The passive index fund industry is dominated by a group known as the “Big Three” — Vanguard, BlackRock and State Street.

However, only one can claim pioneer status.

In 1976, Vanguard Group’s founder John “Jack” C. Bogle created the first passively managed index fund, thereby laying the groundwork for the exchange-traded fund (ETF) about 20 years later.

Today, Vanguard has established itself as a stalwart of the passive investing philosophy, counting Warren Buffet as one its staunchest supporters.

“Jack did more for American investors as a whole than any individual I’ve known,” Buffett said last year after Bogle passed away, aged 89.

“A lot of Wall Street is devoted to charging a lot for nothing. He charged nothing to accomplish a huge amount.”

Vanguard’s philosophy is straightforward, but potent: The investment house is focused on providing low-cost, high-quality “building-block” funds, which investors can put together into broadly diversified, balanced portfolios for the long-term.

This approach is in tune with how Sarwa advises our clients. We decided to have a closer look.

A Deep Dive Into Investment: Our Conversation With Vanguard’s Head of Product Specialism

Vanguard’s Mark Fitzgerlad, Head of Product Specialism, spoke with Sarwa to detail the nuts and bolts of the firm’s philosophical origins, the rise of passive investing and the entrance of ETF products into mainstream investor consciousness.

We caught up with him just as he was exiting another conversion about ETFs. Mark was upbeat from the get go, happily explaining that he was in the right “frame of mind” to dive into the subject.

In particular, he spoke of how technology and regulations have had a democratizing effect on the investment world. These events have helped millions (if not more) save and invest for a better future.

“Insider trading was perfectly legal in the fifties, sixties and seventies,” he noted. “Nowadays it’s much more difficult to have that information advantage.”

Afterwards, following the creation of transparent and cost-effective index funds in the form of ETFs, a coup against active investing began.

“Someone who spends $10,000 will pay the same amount as someone who puts $500 million into an ETF,” says Fitzgerald.

“I struggle to think of another financial instrument that is as democratic.”

We had so many questions we wanted to ask Fitzgerald. We finally decided on the main ones that our community wanted us to dive deep into. You can click on any to jump through the interview.

- What are the historical roots of Vanguard’s investment philosophy?

- What is behind the growing popularity of index funds?

- How has technology helped influence the rise of passive investing?

- How did the invention of ETFs in the early 1990s change the investment world?

- How did the 2008 recession influence the adoption of ETFs?

- What finally took ETFs mainstream?

- What outlook shapes the typical Vanguard investor today?

- Finally, what are some important trends that Vanguard is watching now?

[Note: The below interview transcript has been edited for readability. The full podcast is available at the end of the blog.]

Mark, what are the historical roots of Vanguard’s investment philosophy, and what role do ETFs play?

ETFs have grown out of this secular move to indexing; they’re part of an overall shift to indexing and Vanguard has been on the ground floor from the mid-seventies when [Vanguard founder] John C. Bogle first started on this journey.

Index funds were first seen as a bit of an oddity and something that people couldn’t really understand; quite frankly, they didn’t seem exciting enough when compared with the world of active management.

The index world has since grown steadily — slowly at first in the seventies and early eighties, but then over time investors saw the performance track record of these products.

What is behind the growing popularity of index funds?

There’s been a growing awareness that active management — ie; trying to outperform a given benchmark over time after costs — is incredibly difficult.

Active management [e.g.; most mutual funds] has a very high bar because managers have to take enough risk to get back the costs they charge. Meanwhile, the price of indexing is so much lower on average than active management.

How has technology helped influence the rise of passive investment?

Today, we have access to data and information on a level that was unimaginable in the fifties and sixties, when it was a lot simpler to be an active manager.

Now even the regulations have changed. Insider trading was perfectly legal in the fifties, sixties and seventies. Therefore, today [the playing field is leveled because] you know that other investors also don’t have this valuable data on hand.

Regarding technological advancement, the S&P 500 as we know it was developed in the fifties, and then later redeveloped in the seventies. As technology has got better in capturing stock data, we have been able to create better benchmarks with thousands of securities. In the days of pre computerization, it would have been people doing that with pen and paper.

