Why do so many of us look for investment inspiration through Warren Buffett quotes?

A business prodigy, Buffett bought his first stock when he was just 11 years old. He then used savings to buy and install pinball machines in local shops when he was still a teenager.

Although he got rejected from Harvard (a decision that admissions officers now surely regret) he would go on to become one of the world’s most famous and wealthy value investors.

Today, he is the CEO of Berkshire Hathaway, a former textile company that has been transformed into the world’s highest-priced stock, valued at $469,047.25 at the time of writing. No wonder he is the fifth-richest man in the world in 2022, with a net worth of $118 billion, according to Forbes.

Investors turn to his advice with such admiration that Buffett, the billionaire investor, has earned the nickname the “Oracle of Omaha,” a reference to his home state of Nebraska.

Indeed, his sage perspectives on the market are so sought-after that “Warren Buffet quotes” is among the most Googled phrases in the online wealth management industry today.

Warren Buffett quotes are perhaps so desired because they are entertaining, succinct and easy to digest. Moreover, his quotes apply to a wide range of topics including investing strategies, investment psychology, business management, financial management, and life in general.

Funny and sharp, pithy and wise, Warren Buffett has become every bit the philosopher and high priest of the modern investment world.

However, so dense has the internet become with vast lists of Warren Buffett quotes, that, upon research, we discovered that it was necessary to craft a ‘top 90’ list that covers his most important ideas on investing, financial management, business management, and succeeding in life.

Here, we provide a list of our favourite Warren Buffett quotes to improve your personal finance, inspire your long-term investment goals, and help you succeed in all kinds of endeavours. We’ll cover:

- Warren Buffett quotes on investment strategy

- Warren Buffett quotes on investing psychology

- Warren Buffett quotes on financial management

- Warren Buffett quotes on life and success

- Warren Buffett business quotes

- Warren Buffett gold quotes

- Warren Buffett quotes on life insurance

[Want to build wealth with investment strategies used by Warren Buffett? Subscribe to Sarwa’s Newsletter today for expert insights on investing and personal finance.]

Warren Buffett quotes on investment strategies

Since Warren Buffett is well known for his successful investment career, let’s begin with his quotes on investment strategies.

1. “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.”

Otherwise known as Warren Buffett’s golden rule, this quote sets the foundation for his investing philosophy. Buffett is saying that capital preservation should be the main priority for any investor when deciding to invest their money into the market.

In other words, stay rational.

However, the statement does not perfectly describe Buffett’s actual track record of investing.

Buffett has made plenty of losing investments over his lifetime. Ironically, he even counts his investment into Berkshire Hathaway (once a New England textile company) as one of his biggest regrets. (This is because he, quite irrationally, started buying up shares in the company due to a feud with its then leadership.)

Perhaps the most important takeaway — even the “Oracle of Omaha” is human.

[One way to reduce the risk of losing money is diversification. For more on diversification, read, “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why.”]

2. “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

This quote forms a foundational pillar of Buffett’s long-term investment ethos. He is saying here that you have to think about the grand trajectory of things in life as with investing.

Overall, there is no better time to start thinking about that path than today. A tree takes time to grow, and so will most smart investments. Start early, be patient, and let your money grow.

3. “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

We love this quote because it offers perhaps the best insight into how Warren Buffett approaches the active and passive investment debate. Siding with passive investor legends like Jack Bogle, the founder of Vanguard Group, Buffett urges that we pick our investments wisely — and be ready to hold on to them for the long haul if we wish to see real rewards.

In this quote, he sets a clear divide with the emotional life of day traders, who prefer to scour markets looking for short-term aberrations instead of fundamental long-term growth.

Buffett preaches that the smart investor should also assess a stock by the company’s strengths and weaknesses, looking for long-term advantages it can win within its industry (that is, the fundamentals). This quote also reinforces the previous two quotes, underscoring a philosophy of patience and rational action.

4. “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”

For Buffett, the desire to make quick gains on the stock market is one of the reasons why people make poor decisions and end up losing money.

For example, data from Current Market Valuation, a financial reporting firm, has shown that only 1% of day traders (those who trade stocks for daily profit) make a profit, net of transaction costs. Said differently, 99% of day traders consistently lose money.

Therefore, Buffett prefers to focus on a long-term horizon, even reinvesting his dividends. That is, he makes his stock purchase decisions with the assumption that he would be unable to sell them for the next five years. This assumption ensures that he focuses on buying stocks he would never want to sell.

5. “Our favourite holding period is forever.”

When Buffett explained that you should not hold a stock for 10 minutes if you don’t intend to hold it for 10 years, in actuality, we shouldn’t take him literally; he is not making 10 years the ideal or the cap.

Rather, the point is that you should not hold a stock in the short term if you are not willing to hold it for the long term. Buffett prefers to hold a stock “forever” — an emphatic way of saying to concentrate on the long term.

One implication of this is that Warren Buffett tries to find stocks that are worthy of being held for many years down the line. Instead of focusing on the short-term opportunities of a stock, he considers the fundamentals — the company’s ability to innovate in its market, establish an industry moat, and consistently boost its profitability.

This quote is especially relevant to passive investors.

Instead of losing sleep over the short-term fluctuations of an ETF, you should focus on its long-term potentials and its fundamentals — does it have good enough diversification, is the expense ratio low, how does Morning Star rate the ETF (five-star or one-star), is the ETF provider trustworthy, is it liquid enough, how well does it track its underlying index, etc.?

To be sure, the above quote does not mean that Buffett never sells a stock once he buys it.

Just last year, Buffett exited his position in 15 companies, including Pfizer, United Airlines, Costco Wholesale, and JPMorgan Chase. He also reduced his investment in 22 other companies.

Therefore, while his favourite holding period is “forever”, he does sell when he no longer believes in a company’s fundamentals.

The difference between Buffett and others who time the market is the reason for the sale — change in fundamentals (or to purchase another company with better fundamentals) rather than short-term volatility.

In Buffett’s own words, “All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.”

6. “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”

As said above, since Buffett prefers to hold stocks forever with no intention to sell, as long as they keep performing well, he focuses much attention on doing fundamental analysis.

