The question we are asking is what must happen for Mariam to make money from this contract. Since the call buyer will only exercise the right to buy if it’s profitable to do so, we are, in essence, asking what must happen for Mariam to exercise her right to buy.

If the contract allows Mariam to buy at $150, then it will only make sense to exercise the option if the spot price (the underlying stock price) is greater than $150.

Suppose the stock price is $170 per share on July 15. Mariam can choose to exercise the option by buying the stock at $150 per share from Zainab. She can then go to the spot market and sell the same stock at $170 (ignoring commissions and ask-bid differential for our purpose).

This will give her a gross profit of $20 per share and a net profit of $18 per share (after deducting the option premium). If she decides to hold instead of selling, she still has an unrealized net profit of $18.

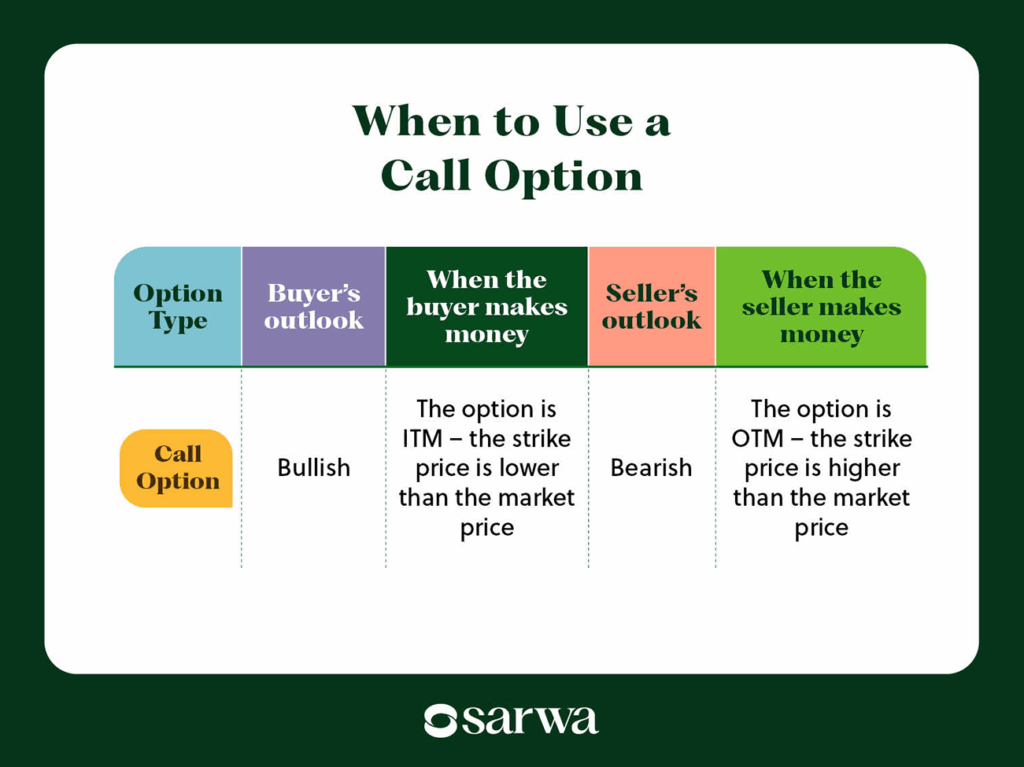

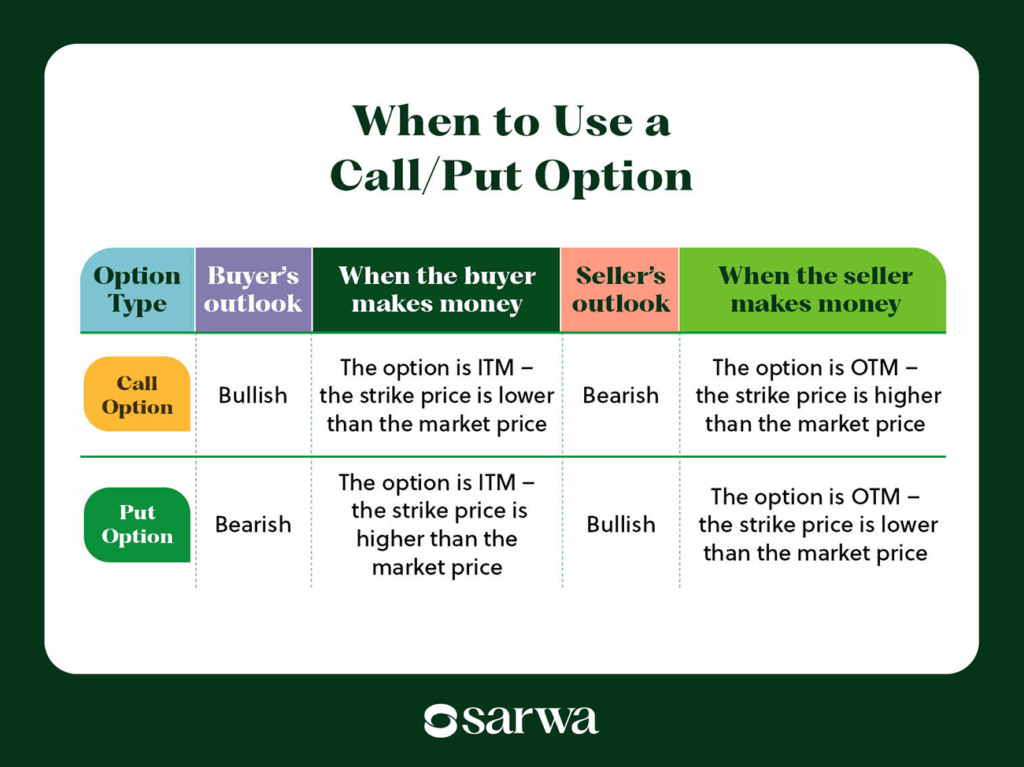

In other words, a call option is profitable for the buyer if the option’s strike price is less than the market price. When this happens, the call option is said to be in the money (ITM); said differently, it has intrinsic value.

Whenever an option is ITM, it is profitable for the buyer.

However, Mariam does not need to even exercise the right to buy before she can make money from a call option. Exercising the right to buy at expiration or before expiration (early exercise) is desirable only when the option buyer has the cash to pay for the underlying asset and has the desire to own it.

Interestingly, many option traders don’t have the cash to pay for the asset and/or are not interested in owning it.

The alternative for them is to sell the option contract to close their position. When an option keeps going ITM, its price keeps increasing. Thus, the option that Mariam purchased for $2 would have increased in value by July 15. Let’s assume it’s now worth $3 per share.

Mariam can then sell this option for $3 per share to Aminat, for a net profit of $1 per share. She would have paid a total of $800 premium to Zainab ($2 per share * 400 shares) and received $1,200 from Aminat ($3 per share * 400 shares), for a total profit of $400. She has made this money without ever purchasing NVDA.

