Arguably, stock market volatility is one of the most misunderstood concepts in investing. Simply put, volatility is the rate at which the price of security increases or decreases over a given period of time. If the price stays relatively stable, the security has low volatility. Whereas if the price fluctuates rapidly, it has high volatility.

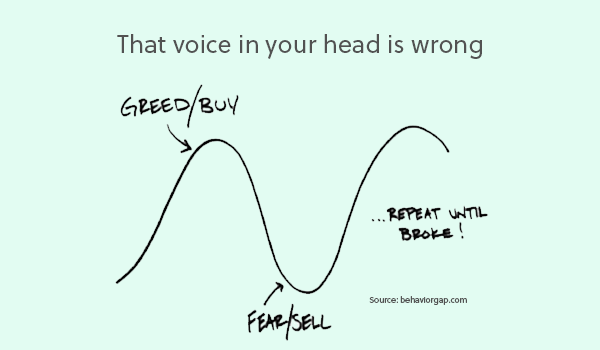

During volatile times, many investors become afraid and begin to question their investment strategies. This is especially true for first time or novice investors, who can often be tempted to avoid investing more or even to sell out of the market and wait on the sidelines until it seems safe to jump back in.

It’s important to realize that market volatility is inevitable. It’s the nature of the markets to move and up and down over the short-term. Historically the stock market has weathered numerous times of notable volatility such as the dot-com bubble and the global financial crisis. Then more recently Brexit, the US-China ‘trade war’, and geopolitical tensions in the Gulf.

Today it’s the infamous Coronavirus.

Instead of being fearful, investors should learn how to handle volatility in order to grow their wealth.

Here are five tips to help you to overcome market volatility:

1. Don’t try to predict the future and stick to your plan

The golden rule when the market turns volatile is to never make knee-jerk reactions or speculate as it’s virtually impossible to predict the short-term ebbs and flows of markets. Personal finance expert Andrew Hallam has observed that:

“When you’ve been investing for a few decades, you’ll see many predictions about the markets. They will always make sense at the time. But nobody can predict stock market moves. Not me. Not you. Not Warren Buffett.”

Time and patience are required to invest successfully for your future. Investors should make a plan which sets out how and when they’re going to invest then stick to that plan for the long-term. Otherwise, they will struggle to hit their financial goals. After all, a goal without a plan is just a wish!

If you are clear with your investment strategy, risk tolerance and believe in the fundamentals of your investment, do not sell early or try to time the market. One of the best ways to invest successfully is by implementing a Systematic Investment Plan (SIP). This will help you to create wealth by investing small amounts of money on a regular occurrence, regardless of what is happening in the market.

If you are unsure of your investment philosophy, or have a particular financial goal in mind, then connect with a financial advisor who can help you to decide on a course of action.

2. Play the long game and stay invested

Short-term losses can trigger anxiety and even the world’s most experienced investors find it uncomfortable to watch their hard-earned money taking a hit during a market downturn. But letting emotions drive your investment decisions may prove costly. One key to living with market volatility is to focus on long-term results rather than the daily or weekly bumps along the way. Staying the course can be difficult, but you could otherwise miss out on a potential market rebound and opportunity for gains.

From 1996 to 2015, the S&P 500 returned an average of 8.2% per year. But for investors who missed out on the top 20 trading days during that entire period, their returns fell to just 2.1% per year. From this we learn that the biggest danger isn’t market volatility – it’s being out of the market.

Often the best course of action is to do nothing. By sticking to your SIP and buy-and-hold strategy, rather than trying to time the market, it’s likely the storm will pass and you’ll maximize your returns. What seasoned investors know that the average person may not is that market volatility actually provides numerous money-making opportunities for the patient investor. Those who stay invested are likely to significantly outperform those who have withdrawn from the market.

3. Think positive and manage your emotions

When you see your investments falling in value due to tough market conditions, it’s tempting to want to do something about it. But intervening on the basis of market movements can actually lower your returns. A ‘Quantitative Analysis of Investor Behavior,’ published in 2017, found that the biggest barrier to long-term success isn’t market volatility, but investor psychology:

“The retention rate data for equity, fixed-income and asset-allocation mutual funds strongly suggests that investors lack the patience and long-term vision to stay invested in any one fund for much more than four years. Jumping into and out of investments every few years is not a prudent strategy because investors are simply unable to correctly time when to make such moves.”

It can be emotionally grueling, but downturns don’t last forever and markets invariably make back their losses over time. Between 1980 and 2015, the S&P 500 fell on average 14.2% at least once per year, but despite these temporary drops it ended up delivering a positive return in 27 of the 36 years. In other words, the market was positive 75% of the time!

4. Control the controllable

Obviously, you can’t control the stock market. But you can control how you react to the inevitable bumps in the road and it pays to focus on what you can control. John Bogle’s rules of investing are a helpful guide here.

Ultimately, successful investing is about weathering ups and downs. What’s crucial is that you carefully consider your overall financial objectives and tolerance for risk before committing capital, then think positively and stay invested over the long term.

It’s also possible to free yourself from the fear of downturns by understanding that the market moves in cycles. For example; looking back over the past century, market corrections (where stocks decline by 10% or more but not more than 20%) occur around once per year on average. But, less than 20% of corrections turn into full-on bear markets. Of the 22 market corrections that have occurred since November 1974, only four of them declined by 20% or more over a sustained period of time. As you will see that the stock market is much more predictable than you ever realized.

Bear markets happen on average every 5 years. We have been – if you might say – overdue for one.

5. Leverage the power of technology

By automating your investments with the help of a robo-advisor, you minimise the chances of your emotions taking over during periods of market stress and harming your returns.

Sarwa helps you do that in a way that’s affordable and hassle-free. When you start your investment journey, you are asked to take a survey so you know what risk level your are conformable with and how tolerant you are to risk. You start by learning about your financial objectives and understand your risk appetite. Your portfolio reflects just that. Then, your money is put to work in low-cost funds, your dividends reinvested, your tax exposure optimized.

So, when volatility does hit, you can sit back, relax and get on with your life whilst continuing to build wealth over the long term.

Ready to invest in your future?