Stock options have proven invaluable for investors who are seeking passive income from the stock market and those who want to hedge their bets, in case the market goes against them.

It is also a great asset for investors who want to make money from price movements in the stock market but don’t have a large capital outlay. The leverage that derivatives like stock options provide can magnify returns if done correctly, making it easier for small-money traders to grow their accounts.

But not many people in the UAE know how to trade options. Most are only familiar with spot trading of US stocks.

However, given these three benefits of knowing how to trade options (passive income, risk management, and potential return magnification due to leverage), traders in the UAE should better understand how to get access to them.

In this article, we will guide you through the process of trading options in the UAE so you can begin enjoying the benefits they provide. We’ll cover:

- Open a stock options trading account

- Choose your favorite stock options trading strategies

- Select your favorite stocks and ETFs

- Create a buy or sell order

- Check the contract performance profile chart

- Close the options contract

Do you want to learn more about the financial markets so you can become a better stock options trader? Subscribe now to Sarwa’s Fully Invested Newsletter for regular updates about your favorite stocks.

1. Open a stock options trading account

The first step is to find a trading platform that gives you access to US stock options in the UAE.

Sarwa is such a trading platform. When you create a Sarwa trading account, you gain access to financial instruments like stocks, ETFs, cryptocurrencies, precious metals, as well as options contracts for both US stocks and ETFs.

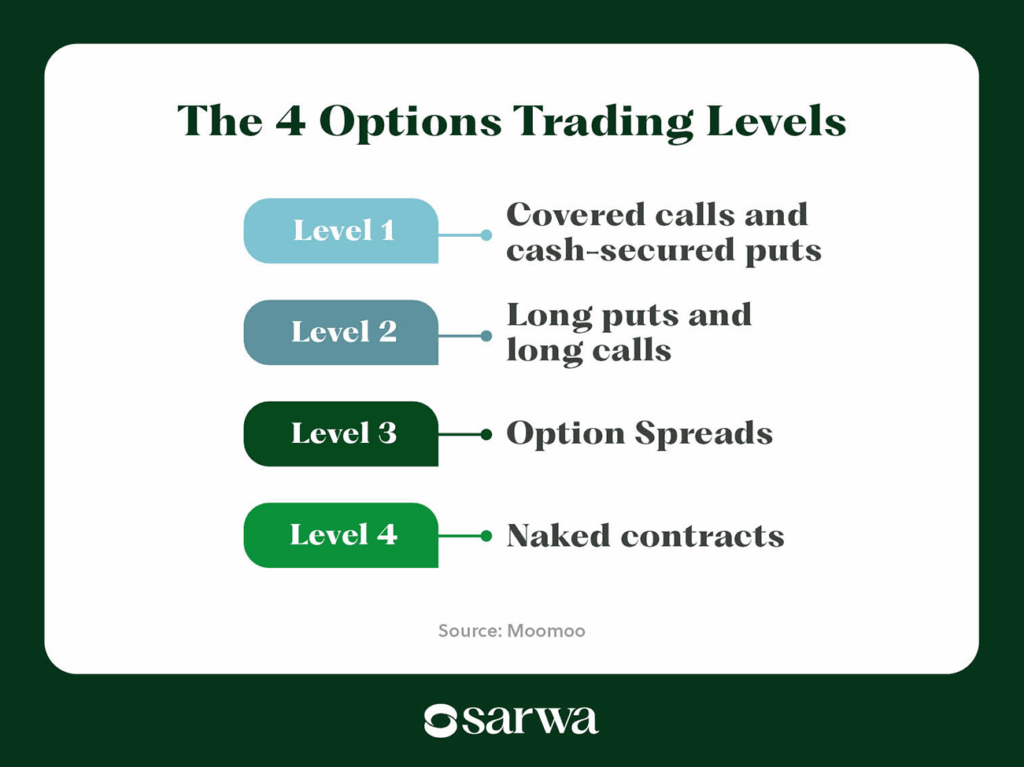

Your stock options trading account on Sarwa will be a Level 2 account. This provides access to Level 1 trading strategies like covered calls and cash-secured puts, and Level 2 strategies like long calls and long puts.

Sarwa does not currently support Level 3 (option spreads, including butterfly spread, iron condor, calendar spread, among others ) and Level 4 (naked contracts, including short straddle, short strangle, naked put/short put, and naked call/short call) strategies.

