There are several dollar-cost averaging benefits that have proven to provide comfort for the cautious investor, who is typically the type of person that is afraid of putting all of their money into the stock market at once.

Imagine investing $100,000 in the stock market today, then the market falls for the next four weeks, and your $100,000 is now worth $80,000.

Well, not many people want to imagine that situation.

Therefore, instead of putting all that money into the (possibly volatile) market at once, they prefer to spread it out over a defined period (say $10,000 every month for the next 10 months) as a way to avoid bad timing and benefit from a bear market (when the market is going down, the same amount will buy you more shares over a period of time).

Dollar-cost averaging also takes away the need for timing the market, an approach that is evident in a popular investment strategy called “buying the dip.”

In this strategy, you save your money and wait until the market has reached rock bottom before buying at a low price to earn higher returns when there is a market correction.

However, “buy the dip” investors usually find out that the price they thought was the dip was only the beginning or middle of the downturn and that market correction might still take a long time to play out. Many tend to fail to time the bottom of the market, only to watch their investment plummet even further, a testimony to the fact that timing the market is a dangerous business.

“Buy the dip is one of those things that works really well on paper, but it doesn’t work well in real life,” said Callie Cox, senior investment strategist with Ally Invest.

Similar to trying to “buy the dip,” there are investors that alternatively choose to wait on the sidelines, holding on to their money until they can “predict that the market is truly at the bottom. Consequently, their money sits idle in their bank accounts, waiting for the dip while missing out on compound returns that they could have earned during that period.

“The issue with buying the dip as a strategy is that you can end up sitting out of the market for those long periods of time when it rallies,” said Dan Egan, director of behavioural finance and investing at Betterment, an online investment firm.

In this article, we want to expound on these benefits of DCA, explain how to calculate dollar-cost average, and examine why many growth-oriented investors prefer lump-sum investing to dollar-cost averaging despite its benefits.

We’ll consider:

- What is dollar-cost averaging (DCA)?

- The top dollar-cost averaging benefits

- How to calculate dollar-cost average

- Dollar-cost averaging vs. lump sum investing

- How to take advantage of dollar-cost averaging benefits

At the end, you will be ready to decide if dollar-cost averaging benefits are worth more than the higher returns provided by lump-sum investing.

1. What is dollar-cost averaging (DCA)?

Dollar-cost averaging is an investment strategy typically used by cautious investors to manage their investments by dividing up the total amount of a lump sum they have to invest, (they came to an inheritance, they received a bonus, they have a sum saved and are new to investing…) over a periodic schedule of purchases.

To continue with the example in the introduction, suppose Mr. A has saved up this $100,000 in a savings account and prefers to dollar-cost average it over 10 months rather than invest as a lump sum. In this case, Mr. A will invest $10,000 at the beginning or end (or anytime in between) of every month.

Let’s emphasise right here that not every systematic investing qualifies as dollar-cost averaging. For example, if Mr. B is using the 50/30/20 budget rule and is saving 20% of his income (which amounts to $5,000) every month, he is investing systematically, but that is not dollar-cost averaging.

[For more on how to create a systematic investment plan, read, “How To Create (And Stick To) A Monthly Investment Plan in the UAE”]

Dollar-cost averaging assumes the presence of a lump sum that the investor has available to invest in the market but chooses rather to split into multiple amounts invested over a defined period.

If Mr. B decided to invest all of his $5,000 every month, that’s lump-sum investing; on the other hand, if he decides to split that $5,000 over the next three months or six weeks, that is dollar-cost averaging.

Why then do people prefer to invest a lump sum over a number of periods rather than go all in at once?

2. The top 4 dollar-cost averaging benefits

A. Takes away emotional investing

The first benefit of dollar-cost averaging is that it helps to stabilise the emotions of risk averse investors.

As we all know, the stock market is very volatile and prices of stocks can move to the upside and the downside very quickly and very significantly.

Risk-averse and new investors can’t deal with seeing their lump sum fall down significantly due to market volatility. Seeing your money shrink is stressful, as we all can attest to.

