You have probably heard many of your friends and family members talk about their dream houses. But how many of them have you heard talk about their dream stock portfolio? Very few or none at all.

Homeownership and investing in real estate remain important goals of many, mainly due to the tangibility of real estate (“I want an asset I can touch and feel).

However, few have paused to consider why real estate is a bad investment, especially when compared to stocks. While clinging to it for its sentimental value, they fail to ask questions about its investment value.

This article will consider that investment value by asking why real estate is a bad investment. Such analysis will help achieve some balance in conversations about real estate and help you make better investment decisions.

Below are the top 10 reasons why buying real estate is a bad investment:

Do you want to learn more about the best investment opportunities for building wealth in the UAE? Subscribe today to Sarwa’s Fully Invested newsletter for weekly personal finance and investing insights that will make you a better investor.

1. It requires a large investment outlay

The initial investment outlay required to own a property is often too high for the average investor. For example, you will need an average of AED 408,000 to own an apartment or a unit in a complex in Dubai and an average of AED 871,000 to own a freehold villa, according to Driven Properties, a real estate company.

How many people have that amount of cash? Not many.

This is why most real estate buyers and investors rely on mortgage financing. But even then, they will need to make a down payment, which is, on average, 20-30% of the property’s price for expatriates and 15%-25% for UAE Nationals, according to Engel and Volkers, a real estate company.

A 20% down payment will still require an initial outlay of AED 81,600 for an average apartment and AED 174,200 for an average freehold villa. Even this is a big deal for many people looking to invest their money and it will require saving money for many months or years to meet that goal.

In contrast, with just $1, you can create a stock trading account with Sarwa and gain access to thousands of US stocks right from the UAE.

You don’t need to save for many months to get started investing in stocks; your AED 500 this month and AED 1,000 next month can be used to purchase a fraction of a share of any company of your choice.

For example, if you like AAPL (the stock of Apple Inc.), you don’t need to put $198 (AED 726) down to get a chance to own a share of it. You can buy 0.3 shares this month, 0.4 shares next month, and 0.3 the month after until you have bought a share of your favourite stock.

The advantage of this is that you can start earning compound returns right now instead of saving money in low-interest savings accounts until you can come up with the down payment for a property.

2. High upfront or closing costs

Closing costs are the expenses that buyers and sellers incur as they finalize a real estate transaction.

In Dubai, the closing costs for a typical real estate transaction can add up to 7-10% of the property’s price, according to Bayut, an online real estate platform.

Some of these costs, payable by the buyer, include:

- Dubai Land Development (DLD) fee (or property transfer fee): This is usually 4% of the property’s price with an extra AED580 administration fee.

- DLD trustee fee: This fee is collected by trustee offices that help with the registration of property transactions. For properties valued below AED 500,000, the fee is AED 2,000 plus 5% VAT while it is AED 4,000 plus 5% VAT for properties valued at AED 500,000 and above.

- DLD mortgage registration fee: This is between 0.25% and 0.5% of the amount you are borrowing through the mortgage.

- Bank mortgage registration fee: This is a different registration fee from the one collected by the Dubai Land Department and it is usually about 1% of the amount you are borrowing plus value added tax (VAT)

- Real estate agent’s commission: This is usually 2% of the purchase price plus VAT.

- Property valuation fee: Though this is optional, it is often recommended. Unlike others, there is no fixed fee for this.

- Municipality fees: These include housing and knowledge fees and add up to 0.25% of the property’s selling price.

In contrast, it costs just 0.25% in transaction costs to purchase stocks on a platform like Sarwa. To say the difference is huge is an understatement.

3. Complex investment process

Purchasing a stock is as easy as selecting the stock you want, specifying the number of shares you want to buy, and then clicking “buy.” If you already have the money in your brokerage account, this whole process will take only a few seconds.

In real estate, it is a different ball game. “The property transfer in Dubai can take up to 10 weeks,” according to Better Homes, a real estate company. “You cannot do anything to speed up the process.”

Though it is possible to close in less than 10 weeks, it is hard to do it earlier than two weeks even if you do everything right, according to Bayut.