Source: Moomoo

If you are curious about how to trade NASDAQ index options or similar indices, ETF options are a good way to access them.

Traditional index options are usually European (can only be exercised on the expiration date), which makes them inappropriate for option buyers who want the flexibility of exercising their option contracts before the expiration date.

In contrast, ETF options are traditionally American and can be exercised on or before the expiration date.

For example, instead of buying or selling a NASDAQ 100 Index option, you can trade QQQ (an ETF that tracks the NASDAQ 100 Index).

[For an introduction to what options trading is all about, read “What is Options Trading in the Stock Market? All You Need to Know.”]

2. Choose a preferred stock options trading strategy

As said above, beginners are better off sticking to Level 1 and 2 stock options trading strategies.

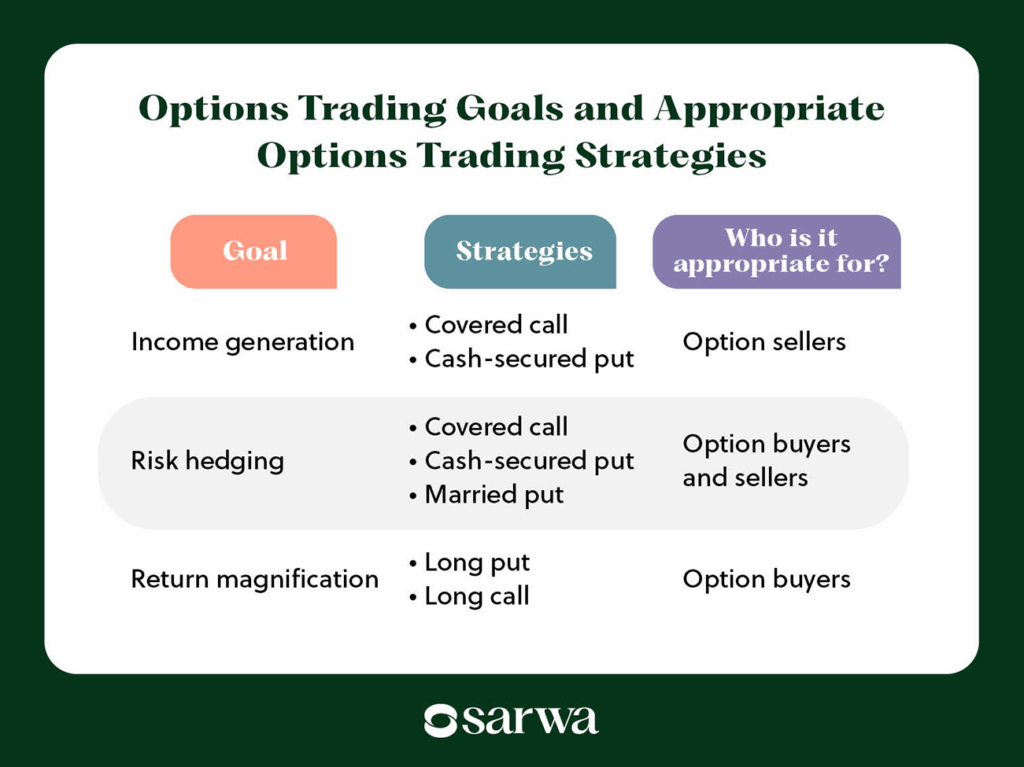

These basic option strategies serve different functions. Therefore, it is important to be clear on what your primary goal is: income generation, risk management, and returns magnification.

[Disclaimer: All the stock options mentioned in this article were selected randomly for educational purposes. This does not constitute a recommendation or investment advice.]

Income generation strategies

If you want to earn passive income from stocks, you can do so by selling the two types of options (call options and put options).

When a trader buys an option, they get the right but not an obligation to buy (call option) or sell (put option) the underlying security. The counterparty (other party) who will sell when the buyer decides to buy or buy when the buyer decides to sell is called the option seller.

In other words, when the option buyer exercises their right, it turns into an obligation for the seller. Option sellers receive a premium to compensate them for this potential obligation.

When it does not make sense for the buyer to exercise the option, they can allow it to expire worthless. In that case, the seller can pocket the option premium without exercising any obligation.