Since a call option is profitable for the buyer when its price increases (and exceeds the strike price), it makes sense for you to buy call options when you are bullish on the stock or ETF (expecting upward price movements).

When does a seller make money from a call option?

We said above that the call option seller will keep the premium received when the buyer chooses not to exercise the option. In this case, they will have no obligation and yet would have pocketed the premium.

Thus, the seller makes money when the buyer decides not to exercise the contract.

What would make a buyer allow the option to expire worthless without exercising it? When it is not profitable to do so.

Let’s go back to the example above.

If the price had fallen to $130 on July 15, then it would make no sense for Mariam to exercise the option. Why buy NVDA at $150 (the strike price) when she can purchase it at $130 in the spot market?

In this case, where the strike price is higher than the current share price, the option is said to be out of the money (OTM). Put differently, the option has no intrinsic value.

Whenever an option is OTM, it is profitable for the seller.

Mariam will not exercise this right, which means Zainab can keep the premium without doing anything (passive income).

Also, the seller does not have to wait till the expiry date to realize profits on the contract; they can do so within the time frame from the origin of the contract to its expiry date.

When an option keeps going OTM, its price keeps reducing. In our example, let’s say the contracts are now priced at $1 per share on July 15.

Zainab can now buy these contracts at $1 per share from Rukayat for a profit of $1 per share. She received $2 per share from Mariam (a total of $800) and paid $1 per share (a total of $400) to Rukayat for a profit of $400.

Since a call option is profitable for the seller when its price reduces (and falls below the strike price), selling call options makes sense when you are bearish on the stock or ETF (expecting downward price movements).

