For investors across it’s been an intense ride. The market’s news are causing concerns: volatility was initially based on investors’ fears about the coronavirus which led into a market correction in just six days, the fastest time registered for a correction. A sharp fall in oil prices also rattled investment markets and, since these two main issues, stocks have been extremely volatile. The market moves up and down, and that’s the nature of it. However, especially for first time investors, watching it swing is not easy.

It’s very important to remember that market movements are a natural part of investing and drops are inevitable. Smart investors know to think long term. The market will always trend upwards, despite short-term setbacks.

1. First thing to do is to do nothing

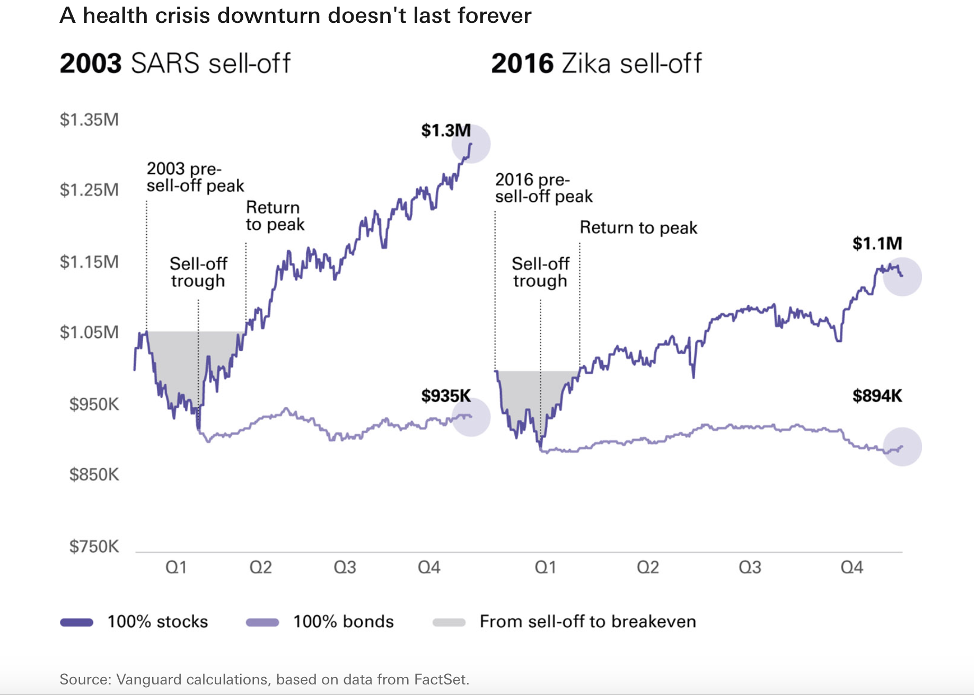

Take a deep breath and block the noise as much as possible. Try not to keep checking for market news. It’s not easy but if you are a long term investor, then the best course of action is to do nothing. When markets fluctuate, sticking with the plan becomes more important than ever. What is happening is nothing new. In 2003, we had the SARS crisis, and 2016 saw a decline due to the Zika virus. Investors need to understand that this is all part of the cycle and that these dips don’t last and the market will recover and move upwards eventually. Sometimes quicker than we think.

It’s only by selling investments during a dip that you might incur a loss. There are only three good reasons to do so:

- You need money for an emergency

- You made a terrible investment that’s consistently underperforming over the long term.

- You achieved a specific goal

2. Re-evaluate your risk profile if necessary

The recent events are a good test to someone’s risk tolerance. When you start investing with Sarwa, we ask you questions to get to know you and to assess your risk appetite. Some questions are about the reaction to market volatility and what would you do when you see a drop. Your portfolio is then built around these answers. But if you are feeling panicky, then high risk may not be for you. However, if you are not scared and your investment goals have not changed, then you need to stick to your plan and stay the course for the long term gain.

If you are 35- 40 years old and your plan is to use that money in 20 to 30 years, whether for your kids future or your own retirement, then the market drop will have no impact on your plan. Your portfolio is set up to grow long term.

3. Look into potential opportunities

If – and only if! – you have excess cash, you already have your emergency fund set up, and you have a good risk appetite, then you can potentially consider a ‘Buy the Dip’ approach.

What is the Buy the Dip approach you ask? when markets go down, lower stock prices create for some an opportunity to buy cheaper and to have an increased value when the markets go up – and they do.

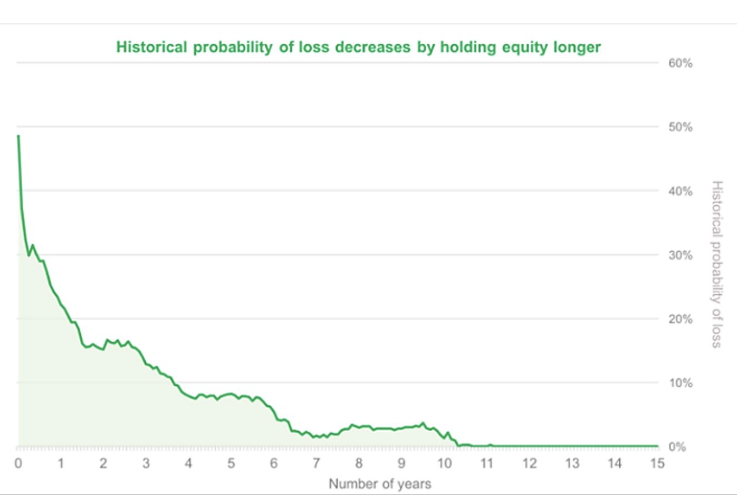

Long term investing not only pays off due to compound interest but also may reduce your chance of losses. According to a study by Macrobond, If you look into the last 50 years, the probability of losing money on your investment drops the more time you stay in the market.

When we design our diversified portfolios of ETFs, we do this with the goal of minimizing losses during periods of market volatility. What we are seeing today is within the expectations of what would happen across each level of risk. We still believe that long term, stocks and bonds will continue to outperform cash as they have done in the past.

Yes, investing has its risk. That said – quoting Warren Buffett – the market rewards patience. Long-term investors benefit not only by remaining invested but by continuing to contribute into their funds during periods of volatility.

The two financial scenarios ahead of us

As the virus cases mount, upending supply chains, cancelling traveling plans and emptying restaurants, the economic effect is being felt across. Market news are reflecting this impact. Critically important for the outcome will be bold approaches from the various national financial authorities including aggressive fiscal policies.

Let’s start with the best case scenario. The economy returns to normal over the short time. Market will operate as per their normal function. With Central banks – like the US Federal Reserve and Bank of Japan – working on restoring liquidity, the markets will go back to assuming their function in pricing assets properly. We will still see lower economic growth because of the pandemic, but the recovery will happen. The fundamental of businesses are still there.

On the other side, we could see difficulty in accessing credit, and borrowers will find a hard time to get funding. This won’t be the direct impact of the pandemic. Right now, the focus is on the wellbeing of the community and public health. We don’t know how long the time frame of disruption will be. This is what will determine where we move from now.

In the long run – as long as central banks make sure the banking system works – we should expect a rebound in the economy. Asset values will go up once this is behind us.

Ready to invest in your future?