Let’s illustrate with a call option. Suppose Trader A buys 5 options contracts of AAPL (Apple’s stock) with a strike price (predetermined or set price) of $250 and an expiry date of December 5 at a premium of $5 per share.

Since this is a call option, Trader A has the right to buy at $250. But suppose the stock price falls to $200 in the spot market. Does it make sense for Trader A to exercise the option? No! Why buy at $250 in the options market when you can buy at $220 in the spot market?

In this case, Trader A will not exercise the option, which means Trader B, the option seller, gets to keep the option premium without any obligation. In our example, the premium will be $500 per contract (one standard option contract is 100 shares) or a total of $2,500 for five option contracts. That’s $2,500 earned without having to do anything.

All stock options trading strategies can be an income generation strategy as long as you are the seller rather than the buyer. For any strategy, you will earn passive income as the seller if the buyer does not exercise the right to buy or sell.

Risk management strategies

There are 3 main risk management strategies: cash-secured put, covered call, and married put.

Let’s illustrate with the third option: a married put.

The married put strategy is one where you go long on an underlying stock (in the spot market) and also buy a put option (the right to sell) on the same stock.

Traders go long on a stock when they are bullish about it. However, there is always a possibility that the price goes against them.

Suppose Trader C has purchased 200 shares of AAPL in the spot market at $250. To hedge against a possible bearish movement, Trader C also purchases a put option with a strike price of $250 and a premium of $5 per share.

If the price goes up to $300, for example, Trader C can sell the 200 shares in the spot market. He won’t exercise the put option, however. Why sell for $250 in the options market when he can sell for $300 in the spot market?

His profit in the spot market will be $10,000 ($300-$250 * 200 shares), while his loss in the options market will be the $1,000 premium paid ($5* 200 shares).

But what if the price fell to $200 in the spot market? Now it makes sense for Trader C to sell his 200 shares in the options market for $250. Since this was the price he bought the shares, he is at break-even. His only loss is the $1,000 premium.

Now, consider if he didn’t buy the put option. He would have had to sell in the spot market for $200 what he purchased at $250, for a total loss of $10,000.

Let’s pull everything together. If the price goes up, his profit would be $10,000 without options but $9,000 with options. However, if the price goes down, his loss would be $10,000 without options but $1,000 with options.

This clearly shows how options trading (in this case, buying puts), for a very small price, can help to limit your losses when market conditions go against you (as it sometimes does).

Returns magnification strategies

Some strategies, like long calls and puts, can help to magnify your rate of return.

A long call is the purchase of a call contract, while a long put is the purchase of a put option contract.

Let’s illustrate how you could potentially magnify your returns on long calls.

Suppose Trader D purchases two call option contracts of TSLA (Tesla’s stock) with a strike price of $150 at a premium of $5 per share (for a total price of $1,000).

Let’s assume that the price rises to $200 in the spot market. If the price of a call option rises, it goes in the money (as its intrinsic value rises), and the more in the money an option is, the higher the premium (which is the sum of intrinsic and time value). Suppose the premium rises to $10.

Trader D can then sell the 2 options contracts at $10 per share, for a total profit of $1,000. For an investment of $1,000, he has received $2,000, for a profit margin of 100%.

Suppose Trader D entered the spot market with his $1,000 when TSLA was trading for $150 per share. He would have bought 6.7 shares. When the price goes up to $200, the value of his holdings would be $1,340 (6.7 shares * $200). For an investment of $1,000, he would receive $1,340, for a profit margin of 34%.

Her profit margin with options is almost 3X that of spot trading.

It’s worth mentioning that nothing stops you from combining all three strategies. However, you can only pursue one strategy for each trade.

3. Select your favorite stocks and ETFs

For US options trading, you have to select the US stocks and ETFs you want to focus on. Want to know how to pick stocks for day trading, check out this blog.

Not all stocks or ETFs are amenable to stock options trading. There are two conditions an asset must meet before you even consider trading its option contracts:

- Liquidity: High trading volume is non-negotiable. A stock is only good for trading if you can quickly enter and exit it. When a stock is liquid, there is a short time between when you create an order for it and when the order gets executed. This guarantees that you can execute your trades at your desired prices.

- Volatility: Stock trading profits from the price movements of stocks. Thus, a stock must be volatile for it to print money for traders. Liquidity and volatility are related since only large volumes of buy and sell orders can significantly move the price of a stock.