How did the invention of ETFs in the early 1990s change the investment world?

Benchmarks were created to check the performance of active managers. Afterwards, new products have come along that can track benchmarks and enable you to compile a portfolio.

This is where the ETF comes in. Through one trade, an ETF can give you exposure to thousands of securities in an incredibly cost-effective way. This was revolutionary.

Until then, active fund managers were using data and inside information, while the person on the street only had their newspaper to get stock prices and fund prices. Nowadays it’s much more difficult to have that information advantage.

How did the 2008 recession influence the adoption of ETFs?

After 2008, a lot of institutions and investors looked at the performance of their funds and said, “Well, hold on a minute. I’m paying these active managers to protect me in a downturn, as much as provide me alpha in an upturn, and that didn’t happen.”

What happened after the global financial crisis is that a lot of investors looked at their performance and realized it’d be better to shift at least a part of their allocation to cheap market beta investments. This would effectively spread risk across hundreds or thousands of securities.

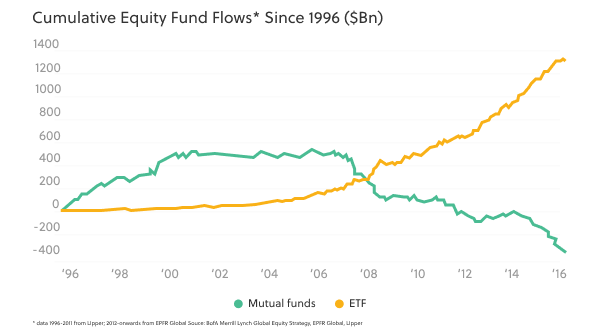

Active managers proved that they’re unable en masse to generate alpha after costs over the long term; it’s still so difficult to time the market and to select securities. Therefore, you saw a huge uptick in flows into indexing, and ETFs were part of that.

[A quick note on ‘investing language’: Alpha means the amount that an investment has returned in comparison to the market index or other broad benchmark. Beta measures the volatility of an investment. It is an indication of its relative risk.]

What finally took ETFs mainstream?

Initially, ETFs were only used by sophisticated investors, institutions and fund managers. But the beauty of an ETF is it’s democratic.

If you or I want to buy an ETF product, we pay the same price as a sovereign wealth fund. There’s no other share class. There’s no hidden pricing. The cost is the cost. And so as institutions and professional managers have adopted more and more usage of ETFs, that’s created competition and demand.

In turn, that’s brought down prices, which has been great for the end investor. This growth and adoption then created a ton of choice and price compression, so we can all benefit from that by buying this product at the same cost.

Someone who spends $10,000 will pay the same amount as someone who puts $500 million into an ETF. I struggle to think of another financial instrument that is as democratic.

What outlook shapes the typical Vanguard investor?

Those that invest with Vanguard are very disciplined. We have investors who are thinking about the long term.

During the recent downturn [resulting from the 2020 pandemic], our investors did not overtrade. They may have opened accounts or increased their allocation when markets were down. But we didn’t see them panic and try to move all their cash out.

[Side note to our Sarwa community: We saw the same results!]

Finally, what are some important trends that Vanguard is watching now?

The idea of robo advisors — which are a more flexible, automated, cost-effective, cost-efficient method of delivering exposures quickly and easily. In that way, ETFs are the perfect components for them.

Furthermore, bear in mind that the majority of assets globally still sit in active strategies and are thus still very costly. We think there’s work to be done on this, to shine a light for the great many investors out there who are not aware of the benefits of ETFs and indexing.

This means that the growth trajectory is really quite large because the bulk of investments still sit in active management.

ESG investing [Environmental, Social, and Governance] is also something that’s coming up all the time. I think the market is still trying to work out what that’s going to look like. There’s a lot of regulatory changes; we’ve got the Paris Accord. So I think there will be innovation there because the world has to address climate challenges.

Finally, I think also we’ll see continued growth in the fixed income side because — in the end — the ETF story has been led by equities over the last 20 years.

Full Interview With Mark Fitzgerald

Sarwa is your online financial advisor. We help you put your money to work in international markets so you can reach your life goals.