The spectacular growth in exchange-traded funds (ETFs) over the past decade has spurred a new generation of budding investors to discover what is an ETF, how it is different from other investment assets (mutual funds and index funds), and what benefits they offer to the investor.

Learning more about ETFs makes sense, if only because they are everywhere in the world of investing.

The global ETF industry rose from just $716 billion in assets in 2008 to a whopping $8.56 trillion at the end of Q1, 2021, an incredible increase of 1,095%. In the same period, the number of stock market listed ETFs grew by 450%, from 1,617 to a total of 8,893. The variety of ETFs continues to grow as fund managers create new ETFs to achieve the investment goals of different investors.

Amidst COVID-19, the U.S. Federal Reserve announced that they would buy high-yield and investment-grade bonds through ETFs, a historic decision that validated the popularity of ETFs.

Today, ETFs can account for about a quarter of the daily volume in the U.S. stock market, and this volume can jump up to as much as 40% on some days, according to Bloomberg.

The staunch credibility of ETFs has risen so much, reports Bloomberg, that even pension plans and insurers now use these funds as the low-cost core of their portfolios.

As more professional and individual investors embrace ETFs, a broader desire to understand what ETFs are (their history, how they differ from other investment assets, the various types), their pros and possible cons, and the best way to invest in them has emerged. Many forward-looking investors also want to know what the future holds for ETFs.

In this ultimate guide to ETFs, we will answer all of your questions about ETFs. We’ll consider:

- What is an ETF? A definition

- What is an ETF? The history of the exchange-traded fund

- Types of ETFs

- 7 benefits of ETFs: Why ETFs became popular

- The cons of ETFs

- Examples of the most popular ETFs

- The future of ETFs

- How to get started investing with ETFs

At the end of this guide, you will have all you need to make wise investments in ETFs.

1. What is an ETF? A definition

An exchange-traded fund (ETF) is a basket of assets such as stocks, bonds, and REITs that tracks the performance of an underlying index (more often than not), and trades on a stock exchange.

Using this definition, there are four essential features of an ETF:

- An ETF is a basket: A single ETF of an asset class (e.g., stock ETF) contains numerous assets that belong to that class.

Unlike individual stocks, where a single purchase means you have a stake in one company (one asset), with ETFs a single purchase gives you a stake in the many assets that constitute that basket.

For example, if you purchase the Vanguard S&P 500 ETF (VOO), you have a stake in all the companies that constitute the S&P 500 index.

- ETFs cover a variety of asset classes: The three major asset classes are stocks, bonds, and REITs. There are stock ETFs like Vanguard S&P 500 ETF (VOO), bond ETFs like Vanguard Total World Bond ETF (BNDW), and REIT ETFs like Vanguard Real Estate ETF (VNQ).

We now have currencies ETFs (an example is the Invesco CurrencyShares Euro Trust, FXE), commodities ETFs (an example is the SPDR Gold Shares, GLD), and Inverse ETFs (an example is the ProShares Short Dow 30, DOG) as well.

- ETFs often (but not always) track an underlying index’s performance: The goal of an ETF is to match the performance (returns) of an underlying index. For example, the Vanguard S&P 500 ETF attempts to approximate the performance of the S&P 500 index.

Unlike mutual funds, ETFs track the market’s performance, vis-a-vis the underlying asset instead of attempting to beat the market.

- ETFs trade on the stock market: Investors trade ETFs on a stock exchange. Unlike index funds (that also track the performance of an underlying index) that are only priced at the end of the day, you can purchase ETFs at any time the market is open (throughout the day). In this way, they trade like individual stocks on the stock market.

Many investors still confuse ETFs with mutual funds and index funds. It’s, therefore, important to differentiate between these three investment assets.

ETFs versus mutual funds

A mutual fund pools funds from different individual and institutional investors and invests in equities, bonds, and other securities. The investor will have ownership interest in a portion of the mutual fund’s value (Net Asset Value). That is, every share of the mutual fund that an investor buys represents a portion of the mutual fund’s investments.

Mutual funds are managed by experienced finance experts who try to outperform the market and charge investors for their management and operating expenses.

