Though budgeting is the foundation of sound financial planning, many people find it difficult to create or stick to one. The 50/30/20 rule is a simple budgeting system that seeks to take away the complications and difficulty traditionally associated with budgeting.

By dividing your income into three simple buckets with a defined allocation formula, the 50/30/20 rule allows you to create a simple monthly budget that you can rinse and repeat for years to come.

With such a simple budget at hand, you can easily take control of your financial life, avoid overspending your income, and commit enough resources to accomplishing your financial goals.

If you have been constantly frustrated by the hundreds of budgeting apps and spreadsheets all over the internet, the 50/30/20 rule can be a big relief that will give you the “at last” feeling.

In this article, we’ll consider:

- What is the 50/30/20 rule?

- How can you apply the 50/30/20 rule?

- What are the practical benefits of the 50/30/20 rule?

- How do you make the 50/30/20 rule work for you?

At the end of this article, you will be ready to kickstart your financial planning with a simple, popular, and effective budgeting system.

You can also take a look at this helpful video on budgeting with the 50/30/20 rule, which is full with lots of helpful tips and explanations.

1. What is the 50/30/20 rule?

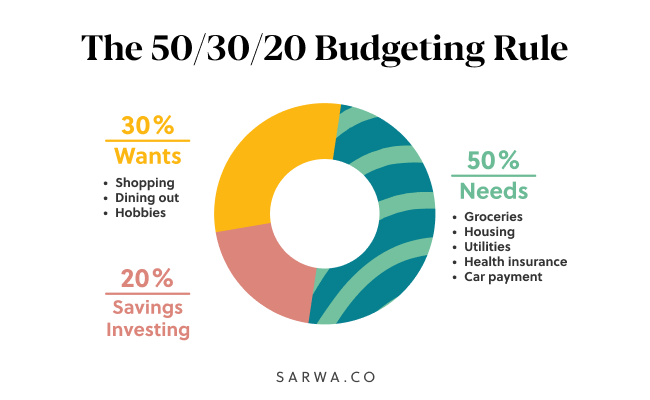

The 50/30/20 is a simple budgeting system where you spend 50% of your income on your needs, 30% on your wants, and 20% on savings and/or investments.

It was popularised by Elizabeth Warren, then an Harvard law professor (and now a US senator), and her daughter, Amelia Warren Tyagi, in the book All Your Worth: The Ultimate Lifetime Money Plan. The rule was designed as a way for working-class families to gain control over their finances and build wealth for the future.

Since the publishing of the book in 2005, the 50/30/20 rule has entered into popular consciousness, becoming the go-to budgeting system thanks to its simplicity and effectiveness.

Needs

In this system, your needs are your basic necessities and they take the largest portion of your income (50%). These are expenses that you cannot do without and they include:

- Rent or mortgage payment

- Utilities

- Groceries

- Transportation

- Insurance payments, etc.

Wants

Wants are other non-essential expenses. Unlike needs, these are things you can do without. They include:

- Eating out

- Vacation/holidays

- Travel

- Entertainment, etc.

Savings/Investments

After budgeting 50% and 30% to your needs and wants respectively, the remaining 20% of your income are for your savings and/or investments. This can go towards:

- An emergency fund

- Down Payment on a mortgage

- Debt repayments

- Savings accounts

- Stocks

- Bonds

- ETFs

- Bitcoin, etc.

[For more on the best way to use your 20% monthly savings, read, “How Much Percentage of Savings Should You Invest”]

To illustrate this budgeting system, consider Mr. A, with a monthly income of $5,000. With the 50/30/20 rule, he will spend $2,500 (50% of $5,000) on his needs, $1,500 (30% of $5,000) on his wants, and $1,000 on savings and investments.

2. How can you implement the 50/30/20 rule?

Having understood what the 50/30/20 rule is all about, let’s move from the abstract to the practical.

How can YOU implement the 50/30/20 rule?

Budgeting might not be fun for many people but “one of the first duties which a man owes to his friends and to society is to live within his income,” according to Thomas Hughes, a former British parliamentarian.

So, how can you use the 50/30/20 rule to live within your income?

There are two ways to do this: the bottom-up approach and the top-down approach.

The bottom-up approach

If you are already used to a particular lifestyle, the bottom-up approach may be more appropriate. Here, the first step is to identify the needs and wants you typically spend money on every month.

After that, you will determine what percentage of your income is your current needs and wants. For example, if your income is $5,000 and you typically spend $2,500 on needs and $2,400 on wants, then your needs are 50% of your income while your wants are 48% of your income (leaving only 2% for your savings/investments).

The next step is to adjust your current spending to fit with your budget (that’s the 50/30/20 rule!). In the above instance, this will mean reducing your wants (cancelling some entertainment subscriptions, for example) from 48% of income to 30% of income so you can increase your savings/investments from 2% of income to 20% of income.

The top-down approach

However, if you are willing to start from scratch, the top-down approach will be more appropriate.

Here, the first step is to identify your monthly income. After that, you will divide your income into needs (50%), wants (30%), and savings/investments (20%). By now, you will have a figure that you should be spending on needs, wants, and savings/investments.

The next step is to decide on what exactly will be the components of each category. For example, if you are budgeting $2,500 for your needs, you need to identify all your monthly needs and allocate the $2,500 amongst them. You’ll repeat the process for your wants.

