If you have followed discussions in the investment community, you are probably familiar with the vocal debate between passive and active investment. Since the popularity of exchange-traded funds (ETFs), this debate has intensified, and many experts are taking sides.

However, one thing cannot be denied: both passive and active investment strategies have their pros and cons.

So, instead of absolutising one and casting away the other, investors should be able to choose the one (or do a little bit of both maybe?) that best fits their financial goals, risk tolerance, skills, and time availability, among others.

At Sarwa, we have designed our platform to cater to both passive and investment strategies so that no one will be left out. By accessing both on a single platform, you can switch between them as your needs change or even try out both to see which one provides better value for you.

In this article, we consider how you can use Sarwa to execute passive and active investment strategies. We then conclude by pointing you to factors that can help you decide between the two. We’ll cover:

- What is passive and active investment in the stock market?

- How to execute a passive investment strategy on Sarwa

- How to execute an active investment strategy on Sarwa

- Choosing between passive and active investment strategies

Do you want to learn more about how to become a better passive and active investor? Subscribe today to Sarwa’s Fully Invested newsletter for more insights into successful investing.

1. What is passive and active investment in the stock market?

Before outlining how to use Sarwa to execute passive and active investment strategies, let’s begin with a clarification on how we are using these terms

Passive investing

Passive investing is an investment strategy where your goal as an investor is to match the market’s performance rather than attempting to beat it.

