Investing can be complicated. Sometimes even intimidating.

There is so much information out there on where to invest, what to invest in, new trends and buzz words; and it is coming from all around: articles, blogs, news feed… WHY DIDN’T I INVEST IN BITCOIN??!

We try to find the right investment, to understand how to start while attempting to shun all the noise around us. It is not easy. That’s why so many people put investing in the backroom of their mind; something to do

That’s where the problem lies. We are busy with work, studies, family, life. There is always something happening, always a bill to pay, and ever so often not enough money put aside. The sad reality is people are missing out on an opportunity where their money can do the hard work for them.

“Money makes money. And the money that money makes, makes more money.” –Ben Franklin.

You nailed it, Ben.

Our generation is one that needs to work harder in a global market where competition keeps increasing and the future, let’s face it, is full of the unexpected. We still

The problem we’re solving

Traditionally, financial services have been reserved

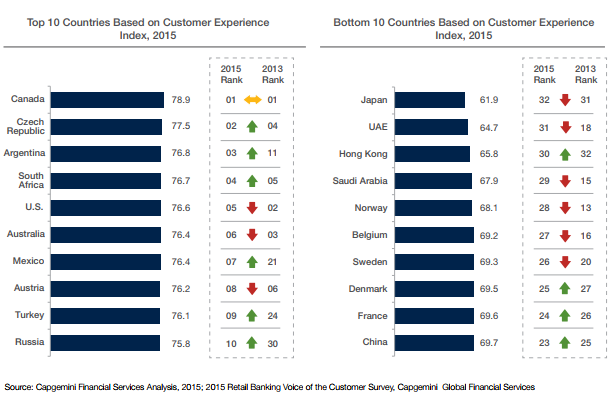

In 2015, The Efma World Retail Banking report revealed that Canada ranked as the #1 country for customer experience, while the UAE was in the bottom 10 countries.

We were based in Canada at the time, Mark was advising Canadian banks on digital transformation, while Jad worked at a high-speed hedge fund developing proprietary trading algorithms.

Having grown up in the Middle East, we had the desire to bring something of great value to the community. Given the lack of innovation in the Financial Services industry in the UAE, we decided to take a deeper dive.

What’s driving this massive mismatch between digital banking experience and consumer digitization with 94% of the population being active internet users?

To answer this question, Nadine joined us as a third co-founder with a deep understanding of the market and what it takes to build long-term, trusted relationships with customers. While we were working in Canada, Nadine was in the UAE working on retail strategy and consumer research. We interviewed dozens of our friends and family working here, and the patterns of poor customer experience and why people weren’t investing their money became obvious:

· They don’t know where to start

· The process is too long, too complicated

· They don’t think they have enough money to start with

· The fees are too high and lacked transparency

· Wealth managers failed to beat their benchmarks

· They were afraid that their money will be locked in expat investment traps

These came back time and again with almost every person we talked to. They all wanted access to a personalized investment solution, and it became clear to us that whatever solution we built needed to be simple, accessible and at a fraction of the cost.

And so Sarwa.co was born.

Acceleration

We knew that democratizing investing wasn’t going to be easy, so we joined forces with the Fintech Hive at DIFC, the region’s first 12-week

Through the hive, we collaborated and received amazing advice from industry leaders such as HSBC, VISA

So how are we doing this?

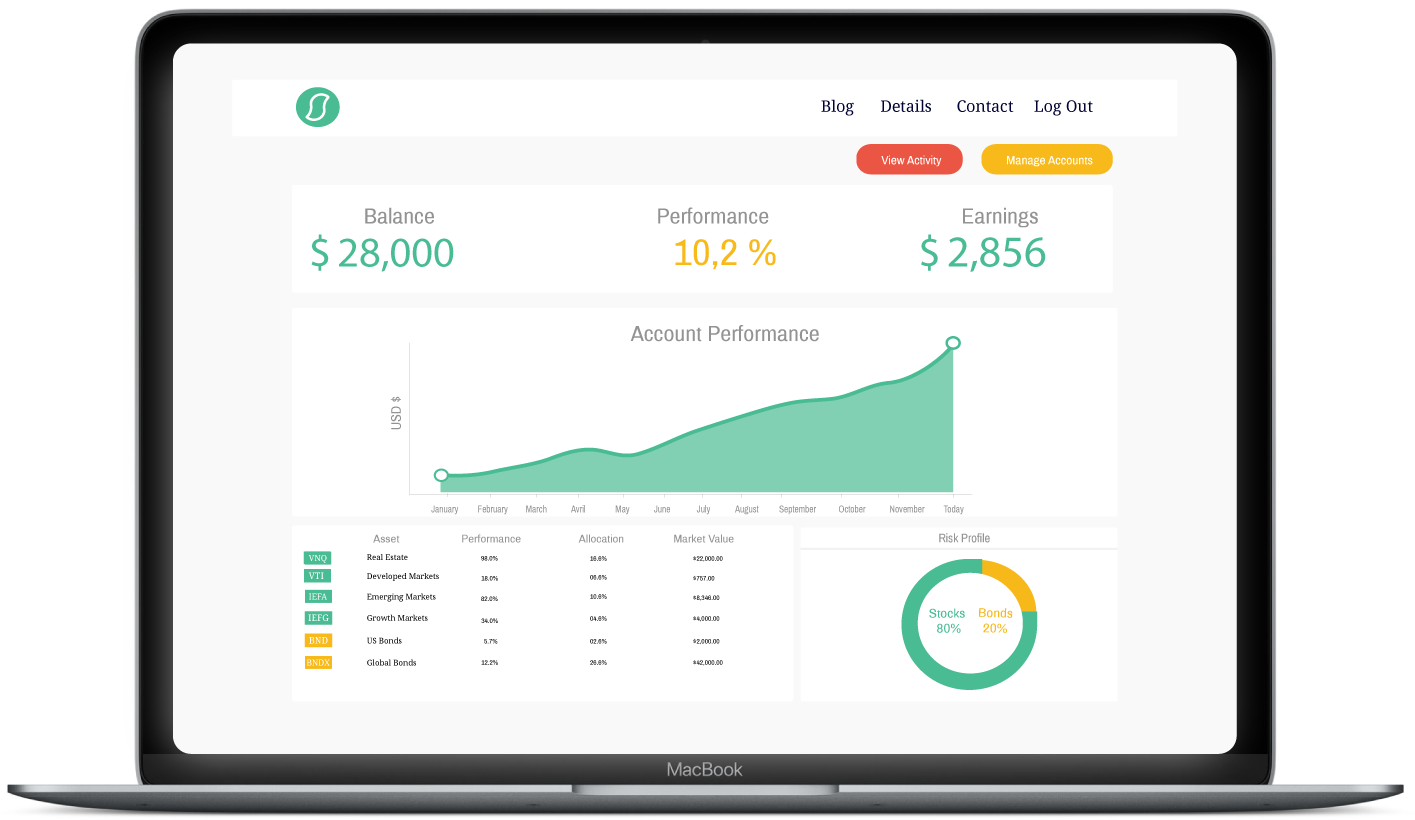

Our mission is to empower people to live the life they want with expert affordable investing.

We do this by using proven passive investment strategies layered with our state of the art technology to give our clients the best returns. We diversify their investments in global markets to reach their goals faster and minimize the risk they face.

We do this at a fraction of the costs of traditional wealth management, so the money saved can be invested and put back to work. Dividends are automatically reinvested too. You can find more details on how it works on our website.

We’re extremely excited to launch in the upcoming weeks. Thank you for reading our story and we hope you will join us!