The global sukuk market is an underappreciated growth story in the investment world. Over the course of about 15 years, the humble shariah-compliant bond market has witnessed rapid growth and is now worth well over $550 billion today, according to Mohieddine “Dino” Kronfol, CIO for Global Sukuk and MENA Fixed Income at Franklin Templeton.

This market capitalisation puts sukuk on a similar footing with the Swiss bond market or even bitcoin, which had a market value of $597 billion in January 2021. But sukuk is a much smarter asset class, and, unlike bitcoin, comes without any of the speculative hazards, high volatility, or exposure to sin industries.

Similar to ESG (environment, social, and corporate governance) funds in the Western world, global sukuk growth got a boost in the post-2008 financial crisis period as people sought out ways to invest with a stronger moral compass.

The sukuk is now at an unsung turning point. Just 10 years ago, Kronfol told us, retail investors couldn’t even buy sukuk. Today, robo-advisors now make the sukuk as easily available as traditional stocks and bonds.

Like conventional bonds, sukuk offers a tool to diversify an investment portfolio with a low-risk, low-volatility asset class.

Kronfol spoke with Sarwa about how Franklin Templeton sees plenty of innovation in the sukuk market, which now includes more intangible assets.

“Today, we have some structures that are backed by telecom minutes, airline seats, or other types of assets that are less tangible, and with exposure to different parts of the capital structure,” says Kronfol.

“In theory, what this innovation and growth allows you to do is to build very robust portfolios that are diversified across different risk factors and that can do well, regardless of where we are in the business cycle,” he adds.

New sukuk strategies are now being carried out by Franklin Templeton to allow investors to follow broader economic trends in the GCC region. With more corporate bonds being added to sukuk portfolios, investors can benefit from efforts Middle Eastern governments are making to replace state-sponsored capitalism with foreign investment and private sector-run economies.

Sukuk innovation also includes replicating trends in the ESG sector, such as by introducing data analytics to produce shariah-compliant scores for individual sukuk.

Going into 2021, Franklin Templeton will also pursue its application for green certification for sukuk funds to meet the growing demand in green trends (which may be set to live through a revival with the new Biden administration).

We spoke with Kronfol about how ESG funds have influenced sukuk, what innovation in sukuk markets looks like, why investors should diversify with this basic building-block asset class, and how robo-advisors are revolutionising access.

1. Sarwa: There is growing interest in ESG funds as people begin to invest with a stronger moral compass. Has the impact of this growing desire to invest morally also helped buoy interest in shariah-compliant assets?

Kronfol: Investing in a manner consistent with clients’ value systems is not something that is new for us. For example, our Franklin Templeton equity strategy has avoided sin stocks going back to the 1940s. I think our firm was ahead of its time in recognising that socially responsible investing was going to be a growing trend. But you are right; ESG has played a role. Today, that is something that we continue to build upon.

Shariah-compliant investing falls under that social responsibility vertical, but there is still some work that needs to be done to score highly on key criteria. Just because it is a shariah-compliant fund or product doesn’t mean that it is going to have a high ESG score. However, shariah-compliant funds start from a good place because they have some exclusions as far as certain sectors and leverage are concerned.

2. Sarwa: That’s to show that just because a fund is shariah-compliant doesn’t mean it’s free of risk. In fact, shariah-compliant assets do carry very different risk factors compared to conventional funds. What are these unique risks?

Kronfol: I think many of the risk drivers associated with shariah-compliant equities or sukuk investing are going to be similar to their conventional counterparts. Areas to focus on include governance, legal due diligence, given the different jurisdictions you’re going to be involved in, and in some geographies there are other social or political risks that one needs to consider.

We also believe in keeping things quite simple, and at the root of what we do is basically trying to understand the willingness and ability of sukuk issuers to pay us back. That’s really what constitutes the core of what we do. The foundation for all of our products includes an intensive research process to understand that fundamental risk: can this issuer pay their debt back?

3. Sarwa: The Sarwa community really digs deeply into the benefits of diversification. This includes the Modern Portfolio Theory. How is sukuk utilised in an investment portfolio to gain benefits from diversification, such as diversification by geographical location?

Kronfol: Our products are global. They are incredibly diversified in terms of their exposures across countries. Diversification is also a core strength of Franklin Templeton, which itself is a global organisation with footprints across many markets and sectors.

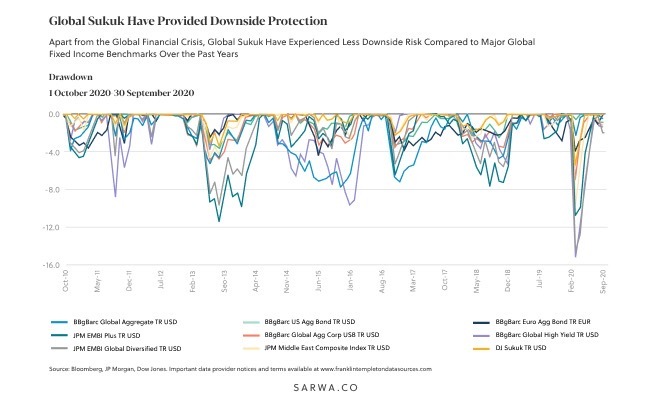

In the context of a global portfolio, this is very attractive because sukuk have strong defensive characteristics. So, for an investor that is looking at building a portfolio, sukuk come with typically very low correlation numbers compared to traditional asset classes. Also, the sukuk asset class has low volatility; that’s very attractive for risk measures of portfolios.

During times of stress, the sukuk market has tended to exhibit very small drawdowns, which make it a particularly useful allocation in a global portfolio because it helps you diversify; and it lowers your risk.