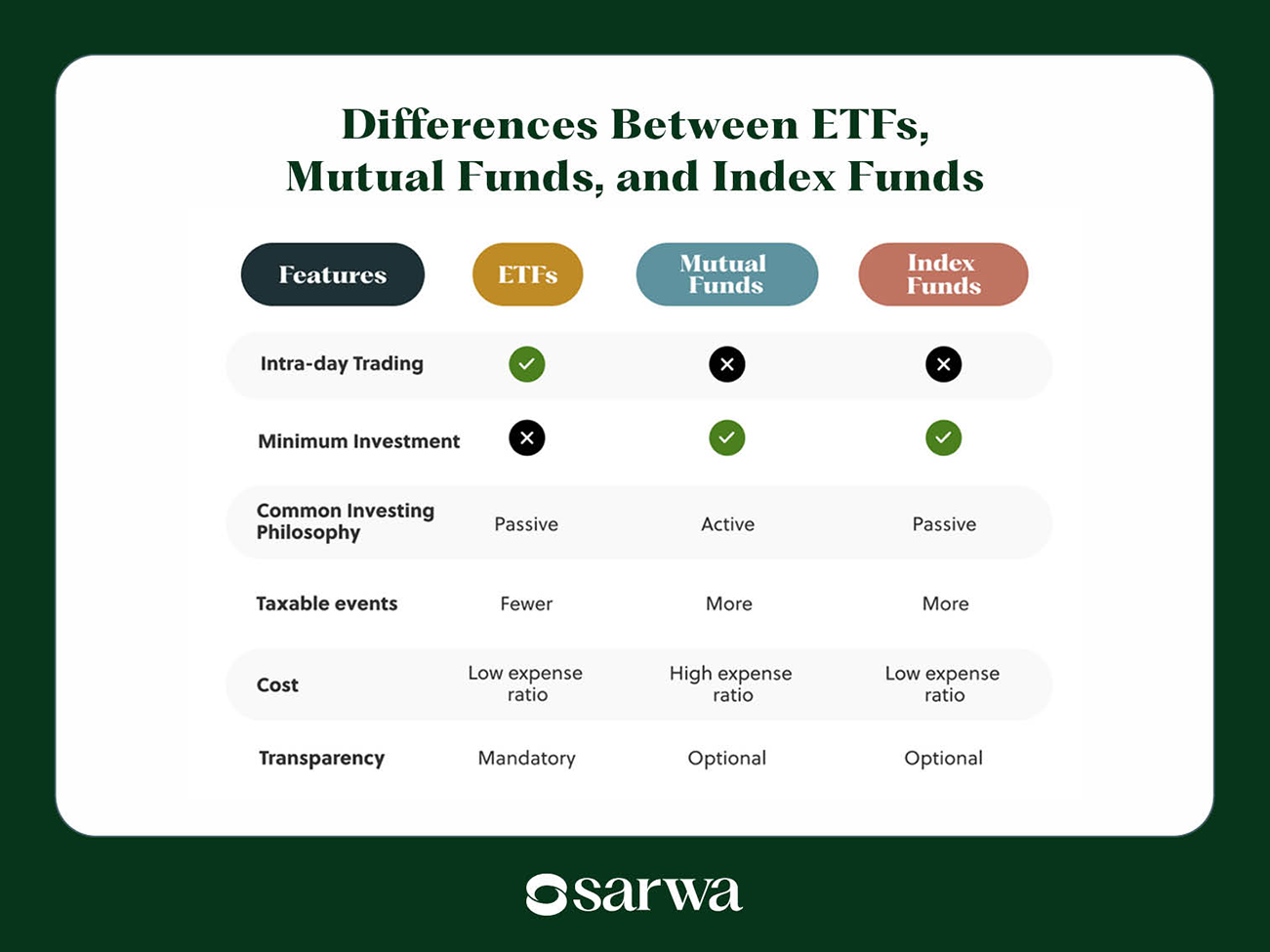

This strategy is usually executed through the purchase of index funds and ETFs.

Index funds are passively-managed mutual funds that attempt to track (rather than beat) the performance of a given benchmark stock index (for example, the S&P 500 index).

ETFs are usually passively managed funds that also track (rather than attempt to beat) the performance of a given stock index. However, unlike mutual funds that can only be traded at the end of the trading day, ETFs (like stocks) can be traded during the trading day.

However, even when an investor purchases index funds or ETFs, they will typically have to decide which ones to buy, how to diversify their portfolios (by asset class, industry, geography, and market cap, etc), and the asset allocation formula to use.

For others who want a completely hands-off approach, this is a tall order. For these investors, robo-advisors or digital wealth managers are an even more passive investment approach.

These are automated investment platforms that can create personalized portfolios based on your investment goals, time horizon, and risk tolerance. With them, you can choose to automatically transfer a certain amount from your bank account every month to your portfolio. The money will be consistently invested in the portfolio created for you; you don’t have to take any action.

Active investing

Active investing is a strategy where investors aim to beat the market rather than just match its performance.

An individual active investor will select individual stocks (and other assets) based on fundamental and technical analysis to generate alpha (a measure of how the returns of an active strategy exceed market returns).

The other way to pursue an active investment strategy is to buy mutual funds – Sarwa does not offer mutual funds at the moment. These are actively managed funds that pool together resources from various investors to purchase and manage assets on their behalf. There are equity funds, bond funds, balanced or hybrid funds, among others.

Mutual fund managers are experts who make buy and sell decisions in a bid to outperform the market. Investors will own shares of the net asset value (NAV) of the mutual fund. These shares can only be sold or bought at the end of the trading day.

2. How to execute a passive investment strategy on Sarwa

Now, let’s consider how Sarwa can help you execute both types of passive investment strategies.

Passive investment strategy 1: Purchasing ETFs

On Sarwa, you will find thousands of ETFs you can use to execute a passive investing strategy.

Though many passive investors only invest in an S&P 500 ETF, we have found that strategy insufficient due to the importance of diversification.

Thus, Sarwa has provided you with ETFs across asset classes, industries, geographies, and market caps:

- ETFs by asset class: You will find stock ETFs (like the S&P 500 ETF), gold ETFs (like SPDR Gold Trust), real estate investment trusts (REIT) ETFs (like Vanguard Real Estate Index Fund), crypto ETFs (like iShares Bitcoin Trust ETF), and bond ETFs (like Vanguard Total Bond Market Index).

- ETFs by industries: You will also find stock ETFs across various sectors (healthcare, finance, materials, industrials, etc.).

- ETFs by geographies: There are stock and bond ETFs that cover developed markets ex-US and emerging markets. Examples include Vanguard FTSE Developed Markets ETF, Vanguard FTSE Emerging Markets ETF, Vanguard Total International Bond ETF, and iShares J.P. Morgan EM Bond ETF, among others.

- ETFs by market caps: You will also find stock ETFs that target large-cap (SPDR S&P 500 ETF), mid-cap (Vanguard Mid-Cap ETF), and small-cap companies (iShares Russell 2000 ETF).