Interestingly, a lot can happen in ten weeks. Whether due to local economic conditions or national ones, a real estate market can plummet between the beginning and the end of the deal, upending whatever plans the buyer has made.

4. Diversification is very difficult

You have probably heard the statement “Don’t put all your eggs in one basket.” In the investing world, this statement highlights the importance of diversification.

Applied to the real estate market, this means investors cannot put all of their money into a single property. If they do, any situation that upends their plans for that property can result in significant losses.

Thus, it is less risky to invest in different property types (commercial properties, residential properties, and industrial properties, etc), across diverse locations, and using a variety of investment strategies (reselling, renting, etc.). Doing this can help mitigate risk, enhance returns, produce stable income, and hedge against inflation, according to Yamas Global, a real estate company.

However, if paying a 20% down payment on one property is hard for many, consider how difficult it will be to do the same for five or ten properties. Similarly, managing a diversified portfolio of real estate properties is demanding (in terms of time and expenses).

Contrast this with stocks. Since you can buy a fraction of a share of a stock, you don’t need much capital to create a diversified portfolio. For example, purchasing 0.2 shares of the top ten stocks in the S&P 500 Index will cost only $502.43 (AED1,845.44) at the time of writing.

Interestingly, stock ETFs (and index funds, to a lesser extent) have made the diversification process much easier. By purchasing a single S&P 500 ETF, you have exposure to the 500 largest companies in the US, diversified across different industries and sectors.

You can also achieve other levels of diversification (by market cap and geography or market, for example) by purchasing multiple ETFs. Like stocks, you can also buy a fraction of a share of an ETF, which means you can attain a broad level of diversification with minimal investment outlay.

5. Lower returns than investing in stocks

In an overview of real estate vs stocks historical returns, we found that stocks consistently outperform.

Below is a chart that summarizes the situation in the US:

Over the past 24 years, the S&P 500 produced an average annual total return (capital gains plus dividends) of 12.42% while the residential and commercial real estate markets produced total returns (capital gains plus rental income) of 4.3% and 9.5%, respectively.

If we go back further, the gap closes a bit but stocks still outperformed.

The same situation holds in the UAE. Between 2004 and 2024, real estate produced an average annual return of 7.82-9.82% while the S&P 500 Index did 11.70% over the same period.

However, it is worth noting that these are gross returns (before the deduction of fees). If we consider net returns – by factoring in the higher transaction and management (more on this later) fees of real estate – the gap would expand further.

6. Illiquidity

Liquidity refers to how easy and fast you can turn an asset into cash without significantly affecting its price. Real estate is well known for its illiquidity.

This illiquidity problem stems from the complexity of the real estate investment process. As we mentioned, it takes an average of two to ten weeks to get a real estate transaction through the finish line.

Imagine if you had an urgent need for money that required you to sell a property. By the time you complete the deal, you might be unable to meet the need.

Many real estate investors solve this problem by selling the property at a discount (for less than its fair value) just to get the needed cash. Add to this the high closing costs and they might end up selling valuable property for a pittance.

Access to capital is another factor contributing to illiquidity. “When transactions require significant pooling of capital, in the form of both equity and debt, transactions move slower,” according to Realized 1031, a real estate investment company.

Another contributory factor is that real estate transactions take place in private rather than public markets. “Contrary to most securities, most real estate transactions are done in private markets,” explained Realized 1031. “Whereas public markets offer daily pricing and extensive consumer knowledge, private markets are priced on an “as-needed” basis and lack transparency. Private markets are harder to access as well, as many private markets require a degree of credibility or status to enter into.”

Again, stock markets do not generally have this problem. Though there are some illiquid markets (OTC markets, stock markets in emerging economies, and small-cap stocks), you will not experience any troubles when trading on major exchanges like NYSE and NASDAQ. You can buy and sell stocks in a few seconds without any liquidity challenge (though high liquidity also comes with high volatility).

7. The price discovery problem

A corollary of the liquidity problem is that the price discovery process in real estate markets is not as transparent as the stock market.