4. Sarwa: This history shows that sukuk performs well during downturns. How has this asset class developed to get to where it is today?

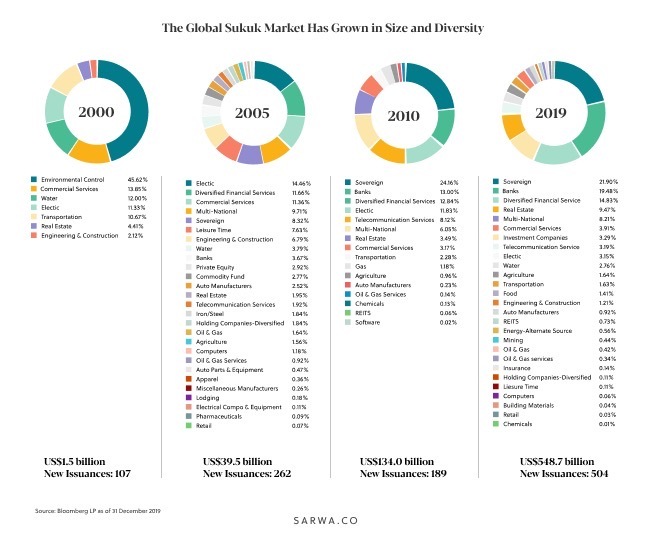

Kronfol: This is a market that went from almost zero about 15 years ago, and then grew rapidly in terms of the number of countries and issuers to become worth over $550 billion today. In a relatively short amount of time, the market has really scaled up significantly.

The market has also been characterised by quite a bit of innovation. We’ve gone from really pretty plain vanilla types of products, for example, the Ijara structures or simple sale and leaseback structures, into more sophisticated assets. Today, we have some structures that are backed by telecom minutes, airline seats, or other types of assets that are less tangible, so to speak.

The market has indeed grown to see representation across countries, sectors, and companies, but also in terms of the assets underlying them. In theory, what this allows you to do is to build very robust portfolios that are diversified across these different risk factors and that can do well, regardless of where we are in the business cycle.

5. Sarwa: As the portfolio manager of major sukuk funds at Franklin Templeton, could you give us a bit of a look under the hood, so to speak, of how you build these funds?

Kronfol: Our process is constantly evolving. There is nothing that stays the same, right? Everything is moving forward. One of the things I’m most proud about is that we have a team that has hardly seen any turnover in the past 12 years. I’ve seen the team grow, mature, develop and become more specialised, especially in our risk and credit analysis.

The trend today is a deterioration in credit metrics. So whether we’re looking at richer or more developed countries, or we’re looking at poorer, faster growing emerging markets, in general, between the pandemic, lower oil prices or lower commodity prices, we’ve seen a lot of the credit metrics deteriorate over the last couple of years.

Now, a big part of our focus is studying how these markets are navigating these more challenging times, and what sort of policies are they putting in place to deal with short-term challenges while also capturing longer-term opportunities. We’re doing that while keeping in mind ESG considerations that we need to consider, whether they are exposed to the transition to low carbon emissions for example or other social risks that we need to be mindful of for our investors.

6. Sarwa: Sukuk is more than just fixed-income government bonds, which is only part of a diversified bond portfolio. How big of a role do corporate bonds play in your portfolios?

Kronfol: When we think about portfolios, we have three broad categories. First is sovereign issuers, which are government bonds. Then, there are quasi-sovereign issuers, such as when governments own a substantial portion of their equity, and this could include banks, airlines or telecom companies. And then we’ve got your traditional corporates, which are private sector companies. As a rule of thumb, our portfolios typically are about one third in each of those main sectors.

Corporate bonds we find the most interesting, the most exciting, and the ones that, frankly, we think need to do more of the heavy lifting going forward. In emerging markets there is this transition away from state-sponsored capitalism into one that is more efficient. This means more of the heavy lifting being done by foreign investors or by the private sector. Therefore, we are seeing more independent issuers, more high yield issuers come into the space, and these are the types of issuers that we want to support and engage with because they provide different types of returns with different risk profiles that typically are more attractive in an environment where interest rates are very low.

In general, we are moving in the right direction. We have built robust portfolios that have done well during times of market stress and that have delivered returns. Over the past 12 years, we’ve had a number of pretty stressful environments, with the financial crisis, emerging markets sell offs, taper tantrums, Brexit and oil market setbacks. And through it all, the sukuk market has delivered roughly 6% annual returns, with levels of volatility that are closer to 4%; that is, the lower the volatility score the less volatile or ‘risky’ an asset is. Those are very solid return and risk numbers.

7. Sarwa: Going forward, there is even greater opportunity as new platforms begin to offer online financial advisory and create portfolios with global sukuk. How have robo advisors contributed to the growing access and understanding of the sukuk and shariah-compliant asset markets?

Kronfol: Robo-advisors are still a small part of our distribution channels, but it’s a fast growing one. As an organisation, we have paid particular attention to these newer and more digitally focused modes of distribution.

This type of platform is also very much quantitatively driven. I feel like when it comes to sukuk, it typically engenders a certain bias, positive with some investors, negative with others. With robo-advisors, they are able to highlight the merits of the asset class for a broad array of investors in a way that is accessible, no matter the type of investor.

8. Sarwa: Sarwa offers a halal portfolio built with global sukuk from Franklin Templeton, which is now accessible in Saudi Arabia. What significance does this portfolio represent to the average halal investor as compared to 10 years ago?

Kronfol: 10 years ago, retail investors never even had access to sukuk. Now robo-advisors can give people access to them. When you take that into consideration with some of the other developments we see with respect to pensions and other kinds of domestic pools of capital, all of that is going to help develop the financial services industry in these markets, which up until now have really been very heavily dominated by traditional or commercial banks.