Before Buffett can buy a company’s stock, the company must have a durable competitive advantage in its industry.

Competitive advantage means that the company has something beneficial (better products, more efficient production methods, better value chain, quality brand) that competitors do not have.

Such competitive advantage must reflect in its ability to charge higher prices, reduce the cost of production, make more profit, and capture a higher market share.

However, such an advantage must also be durable.

A competitive advantage that lasts for just a few years is insufficient. Buffett wants companies that can sustain their competitive advantage for the foreseeable future. And this is evident in its stock holdings. For example, he owns Apple, a company that has been able to charge premium prices for its superior brand.

7. “The most important thing to do if you find yourself in a hole is to stop digging.”

But what should you do if you have already started your investment journey on the wrong foot – failing to do fundamental analysis, focusing on the short term, or yielding to the fear-and-greed cycle?

Well, you have to stop.

Staying consistent on the wrong path will still lead to the wrong destination. Therefore, while Buffett preaches long-term investing, that is for those who are already on the right path in terms of investing strategy. For others, there must first be a reversal from the wrong path and a decisive change to the right one.

As we saw above, even Buffett is willing to sell a stock if he comes to believe that selecting that stock was a mistake. He will not hold it forever in the name of long-term investing. Rather, he will retrace his steps, sell the stock, and buy a better one.

The key is that an overarching strategy and methodology is guiding his decisions. Change doesn’t come about spontaneously.

8. “Price is what you pay, value is what you get.”

This famous Buffett quote strikes at the heart of the “value investor” approach and reveals the secret of how Buffett made his fortune.

After Buffett was rejected by Harvard, he enrolled in an undergraduate degree at Columbia Business School. This is where he studied under Benjamin Graham, today known as the “Dean of Wall Street.” Buffett was largely influenced by Graham’s magnum opus, The Intelligent Investor, which lays out the philosophy for value investing.

In essence, value investors are looking for deeply discounted share prices on the market. There is no better deal than a great company that is on sale for a low price, so the value investor mantra goes. To succeed at value investing, you should aspire to learn more about companies in the hope of discovering which are undervalued and, thus, great investment opportunities.

This other famous Buffett quote also nicely sums up value investing: “Whether we’re talking about stocks or socks, I like buying quality merchandise when it is marked down.”

9. “The three most important words in investing are ‘margin of safety.’”

Margin of Safety (MOS) is the technical term that Buffett uses to determine if he is getting a good price on an investment.

It is the difference between a stock’s intrinsic value and current market price. For example, if Investor A judges Stock A’s intrinsic value to be $100 and the stock is selling for $50, there is a 50% margin of safety on the potential purchase.

The MOS has two benefits for value investors like Warren Buffett. First, it helps them maximise their returns from an investment. If Investor A buys Stock A at 50% MOS ($50 per share), he will make more profit than if he had bought it with a 20% MOS ($20 per share).

Second, which is more important, MOS protects the investor from the risk that they have overvalued the stock’s intrinsic worth.

Suppose that the stock’s worth (intrinsic value) is actually $80 and Investor A has already purchased it for $90 (at 10% MOS), then they have paid a premium for the stock.

However, if Investor A bought the stock at $50 per share (a 50% MOS), they would still have purchased the stock at a discount if the intrinsic value was $80 rather than $100.

10. “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

One way to misinterpret Warren Buffett’s value investing is to assume that the only criteria for buying a stock is that it should be undervalued.

This quote seeks to correct that misunderstanding.

Many companies with poor fundamentals are undervalued. Being undervalued is not an all-telling sign that a stock is a good buy. Rather, the primary task of the investor is to consider if the stock has good fundamentals, to begin with — if the company is wonderful.

Only when you believe that a company is wonderful should you consider if it’s undervalued or overvalued.

For an ETF, this means that the price and expense ratio are not the only important considerations. You need to consider the kind of diversification it offers, the trustworthiness of the ETF provider, the liquidity of the ETF (average trading volume), how well it tracks its index, and the rating Morning Star gives it.

Good pricing and a low expense ratio are important, but they are not the only factors you should consider.

11. “Risk comes from not knowing what you are doing.”

A little bit of research can reduce a lot of risk. Buffett is ever the pedantic investment professor, and in this quote, he reminds us that we should study, study, study.

However, this advice can be often forgotten, especially after an investor has seen some success. A positive feedback loop can be misleading and indeed dangerous for investors.

Instead, as any good teacher prescribes, Buffett instructs that we do our homework.

Research the rules of investing, study holdings before deciding why to invest in ETFs, and learn the lessons of historical data. All of these are important factors that will improve your understanding of the market and reduce your risk when participating in it.

12. “It is a terrible mistake for investors with long-term horizons — among them pension funds, college endowments, and savings-minded individuals — to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks.”

Though portfolio diversification is crucial to minimising risk, it is possible to overdo it.

While some bonds might be good to diversify a portfolio, the longer the time horizon, the less the need for them. For example, an investor with a 12-year horizon may not require a portfolio with 50% bonds. In this case, there is enough time to ride the price volatility of the stock market and make good returns.

To put this into perspective, the S&P 500 returned an average of 11.97% per year between 2010 and the end of 2022. In that same period, the highest yield on the US treasury bond was 3.829%.

However, more bonds might be required when the time horizon shortens significantly, but in the meantime, investors with long-term horizons should continue to prioritise maximising returns in a diversified portfolio of stocks. Some bonds might not be bad, but, at this stage, it is better if their allocation is on the low side.

13. “Do not take yearly results too seriously. Instead, focus on four or five-year averages.”

In the above point, we said that short-term price movements are not that significant because they do not reflect underlying value. In fact, for Buffett, even one-year results belong to the short term.

That is, not even the one-year rise or fall in the price of a stock should be taken so seriously as to demand a decision from the investor.

Significant price changes that reflect underlying value begin, for Buffett, when considering average movements over four or five years.

As he said somewhere else, “time is the friend of the wonderful company, the enemy of the mediocre.” Wonderful companies grow in the long run because then their prices reflect their underlying value rather than the short-term emotions of investors.

In essence, don’t judge a company by its one-year return. Take a longer view.

14. “Never invest in a business you cannot understand.”