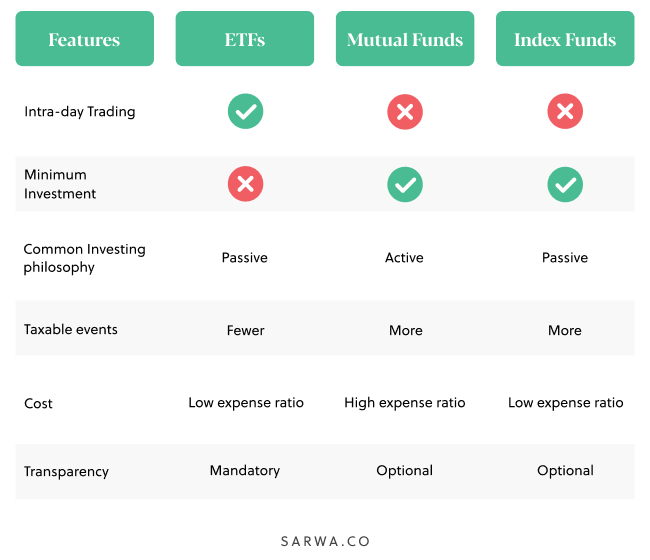

There are six basic differences between mutual funds and ETFs:

- Trading: While you can buy ETFs at any time during trading hours, you can only buy mutual funds at the end of the trading hours. A mutual fund needs to recalculate its Net Asset Value (NAV) at the end of the trading hours before new units of the fund can be purchased. This limitation does not exist with ETFs.

- Transparency: Mutual funds are not mandated to publish the details of their holdings. Many of them don’t do so as a way to protect their trading strategies. On the other hand, ETFs, even actively-managed ETFs are still mandated to publish the details of their holdings.

- Investing philosophy: Mutual funds are actively managed — the fund manager(s) make buy and sell decisions regularly with the goal of outperforming their benchmarks (a market index). While there are now actively-managed ETFs, they are only 20% of the ETF industry. Therefore, ETFs are, by and large, passively-managed funds.

- Operating expenses: In an attempt to beat the market, mutual funds need to hire many financial analysts and traders. Consequently, they incur higher operating expenses that are passed to the investors through the management fees.

- Taxes: Because mutual funds buy and sell their investment assets regularly, they tend to generate more taxable events. ETFs, which are for the most time passively managed, generate less taxable events.

- Minimum investment: Most mutual funds have minimum investment requirements. But with an ETF, investors can buy a single share of an ETF or even a fraction of a share.

[For more on the differences between passive and active investment, read “What’s the Difference Between Active and Passive Investment?”]

ETFs versus index funds

An index fund has the same passive investing philosophy as an ETF. However, there are still certain differences:

- Trading: Index funds can only be traded at the end of the trading hours while ETFs can be traded throughout the trading hours.

- Minimum investment: Most index funds have minimum investment requirements while you can buy just a share of an ETF or a fraction of a share (with some brokers).

- Taxes: Though index funds are passively managed, when an investor wants to redeem his money in an index fund, the manager(s) have to sell some assets to generate the cash. Those sales, depending on how many they are, will generate different taxable events. So, index funds are not as tax-efficient as ETFs.

- Cost: The expense ratio of index funds and ETFs are close. The only difference that arises depends on whether the index fund or ETF charges sales commissions. There is more tendency that an index fund will charge sales commission than an ETF. Some index funds also charge load fees for purchase and sales, while load fees are entirely absent in any type of ETF.

2. What is an ETF? The history of the exchange-traded fund

How did ETFs come to achieve such astronomical growth during the 2010s?

As helpful as the definition of an ETF is, the question at hand (what is an ETF?) cannot be adequately answered without a brief history lesson.

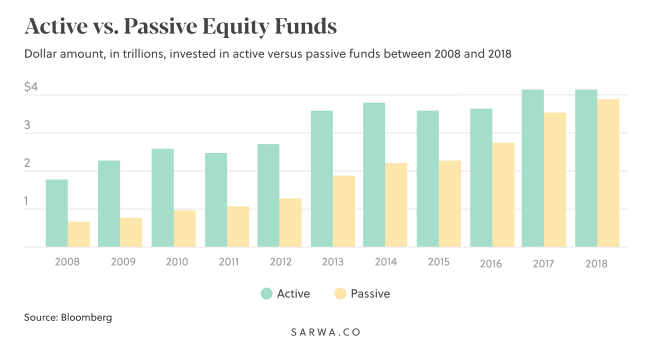

The popularity of ETFs is largely linked to a growing trend for adopting the passive investing approach.