Once you have confirmed that the stock is liquid and volatile, you can then turn to the stock’s options. The options must also show the same characteristics – liquid and volatile. The volume should be significant enough to drive the option price (premium) up or down for you to make money.

If a stock and its option satisfy these two conditions, you are good to go.

However, if you are a trader who values stock market fundamental and technical analysis, you may decide to stick with only liquid and volatile stocks that also have strong fundamentals (based on profitability, efficiency, stability, and liquidity ratios).

4. Create a buy or sell order

Once you have decided on a strategy and an asset, you can start creating buy or sell orders. These buy and sell orders can be for call options or put options.

How much money do you need to trade options?

“How much do I need to trade options?”. This is one of the common questions from those just learning how to trade options.

If you are buying options, the amount you need depends on the premium of the option contract you want to buy. For an option with a premium of $5 per share, you will need $500 to create a buy order for one option contract.

What if you are selling options?

The amount you need depends on the strategy.

For example, a cash-secured put strategy requires that the seller of the put option must have enough money in their account to buy the underlying stock at the strike price should the buyer exercise the right.

Of course, the buyer may not exercise the option, and your cash will remain intact. Also, you can buy the contract (more on that later) or roll over your position into another contract.

The cash security required is more like insurance.

The covered call strategy also requires such insurance in another form. For you to sell a call option, you must own the underlying stock. This ensures that you have something to sell to the buyer should they decide to exercise the option.

Again, this does not mean you have to part with the stock, as there are multiple ways to close an option contract.

In both cases, the amount you need will depend on the option contract.

Consider the example of a cash-secured put where you sell one put contract of NVDA at a strike price of $200. This would require cash holdings of $20,000 (100 shares * $200).

On the other hand, if you are selling a call option of NVDA at a strike price of $200, you will only need to have 100 shares of NVDA in your spot account. What it will cost depends on the market price at the time you purchased them.

Sellers who do not want to put down insurance can use naked contracts. However, given the high risk of these Level 4 strategies, they are not currently available on Sarwa.