When does a buyer make money from a put option?

Do you remember Omar and Abdul? This is their time to shine.

Omar has purchased the right to sell 200 shares of GOOGL for $200 on or before July 25. The option is priced at $2 per share.

When will it make sense for Omar, the put buyer, to exercise this right?

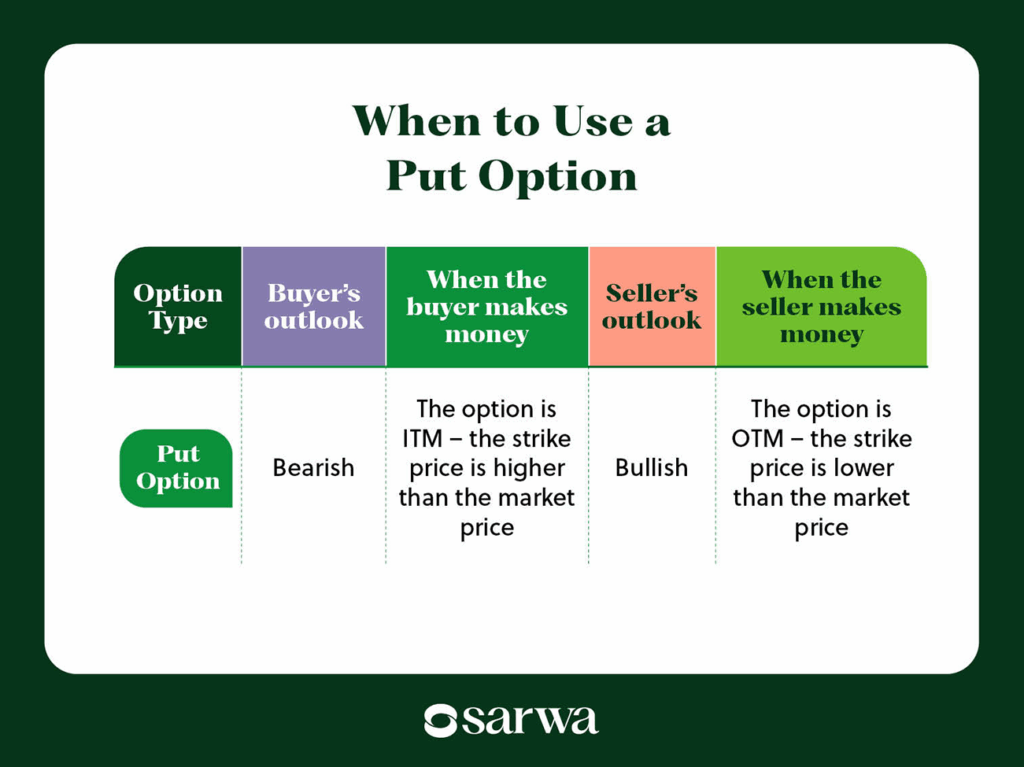

Only when selling at the strike price is more profitable than selling at the spot price. Thus, Omar would want the strike price to be higher than the current share price.

For example, if the current market price is $180, Omar can make money by buying in the spot market and then selling to Abdul for $200, for a gross profit of $20 and a net profit of $18.

When the strike price of a put option is higher than the market price, it is said to be ITM. And as we have said, an option favours the buyer whenever it is ITM.

Similarly, Omar can choose to realize his profits on this contract by selling it. Since it is ITM, the price would have increased. If the price increased to $3, he would earn $1 per share and a total profit of $200.

Since a put option is profitable for the put buyer when its price reduces (and falls below the strike price), it makes sense to buy a put option when you are bearish on the stock or ETF.

When does a seller make money from a put option?

Abdul will make money from selling the put option when Omar does not exercise his right. Again, Omar would not do this if it were unprofitable.

When will a put option be unprofitable for the buyer? This will happen when the strike price is lower than the market price. Such an option is said to be OTM, and every OTM option favours the seller.

Say the price of GOOGL is $220. Why sell for $200 (the strike price) when you can sell for $220 in the spot market?

In this case, Omar will not exercise the right, and Abdul will get to pocket the premium paid when the option expires.

He can also choose to buy the option contract instead of waiting till July 25, since the price would have fallen (it is OTM). If the price falls to $1, he can make a profit of $1 per share and a total profit of $200.