This story begins a few decades back. In the 1970s, investors realized that active management (a style of investing) did not fulfill its promise.

The active management approach was applied by managers of mutual funds in an attempt to outperform the market. They did this by studying and selecting the right type of assets in their portfolio to justify the costs of management.

Active managers charge individual investors a high price to cover overheads and other management expenses on the promise that they will outperform the market, thus justifying the high cost to hire them.

However, many active managers could hardly keep up with the market’s performance; even less outperform it.

The solution to this problem came in the form of a different approach, called passive investing.

From passive investing to ETFs

In 1976, John “Jack” C. Bogle, founder of Vanguard Group, created the first passively managed index fund that tracked the S&P 500.

Unlike the active funds, an index fund seeks to perform as well as its underlying index. Consequently, they are less expensive (less overhead cost and management expenses) and more tax efficient.

Active managers found an important use for this new type of fund. Since active managers try to outperform the market, they need means to measure the market’s performance. They do this through indexes.

For example, the S&P 500 index tracks the performance of 500 large-cap companies in the U.S. There is also the Dow Jones Industrial Average (DJIA), which tracks the performance of 30 large-cap companies in the U.S.

These indexes, initially created for the active managers, became a useful tool for the pioneers of passive investing. They had a standard measurement they could attain. All they had to do was create funds that mirror a particular index, hence the development of index funds, spearheaded by John Bogle at Vanguard.

Twenty years later, ETFs entered the stage. The first ETF, SPDR S&P 500 index (SPY), was created by State Street Global Insights in 1993. While they had similar features with index funds, ETFs offered more.

First, they offered more liquidity since they are traded like individual stocks on the stock exchanges. While you can only buy index funds at the close of the market, you can buy ETFs throughout the day.

Over time, ETFs have also shown more flexibility and innovation. But more on all that in a bit.

ETFs and the 2008 financial crisis

The 2008 recession saw the collapse of many investment banks in the U.S., which was led by Lehman Brothers.

The recession wiped trillions of dollars off the markets causing panic among investors. Institutions once believed to be unshakeable came down on their knees.

Consequently, many investors began to challenge the actively managed funds that charged high fees, incur high taxes, and yet failed to outperform the market. People began to see that they were taking more risk without a higher return to go with it.

This overexposure to risk wiped out large volumes of investments in the recession. Suddenly, even the average investor saw the folly of active investing, and this made people begin to care more about risk instead of an obsessive fascination with returns alone.

This is when a new trend began. The investment community started to abandon the actively managed funds that delivered less than they promised in favour of index funds and ETFs. They saw that these passively managed funds allowed them to minimize risk as they seek to passively track indexes and benchmarks rather than beat them.

The post-recession attitude confirmed Harry Markowitz’s view that the primary concern of the investor is to minimize risk.

Since then, the growth in ETFs has been astounding. Investors discovered an alternative strategy that would minimize their risk and mitigate losses when market volatility strikes.

Now the ETF industry is worth $8.56 trillion, with 8,893 ETFs being traded on the market.

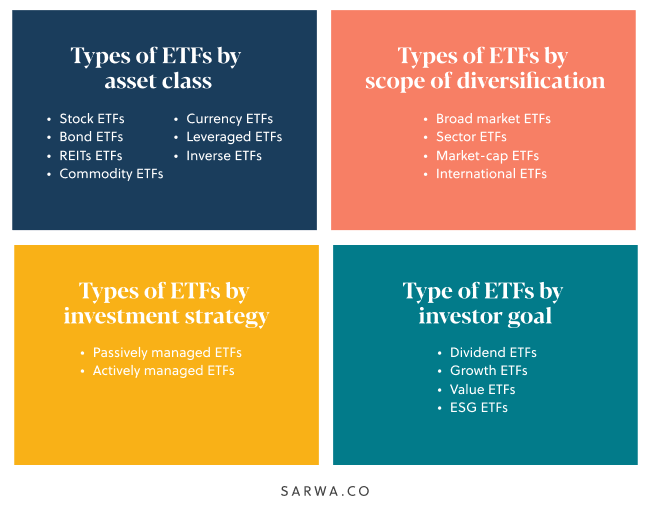

3. Types of ETFs

As ETFs have become more popular, fund managers have been coming up with different types of ETFs to achieve various goals.

