If anyone ever asked why some investors valued gold highly, its performance so far in 2025 is a decisive answer.

While popular stock indices (like the S&P 500 index and the NASDAQ Composite) suffered from the uncertainty effect of Trump’s policies, gold kept its cool. As of May 13, the S&P 500 index was down 0.64% yield-to-date (YTD) and the NASDAQ Composite was down 3.12%. In contrast, gold was up 23.30%, reinforcing the belief that when things are going down is when to buy gold.

Though the stock market has rallied since the US-China trade war subsided, gold is still topping major stock indices. At the time of writing, it is up 41.45% YTD while the S&P 500 index and the NASDAQ Composite are up 6.20% and 7.93%, respectively.

In essence, gold has shown that it is truly a safe haven, store of value, possible inflation hedge, and a portfolio diversification tool (or portfolio hedge).

Knowing how to buy gold safely in the UAE is a good way to diversify your investment portfolio and hedge it against market downturns and economic uncertainty. In this article, we show you five practical ways you can buy gold safely in the UAE.

We’ll cover:

- How to buy gold bullion in the UAE

- How to buy gold stocks in the UAE

- How to buy gold mutual funds in the UAE

- How to buy gold ETFs in the UAE

- How to buy gold derivatives in the UAE

Do you want to learn more about how to create a portfolio that can stand the test of market downturns and economic uncertainty? Subscribe today to Sarwa’s Fully Invested newsletter for regular insights on the financial markets.

1. How to buy gold bullion in the UAE

Gold bullion refers to physical or tangible gold.

For a gold bullion to be traded on major markets, it must be at least 99.5% pure. Those with a purity of 99.9% are referred to as investment-grade pure gold.

There are two types of gold bullion:

- Gold bars: Gold bars are generally bigger than gold coins. They vary in weight, from smaller one-ounce bars to bigger kilo bars.

Sample gold bar

Source: London Gold Center

- Gold coins: Gold coins are nationally minted, and they tend to be smaller than gold bars. Their small size also makes them more liquid than gold bars.

Sample gold coin

Source: Golden Eagle Coins

There is a price premium (or markup) on gold bars and coins (when compared to the spot price of gold). This premium represents the extra work done to produce, package, and ship them.

Price premiums are often higher for gold coins because of their higher demand, sophisticated design, and, sometimes, historical significance (especially numismatic coins, which are viewed as collectibles).

Where can you buy gold bars and coins in the UAE?

If you are considering how to purchase gold coins and bars in the UAE, below are some options to explore:

- Dubai Gold Souk: Dubai Gold Souk is a trading house located in the Deira district of Old Dubai. It’s about a seven-minute walk from the Al Ras station.

There you will find more than 350 retailers buying and selling gold bullion (and other precious metals).

- Bullion retailers and other trading houses: While Dubai Gold Souk is very popular, it is not the only trading house in Dubai. There is also the Diamond Gold and Diamond Park (located on Sheikh Zayed Road), which houses more than 90 retailers.

Also, in Abu Dhabi, we have the Madinat Zayed Gold Centre (located in Al Danah Zone 1) and Hamdan Street (located in Al Danah Zone 1) as two prominent gold trading hubs.

- Independent bullion dealers: Similarly, there are multiple retailers outside of these trading houses where you can buy gold bars and coins. Examples include Kanak House Bullion (located in Business Bay), IBV Gold (with offices in Jumeirah Lakes Towers and Al Quoz), and ISA Bullion (located in Jumeirah Lakes Towers).

Many of these gold dealers have online stores, so you should not have a problem if you are looking for how to buy gold safely online.

- Gold jewelry stores: Some jewelers also buy and sell gold bullion as part of their gold product offerings. Bayut has a list of some of the most reputable dealers.

How to purchase gold coins and bars safely: Useful tips

To buy gold bars and coins safely (offline and online), pay attention to these tips:

- Confirm purity and hallmark: As we have seen, investment-grade gold bullion must have 99.9% purity. Request for the hallmark stamp of the gold bullion to verify both its purity and authenticity.

Sample hallmark stamp

Source: World Gold Council

- Inquire about return policy: If you are buying online, a return policy is a must. This is because you need to see the gold bullion before you can verify its purity and authenticity.

- Be wary of scams (too-good-to-be-true deals): The deal might be unbelievable because the gold is not investment grade, or the other related costs are exorbitant.