Price discovery is the process whereby buyers and sellers determine the fair value of an asset. In an efficient market, the market price of an asset should approximate its fair value.

So, what’s the connection between liquidity and price discovery?

“In liquid markets, where transactions are frequent and friction is low, prices tend to be more stable, and following the Efficient Market Hypothesis, assets often trade close to their intrinsic value,” according to Rishab Chakraborty, the Economics and Policy Editor of Queen’s Business Review, a business publication of Queen’s University, Canada.

“In the real estate market, for example, liquidity is relatively low because properties are large, indivisible, and have high transaction costs,” he continues. “During times of financial distress, liquidity dries up further as buyers hesitate to commit to high-value, illiquid investments. This often leads to suppressed valuations in real estate markets, with assets trading below their intrinsic value, especially in secondary or less active markets.”

In essence, illiquidity can cause a divergence between real estate prices and their fair value.

Lack of transparency is another problem. Because the real estate market is private, there are no centralized platforms that report prices in real time. Thus, the price agreed between a particular buyer and seller will depend more on their negotiation skills since it is difficult to access any publicly available reliable data.

In contrast, the liquidity and transparency of stock markets make price discovery more efficient and reduce the likelihood of price divergences.

8. The problem of active management

There are two main types of properties by investment strategy. First, there are investment properties that are purchased so they can be sold at a higher price. Second, there are rental properties that are purchased so they can be held for passive rental income (an approach favoured by investors with low risk tolerance).

The latter requires active management and this comes with extra commitments that contribute to why real estate is a bad investment:

- Marketing the property: Finding tenants can be a demanding process depending on the property’s location.

- Taking on tenants: This includes screening tenants and drafting lease agreements for the successful one(s).

- Property upkeep: You will need to schedule preventive maintenance and also conduct regular inspections to identify unanticipated issues.

- Collecting rent: Collecting the first rent may be easy but subsequent ones may be more complicated.

- Maintaining financial records: There is also an accounting aspect to managing tenants: managing expenses, keeping records of payments, and knowing when payment is due, among others.

- Addressing emergency requests: Tenants will always call at inconvenient times to make complaints.

- Overseeing eviction processes: This can be a dicey situation that may require some legal processes.

- Dealing with rent increases: This can be another dicey situation.

Of course, you can outsource the entire process to a property manager. But that will set you back by an average of AED 6,719 per month, according to Indeed, a job search platform.

In addition, whether you manage the property yourself or outsource to a manager, there are certain ongoing costs involved in owning a property in the UAE:

- Property maintenance costs: This can range between AED10 to AED30 per square foot, according to Socienta, a property technology company.

- Mortgage life insurance: This is an insurance policy that will pay off the remaining balance on a mortgage if the buyer (and property owner) dies before the mortgage has been paid up.

This can range from 0.30% to 0.60% of the outstanding mortgage amount, according to Damodhar Mata, a financial planner in Dubai.

- Property insurance: The property itself needs to be insured. This can cost between 0.1% and 0.5% of the property’s value every year, according to Engel and Volkers.

For those outside the UAE, other costs include property taxes and homeowners’ association (HOA) fees, among others.

All these costs will reduce the property’s net operating income (NOI) and cause a wider gap between the net returns of stocks and real estate.

In contrast, you don’t usually need to do anything to earn dividend income from a stock.

On platforms like Sarwa, you just need to indicate if you want to reinvest those dividends or have them added to your account balance. After that, you receive your quarterly or monthly dividends with no hassle and at no extra cost.

9. Leverage can amplify losses

Another reason why real estate is a bad investment is that the use of leverage, which is one of its celebrated pros, can become disastrous.

Leverage allows you to use other people’s money to purchase an asset. In real estate, you use the money of the mortgage provider while committing only 20% of your money.

When everything goes well, leverage can be beneficial as it amplifies your returns. For example, if you purchase a property with AED 500,000 of your money and its value appreciates to AED 600,000, your rate of return is 20%.