The best way to consider the various types of ETFs is to classify them under the below categories.

Types of ETFs by asset class

- Stock ETFs: Stock ETFs are exchange-traded funds that invest in equities. A single stock ETF will consist of tens, hundreds, or thousands of equities that belong to an underlying index. For example, the Vanguard S&P 500 Index ETF (VOO) invests in the equities that make up the S&P 500 Index.

- Bond ETFs: A bond ETF will consist of tens, hundreds, or thousands of bonds that belong to an underlying index. For example, Vanguard Total Bond Market ETF (BND) tracks the performance of the Bloomberg Barclays U.S. Aggregate Float Adjusted Index, which consists of bonds traded in the US.

- REITs ETFs: A REIT ETF consists of a number of REITs that belong to an underlying index. For example, the Vanguard Real Estate ETF (VNQ) tracks the performance of the MSCI US Investable Market Real Estate 25/50 Index.

- Currency ETFs: Currency ETFs arose out of the need to hedge ETF investments in foreign countries against the risk of currency devaluation. Because ETFs seek to achieve broad diversification, many of them invest in countries outside of the US. The drawback is that whatever earnings an investment in a foreign country earns will reduce in value if the currency of the investing country (the USD, in this case) is depreciating relative to the currency where the investment was made.

Suppose an investor invests $100,000 in an ETF that invests in the Japanese market. Because it is a Japanese market, the money will have to be invested in Japanese yen. Suppose at the time of investing one US dollar (USD) was worth ¥150, the $100,000 will be worth ¥15,000,000. Let’s assume further that the investment earned a 10% return after a year. The ¥15,000,000 is now worth ¥16,500,000.

Now, suppose that after a year one USD is now ¥200. The ¥16,500,000 worth of investment is now $82,500. Due to the depreciation of the dollar against the yen, the 10% positive return in the Japanese market has turned to a 17.5% loss when converted to USD.

Currency ETFs help investors hedge against exchange-rate risk. A currency ETF can track a single currency against another currency (for example, the Invesco CurrencyShares Euro Trust, FXE, offers exposure to the euro against the USD) or a number of currencies (for example, the Invesco DB U.S. Dollar Index Bullish ETF, UUP, offers exposure to the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc, against the USD)

Unlike other types of ETFs, currency ETFs use derivatives — currency futures, forwards, or options — to provide a hedge against currency fluctuations.

- Commodity ETFs: Commodity ETFs seek to expose investors to precious metals like gold and natural resources like oil and gas. Some commodity ETFs provide exposure to a single commodity (the SPDR Gold Shares, GLD, for example, focuses on gold) while others offer exposure to an index that contains multiple commodities (for example, iShares S&P GSCI Commodity-Indexed Trust, GSG, tracks the S&P GSCI Total Return Index, which consists of energy commodities, livestock, and metals).

Most commodity ETFs don’t have these commodities in physical storage; rather, they invest in future contracts and other derivatives that are backed by those commodities.

- Leveraged ETFs: Leveraged ETFs allow investors to use debt and derivatives (futures and options) to magnify the change in the price of an investment asset as a way to earn additional returns on investment.

Unlike non-leveraged ETFs that track their underlying securities on a 1:1 basis, leveraged ETFs track their underlying securities on a 2:1 (2X leverage) or 3:1 (3X leverage) basis, etc.

So, if the underlying index (say the S&P 500 Index) grows by 1%, the leveraged ETF will grow by 2% or 3% (depending on the type of leverage used). However, if the underlying index also falls, the presence of leverage amplifies the fall and the amount of money lost.

An example of a leveraged ETF is ProShares UltraPro QQQ (TQQQ) which provides 3X daily long leverage to the NASDAQ-100 index.

- Inverse ETFs: These ETFs use various derivatives to make a profit when an index is on a downward trend. Inverse ETFs are a type of leveraged ETFs that provide a hedge against the underperformance of a market index. The ProShares Short Dow 30 (DOG), for example, provides a hedge against the underperformance of the Dow Jones Industrial Average, an index that tracks 30 blue-chip US stocks. When the DJIA is going down, the DOG is going up.

Types of ETFs by the scope of diversification

- Broad market ETFs: They provide diversification across a particular market. Broad market ETFs are not limited to a particular industry within the market or a particular market cap. Vanguard Total Stock Market Index Fund ETF, VTI, provides a broad diversification as it tracks an index that covers all the stocks listed in the US.