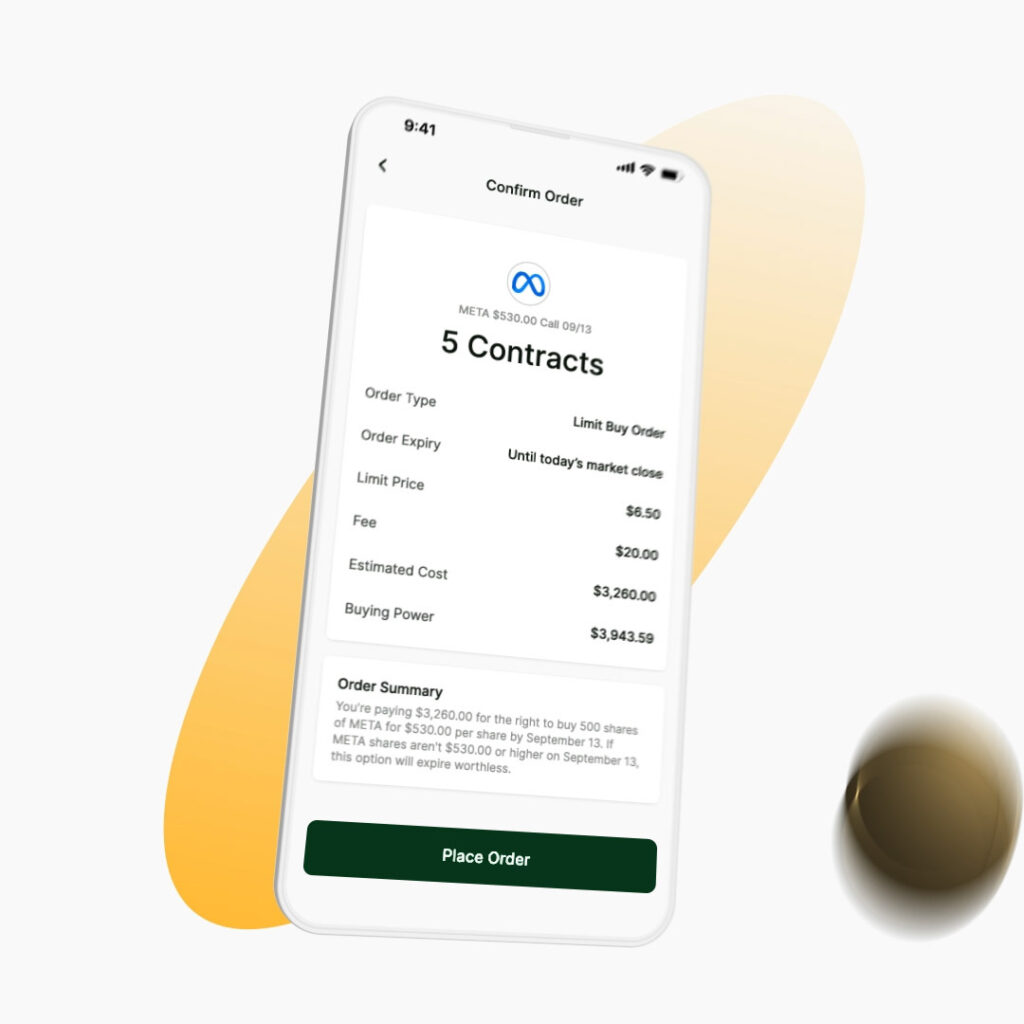

How to place an options trade

Now that we know how much money you need to trade options, let’s consider how to place an options trade.

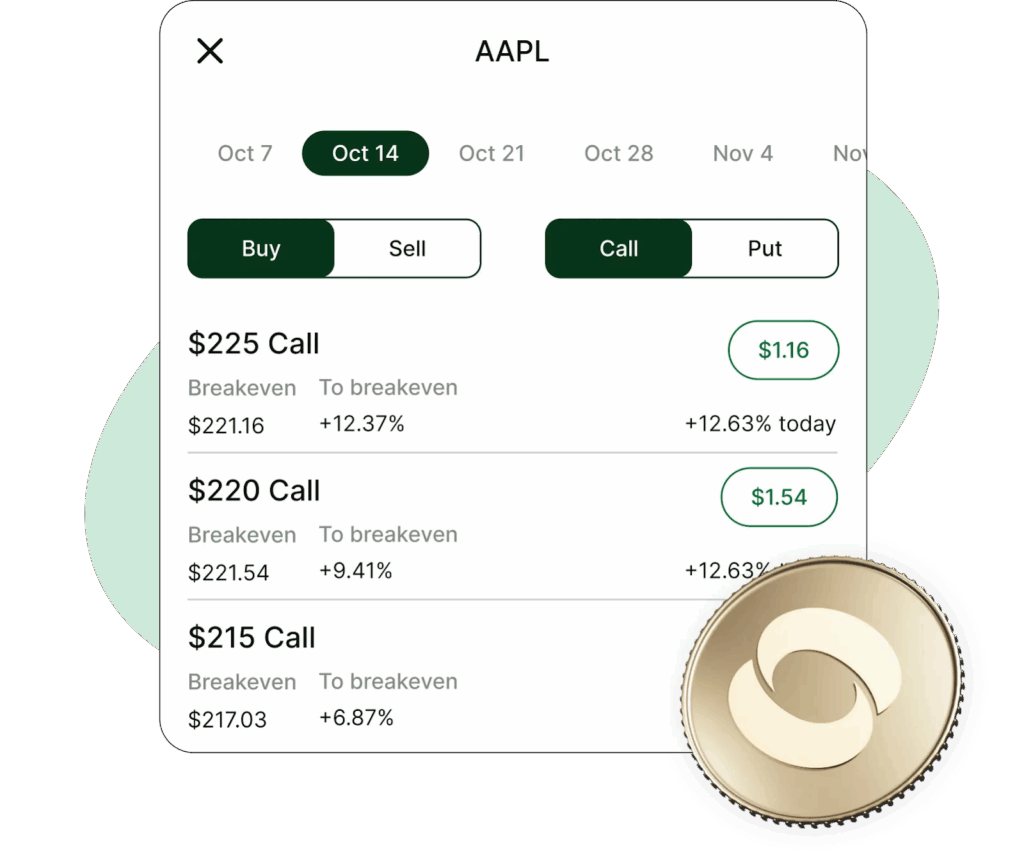

Below is an options chain for AAPL on Sarwa:

The first item on this page is the expiration date. This is the date on which the option contract will expire worthless if the buyer does not exercise it.