What Buffett says here about businesses (individual stocks) is also true of every other investment asset. A primary reason why people lose money when they invest is that they invest in assets or businesses they don’t understand.

Most times, they do it based on the advice of a family, friend, or a stranger who has supposedly made millions from such assets or business. Sometimes, they do so because the particular asset or business is trendy and FOMO (fear of missing out — what Buffett calls greed) compels them to get in on the ride.

Blind faith in others that discounts the need to do personal research (as known as due diligence) is the bane of countless investors.

Before buying any asset (stock, bond, REIT, ETF, cryptocurrency, etc.), you should seek to understand how that asset works. Most importantly, you have to look beyond the return that they are promising and consider the risk as well.

People who promote trendy investment assets focus exclusively on the returns as a way to appeal to your greed. Your first task is to ignore the hype and try to understand the fundamentals of such an asset.

Only when you have a basic understanding of the asset — its returns and risks — should you attempt to invest in it.

Does this mean that you need to get a Masters in Finance? Far from it.

At Sarwa, we do our best to consistently provide you with good investing and financial planning resources through our blog. There, you will find the information you need to look beyond the hype and make sound investment choices.

15. “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.”

The stock market can be intimidating. This is especially true if you have already had an unfortunate acquaintance with the fear-greed cycle. It’s no surprise then that some still prefer to hold on to cash.

But as Buffett points out here, cash is the worst asset you can have. By not investing, you are keeping a depreciating asset that becomes devalued from inflation.

To fight inflation, we must discover ways to keep our wealth growing over time. The best way to do this today is to automate our investments. For those curious to learn more, this can start by building an investment portfolio from scratch after speaking with a financial advisor.

16. “We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits.”

While Warren Buffett believes that cash and cash equivalents are terrible as investments, he wants to keep some cash as a sort of protection so that he can meet tomorrow’s obligations.

In other words, Buffett prefers to have enough cash to meet any ongoing requirements and avoid over-investing.

The lesson here for the individual investor is that you should have an emergency fund that protects you when emergencies arise.

Without an emergency fund, you might have to sell your investments to meet emergencies. Apart from the fact that you might be forced to sell those investments at a loss, you also miss the chance to keep growing that money through compound interest (an opportunity cost). Alternatively, you might be forced to depend on strangers to bail you out or incur debt at an expensive interest rate.

To avoid the above situations, you should keep about three to six months’ worth of your living expenses in a savings or money market account as an emergency fund. After that, you can then invest all your money in the market.

With such security, you have less of a chance to lose sleep because of an emergency or count on the goodwill of other people (be they friends or strangers).

[To learn more about emergency funds and how to start one, read, “How To Start An Emergency Fund That Is Right For You: Smart Planning To Mitigate Financial Troubles”]

17. “Don’t pass up something that’s attractive today because you think you will find something better tomorrow.”

A bird at hand, they say, is worth two in the bush.

Passing over a good investment in the expectation of a better investment in the future is a poor choice.

Not even the best investors can predict how the market will behave tomorrow. The good stock you pass over today might become the next big innovator and there might not be another like it.

Buffett’s advice is that once a stock satisfies the conditions that are important to you, there is little sense in discarding it in the hope that a better one will come in the future.

This advice also applies to the question of when an investor should enter the market. Should you buy that stock or ETF now or wait for a more opportune time (maybe when it is cheaper)?

The reality is that when you invest for the long term, the time you spend in the market is more important than the time you enter the market. Research has shown that the market rises more than it falls and that the longer the time you spend in the market, the lower your risk.

On the other hand, the more time you spend in the market, the more your money can earn compound returns.

Therefore, instead of waiting for a better time, invest your money in a lump sum and watch it grow over the long term.

[For more on the benefits of lump-sum investing, read “Dollar-Cost Averaging vs Lump-Sum Investing: How Should You Invest?”]

18. “When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.”

There is an inverse relationship between the fees that you pay an investment advisor and your net returns. The higher the fees, the lower your net returns.

Warren Buffett was not a big fan of mutual funds that charge high fees to manage investors’ money. His concern is even more understandable given that these mutual funds often fail to outperform the market — which is the main reason why they charge the high fees in the first place.

No wonder Warren now advises that individual investors are better off investing in low-cost index funds, even instructing his trustee to put 90% of his estate in the S&P 500.

These low-cost passive funds are cheaper and they track an index rather than attempting to outperform it to no avail.

This is why Sarwa believes that ETFs — which are even cheaper, more liquid, and more transparent than index funds — are the best way to invest in the market.

[To learn more about ETFs, especially how they differ from mutual funds and index funds, read, “What is an ETF? Benefits of Investing with Low-Risk, Low-Cost, Accessible Funds”]

19. “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble”

There are two opposite and equal errors to avoid.

First is the tendency to see everything as an opportunity.

In this case, the investor must always commit to rigorous fundamental analysis to identify actual wonderful companies with durable competitive advantage.

Second is the disposition to overlook opportunities out of ignorance, fear, and impostor syndrome.

If an investor is lucky to live in a time where many wonderful companies are coming up, there is no reason why they should not take massive advantage of that opportunity (as long as they are still rigorous in doing fundamental analysis).

20. “The best chance to deploy capital is when things are going down.”

When the market is going down, everyone is fearful and instead of looking for new opportunities; they panic-sell their investments.

Buffett believes that market downturns are the best time to look for good companies that are undervalued since the general market decline means such stocks are even more undervalued than if they were in a bull market.

This is good advice even for passive investors.

Market downturns are a good time to invest more money in your diversified portfolio of ETFs. Why? You buy your ETFs cheaper, which means higher overall portfolio returns.

While you should invest any time you have money to do so, without regard for the current condition in the market, market downturns are nonetheless a good opportunity to even double down on your investment rather than exiting the market out of fear.

[To see an example of how to apply this advice in a market downturn, read, “Should What’s Happening To The Bond Market Affect Your Portfolio?”]

21. “Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.”

The last of our stock market quotes from Warren Buffet requires you to answer this question: Who do you receive financial advice from and who do you trust with your money?

Before receiving financial advice or trusting someone with your money, you should be sure they have the requisite knowledge, experience, and success with money. And it will be far better if you have a team of such people rather than a lone ranger or just a few individuals.