Due to this stress, young and risk-averse investors tend to scream and run to their brokers and yell, ‘sell!” The result? They have bought high and sold low, losing a lot of money in the process. “The average man … tends to buy high and sell low,” said Ray Dalio, founder of Bridgewater Associates, the largest hedge fund in the world, while explaining why people lose money in the market.

Instead of this “buy high, sell low” paradigm that results from emotional investing, dollar-cost averaging encourages people to invest a specific amount over a defined period.

Since they are investing their lump sum over an extended period, they can view the market through the lens of a broader timeline and avoid the myopic market panics that results in significant losses (“since I am investing over the next 10 months, there is no need to sell off because my first instalment is losing”). Furthermore, a downward movement of the market provides an opportunity for investors using dollar-cost averaging to get more shares for a lower average cost (see more below) instead of selling off in panic.

As Dee Lee, a certified financial planner, puts it, “some people get frightened when the market drops after they put money in, so the client feels good doing dollar-cost averaging spread over the year.”

“Such a policy will pay off ultimately, regardless of when it is begun, provided that it is adhered to conscientiously and courageously under all intervening conditions,” said Benjamin Graham, the father of value investing.

In other words, for someone who is scared of entering the market all at once, it becomes easier to ignore the market if you continue to make consistent investments into it. If the market is up, stick to your scheduled investment. When the market crashes, stick to your scheduled investment strategy.

In the end, it’ll all average out.

B. Takes away the need for market timing

By sticking to a schedule, dollar cost averaging removes the need to ‘time the market.’ Market timing describes the efforts of investors to ensure they buy securities at the right time so they can maximise their returns. It’s the approach of “buy the dip” investors who try to pinpoint when the market is in a dip and ripe for correction and short-term investors who try to buy low and sell high.

However, timing the market is notoriously difficult even for professional financial experts that dedicate their careers to analysing share price values. Most professional mutual funds, who attempt to time the market, underperform their market indices year after year. In the 20 years from 2000 to 2020, 86% of mutual funds in the US underperformed the market, according to the 2020 SPIVA report.

If these experienced, knowledgeable, and certified managers, who spend all their life researching stocks, cannot perfectly time the market, do you think the average investor can? Probably not. No wonder many “buy the dip” investors find out that the dip is actually “dipper” than they thought.

In fact, attempting to time the market is one of the primary reasons investors lose money in the market.

[For more on why market timing is bad for investors, read “Does Market Timing Work”]

Dollar-cost averaging is an antidote to market timing. With dollar-cost averaging, you seek to invest in the market on a particular day in a systematic fashion such that you are indifferent to what the market is doing on that particular day. Instead of accumulating cash and waiting for the dip, you consistently and systematically invest in the market.

Suppose Mr. A is investing $10,000 at the end of every month. For him, it doesn’t matter what is happening in the market on the 30th of November or the 31st December; he sticks to his plan to invest his lump sum at the end of every month.

Again, this takes away the emotional stress of trying to find the perfect time to enter the market (a pursuit that often leads to losses) and nurtures a long-term investing mindset, which is key to successful investing.

C. Helps to build discipline

We live in a fast-paced world and most of us do not have the financial market knowledge nor the extra time to professionally manage a personal investment fund.

Can you imagine yourself building an ever-growing retirement fund that requires the constant study of securities valuations? Probably not.

“If you like spending six to eight hours per week working on investments, do it,” advised Warren Buffett. “If you don’t, then dollar-cost average into index funds.”

In this way, the benefit is clear: By practising DCA, investors don’t have to overthink their investments and can establish a disciplined pattern for their wealth-building plan, while allowing the market to do the heavy lifting.

D. Opportunity to reduce investment cost and get more shares

Perhaps you have noticed that the dollar-cost averaging benefits we have emphasised thus far are on the emotional side. Does that mean DCA does not have any financial benefit?

Well, it does.

First, when there is a bear market and stock prices are falling, dollar-cost averaging helps you reduce investment cost and get more shares for the same amount.

Let’s take a quick example. If the price of stock A on July 1, 2021 is $100, with $10,000, you can get 100 shares. However, let’s say you used only $5,000 on July 1 and then used the other $5,000 on August 1, 2021 when price fell to $90. In this new scenario, you will get 50 shares at $100 per share on July 1 and 55.6 shares at $90 per share on August 1. Consequently, you will have 105.6 shares at an average price of $94.7 instead of 100 shares at an average price of $100.