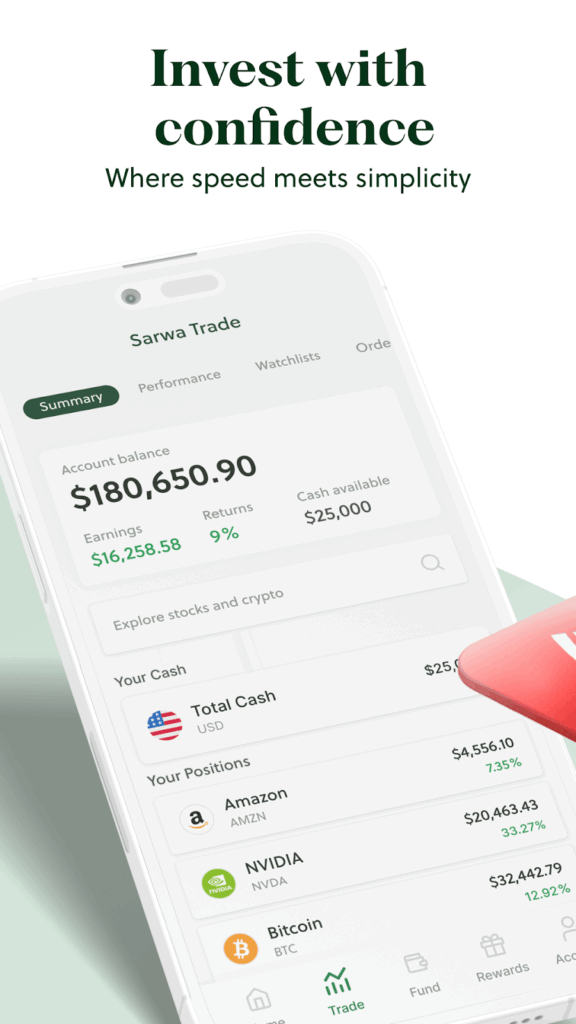

You can access all these ETFs by going to the “Trade” tab from the Sarwa app homepage (available on Google Play Store and Apple’s App Store).

By creating a diversified portfolio of ETFs, you can track the performance of various stock market indices instead of trying to beat the market to no avail.

Passive investment strategy 2: Robo-advisors

However, as said before, creating a diversified portfolio of ETFs also requires a bit of work. If you can’t do this work (or do it well), you may be better off using a robo-advisor.

You can access Sarwa’s robo-advisory platform (Sarwa Invest) directly from the app’s homepage:

During the onboarding process, a Sarwa wealth advisor will ask you to fill out a questionnaire. The answers to these questions will help us understand your investment goals, time horizon, and risk tolerance.

Based on these, we will create a personalized and efficient portfolio for you with the aid of the Modern Portfolio Theory, one of the most popular investment theories in the modern world.

You will also have to make two crucial choices when selecting a Sarwa Invest Portfolio:

Conventional, halal, or socially responsible portfolios

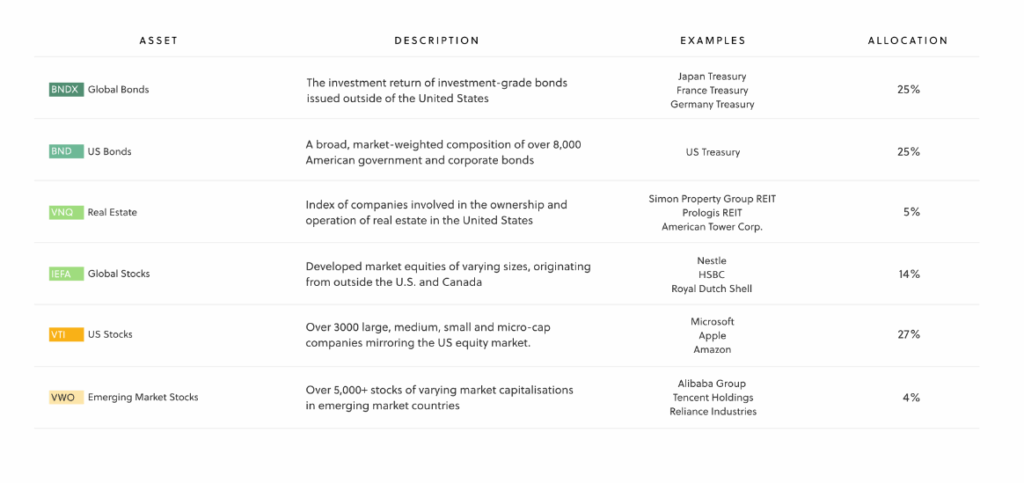

A conventional portfolio is a diversified portfolio of ETFs whose goal is to provide investors with the right risk-return mix that aligns with their investment goals and risk tolerance. You will need a minimum of $500 to get started with a conventional portfolio.

