A key part of becoming an expert saver is finding ways to cut costs. This will mean that you can divert your money into your savings rather than into other people’s pockets.

In this blog post, we focus on some key areas where you can make big savings, without changing your lifestyle. It’s not about being boring! It’s about being smart with your money, so you get more out of life in the long run.

How much do you spend on rent?

Where you live is important. But your home shouldn’t be a burden that stops you from living life to the full. If you’re spending over a quarter of your salary, you’re living beyond your budget.

Downgrading to a smaller apartment or house might not seem appealing. But it can allow you to get more out of life and start planning for the future.

Be smart about using your own car

Road travel is another big expense. In Dubai, it costs Dhs 4 a time to go through a toll gate, up to a maximum charge of Dhs 24 each day. From the DIFC to Marina you have 2 tolls, meaning you pay Dhs 16 a day. Multiply those Dhs 16 by the number of days that you work and that’s Dhs 320 per month and Dhs 3,840 (over $1000 a year) in potential savings! Getting a Salik tag isn’t that expensive and gives you the option of using Shaikh Zayed Road when you need to. But you don’t need to do it. Actually, Shaikh Mohammed bin Zayed Road and Al Khail Road are just as convenient and mostly free-flowing.

More people are using public transport in Dubai now. The Metro is excellent and even the bus network is improving. Cars and cabs are really expensive and bad for the environment, so they’re best avoided if at all possible. The costs just don’t stack up when compared to a monthly ticket for public transport at Dh281. So think before you travel – when the weather allows it! Think about it as your daily workout.

Be sensible with your groceries

Food is one of life’s great pleasures. But that doesn’t mean we can not reduce our costs when it comes to buying groceries.

If you eat premium imported food, your weekly bill for groceries could be as much as approximately Dh1,000 per week. But how many times have you looked in the fridge, only to find a load of food that is no longer good to eat? We’ve all been there, and it’s a quick way to throw away hard-earned money.

So when you’re shopping, it pays to have a look at the “best before” dates on products before putting them in your basket. It’s harder to do this when shopping online. So if you are having food delivered to your home, be vigilant when checking the dates on the packaging and return products that are near expiry. And attempt to eat fresh. Buy what you need, finish it first, and then you can go for second rounds.

No such thing as a free lunch

Another great way to save money on food is to stop buying lunch at work. Preparing lunch at home might not be very cool, but it’s a great way to save money for cool stuff! People spend around Dh65 per day on lunch. That’s Dh1,300 per month and Dh15,600 (close to $4,250 a year) in potential savings. Over 40 years, you could save 624,000 or close to $170,000! These numbers exclude the compounding effect of reinvesting interest on savings, so actually, you could save a lot more.

It’s fun to go out and be social, so indulge your sushi addiction when needed, but try not to over do it. The average meal at home costs around Dh16, versus Dh65 to eat at a restaurant. So, you can save yourself Dh49 every time you choose home over going out to eat.

How much home help do you actually need?

Here in Dubai, we enjoy inexpensive access to home help. Having a maid, nanny, driver or gardener is a great luxury and a real benefit to living in the UAE.

To employ a housemaid, expats need to renew their visa and contract every year at a cost of around Dh7,500. Housemaids’ salaries vary but they around Dh2,000 per month and every two years you are responsible for paying for their flight home, although most try to offer this every year. If you can’t provide accommodation to live in with your family, you will need to budget for a further Dh1,000–2,000 for this. In short, employing a maid is great value, but still expensive.

Instead of this approach, you should consider using an app such as helping.ae. It arranges someone to come and clean your house once or twice a week for around Dh35 an hour. That way, you can reduce your overheads for the home and enjoy the flexibility of using an on-demand service.

Shop around

Shopping around for the most attractive deals is an obvious way to save, but it’s amazing how often we fail to do it when we’re feeling busy, lazy, or both!

Price comparison websites are a great way to find the best prices. Check them out when looking for insurance such us Souqalmal, phones, internet, even gym membership. Apps such as Entertainer and GroupOn offer promotions and discounts when booking services and experiences. If you’re hitting the shops, look for outlets with discounts such us Dubai Outlet Mall and The Outlet Village.

Giving gifts for birthdays, Christmas and anniversaries is expensive. Sometimes it’s fun to splash out, but what people really appreciate is a thoughtful gift. You need to spend a fortune to show your loved ones that you care. They appreciate your time more than your money.