In essence, for the same amount, you can get more shares at a lower cost just by switching from lump-sum investing to dollar-cost averaging. Consequently, the bear market that is often the primal fear of investors becomes an opportunity to get more shares at a lower average cost (which means more profit when you finally sell).

3. How to calculate dollar-cost average

Now let’s see how to calculate dollar-cost average as an alternative to lump-sum investing. We’ll take an example from the stock market and another one from the bitcoin market.

How to dollar-cost average a lump sum

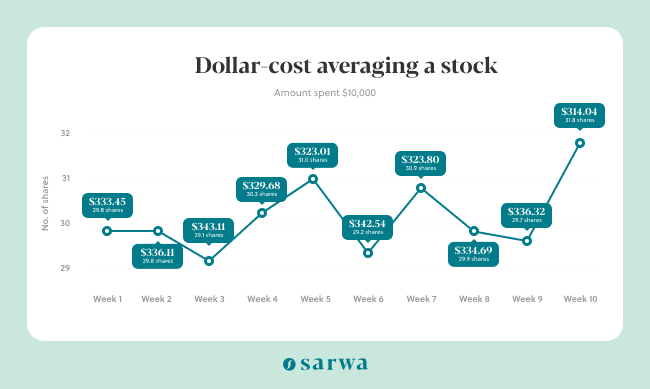

Let’s take a practical example from the actual stock market. Suppose that instead of investing $100,000 on MSFT on November 5, 2021, Mr. A decided to invest it over the next 10 weeks.

InIn the former scenario, he would have bought 298 shares at $335.45 per share (we are considering adjusted close price). For the latter scenario, his investment activity would look like the following, spending $10,000 on share purchases every week for 10 weeks:

In this example, by dollar-cost averaging, Mr. A would have gotten 301.5 shares at an average cost of $331.7 instead of 298 shares at an average cost of 335.45.

By learning how to calculate dollar-cost average, you can see how it leads to lower cost and higher number of shares than lump-sum investing in a bear market.

How to dollar-cost average bitcoin

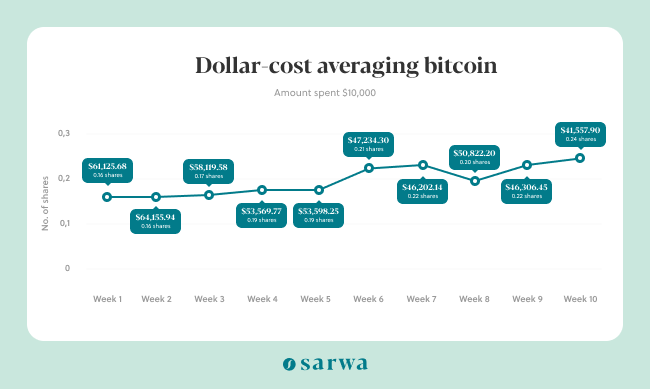

The idea behind dollar-cost averaging is applicable to any security, including bitcoin (and other cryptocurrencies). Now, let’s consider how to dollar-cost average bitcoin.

Below, we’ll apply the same information for Mr. A and replace MSFT with Bitcoin.

If he spent $100,000 on November 5 to purchase BTC, he would have 1.6BTC at a cost of $61,125.68BTC per USD. On the other hand, if he used dollar-cost averaging, his investing activity would look like the following, investing $10,000 per week for 10 weeks instead of all at once:

In this example, Mr. A would have purchased 1.95BTC at an average cost of $51,282.05 instead of purchasing 1.6BTC at $61,125.68.

By learning how to calculate dollar-cost average bitcoin, you can see how it leads to lower cost and higher number of BTC than lump-sum investing in a bear market.

4. Dollar-cost averaging vs. lump sum investing

Given all these advantages, why then do some investors still prefer lump-sum investing?

The best way to explain this is to consider some of the disadvantages of dollar-cost averaging (the other side of dollar-cost averaging benefits) when compared to lump-sum investing.