Also, there is a conventional portfolio for very conservative, conservative, moderate-conservative, balanced, moderate-growth, growth, and aggressive investors. Below is what a conventional portfolio for a conservative investor looks like:

Sample Sarwa Invest Portfolio for a Conservative Investor

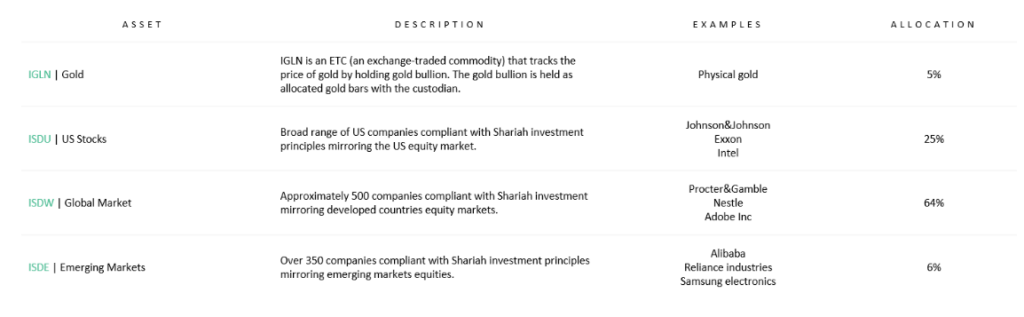

A halal portfolio is a Shariah-compliant portfolio that invests according to Islamic principles. The assets in this portfolio are the BlackRock Islamic ETFs and the Franklin Global Sukuk Fund.

There are also a variety of halal portfolios for different risk profiles: very conservative, conservative, moderate-conservative, balanced, moderate-growth, growth, and aggressive investors.

Below is a sample for an aggressive halal investor:

Sample Halal Portfolio For an Aggressive Investor

You will need a minimum of $500 to invest in a halal portfolio.

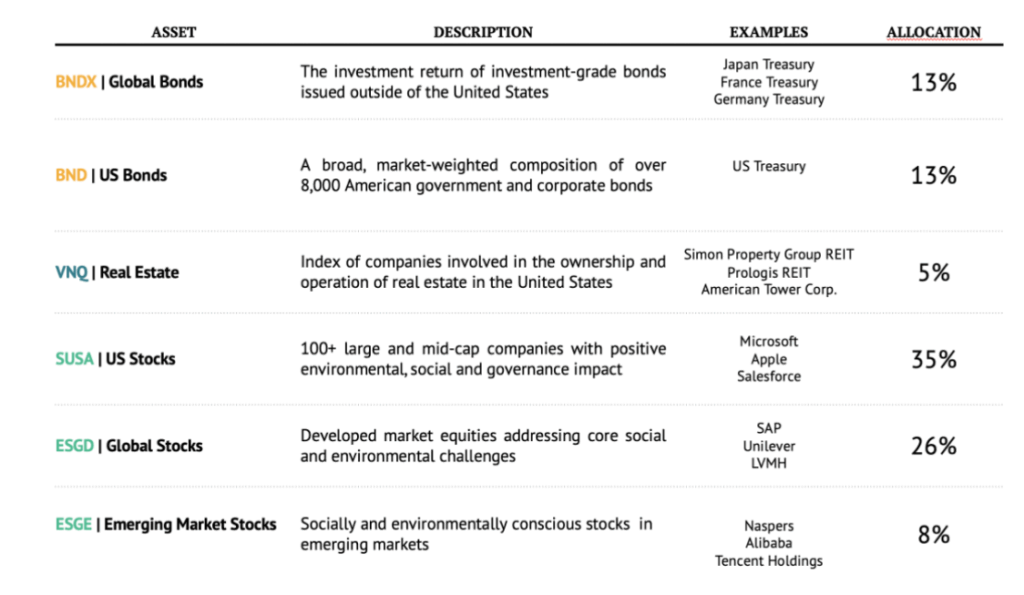

We also provide socially responsible investing portfolios for investors who want their investment choices to match their values. Thus, these portfolios only include companies with good environmental, social, and governance (ESG) scores.

Like conventional and halal portfolios, there are SRI portfolios for all risk profiles.

Below is an example for a balanced investor:

Sample SRI Portfolio for a Balanced Investor

For SRI portfolios, the minimum investment is $2,500.