On the other hand, consider a situation where you borrowed AED 400,000 and paid AED 100,000 in cash. If the property appreciates to AED 600,000, your equity in the property has increased to AED 200,000 (AED 600,000 – AED 400,000). Since your equity was AED 100,000 initially, your rate of return is 50%.

In other words, using 80% leverage has turned a potential 20% rate of return into a 50% rate of return.

However, leverage can also amplify your losses when things go south. Let’s see how this works with the previous example.

If the property’s value falls to AED 400,000 in a cash transaction, you have made a 20% loss. However, for a leveraged transaction, your equity will fall to zero (AED 400,000 – AED 400,000). Since that equity was AED 100,000 before, you have made a 100% loss.

In other words, using 80% leverage has turned a potential 20% loss into a 100% loss, a real financial ruin.

“In addition to magnifying losses as well as gains, leverage carries an extra risk on the downside that isn’t offset by accompanying upside: the risk of ruin,” said Howard Marks, co-founder of Oaktree Capital Management, an investment firm.

Furthermore, there is a cost to leverage: interest payments. These can accumulate over time and reduce your rate of return.

Also, you can be at risk of foreclosure if you enter into a cash flow problem and can no longer afford mortgage payments. Illiquidity also adds more complication since you may be unable to sell the property for enough cash to cover the outstanding amount on the mortgage.

It was situations like these (homebuyers losing their homes due to inability to make mortgage payments and home prices crashing) that led to the global recession of 2008/2009.

Though leverage is also available in stock trading (margin trading), it is optional. Given fractional trading, the average investor does not need debt to buy a stock or even build a well-diversified stock portfolio.

10. External risks

External risks are the last reason why buying real estate is a bad investment.

These include:

- Location risk: A prime location with good infrastructure and tight security can experience changes (demographic or otherwise) that transform it into an undesirable location. If you purchased a property when things were good, you may end up losing money when the negative transformation happens.

- Regulatory risk: Government policies like rent control, zoning laws, and environmental laws can also affect your investment. Rent control can limit your net operating income and cap rate while changes in zoning and environmental laws may require costly renovations.

- Environmental risk: Natural disasters can result in a property’s loss or it can make a location undesirable due to fears of recurrence.

- Economic risk: Economic downturns (local or national) can make it difficult to find new renters or for current tenants to pay rent. Also, changes in market conditions (especially changes in interest rates and inflation rates) can distort the housing market and affect property valuation.

Given the difficulty of creating a diversified real estate portfolio, these external risks can weigh significantly on a real estate investor’s returns.

In contrast, it is easier and cost-effective to diversify a stock portfolio and reduce the impact of the external risks of a given stock.

Gaining exposure to the real estate market via REITs

These ten points are the reasons why real estate is a bad investment. But that does not imply that you should seek zero exposure to the real estate asset class. Instead, you should consider better alternatives like Real Estate Investment Trusts (REITs).

REITs are the stocks of companies that buy and sell properties (equity REITs) and finance mortgage loans (mortgage ETFs). Like stocks, they are traded on the stock exchange market during regular trading hours.

How do REITs solve the problems associated with real estate? Consider these points:

- No large investment outlay: You can buy a fraction of a REIT just like you buy a fraction of a share.

- Low transaction fees: The transaction fees for REITs do not differ from those of stocks.

- Fast transactions: You can also buy and sell REITs in seconds.

- Easy diversification: Since there is fractional trading, you can purchase multiple REITs without a huge initial outlay. Also, the availability of REITs ETFs makes diversification much easier.