Usually, the further away the expiration date, the higher the time value of the contract, and higher time value leads to higher price (premium).

Below the date, you can toggle between being an option buyer or seller. Once you have chosen your strategy, you can then toggle between a call option and a put option.

In essence, there are four options: buying a call option, selling a call option, buying a put option, and selling a put option.

For this example, there are three call option contracts with an expiry date of October 14.

The price on the left ($225, $220, and $215) is the option’s strike price, while the one on the far right ($1.16, $1.54) is the premium (per share).

If you click any of these option contracts, you will see a “buy” button that allows you to create a buy order.

Suppose you were selling, you would get a “sell” button instead.

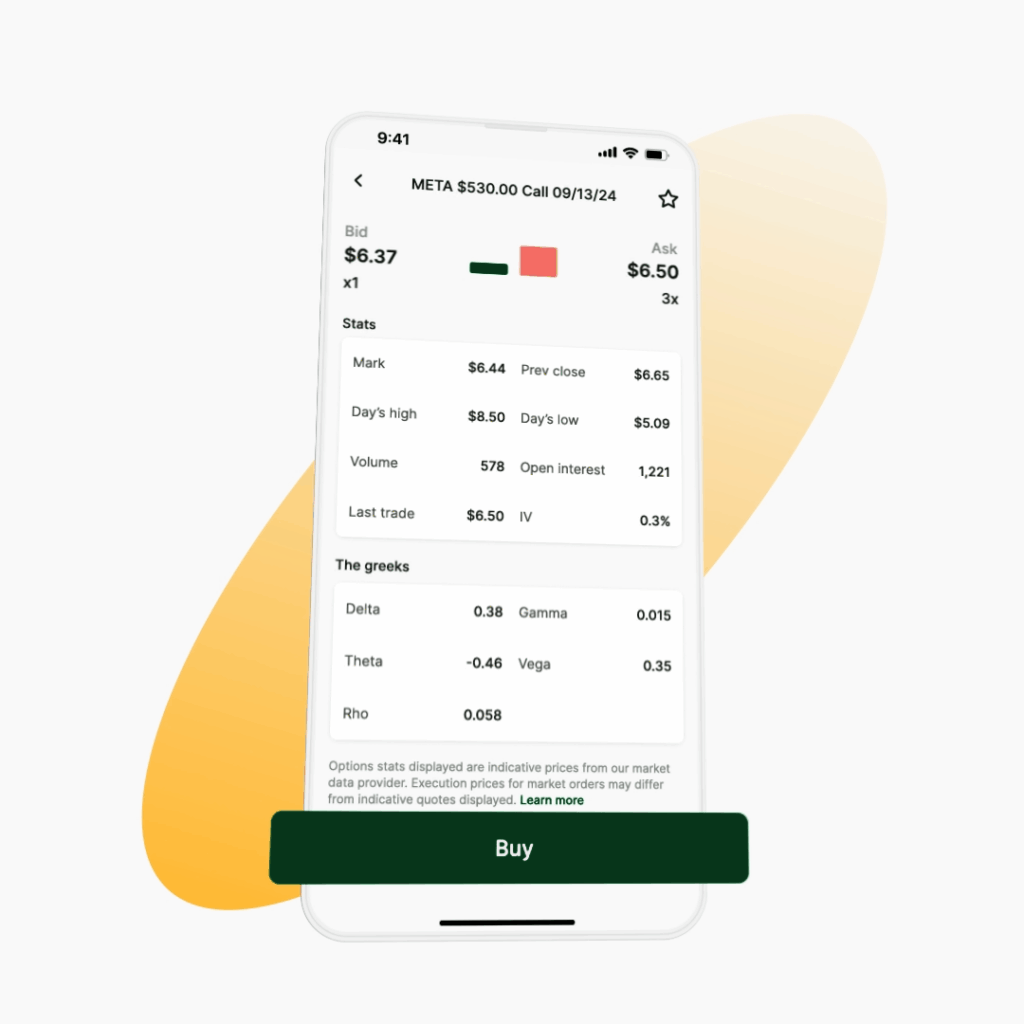

You will also find other information like volume, open interest, the Greeks (delta, theta, rho, gamma, and vega), implied volatility, and the premium’s high, low, and previous close.