For example, Sarwa has a wealth advisory team with experience and expertise in finance, trading, consulting, business development, investor relations, and investing technologies, including former employees of Accenture, McKinsey and Co, PwC, and Vigilant Global.

We also have investment advisors and experts including Dr. Jiro Kondo, an Assistant Professor of Finance at McGill University, and Dr. Zeina Zeidan, the chair of the Board of Royal Financials. And many public figures serve as Sarwa’s ambassadors, as well.

Again, ensure you are trusting your money with people who have the requisite knowledge, experience, and a proven track record of managing money.

If we listen to Buffett, the smartest way to invest is to take action today and enjoy its benefits over time.

22. “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

Instead of investing in many companies, Warren Buffett prefers to focus on a few valuable ones. One reason he does this is that it is generally easier to evaluate and monitor a few companies than a hundred (for example).

Those who have a thorough knowledge of a few companies do not need to spread their capital over hundreds of stocks. Rather, they can derive maximum benefit from the few stocks that they have mastered.

23. “Diversification may preserve wealth, but concentration builds wealth.”

Portfolio diversification aims at risk minimisation rather than return maximisation. Many risk-averse investors don’t mind this trade-off since capital preservation is the priority for them.

However, if the goal is to build wealth, concentrating on a few stocks that you understand and have adequately researched is a better strategy.

“An investor who studies trends and has a keen understanding of how different companies and industries react to various market trends profits much more by using that knowledge to their advantage rather than passively investing across a wide range of companies and sectors,” according to Investopedia.

24. “We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it. In stating this opinion, we define risk, using dictionary terms, as “the possibility of loss or injury.”

Though portfolio diversification has been touted as risk minimising, Buffett insists that concentration can even provide this benefit while also maximising returns (as we said above).

If we define risk as the possibility of losing money, then the investor who has great knowledge about a few companies, thinks about those few companies intensely, and has high standards before buying into a country, is less likely to lose money.

Since these three factors make it less likely the investor would lose money, then concentration has decreased rather than increased risk.

This perception of risk as the probability of losing your money rather than volatility has now been embraced by other financial analysts.

25. “Investors should be sceptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the models. Beware of geeks bearing formulas. ”

Though mathematical models may have their place, nothing can eclipse evaluating the fundamental and qualitative characteristics of companies.

Moreover, past performance is not proof of future potential, Rather, the latter depends on other qualitative factors:

26. “I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

If the success of a business is due simply and solely to the genius of its founder, what happens when the founder dies and the next CEO is not a genius?

Since there are not so many geniuses in the world (otherwise the word would lose its meaning), it is important to invest in businesses that do not require geniuses to run them.

“Great organizations are bigger than one person. They are built on a solid foundation that can stand the test of time,” said Auren Hoffman, CEO of SafeGraph, a software company.

27. “Derivatives are financial weapons of mass destruction.”

With derivatives, investors can lose a lot of money and that very quickly. This is why Warren Buffett called them financial weapons of mass destruction.

The presence of implicit leverage, complex payoff patterns, and the lack of transparency are the three factors that make derivatives a financial weapon of mass destruction, according to Bill Emmons, an economist at the St. Louis Fed.

If used imprudently, they can lead to large losses.

28. “You should never test the depth of the water with both feet.”

Taking an excessive risk, especially with something you are new to does not make any financial sense.

If you are new to a financial asset, an industry, or a company, then you should not go all in. In such cases, risk should be taken in moderation.

29. “A good business is not always a good purchase – although it’s a good place to look for one.”

In essence, price also matters.

Though Buffett prefers to buy a wonderful company at a fair price rather than a fair company at a wonderful price, the best thing is to buy a wonderful company at a wonderful price.

As said above, buying undervalued stocks is a core part of value investing.

30. “Our advantage, rather, was attitude: we had learned from Ben Graham that the key to successful investing was the purchase of shares in good businesses when market prices were at a large discount from underlying business values.”

Buffett learnt value investing from Benjamin Graham and he believes that this is the key to the success of Berkshire Hathaway.

Again, there are two sides to this: buying shares in good businesses and buying them when they are undervalued.

[To learn about value investing by examining the portfolio of Warren Buffett, read “Key Lessons From Warren Buffett’s Top 10 Stock Holdings”]

31. “You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence.”

No one can become an expert on the thousands of stocks listed on stock exchanges. Thankfully, no one has to.

By exploring your circle of competence – “an area in which we have a lot of earned knowledge,” according to Farnam Street, a financial blog – you can find opportunities that others can’t.

For example, if you have experience in the world of manufacturing and retail over the years, then consider starting your journey evaluating stocks of companies in those industries. Similarly, if you have lived in a state for a long time, consider starting with companies with significant operations in that state.

32. “Cash combined with courage in a time of crisis is priceless.”

Warren Buffett does not get perplexed by bear markets. Instead, he sees them as opportunities to buy wonderful companies for cheap.

In bear markets, many people are selling off, cutting their losses. For value investors, that is the time to buy. This is why Buffett said having cash in those times and the courage to go against the trend (buying when others are selling) is priceless.

Remember, bear markets are opportunities to reduce your average cost, which means higher returns.

33. “Trust in American ingenuity”

The American economy has continued to make millionaires and billionaires. Its stock market contains some of the most successful companies in the world and it remains the largest (by market cap), most liquid, and most diversified.

This is why at Sarwa we provide UAE investors with access to this market through our Sarwa Trade and Sarwa Invest products.

[For an ultimate starter kit to investing, read “How to Invest Money in the UAE” — one of the most popular articles on our site.]

34. “Invest in companies you believe in”

Before investing in a company, ensure you have done your research and you are convinced of its potential.

If you are unsure of the future drift of a company, there is no point buying its stock, irrespective of how well it is currently doing or what others are saying about it. You need to have your conviction.

Warren Buffett’s quotes on investing psychology

Strategy is important but having the right mental and psychological perspective is also important.

Below are Warren Buffett’s quotes on investment psychology.

35. “Beware the investment activity that produces applause; the great moves are usually greeted by yawns.”

Successful value investing requires identifying wonderful companies when their market price is well below their intrinsic value.