- Buy from reputable dealers: Another way to avoid scams is to stick to the most reputable dealers. You can start with the ones we have listed above and check what people are saying about them both online and offline.

- Compare transaction costs: Talking about costs, you should shop around and compare across various retailers. Two retailers selling the same quality of gold can charge different transaction fees. Take advantage of the price differential.

- Request for a certificate of authenticity and a full invoice: The former confirms genuineness while the latter certifies ownership. Both will prove useful when you are ready to sell the gold bullion.

- Check the current market price: It’s good to know what the current price of gold is before going to the market or ordering online. This will give you an idea of the premium the seller is charging and help you decide when it is excessive.

- Keep it safe: Some secure storage options include a bank safety deposit box, private vault, and home safe, among others.

However, if you want easy access, insurance, and protection from the possibility of bank failure, you might be better off keeping your gold outside of the banking system.

- Diversify the storage of your gold: Also, avoid keeping all your eggs (gold) in one basket (safe or vault). If one basket is tampered with, at least you still have the eggs in the other baskets.

- Don’t buy with credit: If you purchase an asset with borrowed money, you may find out that the interest payment on the loan exceeds the rate of return of the asset. This is why you are better off buying assets with your savings rather than borrowed money.

2. How to buy gold stocks in the UAE

Gold stocks (also known as gold mining stocks) refer to the stocks of companies involved in gold mining, production, delivery, and trading.

Since the profits of these companies depend on the price of gold, purchasing them is a way to gain exposure to the gold market. It is similar to buying REITs (the stocks of real estate companies) instead of physical real estate.

Gold stocks are preferable if you are not willing to deal with the illiquidity (finding a counterparty), cost (premiums, storage costs), and security issues (providing secure storage) associated with gold bullion. They also come in handy if you prefer to earn passive income from your gold investment (through dividends) instead of waiting for only price appreciation.

Where can you buy gold stocks in the UAE?

Unfortunately, mining companies in the UAE are privately owned and are thus not available to retail investors.

But cheer up! Many gold companies in the US are publicly listed, and with Sarwa, you can buy their stocks right from your sitting room or office in the UAE. Some of them include Newmont Corporation and Wheaton Precious Metals Corporation.

How to buy gold safely in the UAE: Tips for buying gold stocks

Even when buying gold mining stocks in the US, you should consider the following tips:

- Check the company’s fundamentals: Just being a gold company is not enough reason to buy a stock. While you want exposure to gold, you also want to pick a company with good fundamentals.

Check the profitability (return on equity, for example), liquidity (current ratio, for example), stability (debt to equity, for example), and gearing ratios (interest cover, for example) to ensure the company is fundamentally sound.

Have a look at Warren Buffett’s stock holdings to better understand how to conduct this fundamental analysis.

- Ensure there is liquidity: If the stock is illiquid (low trading volume), it will be hard to sell. Since liquidity is one advantage of gold stocks over gold bullion, it is important to choose gold stocks that are liquid.

- Ensure its price correlates with the value of gold: If the stock’s price does not move with gold’s, then exposure to it does not imitate exposure to gold. In that case, you are just buying another stock instead of a gold stock.

Compare the chart of gold with the stock’s chart and see if there is a common pattern to their price movements.

- Diversify your holdings: Purchase multiple gold stocks to reduce exposure to the unique risk of a single gold company.

- Consider dividend history if passive income is important to you: Some prefer gold stocks because of the opportunity to earn passive income. If that’s you, check the stock’s dividend history to be sure they regularly pay dividends.

3. How to buy gold mutual funds in the UAE

Gold mutual funds pull together money from multiple investors to purchase gold stocks. Each investor will have a share in the mutual fund itself rather than a direct interest in the underlying stocks.

This is a preferable option for investors who value diversification but don’t have the funds to purchase multiple gold stocks.

Where can you buy gold mutual funds in the UAE?

At the moment, there are no local gold mutual funds in the UAE. This is understandable since most gold companies are privately owned.

Nevertheless, you can gain exposure to gold mutual funds in the US through firms like Abu Dhabi Commercial Bank (ADCB) and Hong Kong and Shanghai Banking Corporation (HSBC). They provide access to gold mutual funds like the Franklin Gold and Precious Metals Fund and the Invesco Gold and Special Minerals Fund.

However, as we will soon see, there is a better option that provides the advantages of gold mutual funds without their cons.

