Figuring out how to buy US stocks in the UAE is the first step towards profiting from the global wealth that has been (is being and will be) produced by some of the top companies in the world.

The US still has the largest GDP in the world ($20.953 trillion in 2020, according to the official figures from World Bank). Consequently, the US stock market is the biggest in the world and it houses some of the biggest and most prosperous companies, including Amazon, Alphabet (Google), Meta (Facebook), Apple, among others.

Consequently, investors that want to build wealth cannot ignore the US stock market. It is no wonder, then, that nine of the top ten holdings of Berkshire Hattaway, Warren Buffett’s company, are players in various sectors of the US stock market.

In this article, we want to help you build a smart investment portfolio by showing you how to buy US stocks in the UAE, and thus share profits in the largest and most successful companies in the world.

We’ll cover this in two large sections:

- Why should you invest in the US stock market?

- How to buy US stocks in the UAE

At the end of this article, you should have all the information you need to begin your investment journey in the US stock market.

[Looking for a no-minimum balance account to start investing in the US stock market? Sign up to Sarwa Trade, a stock trading app that allows you to easily access US stocks.]

1. Why should you invest in the US stock market?

As said above, the US has the largest GDP in the world. Its GDP of $20.953 trillion is more than $6 trillion higher than that of China, the country with the second-largest GDP.

The prosperity of the US is evident in the relative success, stability, size, and growth of many of the companies that operate there.

For example, five of the fast-growing technology companies in the world – Facebook (now Meta), Amazon, Apple, Netflix, and Google (now Alphabet) – are often grouped together (dubbed the FAANG stocks) and analysed by investors.

Four of these five companies (excluding Netflix) have already surpassed the $1 trillion market cap mark. For context, understand that by 2020 figures, only 16 countries in the world have a GDP greater than $1 trillion.

[For more on the FAANG stocks and why investors love them, read, “What Are FAANG Stocks? A Guide To High Growth Tech Stocks”]

But this is not only a technology thing. Investors have also analysed and identified a certain set of companies that are industry leaders, have a proven track record, are stable, deliver strong returns over the long term, pay dividends, and increase their dividend payout regularly. They call them blue-chip stocks.

Many of these so-called top blue-chip stocks – Disney, Walmart, Coca-cola, P&G, JP Morgan, Berkshire Hathaway, among others – are also operated and listed in the US.

In essence, there is a lot of current and future potential wealth creation in the US stock market.

No other financial market is as large, accessible, transparent, and liquid as the US market, according to Charles Schwabb, a multinational financial services company in the US. “Its transaction volume, market capitalization, and number of listed companies make this market a unique investment opportunity for international investors,” says Schwabb.

Let’s take that one by one:

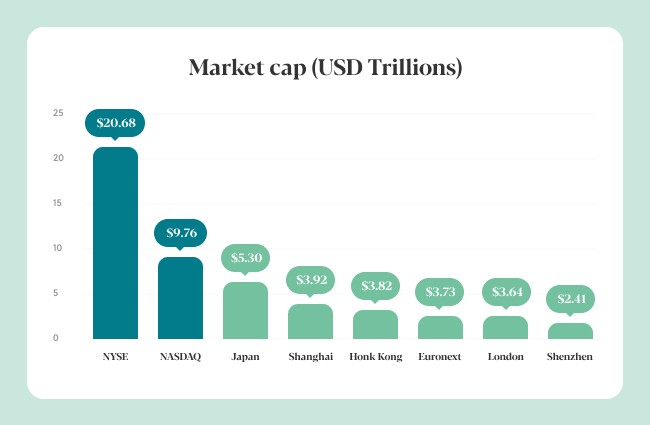

- Market capitalisation: NASDAQ, the second-largest stock exchange in the US is larger than any other stock exchange in the world. When you now add NASDAQ’s market cap with NYSE’s, the gap becomes even wider.