At this point, not many people will consider such companies a great buy. Only those who have seen the durable competitive advantage will make a purchase. And when they buy, it will not be to the applause of the larger investment world.

Many people only saw the wisdom of Warren Buffett’s approach in the rearview – after the purchase had proved successful.

Similarly, some of his most successful buys were not companies producing “exciting” or “world-changing” products or services. For example, Gillette was making razors and See was making Candies.

Buffett was not quick to purchase technology companies, which was why he was able to avoid suffering from the bursting of the dot-com bubble.

In essence, successful investing will be proven right from the rearview rather than from the windshield.

36. “The business schools reward difficult complex behaviour more than simple behaviour, but simple behaviour is more effective.”

Though successful investing is not simplistic, it does not need to be complex. In fact, for Buffett, simple behaviour can be more effective than the complex behaviour encouraged by business schools.

This point ties into the previous one. Simple behaviour will not meet with much applause compared to complex stock trades. But those simple actions – flowing from time-honoured principles – can do more good.

It’s not surprising then that Warren Buffett has encouraged investors to put their money in passive funds – which encourages simple behaviour – rather than active funds – which encourages more complex behaviour.

And the fact that most active funds find it difficult to beat their indices while charging higher fees and using all kinds of complex strategies, is proof of the wisdom of the simplicity that Buffett is advocating.

37. “The most important quality for an investor is temperament, not intellect.”

Disciplined investors are wealthy investor because they have learned that market fluctuations are normal and that patience pays off.

In this quote, Buffett touches on the psychological nerve of most investment failures. Humans are by nature irrational beings and are often tempted to make trades when they think the market is working against them.

In contrast, it is the well-tempered investor who learns to not watch the market. This is the person who ultimately ends up reaping the most rewards over the long term.

Buffett extols that building more wealth does not require you to be necessarily smarter than another investor, but rather that you become more disciplined with your reaction towards the irrationality of the market.

“You don’t need to be a rocket scientist,” goes a similar Buffett quote. “Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”

38. “Remember that the stock market is a manic depressive.”

Following stock market news can be depressing. Because the stock market is volatile, stock prices move up and down. And investors who don’t have the emotional intelligence to weather that volatility might end up making poor decisions.

Investors must understand that short-term price movements (especially declines) are reflections of investors’ speculation rather than the underlying value of the stock itself.

Understanding this will help investors stop considering every fall in price as a significant event requiring a response.

Instead, investors should focus on whether a company is keeping its comparative advantage and if the management team is still working by the principles that made the company a good one.

It’s only changes in these more fundamental factors that necessitate a response from the investor. Everything else is just noise.

39. “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

Few quotes provide as much insight into the mind of Warren Buffet as this one.

In this famous quote, Buffett reflects on an important fact: humans are naturally irrational. We can expect a large quantity of them in a group to do irrational things. This is why large market swings are often based on the whims of traders.

By rationally learning to work against this status quo, we learn that fighting the urge to follow the herd mentality into a stock will pay off. Meanwhile, running into a trend will often lead to disaster.

The best way to fight this greed and “become rich” is to think long-term and begin investing in automated savings, retirement planning, or other investment schemes as soon as possible.

40. “No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

One of Buffett’s most oft-quoted and colorful phrases, here the Oracle of Omaha is instructing us to understand that things cannot be rushed. There is no such thing as a successful ‘get rich quick’ scheme; investments — like babies — always take a certain amount of time to grow.

Indeed, by hastily jumping into an investment in the stock market you do more harm than good to your hard-earned wealth.

The best bet: Always take a breath, learn to be patient, research and seek out expert financial guidance when needed.

41. “Games are won by players who focus on the playing field –- not by those whose eyes are glued to the scoreboard.”

Continuously keeping track of stock market movements can lead you to make unnecessary decisions you may later regret.

Instead of fixating on stock price movements, focus on doing fundamental analysis, selecting the right stocks, and valuing them.

42. “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

It’s important to take investment advice, not with a grain of salt, but rather with a whole bucket.

No investment expert or advisor knows the future. Forecasts about how the stock market will perform in the future are just that — mere forecasts.

Timing the market and making investment decisions purely based on market forecasts is not a good strategy.

Instead of trying to predict the market, Buffett prefers to focus on identifying companies with good fundamentals that the market is undervaluing. As long as the fundamentals don’t change, he will hold such stocks for the long term.

This combination of a focus on fundamentals and a commitment to the long-term will also save you from the emotional rollercoaster of reading every forecast by any investment “expert.”

43. “We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

Discipline is what you need to become a successful investor. With it, you can outperform a smarter person who is ruled by the fear and greed cycle.

This does not mean that you should not try to be a smarter investor; rather, it emphasises that the priority is being level-headed and learning how to separate noise from substance.

44. “An investor should act as though he had a lifetime decision card with just twenty punches on it.”

If you knew you would only have to make 20 stock decisions in a lifetime, then you would be more cautious about the stocks you buy.

You would also want to buy stocks that you won’t ordinarily have to sell.

That’s the exact mindset Buffett wants you to have towards investing – that of a long-term investor.

45. “If past history was all that is needed to play the game of money, the richest people would be librarians.”

Again, past performance is not proof of future performance.

Knowing the history of the performance of some stocks is not all the work that is required. Many qualitative factors must be considered when deciding whether you should purchase a company’s stock.

46. “Calling someone who trades actively in the market an investor “is like calling someone who repeatedly engages in one-night stands a romantic.”

There might be nothing wrong with being an active trader of stocks but Buffett prefers to distinguish traders from investors.

Traders seek to make money from short-term price fluctuations. Consequently, they are more actively engaged in the market, with some (day traders) opening and closing many positions in a single day.

On the other hand, investors are more oriented to the long term. They want to profit from a company’s price approximating its intrinsic value over the years.

47. “Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market.”

When choosing a stock, consider if you would be happy to hold the stock even when it’s impossible to sell it (no market to sell it).

If your answer is no, then you should probably not buy it, according to Buffett. You should only proceed to buy a stock if you are willing to hold it permanently. Remember that “our favourite holding period is forever.”