The cons of dollar-cost averaging

Less returns (miss out on compounding)

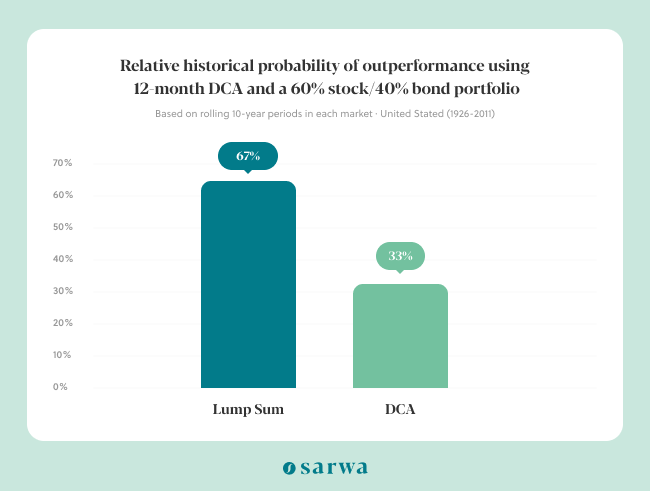

A Vanguard study reported that with a 60/40 portfolio (a portfolio with 60% stocks and 40% bonds), lump-sum investing outperformed DCA 67% of the time over six months and 92% of the time over 12 months.

Before Vanguard, a1997 report by Richard Williams and Peter Bacon also showed that 67% of the time, $120,000 invested in the S&P 500 at the beginning of the year outperformed $10,000 invested every month for 12 months.

Why is this so?

Well, the answer is a little word called compounding, what Albert Einstein called the eight wonder of the world.

When you invest $100,000 today, it starts generating returns today and every return generated will also generate fresh returns, ad infinitum. Consequently, the earlier you invest in the market, the more compounding you can enjoy and the higher the amount you invest, the more compound interest you can earn.

Dr. Jiro Kondo, professor of finance at McGill University in Montreal, Canada, and head of Portfolio Construction at Sarwa, underscores that DCA shouldn’t be used by investors seeking to maximise returns: “DCA won’t enhance performance in our traditional metrics on average. In fact, it will lower your expected return, but also lower your risk, since you delay your entrance into financial markets.”

Investment cost can increase and you can get less shares

While the two examples we looked at in the previous section (“how to calculate dollar-cost average”) showed how DCA can lead to lower cost and more shares/BTC, this doesn’t always happen.

In fact, it only happens in a bear market where market downturns are more than market upturns. If the market rises more than it falls, average cost will rise and no. of shares/BTC purchased will fall with DCA.

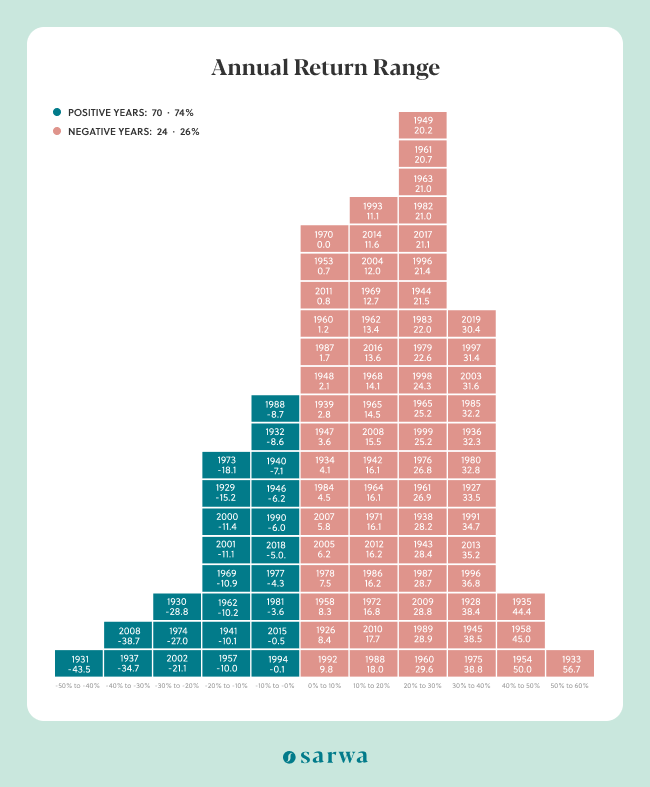

Well, in actual fact, the market rises more than it falls (74% to 26%), according to research by the Centre for Research in Security Prices (CRSP), which means the (financial) advantage of DCA might not pan out over the long term.