How to buy gold safely in the UAE? Tips for buying gold mutual funds

Below are some tips for buying gold mutual funds:

- Read the prospectus: The fund’s prospectus will outline its investment objective, strategy, fee structure, past performance, management team, among others. It’s a good way to know how they run the fund.

- Check current holdings: Since diversification is a fundamental reason for choosing gold mutual funds, check current holdings to ensure the fund is well diversified (given your risk appetite).

- Compare performance: Also, compare historical performance (old and recent) of different funds.

- Compare expense ratios: Performance should be matched with fees (expense ratios) to determine the fund with the highest value for money.

4. How to buy gold ETFs and ETCs in the UAE

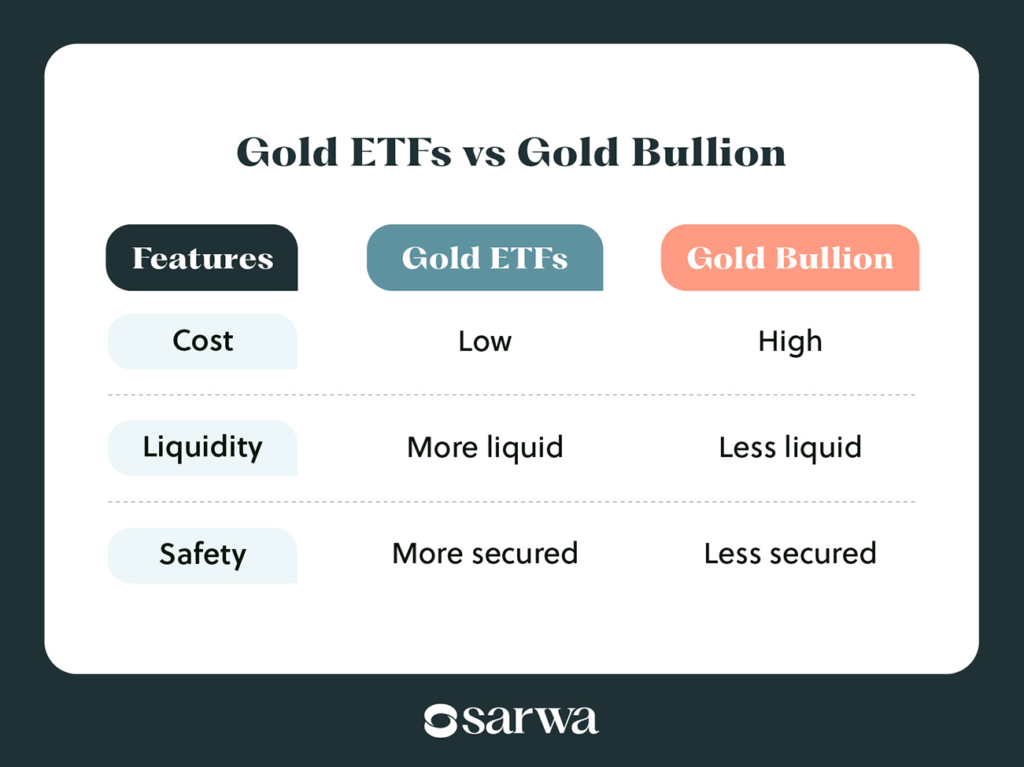

In popular language, gold exchange-traded funds (ETFs) are funds that invest in gold stocks or gold bullion.

However, for accuracy’s sake, we can define gold ETFs (also known as gold mining ETFs) as funds that invest in gold stocks (and derivatives) and gold exchange-traded commodities (ETCs) as those that invest in gold bullion.

Gold ETCs (also known as digital gold) are appropriate if you want exposure to gold’s spot price without storing gold (the fund handles storage) or dealing with the illiquidity of physical gold. Moreover, if you sell your shares in the ETC, what you receive is fiat currency, not physical gold.

If you prefer the indirect exposure provided by gold stocks but want diversification as well, gold ETFs are appropriate.

