For some people, they get eased into bad news with the slow peeling of the band aid, while for others(e.g me), we get:

“My man, with inflation at 13% and a low interest rates of 1–3% you are better off losing that money to a quick rich scheme”

Let’s unpack that statement; That was a potential employer in Lagos, Nigeria telling me why they don’t give their employees a pension (the 13% inflation rate was Nigeria’s inflation rate at the time). He definitely said a lot more things, and while I didn’t get to work for him (for reasons you can probably read between the lines) that was an eye-opening moment with regard to inflation, and if I’m being honest, no one ever told me about when it came to saving for my future.

If you already know about the effects of inflation and how it affects your savings, you should probably skip this post. But if you’re like me, and are clueless about how inflation affects your future savings and dreams, you should read on.

In a nutshell, if your savings were in a sack and you were carrying that sack on your back for the next twenty years, adding money to it from time to time, inflation is that thing that sticks a hole at the bottom of the sack so as you move forward, the money leaks to the ground, and when you arrive at your final destination (retirement, kids college, wedding e.t.c ), you realise you have a lot less money than what you actually put in.

Don’t believe me? Let us dive into the details together;

Understanding Inflation

I love the way thebalance.com explains it:

“Inflation is the increase in the prices of goods and services over time. It’s an economics term that means you have to spend more to fill your gas tank, buy a gallon of milk, or get a haircut. Inflation increases your cost of living.”

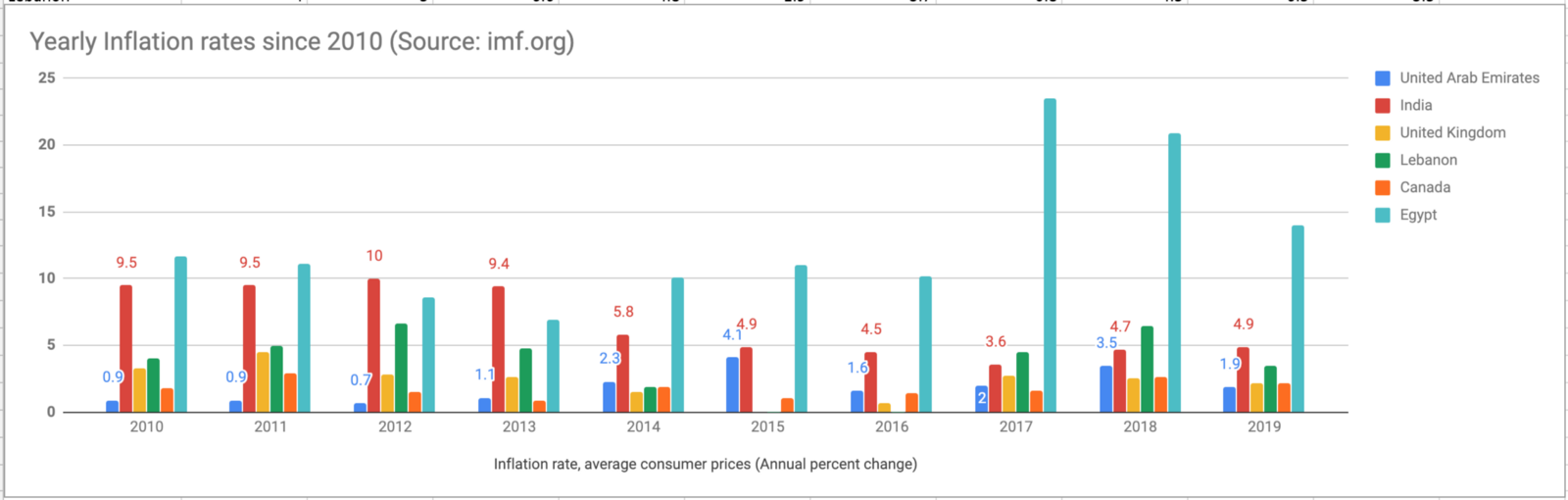

Inflation could be caused by a number of factors, e.g increase in money supply, increase in demand of goods, increase in the cost required to produce goods and many more. For some countries the inflation rate is crazy high, e.g, in India, it’s currently 4.9%, UK, it’s 2.2%, UAE 1.9% , Lebanon 3.5%, Egypt 19%, Canada 2.2%.

What this means is, the amount of money it would take to afford something today, is not the amount of money it would take tomorrow.