[For more information on buying US stocks from the UAE, read “How to Buy US Stocks in the UAE (With No International Transfer Fees)”.]

48. “The stock market is a device for transferring money from the impatient to the patient.”

“The average man tends to buy high and sell low,” according to Ray Dalio, founder of Bridgewater Associates, a hedge fund.

When the average man buys high and sells low, he loses money because of his impatience.

But the value investor is always there to buy low when the average man is selling low. By buying low, value investors reduce their average cost and maximise their returns.

49. “Temperament is also important. Independent thinking, emotional stability, and a keen understanding of both human and institutional behaviour is vital to long-term investment success.”

This quote summarises everything we have discussed so far about investment psychology.

To succeed, you must have an independent mind – being able to do your research instead of following the crowd.

You must also have the emotional stability to stay level-headed even during market downturns.

Finally, you must understand human behaviour and profit from it since the stock market transfers wealth from the impatient to the patient.

Warren Buffett quotes on financial management

Successful investing requires that you know how to manage your money. This includes budgeting, saving money consistently, and sticking to your budget.

Even Warren Buffett recognises that no one can build wealth without financial management, as these quotes will illustrate.

50. “Never depend on a single income. Make an investment to create a second source.”

Here you have the pillar for why investment is so important. In life, we should never rely on a single source of income. Investing opens up a proven avenue to generating that all-important second income stream.

In this quote, Buffett also alludes to the importance of basic diversification. By establishing more than one income source, we essentially begin to diversify our revenue streams.

Diversified, long-term investing is a recipe for success and this is what we provide with Sarwa Invest.

51. “Do not save what is left after spending; instead spend what is left after saving.”

Since George Clason’s The Richest Man in Babylon became popular, the concept of paying yourself first has become popular.

Like Clarson, Buffett also advises that you pay yourself first by saving before spending. If you don’t save, you might overspend – even on irrelevant items – and end up with nothing.

However, if you save first, you are “forced” to live within your budget and avoid impulse buying.

52. “If you don’t find a way to make money while you sleep, you will work until you die.”

Money should be your servant and not the other way around.

When money works for you, then you can make more money without working. But if you only work for money, you will have to keep working until you die.

While human beings can only work for several hours a day, money can keep working for you 24/7 for as long as you are invested in the financial market.

If you want to achieve financial independence before or at retirement, then you must put money to work.

53. “If you buy things you do not need, soon you will have to sell things you need.”

If you are in the habit of buying things you don’t need, you will end up spending money you should have saved. And when emergencies arise, you will be forced to sell things you need since you can’t turn to your savings.

Moreover, consistently buying things you don’t need can lead you into debt, which Publililius Syrus, the Syrian writer, calls the “slavery of the free”

54. “The more you learn, the more you earn.”

Personal finance experts talk a lot about how to save money by reducing your expenses.

While that is good and fine, sometimes what you need to upscale your finances is to increase your earning capacity. Whether that is earning more from your job or creating passive income sources, you must commit to increasing your income.

For Buffett, knowledge is the source of income. The more you learn, the greater your capacity to increase your earning potential.

55. “An idiot with a plan can beat a genius without a plan.”

Even with the right trading strategies and psychology, you can still fail as an investor if you don’t have a plan.

At Sarwa, we encourage investors to have a systematic investment plan. This plan highlights your investment goals and how you want to distribute your monthly savings towards these goals.

Such a plan helps you focus your investment choices.

56. “Stay away from the mentality of using the credit card compulsorily and invest on yourself. Wealth has not created mankind but mankind has created wealth. Live your life in the simplest manner possible.”

Some debt – mortgage, education – might be good but most consumer debt –including credit card debt – is bad.

Frugality is a virtue that you should embrace if you are keen on building wealth. Instead of embracing a lifestyle you can’t afford, live within your means for the sake of your future.

57. “I’ve never believed in risking what my family and friends have and need in order to pursue what they don’t have and don’t need.”

Learn to separate your needs from your wants.

Investing is good but there is no point investing money that should be going to your needs.

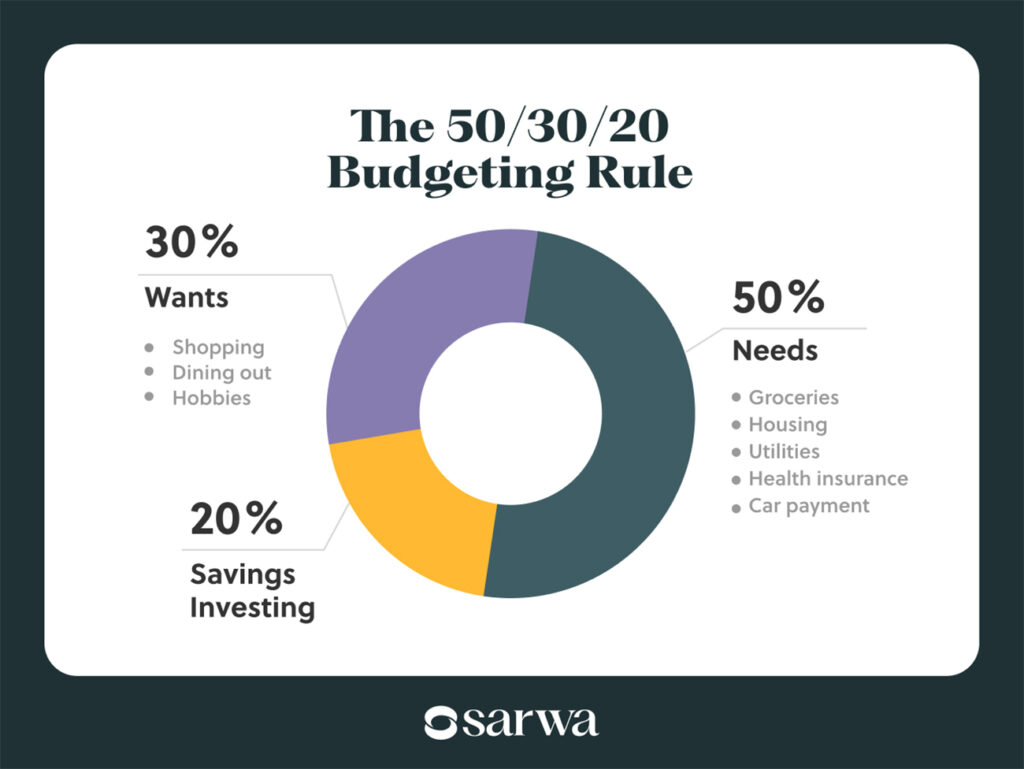

This is why the 50/30/20 rule is a very good budgeting system. It tells you to spend 50% of your income on needs, 30% on wants, and the remaining 20% should be saved.

