So… someone said “options trading” and now you’re either curious, confused, or convinced it’s only for math geniuses and hedge fund bros. Let’s put that to rest.

This article is about building the foundations for options trading: specifically, what does it mean to buy an option, and how does it work exactly?

What does it mean to buy a call option?

At its core, buying an option means you’re making a low-cost wager on what you think a stock will do. You’re not buying the stock itself — you’re buying the right to make a move later. With us so far? Great.

There are two types of options you can buy: calls and puts.

And yes, you’re probably thinking, “What does that even mean?” Valid question. Because whoever named these things clearly wanted to make finance feel like a golf club. But don’t worry, I’ve been there, but now I’m here, slightly under-caffeinated, but ready to explain it like your smarter friend who Googled it first.

📈Lesson #1: How to buy a Call Option (aka “I think this stock’s going to the moon” *wolf sounds*)

Imagine this:

You love apples.

Right now, one apple costs $2 at the store.

Your friend says: “hey! I’ll sell you this special apple coupon (call options contract) for $1.

If the apple price changes (goes up or down), you can still use it to buy the apple for $2.”

You think, “that’s cool, I believe apples are going to get more expensive!” and pay your friend $1 for that coupon.

What happens next?

Scenario 1: Apple price goes up from $2 to $5

- You use your coupon to buy the apple for $2.

- You can now sell the apple to someone else for $5.

- You made $3 profit.

Remember though, you paid $1 for the coupon.

So your real profit = $3 – $1 = $2

You made a $2 profit from a $1 coupon = 200% return!

Scenario 2: Apple price stays at $2 or drops

- Your coupon is kind of useless now. You can already buy apples for $2, so there’s no need for the coupon.

- Nobody wants it.

- It expires worthless.

You lost the $1 you paid. That’s your maximum loss.

Now enough about apples, let’s talk Tesla.

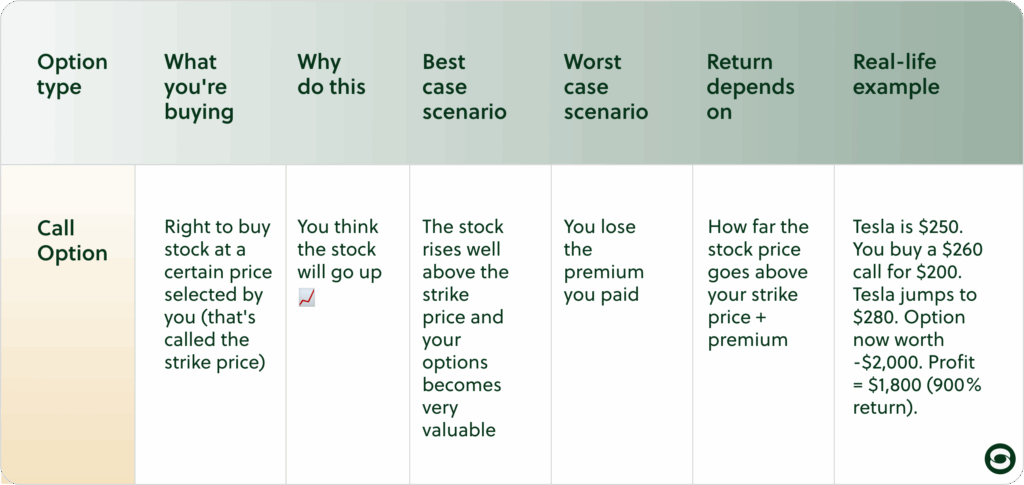

Let’s say Tesla is like our apple:

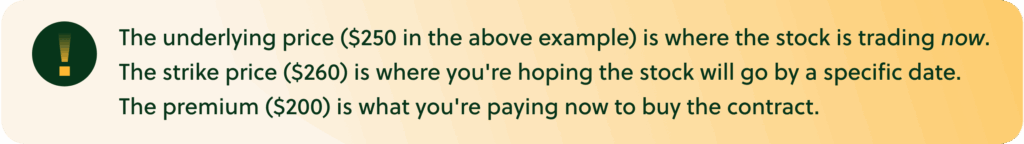

- Tesla is trading at $250 today.

- You buy a $260 call option for $200.

- The option expires in 2 weeks.

We’ve also introduced something new in the above example: the expiration date.

The expiration date is your option’s deadline.

If your trade idea doesn’t play out by then, you’ll lose the premium.

So you’re not just anticipating direction of price movements, but timing too.

What this means: you paid $200 ($2 per share*) for a “coupon” that is giving you the right to buy Tesla if its price goes up to $260 or more, before 2 weeks are up. It’s even better if it goes above $260 + $2 (premium) = $262, because that’s what you need to break-even.

*Note that 1 option contract = 100 shares of a stock. In this particular case, your option premium is $2 per share. So 2 x 100 shares = $200 premium.

Scenario 1: Tesla goes up to $280 a week after you bought the call.

- You use your option to buy at $260

- You can sell it at $280 = you make $20 per share × 100 shares = $2,000

- But you paid $200 for the option contract

Real profit = $2,000 – $200 = $1,800. That’s a 900% return.

Scenario 2: Tesla stays at $250 or drops

- Your option is useless (why buy at $260 when it’s cheaper in the market?)

- Nobody buys it.

- It expires.

You lose the $200 you paid.

TL;DR – Buying a Call Option Means

- A call option is like a coupon that might become super valuable.

- You pay a little money now hoping you can use it later to make a lot more.

- If the stock price goes up = you make a profit

- If it doesn’t = your maximum loss is the money you paid for the premium