- Sector ETFs: These ETFs focus on a particular industry within the broader market. A sector ETF offers diversification only within a given industry/sector. The Vanguard Information Technology (VGT) offers exposure to the technology sector while the Vanguard Energy ETF (VDE) offers exposure to the energy sector.

- Market-Cap ETFs: They offer exposure to equities that belong to the same market-cap classification — large cap, mid cap, or small cap. For example, Vanguard Small-Cap Growth ETF (VBK), tracks the performance of the CRSP U.S. Small Cap Growth Index. On the other hand, The Vanguard S&P 500 Index ETF, VOO, diversifies across the biggest 500 companies listed in the US. Mid-cap ETFs like Vanguard Mid-cap ETF (VO) diversify only across mid-cap companies.

- International ETFs: These ETFs seek to provide exposure to markets outside the US. Some international ETFs like Vanguard FTSE Developed Markets ETF (VEA) focus on developed markets like Canada, The Pacific Region, Europe, and the Middle East. Others like the Vanguard FTSE Emerging Markets ETF (VWO) focus on emerging markets like China, Brazil, South Africa, and Taiwan. There are also international ETFs for bonds. An example is the Vanguard International Bond Market Index ETF (BNDX), which invests in bonds in both developed and emerging markets.

Types of ETFs by investment strategy

- Passively traded ETFs: Before 2008, all ETFS were passively traded. ETFs were created based on the passive investing philosophy of John Bogle. Bogle probably did not envisage that a day would come where ETFs would have to be classified based on investment strategy. Passively traded ETFs seek to track the performance of the underlying index. They are not actively managed by expert fund managers who try to beat the market or make the fund more profitable during bearish market conditions.

- Actively managed ETFs: Bear Stearns launched the first actively-managed ETF, Current Yield ETF (YYY) in 2008. Currently, there are more than 500 actively-managed ETFs.

With actively-managed funds, fund managers can respond to market conditions and change the composition of the ETF (change the sector allocations, for example) or even diverge from the underlying index.

Types of ETFs by investor goal

- Dividend ETFs: These ETFs comprise of dividend-paying equities. Dividend ETFs focus on investors who want to earn regular income from their investments. For example, Vanguard Dividend Appreciation ETF (VIG) tracks the NASDAQ US Dividend Achievers Select Index, which consists of US stocks that have increased their dividend payout for at least ten consecutive years.

- Growth ETFs: Instead of dividend, these ETFs focus on companies that can grow their share price faster than others through above-average earnings. For example, Vanguard Russell 1000 Growth ETF (VONG) tracks the Russell 1000 Growth Index, which consists of US companies with growth characteristics.

- Value ETFs: These ETFs follow the investment philosophy of Benjamin Graham and Warren Buffett by investing in equities that are undervalued by the market (their market price is lower than their intrinsic value). Such undervalued stocks (provided they have good fundamentals) are then held for a long time as the market price seeks to equal its intrinsic value. The iShares MSCI USA Value Factor ETF (VLUE) is an example of a value ETF. It tracks the performance of the MSCI USA Enhanced Value Index, which consists of undervalued US stocks with good fundamentals.

- ESG ETFs: ESG (environmental, social, and governance) investors seek to contribute to some environmental, social, and corporate governance efforts in addition to their desire to achieve sustainable growth of their investments.

As the interest in ESG investing has grown, many ETFs have entered the market to serve the needs of ESG investors. These ETFs only invest in stocks that satisfy some publicly-available ESG criteria.

For example, the Vanguard FTSE Social Index Fund Admiral Shares (VFTAX), tracks the performance of the FTSE4Good US Select Index, which contains stocks that meet certain ESG criteria.