Know the boundaries between those three categories and stick to them.

Warren Buffett quotes on life and success

Some of the principles required for successful investing also apply to life in general. So, in addition to talking about investment, Warren Buffett has given us important lessons and principles to succeed in every other area of life.

We consider some of them below:

58. “The most important investment you can make is in yourself.”

There are two things you should constantly invest in: your ability to make money and your ability to make money work for you.

Whatever you do, become better at it so you can command more value and increase your income.

But remember that while you can only work for a set amount of hours a day and a certain number of years, money — because it is intangible — can work 24/7, forever.

Therefore, you should also invest in your financial education. Read Sarwa’s blog, attend our webinars, and consume content from other reliable financial resources (we often link to them in our articles).

59. “Honesty is a very expensive gift, Don’t expect it from cheap people.”

Knowing who to trust is important in investment and life in general.

If a company is managed by dubious people, then it is unwise to expect honesty or virtue from them. In the same way, people who have shown themselves to be “cheap” do not deserve to be trusted.

60. “Intensity is the price of excellence.”

What Buffett said about concentration (instead of diversification) applies to other areas of life. Focusing on a few things and doing them well is better than pursuing so many things.

Excellence and expertise are widely celebrated in today’s world but those two things require focused efforts or what Buffett calls intensity.

61. “If you’re in the luckiest one per cent of humanity, you owe it to the rest of humanity to think about the other 99 per cent.”

Buffett is a firm believer in charity.

While this quote is a clarion call to the top 1%, charity can be embraced by all. You might think you are poor in comparison to someone like Buffett or Mark Zuckerberg, but you are also a rich man to some people.

Do your best to be charitable.

62. “The difference between successful people and really successful people is that really successful people say no to almost everything.”

Remember what we said about the intensity of efforts? This is the corollary. If you are focusing on a few things, it means you will have to say no to many other things.

Saying no means you cherish your time and you have realised that you can’t do everything (and if you can do everything, you can do them all well).

63. “There comes a time when you ought to start doing what you want. Take a job that you love. You will jump out of bed in the morning. I think you are out of your mind if you keep taking jobs that you don’t like because you think it will look good on your resume. Isn’t that a little like saving up sex for your old age?”

Doing a job you love is key to personal fulfilment and it should be a goal that you should pursue.

Buffett recognises that many people will have to take jobs they don’t enjoy so they can earn income or improve their resume.

However, the time must come when doing what you love should be the priority.

64. “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”

Perseverance is indeed a virtue. But there are times when what is needed is not perseverance but pivoting (a change).

In investing, this means that if you have made a bad investment, you should rather cut your losses than holding on to it out of sheer hope.

The same thing applies in other areas of life.

65. “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that you’ll do things differently.”

Don’t allow short-term gains to make you lose focus on what you have been building for years.

A good reputation is important in life and you should not risk it for some short-term gains.

66. “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.”

Nobody knows it all. We all need to interact with other people to sharpen our minds.

If you want to become a better person, then hang out with people who are even better than you. This applies to investing (hanging out with better or more experienced investors) as well as other areas of life.

The interesting thing about life is that what we want to achieve has been achieved by someone else before us. Therefore, seeking out those people (physically or through their books) is a good way to optimise for our improvements.

67. “Get something to improve yourself at least 1% each day”

Everyone wants to be the next Warren Buffett, Elon Musk, Mark Zuckerberg, or what have you.

The reality is that these people did not become who they are overnight. It is a result of continuous daily efforts.

Therefore, if you want to be successful in any area of life, you need to devote yourself to continuous improvement. Buffett advises that there should be something we are improving on at least 1% each day.

68. “Reading could be the BEST addiction one could have. The only proven side effect is imagination & an edge in knowledge.”

Reading is one way to continuously improve yourself every day.

It is one of the secret sauces of Buffett’s success (among many others).

If you want to be a successful investor, read books and articles from successful investors. If you are in human resources and want to be better at it, read books by the most successful HR executives.

69. “Tell me who your heroes are and I’ll tell you how you’ll turn out to be.”

Having the right mentors, heroes, and role models is crucial in life.

But it is not enough to have heroes if you are not learning from them.

Find out those who have made a name in your field or in other areas of life that interest you and learn from them.

70. “People always ask me where they should go to work, and I always tell them to go to work for whom they admire the most.”

And if you have an opportunity to work for someone who is your hero, mentor, or role model, don’t let it slide. Books are good but nothing compares with direct acquaintance and mentorship from the people you admire most.

71. “You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.”

Good ideas and opportunities don’t come all the time, make maximum use of them when they do come.

Warren Buffett business quotes

If you are an investor, you need to know what to look for in a business before considering buying stocks in it.

Similarly, if you are a business person, you need to know how to run your business in a way that makes it attractive to investors.

Whichever category you belong to, these Warren Buffett quotes will prove useful:

72. “Somebody once said that in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don’t have the first, the other two will kill you. You think about it; it’s true. If you hire somebody without [integrity], you really want them to be dumb and lazy.”

Human resources remain the most important factor of production. Therefore, a business that wants to succeed must be deliberate about the kind of people it employs.

For Buffett, three qualities are non-negotiable: integrity, intelligence, and energy. But among the three, integrity is the most important. This is because an employee with intelligence and energy without integrity will be a menace to the business.

73. “I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business. I do it because I like this kind of life.”

Business executives and leaders must be people who can think deeply. This might seem hard in a culture of doing and busyness but is a competitive advantage for those who can master it.

Thinking deeply, away from the noise of the corporate world, can help you make better business decisions.

74. “In the world of business, the people who are most successful are those who are doing what they love.”