It’s important to note that inflation is really not all bad, there are a number of pros too. For example, moderate inflation is part of the reason the nominal value of your pay check increases*(amidst your hard work and four degrees of course). It also makes it easier for debtors to repay their loan with money that is less valuable compared to the money they borrowed initially(please don’t go on a borrowing spree because you think inflation will help you). Moderate Inflation helps with economic growth too.

Still not convinced? Let’s take a Big Mac;

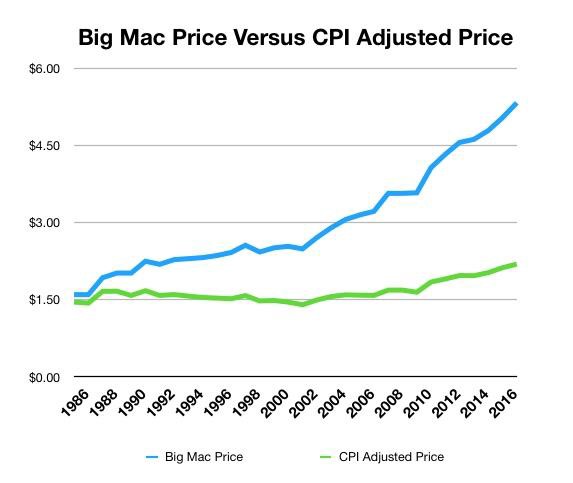

While I don’t want to get too technical, let’s look at something interesting: The Big Mac Index. The Big Mac Index is a concept invented by The Economist in 1986, it’s pretty simple, they compare the price of a McDonald’s Big Mac burger in two countries, and use that price comparison against the actual exchange rate of the two currencies to determine if either of the currencies is being undervalued.

Quick example: say a burger costs $1 in the US and £3 in the UK. The Big Mac Index valuation for GBP/USD would be 3.0, or three divided by one, which could then be compared to the GBP/USD exchange rate.

One thing this historical comparison of the Big Mac Index between currencies can show us today is the price comparison of the same product over time. In April 2000, a Big Mac cost US$2.51. However, in January 2019, the same Big Mac costs $5.58. That’s a 55% increase in 19 years, which means, inflation has reduced the power of $2.51 by 55% in the last 19 years, and while not at the same rate, this same concept affects everything we spend our money on today: gas, rent, housing, travel, food, education, raising a family etc. A house that cost $40,000 in 2000, is probably worth over $100,000 today. You see where I’m going with this?

The impact

Let’s do some number crunching. Imagine/hope/pray your country’s economy is stable enough for its inflation rate to not sky rocket but stay at about 3% per year. Going by that inflation rate your $100,000 savings (an amount which is not even a piece of cake to have) will be worth roughly $66,666+ in 20 years.

Still sticking to that 3% inflation rate, you have to be growing your money by at least 3% per year, and that’s just to keep the same value of your money in X amount of years. Now, if you want your money to have more value (which I hope you should — I mean if you don’t, you may need to get checked) you definitely want to consider growing your money to more than 3% per year. How can you achieve that when your bank’s annual interest rate on your savings is between 0.5–1%?

It’s a tough reality, and that’s why you have to be looking at investment options to grow your money over the years. You should definitely do a little more research on this if you’re not fully convinced.

I should also mention, savings is actually very important. Want to achieve short and semi-long term goals? You should definitely save for it. However, for long term goals like retirement, children’s college, buying a house (maybe without mortgage) etc, you definitely want to grow that money over the years.

It would be unfair of me to give you this somewhat depressing news without a glimmer of hope; Of course now you know you can’t just “save” your money to financial freedom, you need to start thinking about growing your money, and you need to start fast, because the earlier the better.

Three things you can do to remedy this is:

- Invest your money

- Make more money

- Invest more as you make more money

The advice to make more money might sound cliché, but it may be the most important one; get that second gig, ask for a raise, reach out to that company, no matter what, secure more bags. You definitely cannot achieve the financial freedom for your future by not being proactive.

Bringing it all together!

There are a ton of investment options out there today, stock market, real estate, gold, etc. The stock market is definitely a good one, and while it’s common for people to say they were burnt by the “stock market”, you’ll have to admit, no one can accurately predict the future of the value of companies. However, that’s what a lot of people that get into the stock market try to do. Some might say they have the “winning” stocks you should invest in, but more often than not, that never pans out, and money goes down the drain.