Just as with spot markets, you can create limit or market orders. A market order will be executed at the current premium, while a limit order will only fill you in when the premium reaches a certain price.

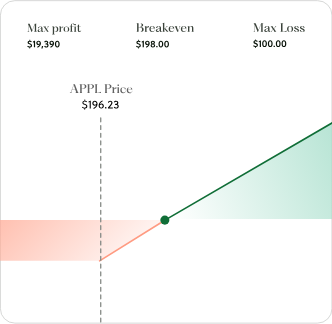

5. Check the contract performance profile chart

In the sample chart above, you will notice a small section below the strike price labeled “breakeven” and “to breakeven.”

The breakeven price is the price at which the option buyer or seller breaks even (no profit, no loss).

Since the buyer will pay a non-refundable premium, it means that the profit on the options contract equals the premium paid at this breakeven price. For an option seller, the breakeven is the price at which the loss on the options contract equals the premium received.

To the right of the breakeven price is the percentage movement in the market price needed to get to that break-even price.

You can also get a graphical representation of the options contract’s potential performance through the performance profile chart.

As seen below, it also shows the maximum profit or loss you can make on the trade, in addition to the breakeven price.

6. Close the options contract

The last part of knowing how to trade options is understanding how traders close option contracts.

If you are an option buyer, you can close your options position before the option expires in any of the following ways:

- Exercise before expiration: For American options (unlike European options), which is what Sarwa provides, you can exercise the option within the timeframe from the purchase date to the expiration date.

If you want to take profit or cut short your losses because you believe the market will go against you, you can close the contract through an early exercise.

- Selling the option contract: You can sell the option contract to another person. If the premium you receive is higher than the one you paid (the option is in-the-money), you will be in profit, and vice versa (out-of-the-money). This is another good way to cut short losses or take profits.

- Rolling over your position: You can move from one option contract with a given expiration date to another one with a longer expiration date (or a different strike price).

Since the time value of an option contract increases with a longer expiration date, rolling over gives the option position more time to become profitable.

In other words, traders roll over their positions to increase returns or defend a position that is currently losing money.

As a seller, your options are:

- Buying the option contract: You can buy the same option contract from another trader to close your position. You will be in profit if the premium received is greater than the premium paid for this purchase.

- Rolling over your position: You can roll over your options position to a similar contract with a different expiration date or strike price.

Why should you trade options with Sarwa?

Sarwa is one of the few trading platforms/brokerages that provide you access to US options trading in the UAE.

When you trade options on Sarwa, you will enjoy the following benefits:

- Exchange-traded options: Sarwa offers exchange-traded options rather than contracts for difference (CFDs), which are only available in over-the-counter (OTC) markets. The advantages of options over CFDs include more liquidity, the possibility of income generation strategies, and support for more hedging strategies.

- Free deposits and withdrawals: Transfers from your local bank account to your Sarwa trading account, and vice versa, are free.

- Beginner-friendly trading: Sarwa provides easy and seamless access to a Level 2 trading account. More complex stock option trading strategies (Level 3 and Level 4) are currently excluded since beginners don’t have the skills or risk tolerance to handle them yet.

- Excellent UI/UX: Sarwa’s trading platform is easy to navigate with a user-friendly interface that optimizes your trading experience. As seen from the charts above, you can quickly and easily find whatever you are looking for.

- Limit and market orders: You can create both market and limit orders, depending on your strategy.

- Secure and regulated trading platform: Sarwa uses bank-level SSL security to protect your data and money. They are also regulated by the ADGM Financial Services Regulatory Authority.

- Committed to education: Through its blog and newsletter, Sarwa provides resources that will make you a better trader.

What, then, are you waiting for? Sign up today for a Sarwa account to make your money work., manage your risk, and take trading into your own hands through stock options trading.

Takeaways

- Stock options offer three main benefits: passive income, risk management, and potential returns magnification. They are very valuable for UAE traders of US stocks and ETFs

- Successful options trading requires choosing liquid and volatile stock options with a liquid and volatile underlying asset (stocks or ETFs) and selecting strategies aligned with your goals.

- Successful options trading also requires knowing how and when to close a trade to take profit or cut short losses.

- Sarwa provides access to US stock options via a Level 2 account, supporting strategies like covered calls, cash-secured puts, married puts, long calls, and long puts.