Inclusion of crypto

There is an option for you to allocate 5% of your portfolio to crypto (Bitcoin).

We invest in Bitcoin through the iShares Bitcoin Trust ETF (IBIT), which provides exposure to bitcoin in the form of a security. This removes the need to manage wallets, private keys, and crypto exchanges.

The crypto option is available for both conventional and SRI portfolios.

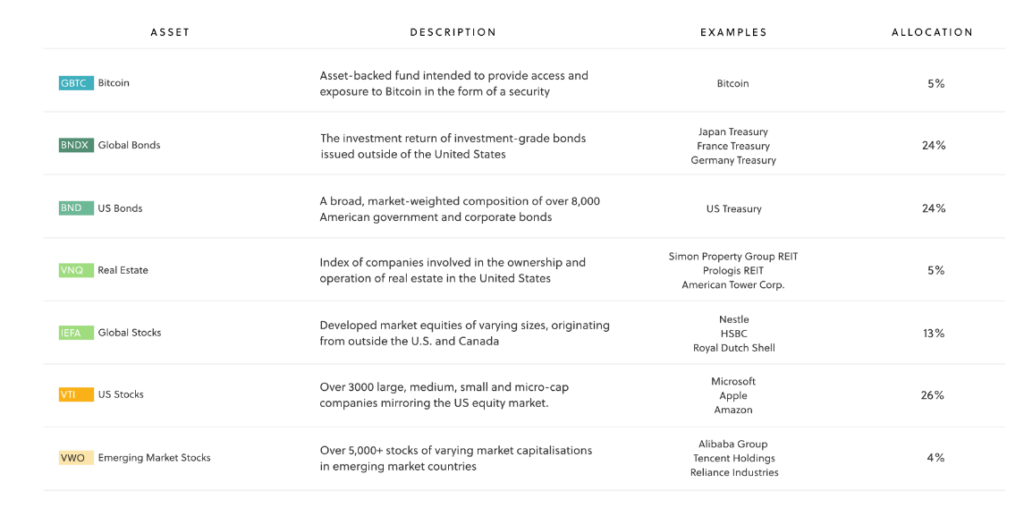

Below is how the conventional portfolio for a very conservative investor will look with a 5% crypto allocation:

Sample Conventional Crypto Portfolio for a Conservative Investor

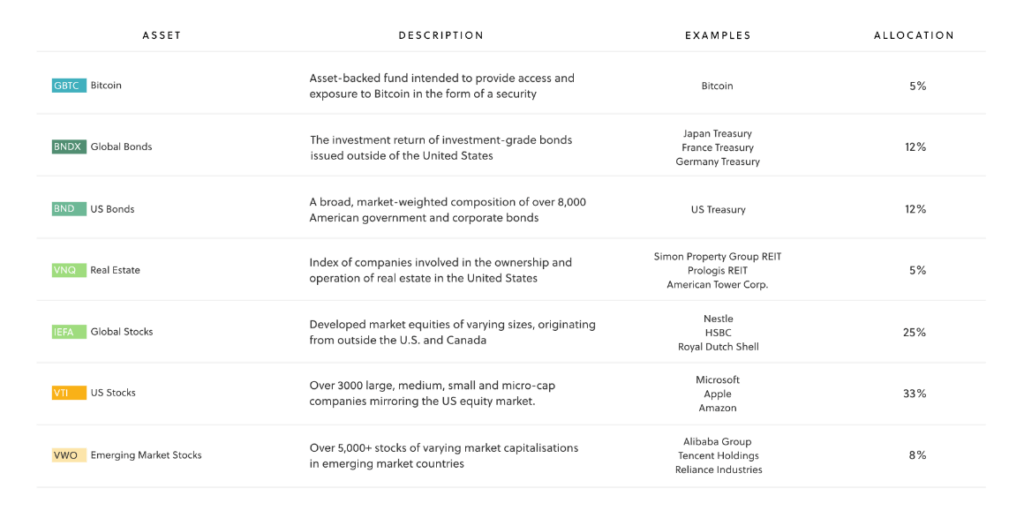

Also, an SRI portfolio for a balanced investor with a crypto allocation will look like this:

Sample SRI Crypto Portfolio for a Balanced Investor

Note, however, that a crypto portfolio is not typically available for halal investors.