Saving doesn’t necessarily mean buying things that are cheap. It simply means looking for value. Cheap products are a false economy. Instead, invest in key items like a nice couch, a comfortable bed, and a car that’s safe and reliable. By choosing quality over quantity and buying things that built to last, you will spend less over the long term.

Save big on TV

How much time do you spend watching TV? If the answer is not a lot, you should consider switching to a basic package. You’re already paying up for the Internet (which, let’s face it, is a necessity). Adding an expensive TV package could result in you spending as much as Dh999 per month, depending on speed and channels.

People in Dubai work a lot and most of us don’t have time to watch millions of premium channels. Basic packages have all the channels that you need, and you can always supplement with Netflix.

Ditch the credit card

Very few people can resist credit. And yet, it has a really negative impact on your finances. Credit card issuers charge exorbitant fees, as much as 36% a year. If you do need to borrow a substantial sum of money, it might make more sense to apply for a personal loan from your bank, since they charge much less interest than credit cards.

The wider point is that borrowing money – and paying it back – is stressful. It impairs your ability to enjoy life and work. So avoid it if you can.

Don’t keep money in your wallet.

Carrying cash around with you is a sure fire way of wasting money.

Firstly, you have to go to an ATM to withdraw the cash. This is time-consuming, but it also incentivises you to take more cash than you actually need, since you don’t want to waste time by having to return to the cash machine again.

Then, when you break a note, you end up with a handful of annoying coins jangling around in your pocket, which makes you more likely to spend them or simply leave them lying around the home. Carrying cash encourages you to round up your spending. Better to stick to debit cards.

Save your change

Remember pumping coins into your piggy bank when you were a kid?

If you do have spare cash lying around, set it to work! Saving loose change is an amazing – and massively underrated – way to save. Your 25 fils or Dh1 coin can seem insignificant, but if you consistently bank them rather than frittering them away (or worse still, leave them lying around your home), you could easily end up with hundreds before you know it.

Then you simply have to decide whether to treat yourself to something you’ve wanted for ages, or add it to your investment kitty. The choice is yours.

Start now

Developing a saving habit isn’t easy. It won’t happen overnight, but by making small, incremental changes, you can reach your financial objectives over the long term.

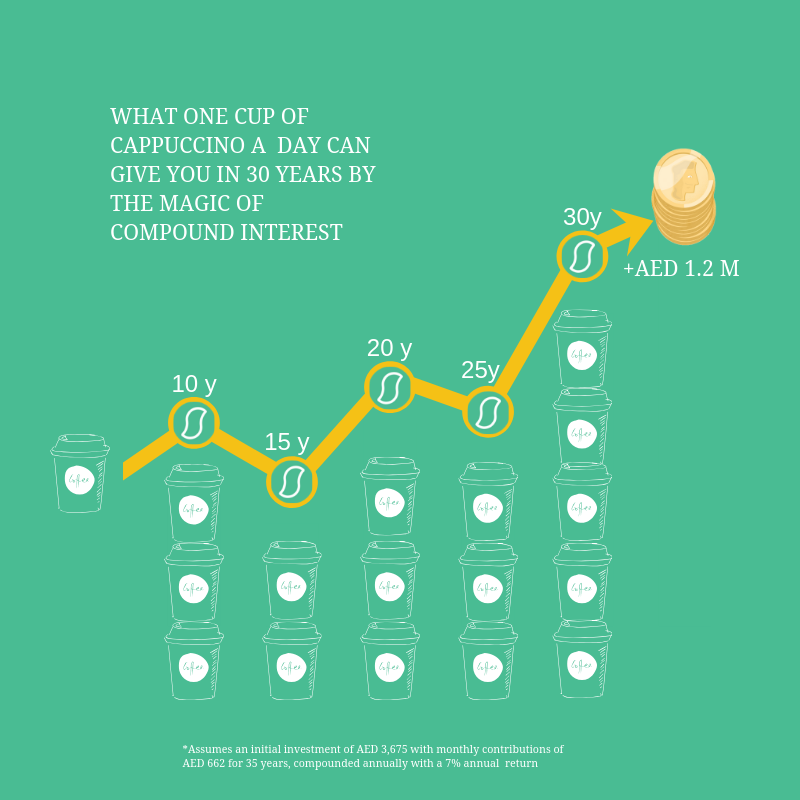

Don’t underestimate the awesome power of compounding.