Performance of the CRSP US total stock market index between 1926 and 2019

Transaction cost can rise in certain situations

Also, if you are in a situation where you purchase stocks at a high brokerage cost, dollar-cost averaging can eat into your profit (buying 10 times will not be as cheap as buying once).

However, you can remove this advantage by buying your stocks with Sarwa Trade, which charges zero commission on purchases and sales.

Less useful for long term investors

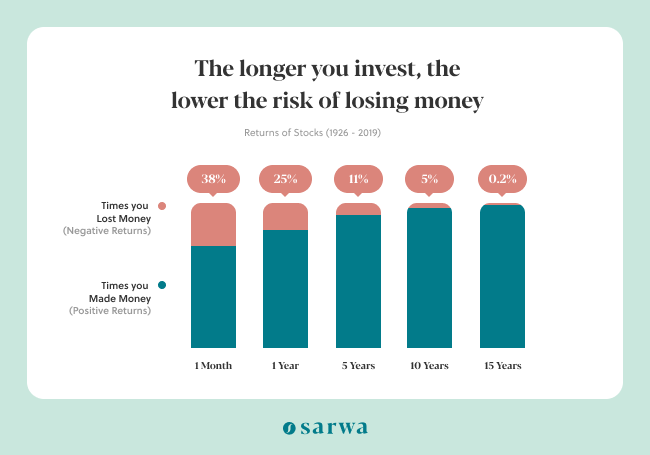

Since the market rises more than it falls, long-term investors have little to benefit financially from DCA. Moreover, research has also shown that the longer you stay in the market, the lower the risk of losing your money.

If you are in it for the long term (as you should be), short-term fluctuations that make dollar-cost averaging attractive won’t matter much to you.

5. How to take advantage of dollar-cost averaging benefits

Nevertheless, dollar-cost averaging remains a safe haven and refuge for risk-averse and cautious investors who desire the emotional stability, discipline, indifference to market timing, and opportunity for lower cost and more shares in bear markets that it offers.

In fact, after saying investors looking to maximise returns should stick to lump-sum investing, Dr. Jiro Kondo concludes “I think the behavioural benefits are important. DCA helps overcome emotional fear of diving into financial markets all at once and helps commit to making regular deposits into financial markets going forward.”

So, how can you enjoy these dollar-cost averaging benefits?

Today’s advancements in financial technology have empowered investors to take advantage of the benefits of dollar-cost averaging in ways that the average investor couldn’t do just a decade ago.

Sarwa was founded with the principal mission of providing wider access to this technology through a robo advisory platform, which allows for convenient automated investments that apply the principles of dollar-cost averaging.

Are you ready to invest and take advantage of dollar-cost averaging benefits? Schedule a free call with a Sarwa wealth advisor who will guide you through.

Or are you still confused whether to choose dollar-cost averaging or lump-sum investing?

Our wealth advisor will also seek to understand your financial situation and advise you accordingly. At Sarwa, we profile each of our clients to determine what will best suit their goals. Furthermore, we’ve developed our automated investment technology so that investors can easily take advantage of dollar-cost averaging and/or lump-sum investing strategies.

Takeaways

- New and cautious investors prefer to use dollar-cost averaging because it takes emotion out of investing, removes the need for market timing, and nurtures the financial discipline needed to achieve financial goals.

- Dollar-cost averaging also provides the opportunity to get more shares (or any other securities) at a lower average cost during bear markets.

- Nevertheless, lump-sum investing has been shown to produce better returns than DCA. Moreover, most of the benefits of DCA are less useful for long-term investors.

- Before choosing between dollar-cost averaging and lump-sum investing, evaluate your unique financial situation and talk to a financial advisor.