As said above, you don’t need to do anything when you subscribe to a robo-advisor portfolio. You can automate your monthly contributions to the portfolio (if you use a monthly investment plan) and be done with it.

Also, Sarwa will automatically rebalance your portfolio when market movements throw it off-kilter. You can also choose to automatically reinvest your dividends (or other income) instead of withdrawing them from your account.

3. How to execute an active investment strategy on Sarwa

As an individual with the relevant skills and time to conduct sound fundamental and technical analysis, you can execute an active investment strategy by purchasing individual stocks, REITs, and cryptos on the Sarwa app. All these asset classes are available on the “Trade” tab of the app:

Since ETFs trade on exchanges like stocks, you can also use them to gain access to some asset classes (like bonds and precious metals) if you need to reduce the risk exposure of your portfolio. However, unlike a passive investor, you may have to make frequent buy and sell decisions depending on your portfolio’s performance.

At Sarwa, we provide you with a wide range of information on individual assets that can help you with your fundamental and technical analysis. Also, our blog and newsletter will teach you how to master both types of analysis.

Furthermore, we offer market, limit, and stop orders to help active investors nail down the specific entry and exit prices they want.

To pursue an active strategy on Sarwa, you only need to start with a minimum balance of $500.

4. Choosing between passive and active investment strategies

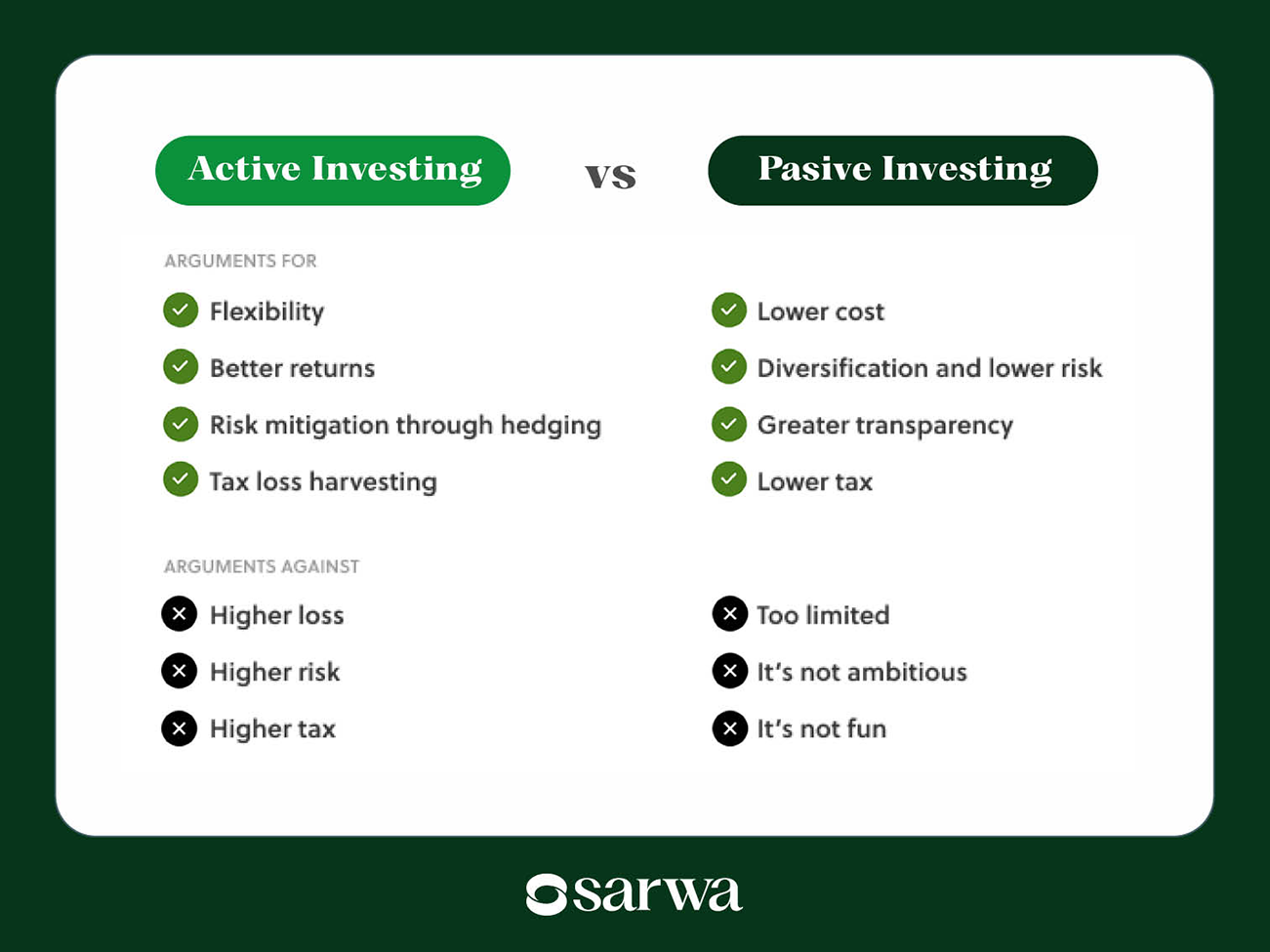

Passive and active investment both have their pros and cons.

The pros of passive investment include lower cost (due to fewer buying and selling decisions), lower risk (due to broader diversification), more transparency (ETFs are mandated to declare their holdings), and lower tax (due to fewer taxable events).

However, some investors find it too limited and restrictive, and, let’s be honest, a little boring.

On the other hand, the pros of active investing include flexibility (you can easily adapt to new market conditions), potential for higher returns, risk mitigation through hedging, and tax loss harvesting.

But some investors are cautious because of higher risk, higher costs (due to higher fees), higher taxes (especially capital gains taxes), and the fact that portfolio managers tend to underperform their benchmark indices despite the high management fees they charge. Some will consider poor active funds’ performance to be the main reason for the rise of passive investing.

How then can you choose which of these strategies to execute on Sarwa?

Below are some factors to consider:

- Investment acumen: If you don’t have the skills to do detailed research or execute risk hedging strategies, it might make sense to stick to passive investing.

- Time availability: Researching individual assets also requires time. Passive investing might be more appealing if you don’t have the time to do the needed research. The only other alternative for an active investor in this case is purchasing mutual funds.