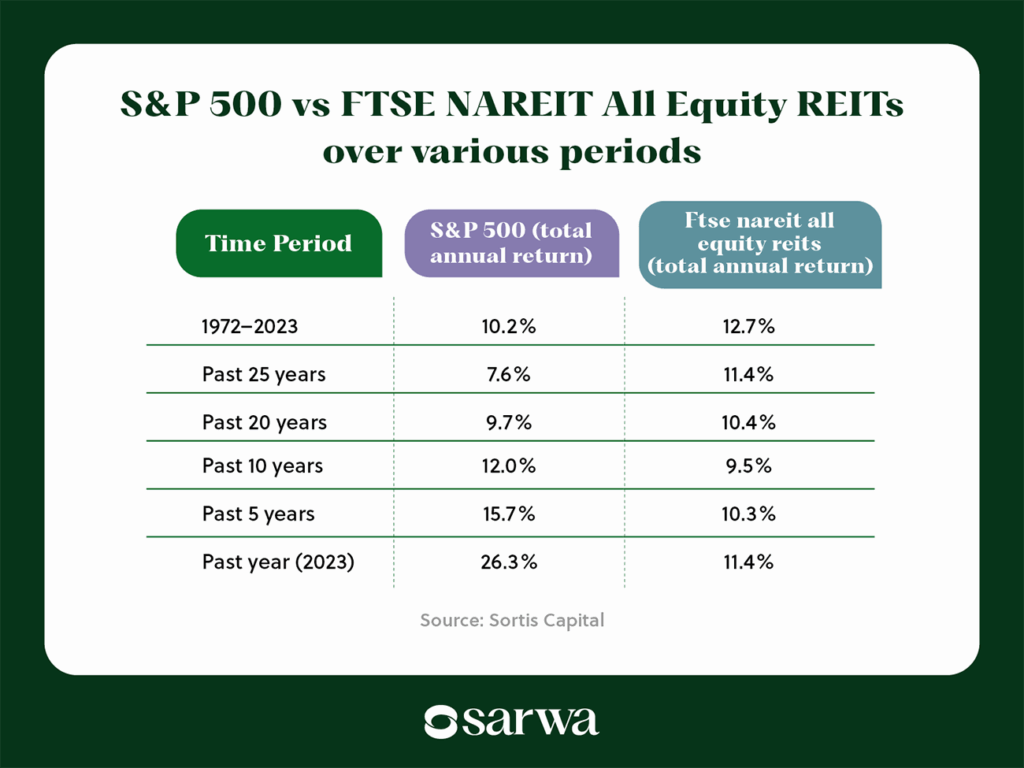

- Comparable returns with stocks: REITs have better annual returns than stocks over the last 50, 25, and 20 years while stocks have better annual returns over the past ten and five years, according to Sortis Capital, a financial services firm.

Source: Sortis Capital

- Liquid markets: You won’t have an illiquidity problem when you purchase REITs on popular stock exchanges.

- Efficient and transparent price discovery: Since the market is liquid and public, price discovery will be efficient and transparent.

- No active management: In a truly passive income fashion, you can earn dividend income on REITs without having to do anything.

- No need for leverage: You don’t have to use leverage to invest in REITs.

- External risks: Diversification can help you mitigate the risks associated with individual REITs.

With Sarwa, you can invest in and trade US stocks, REITs, and ETFs right from the UAE. Transfers from your local UAE bank account to Sarwa are free and both deposits and withdrawals are processed immediately.

We protect your data and money with bank-level SSL security and provide you with an easy-to-use platform that won’t stress you. And remember, you can get started with as little as $1.

What are you waiting for? Sign up for a Sarwa account to start using your money to purchase good investments like stocks, ETFs, and REITs and increase your net worth.

Takeaways

- Buying property demands a substantial initial outlay (often hundreds of thousands of dirhams), plus closing costs of up to 10% of the purchase price. In contrast, stock investing can start with as little as $1 and with transaction fees as low as 0.25%.

- Selling property can take weeks or even months, making it hard to access cash quickly—especially in emergencies. Stocks, on the other hand, can be bought and sold in seconds on public markets with transparent pricing.

- Owning multiple properties across sectors and locations requires significant capital and management. Meanwhile, investors can easily build a diversified stock portfolio—even with small amounts—using fractional shares and ETFs.

- Historically, stocks (like those in the S&P 500) have outperformed real estate in both the U.S. and UAE. When factoring in fees, management effort, and the risks of leverage, stocks offer more attractive risk-adjusted returns.

- Investors still interested in the real estate market should consider REITs instead.