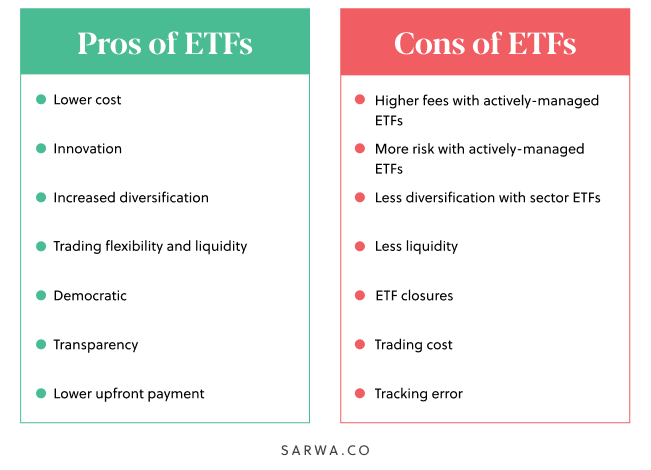

4. Seven benefits of ETFs: Why ETFs became popular

ETFs did not become popular only because active managers were failing. Their rise can be associated with the fund’s inherent ability to offer a low-cost, diversified, flexible and innovative trading option to the average investor, be they novice or professional.

To understand what is an ETF, we must now look at the benefits of this popular fund.

1). Lower cost

Active management means that a portfolio manager must diligently pick specific stocks to invest in, rather than let the investments track a broad, diverse index.

For this reason, mutual funds typically charge more in fees than ETFs (even actively-managed fees), mostly because of the additional costs spent on analysts, economic and industry research, all on top of management.

In the US, the average expense ratio, or administrative and operating expenses, of mutual funds was 0.78% in 2017, whereas it was only 0.21% for equity ETFs, according to the Investment Company Institute.

2). Innovation

Expansion in the variety within the ETF industry has been nothing short of innovative. The first ETF came out in 1993, and now there are more than 6,000 ETFs.

ETFs now offer more niche-specific funds (robotics, technology), international funds (emerging market funds, developed market funds), sustainability funds (ESG; ie, environmental, social, and governance-funds), factor-based funds (high-dividend yield funds, minimum volatility funds), and leveraged and inverse funds (short and bear ETFs).

This innovation is another reason why ETFs are growing faster than index funds.

3). Increased diversification

One of the results of such innovation is increased diversification. Using this unparalleled range of stock market exposure, investors can further diversify their risk by investing across disparate industries (pharma and finance, for example) and markets (developed and emerging). ESG funds can also help reduce the long-term risk of a portfolio.

[For more on the relation between diversification and portfolio risk and how to achieve broad diversification, read, “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why”]

4). Trading flexibility and liquidity

ETFs trade on the stock exchange throughout the day, thus offering investors more trading flexibility and liquidity. You don’t need to wait until the end of the day to buy ETFs.

ETFs are heavily traded throughout the day among many different parties. This makes them quite liquid, which means they can be traded quickly without changing the asset’s price and making it easier to rebalance a portfolio.

A Greenwich report shows that 90% of asset managers prefer bond ETFs to other sources primarily because of the liquidity they offer.

Index funds don’t have such flexibility and liquidity.

5). Democratic access

No one explains this point better than Mark Fitzgerald, Head of Product Specialism at Vanguard. Responding to the question “What finally took ETFs mainstream?” in an interview with Sarwa, he said:

“The beauty of an ETF is it’s democratic.

“If you or I want to buy an ETF product, we pay the same price as a sovereign wealth fund. There’s no other share class. There’s no hidden pricing. The cost is the cost. And so as institutions and professional managers have adopted more and more usage of ETFs, that’s created competition and demand.

“In turn, that’s brought down prices, which has been great for the end investor. This growth and adoption then created a ton of choice and price compression, so we can all benefit from that by buying this product at the same cost.”

6). Transparency

Most ETFs provide a daily report, so you know exactly where your money is invested. Mutual funds are required only to disclose their portfolios every quarter.

This means you can see the securities that constitute your ETF at any point in time.

“The scandals that have rocked the mutual fund world over the years have left the world of ETFs untouched,” said Russell Wild, author of Exchange-Traded Funds for Dummies.

“There’s not a whole lot of manipulation that a fund manager can do when his picks are tied to an index. All in all, ETF investors are much less likely ever to get bamboozled than are investors in active mutual funds.”

7). Lower upfront payment

Mutual funds often require high initial investment minimums.

With ETFs, you can buy as little as one share — which means you don’t need a large balance to get started. You can even buy a fraction of a share of an ETF.

5. The Cons of ETFs

As ETFs continue to multiply, some ETFs, in an attempt to achieve certain investment goals, have moved away from certain principles that make ETFs advantageous. Consequently, not all these cons apply to all ETFs across the board.

- Higher fees with actively-managed ETFs: Because actively-managed ETFs have to make constant investment decisions, they need to spend more money on investment analysts, leading to higher overheads. They will transfer this higher overhead cost to investors through a higher expense ratio.