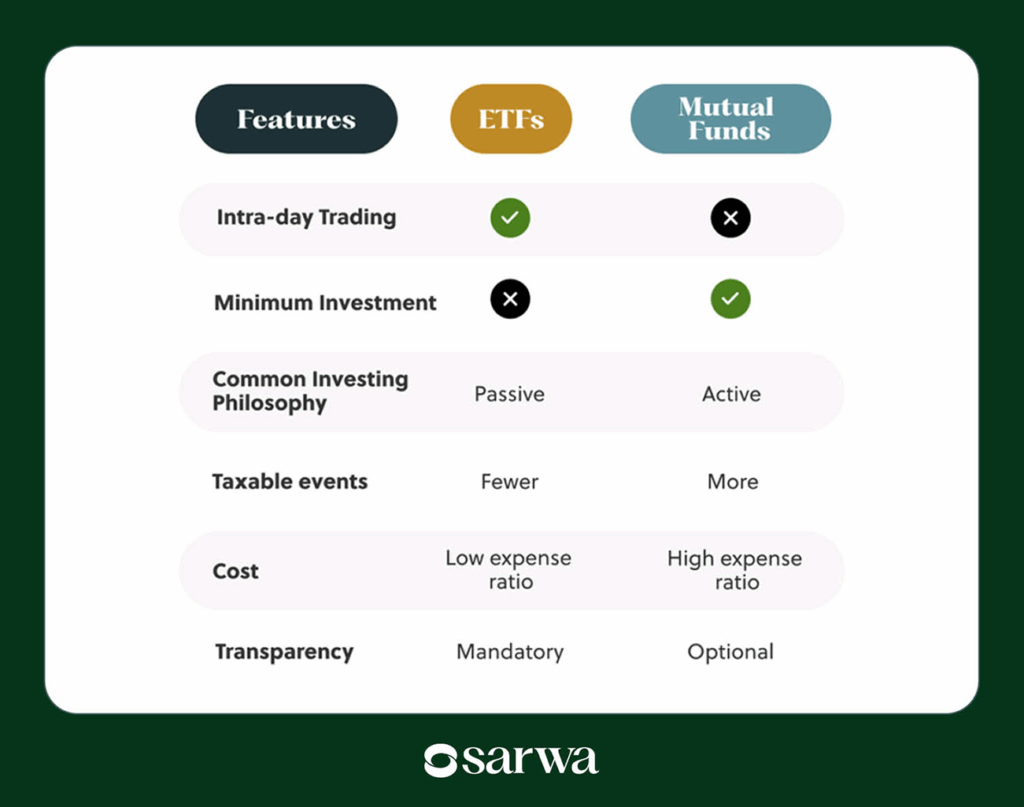

Furthermore, they are more cost-effective (lower expense ratio), transparent (required by law to publish current holdings), accessible (no minimum investment requirement), and liquid (can be bought during trading hours; no need to wait till the end of the trading day) than gold mutual funds.

Knowing how to invest in gold ETFs and ETCs in the UAE remains the smartest way to gain exposure to gold.

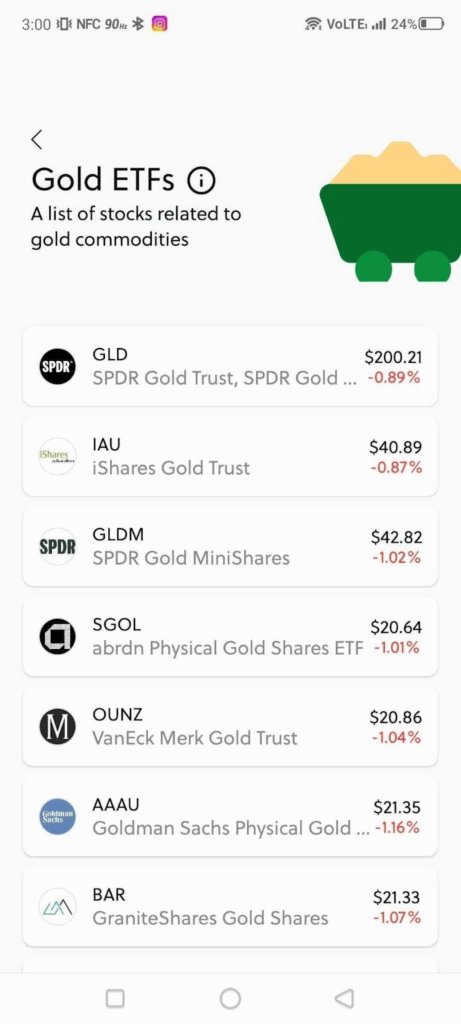

Where can you buy gold ETCs and ETFs in the UAE?

Sarwa provides access to popular gold ETCs in the US right from the UAE. At this moment, this includes:

How to buy gold safely: Tips for buying gold ETCs and ETFs

- Compare historical performance: Since they are all tracking gold bullion, returns should be similar. But it won’t be the same. Look for the ETCs posting higher returns, even if it’s marginal.