Source: Charles Schwab

This reinforces the fact that the biggest companies are in the US.

[To understand why the stock exchange you buy stocks from is important, read, “What Is A Stock Exchange? Everything You Need To Know”]

- Transaction volume and liquidity. The more transaction volume occurs in a stock exchange, the more liquid it is and the more liquid, the better (and the easier it is to quickly buy and sell).

Again, the US stock market is more liquid than any other top stock exchanges in the world.

Source: Charles Schwab

- Diversification: The US stock market also has the highest number of listed companies which makes it easier to diversify across industries and market cap.

Source: Charles Schwab

[For more on why diversification is important to wealth building, read, “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why.”]

To summarise, the US stock market provides the best opportunity for high returns, diversification, liquidity, and risk minimisation (the more stable the companies, the less your risk exposure).

Given the above, how then can you invest in the US stock market from the UAE?

2. How to buy US stocks in the UAE

As a digital financial advisor, we at Sarwa have always aimed at enabling UAE residents to maximise the returns from their investment by providing them access to the US stock market.

We created Sarwa Trade to give every UAE resident access to the thousands of stocks and ETFs that are available in the US stock market – and you can start without any minimum balance.

How to use Sarwa Trade

Now let’s consider how to invest in US stocks from the UAE through this stock trading app.

The dashboard

After you have signed up for an account, you will gain access to the stock trading dashboard where you can carry out all necessary activities.

That dashboard will look like this:

Let’s consider a few elements on this dashboard.

Summary

The “summary” tab is the homepage of the Sarwa Trade dashboard. Here, you’ll find:

- Your account balance: This is the total amount of money (in USD) that you have in the account, including the ones you have invested in stocks and the one still available as cash.

- Earnings: This is the dollar amount of all the money you have made trading stocks. If you have lost money, the earnings figure will be in the negative. Simply put, it is the difference between what you paid to buy your stocks and the market prices of those stocks. As market prices change, this figure will change.

- Returns: This is your earnings as a percentage of the amount you invested. For example, if you purchased stocks worth $1,000 and they are now worth $1,200, your earnings is $200 while your returns is 20% ($200/$1000 * 100).

- Cash available: This is the amount in your account that you have not yet invested in the stock market.

- Positions: This is a list of all the stocks you have purchased. For each stock listed, you will see how many of it you have, how much you have spent on it, the current price, and your returns on that particular stock.

- Search bar: Here you can search for any stock you want to research or buy.

- Sarwa market bites: These include our daily digest where we bring you daily news that are important to your stock trading decisions and our weekly review where we recap what has happened over the week. Our market bites are designed to help you keep track of what’s happening in the market so you can make better trading decisions.

- Most popular: This is where we bring you some trending stocks that other investors/traders are buying. If you are not sure what to buy, you can start researching what others are buying and consider if they fit with your own strategy.

We don’t just want you to use our app; we want you to use it as a tool for your investing/trading success.

You can also find articles that will help you improve your investing/trading proficiency on the Sarwa Blog. The best introductory article that will get you started is “How To Buy Stocks in The UAE: The Ultimate Guide”, which includes four important that every new investor should consider before buying stocks.

For those with a stronger grasp of the stock market, we recommend you read “How to Make Money Trading Stocks: The Ultimate Guide,” which breaks down the tools and methods that traders use to profit in the stock market.

Performance

The performance tab is where you get more information on how your stocks have performed. It is a comprehensive breakdown of the earnings and returns figure on the summary tab.

Watchlist

A watchlist is a list of stocks that you have purchased or are considering to purchase upon further research.

To include a stock to your watchlist, just search for it on the “watchlist” tab and add it. Once you are ready to purchase any stock from your watchlist, you can go straight to watchlist and create a buy order.

[For more on how to use a watchlist, read, “What is a watchlist”]

Transaction

The transaction tab is where you can view all the buy and sell orders you have created. There you will find the status of each transaction – whether completed, pending, or failed.

