Bitcoin might not have a centralised authority or be useful for industrial purposes, but it is a good store of value and an attractive investment asset.

View more Why Invest in Bitcoin? Understanding The Value of “Digital Gold”Category: blog, Dashboard

What are Stocks and Bonds? An Investor’s Guide

Truly understanding stocks and bonds — the building blocks of investing — will help you make better investment decisions.

View more What are Stocks and Bonds? An Investor’s GuideLSE vs NYSE: Which Exchange Benefits Investors Most

These two stock exchanges are certainly not similar. So which is best for your investments?

View more LSE vs NYSE: Which Exchange Benefits Investors MostWhat is Digital Wealth Management: How Investing Became Made for Everyone

Digital wealth managers are bringing once-elitist financial services within the grasp of all.

View more What is Digital Wealth Management: How Investing Became Made for EveryoneShould What’s Happening To The Bond Market Affect Your Portfolio?

Over the past three months, the fixed-income market has experienced considerable volatility, and conservative risk-averse investors — who are typically heavily invested in bonds —…

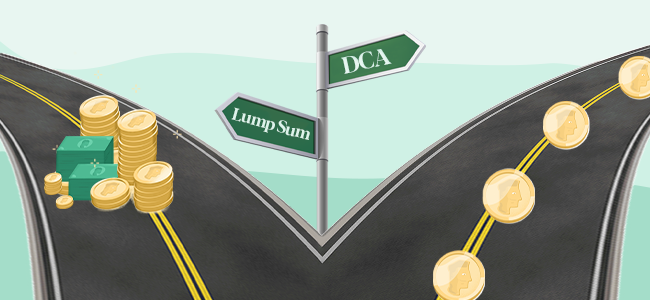

View more Should What’s Happening To The Bond Market Affect Your Portfolio?Dollar-Cost Averaging vs Lump-Sum Investing: How Should You Invest?

Should you invest all your money at once — or spread it out over a predetermined period?

View more Dollar-Cost Averaging vs Lump-Sum Investing: How Should You Invest?The Brilliance of Modern Portfolio Theory: A Nobel Prize-Winning Formula To Cut Investment Risk

About 68 years after the creation of the Modern Portfolio Theory, it remains the most popular portfolio management theory among retail and institutional investors today.…

View more The Brilliance of Modern Portfolio Theory: A Nobel Prize-Winning Formula To Cut Investment RiskIs Sarwa Safe? How Sarwa Protects Your Investments

With banks failing in the US and Switzerland, you are probably wondering if your money with Sarwa is safe. Here we explain just how your money is protected and segregated for safe keeping.

View more Is Sarwa Safe? How Sarwa Protects Your InvestmentsThe Winning Habits These Popular Finance Bloggers Use To Achieve Financial Freedom

You’re probably familiar with that feeling — a sudden urge to get your finances in order. Yet, most people today still fail to undertake the…

View more The Winning Habits These Popular Finance Bloggers Use To Achieve Financial Freedom