- Risk appetite: If you are risk-seeking (don’t care about high short-term volatility) and don’t care much about diversification, you might find active investing more appropriate. However, if you are risk-averse and value diversification, passive investing will be more appealing.

- Investment goals: Active investing may be more appropriate for investors who want to earn consistent short-term income from their investment decisions. Though active investors can also be long-term (buy and hold) investors, the low cost of passive investing makes it more amenable to long-term investing.

- Investment cost: If the cost of investing is very important to you, a passive investment strategy will make more sense. Roboadvisors will charge lower fees than mutual funds, and the expense ratios of passive index funds and ETFs are lower than those of mutual funds.

However, it is worth repeating that active and passive strategies don’t need to be mutually exclusive.

There are now actively-managed ETFs that seek to bridge the gap between passive funds (index funds and ETFs) and active funds (mutual funds). Also, some investors use a passive approach for large-cap stocks and an active one for mid-cap and small-cap stocks.

It’s also possible to use passive investing for unfamiliar markets (international non-US markets) and active investing for niche segments, according to Livemint, a financial news agency. There are other such strategies, as documented by State Street Global Advisors, one of the top players in the ETF market.

Even active fund managers are now blending passive strategies into their investment system, as the CFA Institute reported.

This is one of the reasons why we at Sarwa combine both strategies on our app. You can easily switch between your active and passive investing portfolios on the same platform.

At Sarwa, we make it easy for you to pursue any of the strategies or both of them, depending on your unique investment profile.

Also, investing with Sarwa is safe and cost-effective. We use bank-level SSL security to protect your data and money, and transfers between your local UAE bank account and your Sarwa brokerage account are free.

We also allow fractional purchases of ETFs, stocks, cryptos, and REITs. If you can’t afford (or don’t want to) buy a share, you can purchase a fraction instead.

Finally, if you don’t have an investment plan, you can schedule a call with one of our wealth advisors who would be glad to help you get started.

What are you waiting for? Sign up today for Sarwa to start building wealth for the future as an active or passive investor (or both)

Takeaways

- Both passive and active strategies have pros and cons; the best choice depends on your goals, skills, time, and risk appetite.

- There are now attempts by active investment managers to embrace passive strategies. Investors are also finding creative ways to combine both approaches.

- With Sarwa, investors can seamlessly switch between passive (ETFs, robo-advisors) and active (stocks, REITs, crypto) strategies on the same platform.

- Low fees, fractional investing, and secure transfers make Sarwa ideal for all investor types.