Since a put option is profitable for the put seller when its price increases (and rises above the strike price), selling put options makes sense when you are bullish on the stock or ETF.

For ease of comparison, we can combine both tables in one:

4. Call option vs put option: The strategies available with them

There are three levels of stock options trading strategies:

- Level 1 strategies: These are simple, basic strategies that are appropriate for beginners. They don’t require you to have the underlying asset or enough cash to buy them.

- Level 2 strategies: These are intermediate strategies that may require that you have the cash to purchase the stock or already own it. Beginners can also use these strategies; they only need to have more cash to do it.

- Level 3 strategies: These are advanced and complicated strategies that involve the use of spreads (combining multiple option positions). Financial advisors often advise that beginners should stay clear of these strategies since the potential for losses is higher.

Our aim in this section is to classify various Level 1 and 2 strategies under the option put vs call categories. This will help you understand which strategy is appropriate for which option type.

Level 1 call option strategies

There is only one strategy that can be viewed from the perspective of the buyer or the seller.

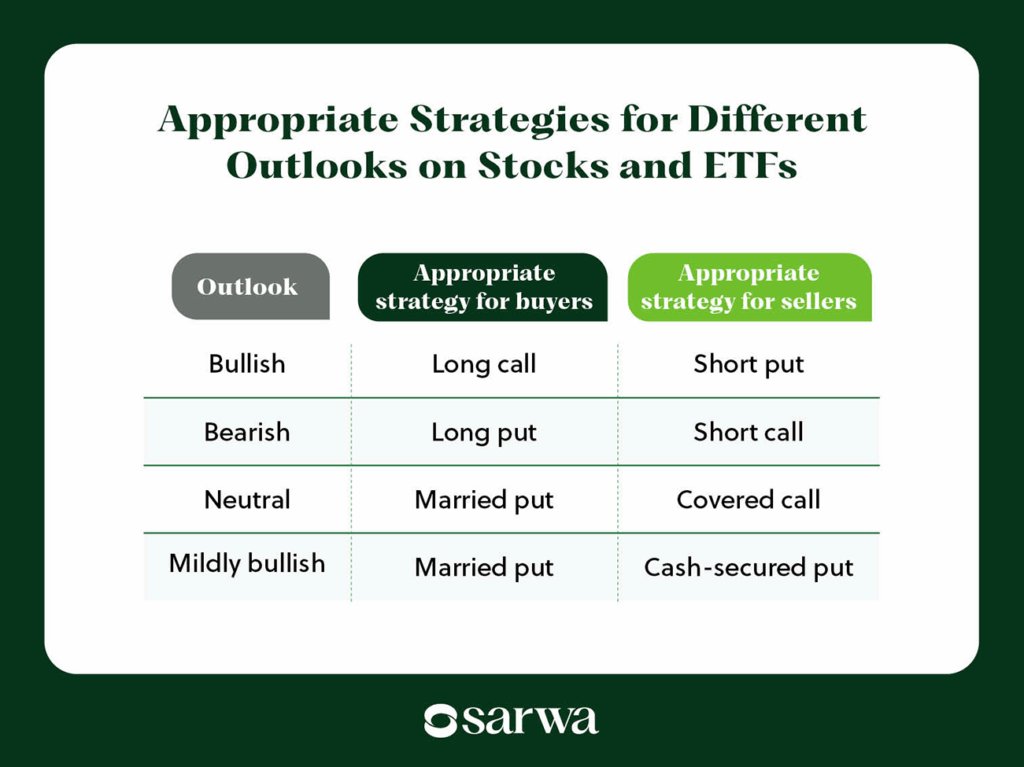

From the buyer’s perspective, this strategy is called a long call strategy. It involves buying a call option. As we have seen, this is an appropriate strategy when you are bullish on a particular stock or ETF.

If we shift to the seller’s perspective, this is called a short call strategy. It involves selling a call option, and it is an appropriate strategy when you are bearish on a particular stock or ETF.

Level 1 put option strategies

A long put strategy is one where traders buy put options. This strategy is a good choice when you are bearish about a stock or ETF.

The seller of the put option is following a short put strategy, and it indicates a bullish outlook.

Level 2 call option strategies

The covered call strategy is a level 2 strategy.