Visit our FAQ page to learn more about how Sarwa Trade works.

How to create buy orders from the Sarwa Trade App

In learning how to invest in US stocks from Dubai, you must get a good grasp of how to create buy orders on the app.

Below are the simple steps to take:

-

Choose the type of buy order

Once you have selected a stock to buy (by searching for it through the summary tab or the watchlist tab), you will see the various buy orders that you can create.

- Market order: This is an order to buy the stock at whatever price it is trading at the time you create the order.

You can create a market order by specifying the number of shares you want to buy (0.1? 1? 2?).

Alternatively, you can specify the amount of dollars you want to use to buy a percentage of a stock. This is called fractional investing – and it allows you to buy pieces of US stocks from the UAE without committing to the value of an entire share.

- Conditional order: A conditional order can be a limit order or a stop order. With the former, you will set a maximum price beyond which you are not willing to buy a stock. That is, you are willing to buy the stock for that price or less. For example, if the price of TSLA is $611.34, you can set a limit order for $600. Whenever the price is $600 or less, your order will go through.

For stop order, the price you set is a fixed price (rather than a maximum amount). Whenever the market price hits the stop price you have set, the order is converted to a market order and it is completed.

2. Confirm and place your order

Once you have filled in your market or conditional order, the app will allow you to review your order before placing it. This is to give you a chance to ensure there are no errors in your order.

3. Confirmation page

Once you have reviewed and placed your order, you can follow it up on the transactions tab. When an order has been completed (executed), you’ll receive a confirmation to that respect.

Why choose Sarwa Trade

As a digital financial advisor that has spent time listening to real people in the UAE market, we have created Sarwa Trade to meet the specific demands of local investors and provide them with the best value possible. How so?

- No minimum investment requirement: Sarwa Trade aims to cater for all investors, regardless of their level of income. This is why we don’t require you to have a minimum amount in your account before you can begin trading. Is it $1,000 you can start with or is it $10,000? You are welcome to start.

- Zero transfer fees for local accounts: Since we are primarily committed to helping you invest in US stocks from the UAE, we don’t charge any commission when you transfer money from your local AED account into Sarwa Trade. This means you don’t have to pay for foreign exchanges to get your own dollars before you can start trading US stocks or ETFs.

- Fractional trading: We realise that some of these US stocks and ETFs can be very expensive and many of you may not have the funds to buy one share at once (for example, Amazon’s stock costs $2,720 per share at the time of writing).

Well, we believe that should not stop you from enjoying the benefits in the US stock market. That’s why we allow you to buy just a fraction of a share. Don’t have $2,720 to buy a share of AMZN? You can buy 0.1 shares for $272.

- SSL encryption: In a world where cyber hacks are common, we have put in place bank-level SSL security to secure the platform and keep all your data safe.

- Simple sign-up: We don’t encumber you with page after page of onboarding. You can simply sign up in a few minutes and start trading as soon as possible.

- Mobile-first experience: Everything you will ever need to buy and sell US stocks or ETFs is available on the Sarwa Trade mobile app. It has been well-designed to make it easy for you to navigate and use.

Learning how to buy US stocks in the UAE need not be a herculean task. With Sarwa Trade, you can cheaply (zero transfer fee), easily (mobile-first experience), quickly (few minutes sign up), and profitably (news and educational guides) invest in US stocks from the UAE.

To get started, sign up for a no-minimum balance account and let the trading begin.

Do you still have any questions? Get in touch with us and we’ll do our best to help you get started.

Takeaways

- The US stock market offers opportunities for investors in the UAE to invest in the most successful companies in the world.

- The US stock market is the largest (market cap), most liquid, and most diversified market in the world.

- UAE investors who want to earn high returns and enjoy the benefit of diversification and high liquidity must gain access to US stocks.

- With Sarwa Trade, you can invest in US stocks from the UAE easily, cheaply, quickly, and profitably.