While passively-managed equity index ETFs charge an expense ratio of 0.18%, their actively managed counterparts charge an average of 0.69%.

- More risk with actively-managed ETFs: Actively-managed ETFs are riskier. Active investing tries to time the market, a risky venture that makes investors lose money.

- Less diversification with sector ETFs: Sector ETFs provide only an industry-specific diversification, which is not broad enough to minimise investors’ risk.

- Less liquidity: With many ETFs coming to the market, investors will start to experience liquidity problems. A liquidity problem occurs when you cannot sell your investment when you want to because there is no demand to match. This is often common with ETFs that have low intra-day trading volume.

- ETF closures: Thirty-three ETFs have closed already in 2021. From 2004-2019, 25% of registered ETFs closed. By October 2020, about 200 ETFs had closed. Thus, it’s important to understand that at the rate at which ETFs enter the market there will also be a tendency for some to fail and close.

When an ETF closes, you will have to sell your investments earlier than planned, which may lead to a big loss if you sell when your position is down.

- Trading cost: If your broker charges commissions, then the cost of buying and selling ETFs can be high, especially if you buy and sell them regularly. This is why we advise that you embrace lump-sum investing rather than dollar-cost averaging or market timing.

[For more on the differences between lump-sum investing, DCA, and market timing, read, “Dollar-Cost Averaging vs Lump-Sum Investing: How Should You Invest?”]

- Bid-ask spread: The difference between the ask price (the price the seller is willing to sell) and the bid price (the price you offer to pay) of an ETF, like stocks, can be high on any trading day. This bid-ask spread is an additional loss and represents the disadvantage of intra-day trading (trading within trading hours), an important feature of ETFs. The more often an investor buys and sells ETFs, the higher the cumulative effect of the bid-ask spread will be, or vice versa.

This is why Sarwa advises that investors focus on long-term investing rather than buying and selling ETFs regularly. With the former, you have nothing to fear from bid-ask spreads while with the latter, bid-ask spreads could add up to a significant loss.

- Tracking error: Sometimes ETFs are unable to match the performance of their underlying index due to certain technical difficulties inherent in the nature of the ETF (apart from the expense ratio they charge). However, tracking errors are directly related to how active an ETF is managed and inversely related to how passive an ETF is managed. Therefore, the more passively managed an ETF is, the less the possibility of tracking errors. This is another reason why actively managed ETFs are not the best.

Given these cons, it’s advisable to buy ETFs that are highly rated, sold by well-established companies (like Vanguard, iShares, Invesco, etc.), and with high intra-day trading volume.

Similarly, to avoid high risk and fees, choose passively traded ETFs and embrace lump-sum (and long-term) investing. Finally, ensure you have a broadly diversified portfolio (sector diversification is not enough) that will minimise your risk and maximise your returns.

6. Examples of the most popular ETFs

The popularity of an ETF is difficult to measure.

While intra-day trading volume is one good measure, it’s possible that investors prefer to hold some ETFs for a long period, which means their trade volume won’t be as high.

What follows is not a list of the best ETFs but the 10 most popular ETFs by trading volume. Moreover, the trading volume only represents the average of the past three months. So, these are only the most popular ETFs in the last three months (at the time of writing).

The most popular ETFs by intra-day trading volume

- ProShares UltraPro Short QQQ (SQQQ): This is a leveraged ETF that provides a 3X daily short leverage on the NASDAQ-100 Index. Its current trading volume is 75,209,734.

- SPDR S&P 500 ETF Trust (SPY): This is an equity ETF that tracks the performance of the S&P 500 Index. Its current trading volume is 65,708,875.

- Financial Select Sector SPDR Fund (XLF): XLF is a sector industry that invests in stocks across the US financial industry. Its current trading volume is 53,941,613.

- Invesco QQQ Trust (QQQ): QQQ tracks the performance of the NASDAQ-100 Index. Its current trading volume is 39,017,805.

- iShares MSCI Emerging Markets ETF (EEM): This is an international ETF that focuses on equities in emerging markets. Its current trading volume is 33,900,910.

- Energy Select Sector SPDR Fund (XLE): This is a sector industry that invests in stocks across the US energy sector. Its current trading volume is 29,391,438.