- Compare expense ratio: Though ETFs generally have low expense ratios, there is no harm in comparing them and selecting the one with the better value for money (net returns – returns minus expense ratio).

- Compare liquidity: Since liquidity is crucial in selecting gold ETCs over gold bullion, ensure that the ETF has good trading volume.

- Confirm cash redemption: One of the selling points of ETCs is that you can profit from gold trading or investing without taking delivery of physical gold. Thus, ensure the ETC you are selecting allows cash redemption.

5. How to buy gold derivatives in the UAE

Gold derivatives (futures and options) provide another option for purchasing gold in the UAE.

Gold futures are standardized contracts that impose on the buyer the obligation to buy and the seller the obligation to sell a given amount of gold at a future date at a predetermined price.

Gold options are contracts that give the buyer the right to buy or sell gold for a predetermined price (strike price) on or before the expiration date. The seller acts as the counterparty and takes the opposite side of the trade. An obligation only arises for the seller when the buyer decides to exercise their right to buy or sell.

For more on options, read “What is Options Trading in the Stock Market?”

Most options and futures contracts don’t last till the expiration date, which means traders don’t usually take physical delivery of the gold.

Thus, gold derivatives function more as a way for traders to profit from the price movements of gold without buying or selling it. Some also use it to hedge against the volatility of gold.

One advantage of gold derivatives is leverage. When you are right, leverage can magnify your returns.

However, gold derivatives are risky. They are complex and volatile. Moreover, the same leverage that can magnify returns can also amplify losses. This is why many personal finance experts advise beginners against them.

Where can you buy gold derivatives in the UAE?

You can purchase gold derivatives on the Dubai Gold and Commodities Exchange.

A platform like Interactive Market also provides access to international derivatives markets like the US.

How to buy gold online safely: Tips for buying gold derivatives

- Understand the risks: As said above, derivatives are risky and best left to expert traders. Top risks include complexity, volatility, and the double-edged nature of leverage.

- Have a strategy: There are many futures and options trading strategies. Choose the ones that are most appropriate for your trading and investment needs.

- Learn to manage risk: Taking profits early and cutting losses short can help you better manage risk and avoid buying or selling the underlying when you don’t want to.

- Conduct solid technical analysis: Don’t just make guesses. Improve your technical analysis skills so you can better predict future price movements.

Start buying gold stocks and ETCs safely with Sarwa

If you want to hedge your portfolio against market downturns and economic uncertainty, then you should be interested in gaining exposure to gold.

For direct exposure, gold ETCs provide a cost-effective (without the high cost of buying, storing, and safeguarding physical gold), liquid (easier to buy and sell), and simplified option (trade on your phone).

If you prefer an indirect exposure, you can purchase gold stocks.

At Sarwa, we offer you a cost-effective, accessible, secure, and simple way to buy gold stocks and ETCs from the UAE:

- Cost-effective: Transfers to your Sarwa brokerage account from your local bank account (and vice versa) are free. Also, we only charge the greater of $1 or 0.25% of the traded value of stocks, ETFs, and ETCs, which is less than the average fee brokers charge.

- Accessible: You can start trading stocks and ETFs with as little as $1. Also, we offer fractional trading, which allows you to purchase a fraction of the share of a stock, ETC, or ETF.

- Secure: We protect your data and money with bank-level SSL security.

- Simple: The exquisite user experience (UX) and user interface (UI) we provide make our platform easy to use for beginners.

Furthermore, we provide regular educational materials through our blog and newsletter.

We don’t just provide you with a platform to trade and invest; we also provide the information that will help you become a better and more profitable trader and investor.

Are you ready to buy gold safely in the UAE to diversify your portfolio? Sign up now for Sarwa for cost-effective, accessible, secure, and simple trading of gold stocks and ETCs.

Takeaways

- Gold has significantly outperformed major indices like the S&P 500 and NASDAQ in 2025, reinforcing its reputation as a safe haven and store of value during periods of economic and political uncertainty.

- Investors in the UAE can access gold through various channels: physical gold (bars, coins), gold stocks, gold mutual funds, gold ETFs/ETCs, and gold derivatives (futures and options).

- Each option has its advantages and will appeal to various types of investors.

- Gold ETFs (stock-focused) and ETCs (bullion-focused) are the most cost-effective, diversified, and liquid ways to gain gold exposure.