With this strategy, an option trader who already owns the underlying stock or ETF also sells a call option on it.

If the price falls below the strike price, the call option will be OTM and the seller will keep the premium already received and the stock owned.

However, if the market price rises above the strike price, the call option will be ITM. If the buyer chooses to exercise the right to buy, the seller can just sell the underlying stock he already owns.

If the seller bought the stock at a price that is equal to the strike price, then there is no loss on the sale. Thus, total profit equals the premium already received.

This is a good strategy when you are uncertain about whether the market will be bullish or bearish. You can hedge your bets by ensuring you can make money either way.

Level 2 put option strategies

There are two strategies here: cash-secured put and married put.

- Cash-secured or cash-covered put strategy: This strategy involves selling a put option while ensuring there is enough cash in the brokerage account to purchase the underlying asset in case the buyer exercises the option.

If the market price rises above the strike price, the put option will be OTM, and the seller will get to keep the premium.

However, if it becomes ITM (market price falls below the strike price) and the buyer exercises the option, the seller will use the cash to buy the underlying asset from the option buyer at more than its market value (strike price exceeds market price).

Nevertheless, if the strike price at which the seller purchased the asset is lower than the market price at the time the contract was agreed, he would have bought it at a cheaper price from that perspective.

It is an appropriate strategy for a seller who is bullish about a stock he doesn’t mind holding if the market goes against him.

- Married or protective put: With this strategy, a trader with a long position on a stock or ETF also purchases a put option.

If the put option becomes ITM, the trader can sell his holdings in the options market for a higher price than what is available in the spot market.

However, if it becomes OTM, he can sell in the spot market for profit and only lose the premium paid to the seller.

It is a good strategy where you are only mildly bullish about the stock and would love to hedge against the possibility of a bearish movement.

5. Call option vs put option: Which is better for you?

So, which option should you trade?

It is obvious by now that there is no straightforward answer to this question. Two factors are crucial – your outlook on the stock and what side of the contract you want to be on (buying or selling).

If your outlook is bullish, you can buy a call option (long call) or sell a put option (short put). On the other hand, you can sell a call option (short call) or buy a put option (long put) if your outlook is bearish.

In some cases, your outlook is neither strongly bullish nor strongly bearish, and you want to hedge against the market going against you. If you already own the stock but are unsure whether it will go up or down, a covered call strategy is appropriate. A cash-secured or married put will work if you are only mildly bullish; the former if you have the cash to purchase the asset in case the market is bearish, and the latter if you already a long position on the underlying stock.

The decision on whether to sell or buy an option depends on your risk-return profile.

Selling is riskier since, in many cases, potential losses (if the buyer exercises the option) are uncapped, while potential profits are capped at the premium received.

However, you can manage this risk by cutting losses short with stop loss orders, as well as prioritizing Level 2 strategies (which will require a higher capital base).

On the positive side, the time decay advantage (the time value of options reduces as they near the expiration date) ensures that sellers often win more trades. Many sellers generate passive income this way.

Buying, on the other hand, is less risky since your potential losses are capped at the premium paid, while potential profits are uncapped in most cases. However, since time decay favours sellers, you may not win as much as they do.

Moreover, you can combine a buying and selling strategy by buying on some occasions and selling on other occasions.

If you are in the UAE, you can easily buy and sell both call and put options of US stocks and ETFs through Sarwa. We provide a simple and intuitive platform that is easy to navigate. Our performance charts will also help you understand the current state of your trade, the breakeven point, maximum profit, and maximum loss.

We also secure your data and money with SSL security while providing 24/7 customer support and educational resources. To help you keep a large portion of your profits, we charge low commissions and provide free transfers from your local bank account to your brokerage account, and vice versa.

Are you ready to start trading call and put options in the UAE? Sign up today for Sarwa for a convenient and enjoyable stock option trading experience.

Takeaways

- Calls give buyers the right to buy an asset, while puts give them the right to sell. When buyers exercise this right, it results in an obligation to sell for sellers of calls and an obligation to buy for sellers of puts.

- Retail traders use options not just to speculate but also to generate income and to hedge risk.

- The stock option trading or investment strategy to use depends on your outlook on the stock or ETF in view, and whether you prefer to be a buyer or a seller.

- As a beginner trader, you should focus on Level 1 and Level 2 call and put strategies.