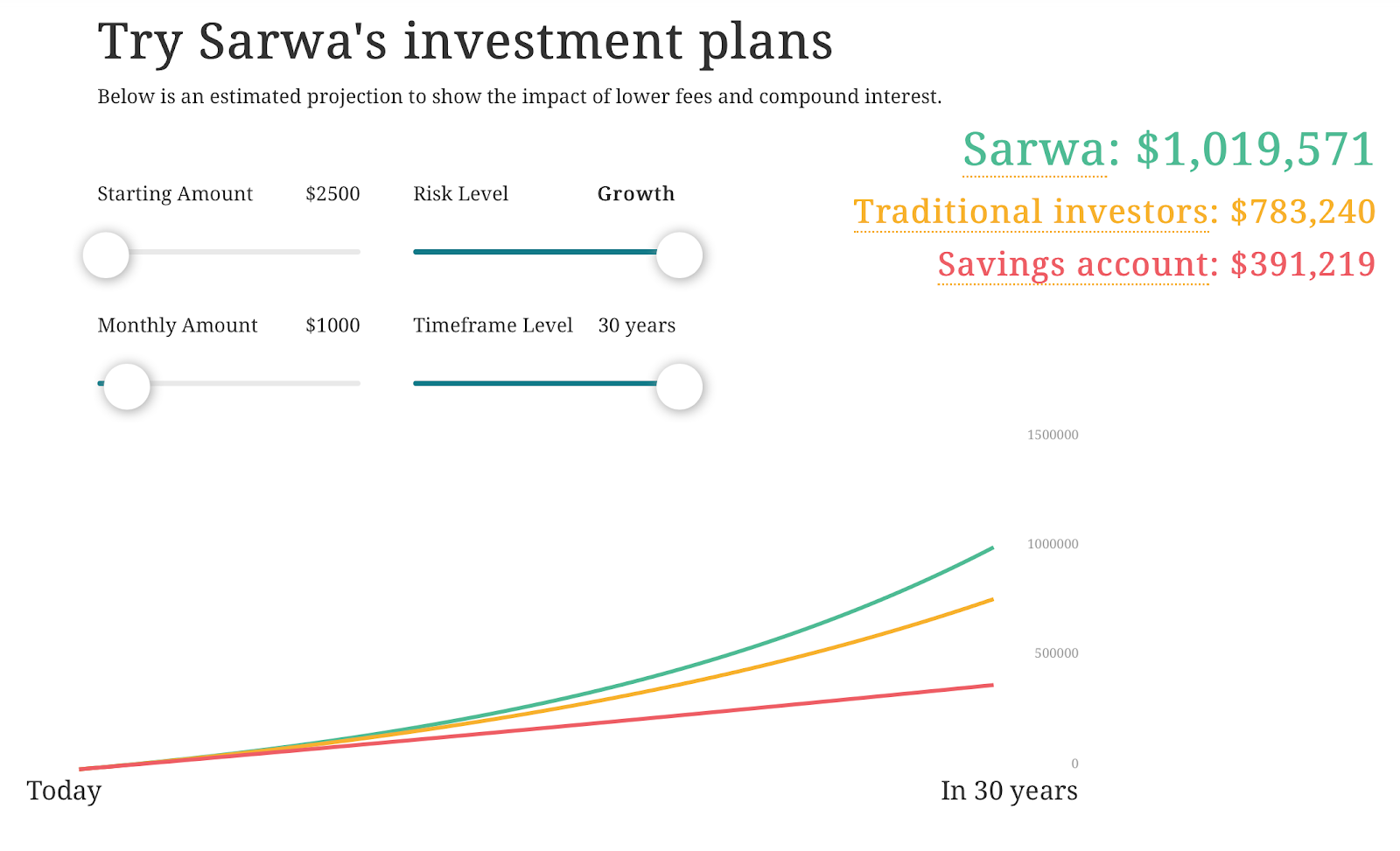

By working through the ideas in this article, you can save around Dh4,000 per month. That’s well over $1000! By putting that money to work for 30 years via Sarwa at a growth risk level expecting a 7%, you can generate $1 million in savings by the time you retire.

If that sounds good to you, it’s time to begin!

Ready to invest in your future?