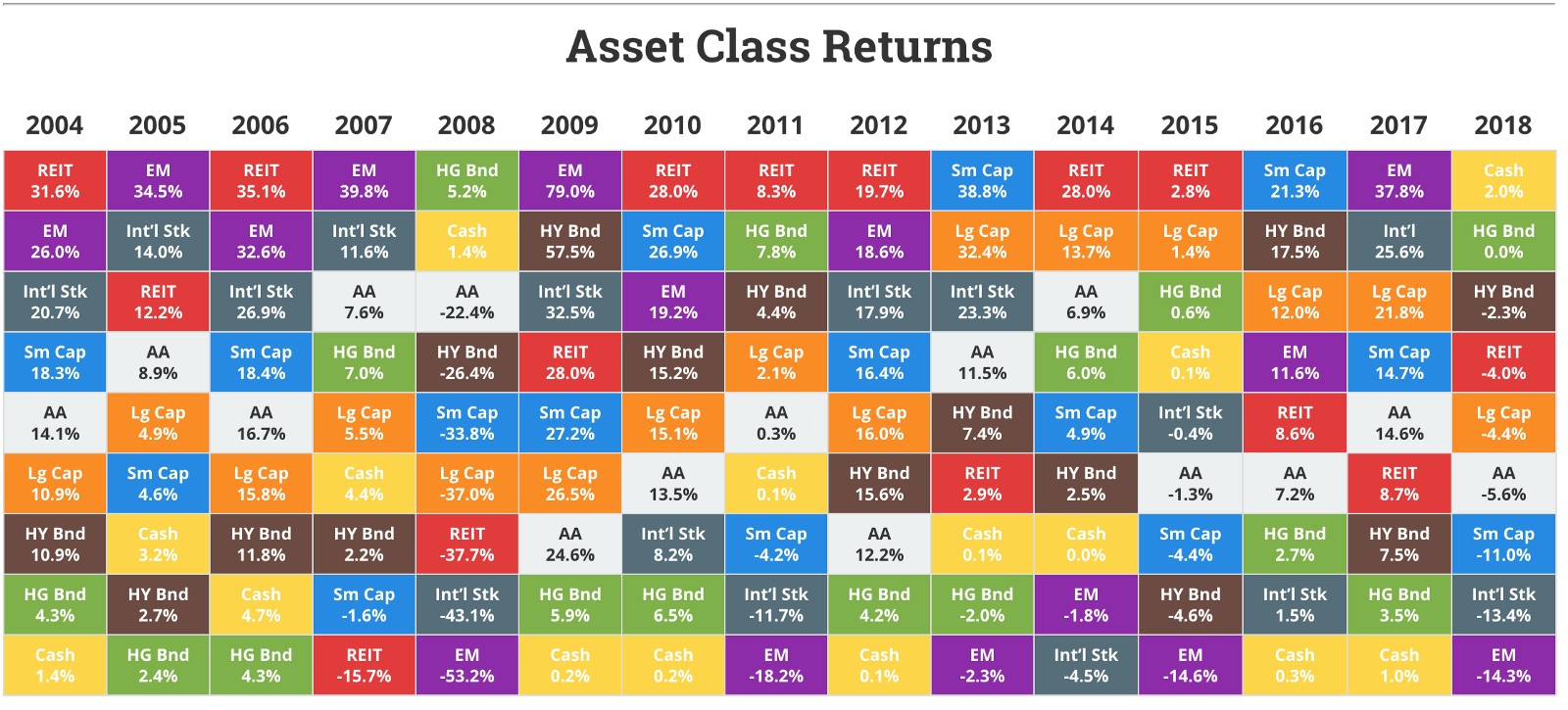

When considering the stock market, you want to go for diversification. This simply means, instead of putting all your eggs in one or a couple of so called “winning” stocks, you split your money into various investments that cut across the stock market, bonds, real estate, etc. Diversified portfolios are a really great option because they reduce risk without sacrificing returns. But don’t take my word for it., the chart below is a representation of investment asset classes performance in the past 12 years of the global market, and if there’s any common trend year on year is that the ones on top are never certain.

Take aways from this chart:

- It’s nearly impossible to pick the winning asset category each year.

- You’re better off spreading your investment across multiple asset classes to lower your risk and optimise returns.

Last thing you should know is, when it comes to investments, you always want to ensure you’re keeping your costs low. A 2–3% charge might seem small today, but compound interest across 20–30 years could interpret that to over $300,000+ lost in fees. Try to keep your fees lower than 1%.

I hope you found this informative, and I wish you all of the success on your financial journey!