- ProShares UltraPro QQQ (TQQQ): TQQQ is another leveraged ETF that provides a 3X daily long average on the NASDAQ-100 Index. Its current trading volume is 29,390,766.

- iShares Russell 2000 ETF (IWM): This is an equity ETF that tracks the performance of the Russell 2000 Index, which consists of small-cap equities in the US. Its current trading volume is 27,317,969.

- iShares MSCI Brazil ETF (EWZ): EWZ is an international ETF that invests in equities in the largest and most liquid equities in Brazil. Its current trading volume is 27,182,121.

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX): This is an inverse ETF that provides a hedge against the S&P 500 Index. Its current trading volume is 26,163,146.

Again, the list above represents popularity in the last three months measured by average trading volume.

However, when it comes to pure value, Vanguard ETFs have proven to be top performers.

Vanguard ETFs have an average expense ratio that is 82% lower than the industry average. Also, Vanguard ETFs are building-block funds, meaning investors can create a broadly diversified portfolio with only a number of Vanguard ETFs. Moreover, 90% of Vanguard funds have earned higher returns than their peer-group average.

Finally, Vanguard also has the second-highest Asset Under Management (AUM) in the industry.

So, when it comes to pure value, you should consider these most popular Vanguard ETFs to add to your portfolio.

7. The future of ETFs

ETFs are a disruptive technology that has transformed the investment climate. But ETFs are not done with their story, not even close.

The mainstream adoption of ETFs is one of the crucial fuels propelling the rise of digital financial planners.

A digital financial planner, among other functions, helps investors automate their investments by creating a diversified portfolio of ETFs that reflect their risk tolerance. They also provide the automated rebalancing of portfolios to keep up with the investor’s risk tolerance.

Digital financial planners are also far more low-cost options than the average financial advisor or wealth manager. For example, Sarwa charges between 0.5% and 0.85% on your account balance, which is very low compared to the 2% to 3% financial advisors or wealth managers charge.

[For more about digital financial planners, read, “How can an Online Financial Planner Help Me”]

Mark Fitzgerald at Vanguard also believes that ETFs will be a big part of ESG Investing in the future. And this is already becoming a reality with 50 ESG ETFs now available in the US market.

“I think the market is still trying to work out what that’s going to look like. There’s a lot of regulatory changes; we’ve got the Paris Accord. So I think there will be innovation there because the world has to address climate challenges,” says Fitzgerald.

He also expects us to see more fixed-income (ie, bond) ETFs.

“I think also we’ll see continued growth in the fixed income side because — in the end — the ETF story has been led by equities over the last 20 years.”

The Greenwich report quoted above echoes his sentiment. It shows that 60% of asset managers have increased their investment in bond ETFs, with allocation to bond ETFs now 18% of total fixed-income assets.

8. How to get started investing with ETFs

You now have a clear idea of what is an ETF and how it benefits investors.

ETFs can be bought through your broker like you buy stocks on the stock market.

To do this successfully, however, you will still need to research the thousands of ETFs available in the market and create a broadly diversified portfolio. You will also need to know how to achieve broad diversification with your ETFs choices.

Digital financial planners have taken away the stress of this operation. With a digital financial planner like Sarwa, you’ll receive guidance in determining your risk tolerance to construct a portfolio that matches your unique financial profile.

Sarwa uses the Modern Portfolio Theory to choose passively-managed ETFs that will minimise your risk and maximise your return given your risk appetite.

With Sarwa, it has never been easier to use ETFs to achieve broad diversification for long-term investment goals.

Now that you know what ETFs are, it is time to start building your diversified investment portfolio.

Schedule a free call with a Sarwa Wealth Advisor and we’ll help you get started on your investment journey.

Takeaways

- There are four main features of ETFs: It’s a basket of securities, it cuts across various asset classes, it mostly follows and tracks the performance of an index, and it is traded, like stocks, on the stock exchange market.

- ETFs arose as part of the transition from active investing to passive investing.

- After the 2008-2009 financial crisis, ETFs became popular as more people saw the folly of active investing. There are now different types of ETFs with different appeals to different investors.

- ETFs are low-cost, tax-efficient, democratic, innovative, flexible, liquid, and transparent. They also increase diversification. New ETFs that focus on specific investors may have lost some of these advantages.

- ETFs have been responsible for the growth of robo advisors. We also see more ESG and fixed-income ETFs. These trends will continue.