Your goal, then, is to ensure that you don’t spend beyond what you have allocated for each category.

Fitting the 50/30/20 rule with your financial goals

While the 50/30/20 rule is universal in its application and effectiveness, the nature of your financial goals may require you to tweak it a bit.

A good way to illustrate this is to consider the FIRE (financial independence retire early) movement.

Simply put, the FIRE movement encourages people to attain early financial independence and/or retirement. In some cases, this requires adherents to save 60-80% of their income, what has been called “extreme savings”. Consequently, people like that have to budget 20-40% of income on needs and wants.

[For more on the FIRE movement, read our interview with Jacob Fisker, one of its early pioneers.]

Even if you are not part of the FIRE movement, achieving your financial goals may require more than 20% savings/investments. The simplicity of the 50/30/20 rule makes it easy for you to tweak the number to what you need to achieve your financial goals.

[If you are looking for how to reduce your expenses and increase your savings in the UAE, read, “12 Hacks for How to Save Money in Dubai Like A Resident”]

Also, your circumstances might require spending more on needs (say 60%) and less on wants (say 20%) or vice versa (say 40% on needs and 40% on wants). The most important thing is to keep your financial goals in mind and see how you can tweak the rule to give you the maximum possibility of achieving those goals.

3. What are the practical benefits of the 50/30/20 rule?

The first benefit of the 50/30/20 rule is that it helps you foster a savings habit. And when it comes to building wealth, consistency is important.

Because of the compound interest advantage, $1,000 invested every month is more valuable than $12,000 invested at the end of the year. Each of the $1,000 invested every month would have earned interest and that interest would have earned additional interest.

In other words, it’s better to start investing as soon as you have the extra capital saved up. This is called lump-sum investing, not to be confused with dollar-cost averaging, which is taking all your available capital and breaking it down to slowly enter the market.

Secondly, as discussed above, the 50/30/20 rule is flexible. Its simplicity allows you to tweak it to fit your specific financial situation.

Finally, it helps you gain mastery of your finances, which is the first step towards financial stability and prosperity. By knowing and controlling where each dollar of your income is going, you can easily plan for your financial future.

4. How do you make the 50/30/20 rule work for you?

Creating a budget is the easier part, the real task is sticking to it. What is the 50/30/20 rule without the discipline to make it work?

If you are constantly spending more than 50% and 30% of your income on needs and wants, respectively, you won’t be able to achieve your financial goals nor gain a foothold on your financial future.

The first step towards sticking to your budget is to change your perspective on budgeting. Instead of seeing it as an enemy of freedom (something that inhibits you), see it as an enabler of financial freedom.

First, budgeting frees you from addiction and tyranny to consumerism; it helps you do away with things that are not important and gives you the self-control and self-mastery needed for delayed gratification.

Second, budgeting frees you from addiction to the here and now by helping you develop the discipline to save for the future YOU. “A budget doesn’t limit your freedom; it gives you freedom,” said Rachel Cruze, financial advisor at Ramsey Solutions.

After a change of mindset, you need to take practical steps towards sticking to your budget.

One hack that has been effective for many is to make a continuous or mid-month tab of your spending so you can know how far you have gone.

Let’s see how this works.

If your budget for grocery spendings is $1,000 for the month, keeping a record anytime you spend money on groceries can help you identify when you are on the brink of going overboard. With this, you will know when you have spent 30%, 50%, 70% (or any %) of your groceries budget and when you need to soft pedal to avoid exceeding your budget. You can do this for every need or want.

Take eating out as another example. If your record shows that you have spent 100% of your allocation for the month, then you know you can’t afford another dinner outside. Without the record (and the knowledge that you are at 100%), you might continue to eat out until you are way over the budget.

A similar hack, provided you are not afraid of carrying cash for security reasons, is to withdraw the cash for your needs and wants and put each allocation in a separate envelope ($1,000 in the groceries envelope, $200 in the eating out envelope, for example). In this way, you won’t be able to spend money meant for your savings/investments unknowingly.

However, a much better hack is to save and/or invest before spending.

George Clason, author of The Richest Man in Babylon, popularised this idea with the dictum “pay yourself first.” By saving first, you are forced to develop the self-control needed to stay within your budget.

At Sarwa, we also encourage this habit by giving you the option of automating your investments every month.

[To learn how to use your monthly budget to create a monthly investment plan, read, “How To Create (And Stick To) A Monthly Investment Plan in the UAE”]

Now that you know how to create a budget with the 50/30/20 rule, it is time to create one for yourself.

If you are still unsure how to fit your financial goals into your budget, schedule a free call with a Sarwa wealth advisor and we’ll answer all your questions.

Takeaways

- The 50/30/20 rule is a simple, easy to use, and effective budgeting system that removes the complications associated with budgeting.

- In this system, 50% of your income goes to your needs, 30% to wants, and 20% to savings/investments.

- The 50/30/20 rule is flexible and can be adapted to fit with your financial goals.

- Recording your expenses, spending cash for your needs and wants, and automating your investments are three ways to stick to your 50/30/20 budget.

- The 50/30/20 will help you build wealth through consistent savings and gain control over your finances.