Just as employees should do what they love, entrepreneurs must also create businesses around what they love doing.

When things are difficult and time are hard, it takes passion and love to keep going.

75. “I learned to go into business only with people whom I like, trust, and admire.”

Business partnerships require trust. Don’t go into business with people you don’t trust.

Apart from causing you financial loss, such people can ruin your reputation. And remember that while it takes 20 years to build, reputation can be destroyed in just five minutes.

76. “In the business world, the rearview mirror is always clearer than the windshield.”

Hindsight is 20/20 is a statement that describes how things become clearer after they have happened.

Buffett is making the same point here. When you are looking back at what happened, things are clearer but when you are looking ahead, they are not as clear.

77. “In the long run managements stressing accounting appearance over economic substance usually achieve little of either.”

Prioritising accounting appearance has led many companies to cook their books and window dress their accounts.

For Buffett, the economic substance of a business should be more important than its accounting appearance. What you are is more important than what you are pretending to be.

This is one reason why he separates good businesses having bad times from bad businesses. If the substance is good, the bad times will pass and there is no need to pretend that the bad times don’t exist.

78. “Culture, more than rule books, determines how an organisation behaves.”

What an organisation will be is premised more on its culture (informal rules) rather than its formal rules.

Of course, formal rules are important. However, organisations should prioritise the kind of culture they create.

79. “If each of us hires people who are smaller than we are, we shall become a company of dwarfs. But, if each of us hires people who are bigger than we are, we shall become a company of giants.”

Just as individuals should keep the company of those who are smarter than them, business owners should also hire those who are better than them.

80. “Having first-rate people on the team is more important than designing hierarchies and clarifying who reports to whom”

In fact, Buffett believes hiring smarter people is more important than establishing a bureaucracy.

Moreover, smarter people don’t like to be micromanaged. They need the freedom to be creative.

81. “It’s only when the tide goes out that you learn who’s been swimming naked.”

When the economy is doing well, every company looks fine. But when recessions and economic disasters hit, the companies with good fundamentals will be separated from those who are not as sound as they looked in good times.

This quote applies especially to financial companies who “overextend when times are good only to regret their imprudence when the tide eventually (and inevitably) turns.”

In essence, good times lead many businesses to take imprudent risks that are revealed to be unwise when difficult times arrive.

82. “ABCs of business decay, which are arrogance, bureaucracy and complacency.”

We have already seen that Buffett prefers hiring smarter people and giving them the space to be innovative. The reason is that he sees bureaucracy as one of the causes of business decay.

The others are arrogance and complacency. The former often leads to the latter as in the case of market leaders who believe they are too big to fail and refuse to spend money on R&D only for smaller companies to eat them up.

83. “If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. If you have to have a prayer session before raising the price by 10%, then you’ve got a bad business.”

Buffett focuses on companies that have an economic moat, which Investopedia defines as the “ability to maintain competitive advantages to protect its long-term profits and market share from competitors.”

One way this manifests is the ability to raise prices without losing market share. If your products are so valued by your customers that they prefer paying a higher price than switching to a competitor (think Apple), then you have a solid business.

This is a goal every business owner should aspire to.

84. “The requisites for board membership should be business savvy, interest in the job, and owner-orientation.”

The people who sit on a company’s board are as important as the executives driving its daily affairs.

Buffett believes that owners should select those who are business savvy, actually want the job, and are oriented towards the interests of the owners.

85. “Over the years, Charlie and I have seen all sorts of bad corporate behaviour, both accounting and operational, induced by the desire of management to meet Wall Street expectations.”

It’s interesting how many businesses start derailing when they go public. They start to make decisions that will meet the expectations of investment managers.

Some otherwise innovative companies start playing it safe to please Wall Street. And, as Buffett noted, some will start making all sorts of accounting and operational missteps.

Companies must be careful of losing their identity to please Wall Street.

86. “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Buffett does not believe that good management will solve every problem. If a business has bad economics, even the best of managers may find it hard to turn it around.

Instead, their reputation for brilliance may be soiled while that of the business for bad economics persists.

Thus, while Buffett considers management in choosing a company to invest in, that is not everything.

87. “Managers who want to expand their domain at the expense of owners might better consider a career in government.”

We have seen cases of managers who seek to increase their power and influence to the detriment of the owners of the business. This is an anomaly that owners should look out for.

In the business world, the interests of shareholders should be a priority over petty politics.

Warren Buffett gold quotes

Warren Buffet also has some things to say about investing in gold.

88. “[Gold] gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Warren Buffett doesn’t like gold because it has no utility. It is one of those assets you buy not for what it can produce but out of sheer belief that someone will pay more for it in the future.

Of course, gold advocates disagree believing that its value lies in the protection it offers during economic downturns.

[For more on the reasons why investors like gold, see “How to Invest in Gold in the UAE: 5 Accessible Ways to Consider.”]

89. “I have no views as to where (gold) will be (in the next five years), but the one thing I can tell you is it won’t do anything between now and then except look at you”

Gold is not procreative. It doesn’t produce anything. And this is why Buffett believes they provide no utility.

In one interview, he said “It’s a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that.”

That is, when you invest in the stocks of companies, those companies go out there to make money and their stock prices respond to earnings. But gold does not procreate, it only looks at you.

90. “What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As ‘bandwagon’ investors join any party, they create their own truth — for a while.”

Buffett acknowledges that people embrace gold as a way to protect themselves against economic downturns.

However, he believes that for most people, this is just a result of being fearful. People tend to pack their money into gold when they fear that the dollar or the economy as a whole is about to crash.

[Are you ready to invest and grow your wealth but don’t know how to start? Schedule a free call with one of our wealth advisors to learn how Sarwa can help you begin your investment journey.]

Takeaways

- Learning from established investors like Warren Buffett, through his stock market quotes, is crucial to succeeding at investing.

- For Buffett, successful investing requires a long-term focus, fundamental analysis of companies, and the principles of value investing.

- Buffett also believes that business management requires focusing on substance over appearance, hiring the best talents and giving them freedom, and nurturing a culture of trust.

- Some of Warren Buffett’s thoughts on honesty, financial management, doing what you love, and reading, among others can also help achieve success in other areas of life.