“Cash is trash,” or so often says Ray Dalio, the head of the world’s largest hedge fund, and with good cause. The logic here is simple: Keeping your money in a savings account is a poor decision because you’ll end up losing out to inflation and receive dramatically lower returns compared to investing.

The solution is to start learning to invest your savings in the market as soon as possible, and this is where one of the biggest questions that we hear new investors ask comes up: “how much percentage of savings should I invest?”

To accurately answer this question, you’ll need to formulate a financial plan that addresses a variety of personal factors, including an emergency fund and your capacity for risk.

Traditionally, investors are torn between these two desires: protecting their money (that is, avoiding losing it) and growing it.

We see this grand desire play out in no better way than with Warren Buffett’s famous Golden Rule: the first rule of investing is to avoid losing your money, and the second rule is to remember the first one.

We get it: Navigating between protecting our money (the main reason some people gravitate towards savings) and growing it in stock investments can look difficult.

However, in this article, we’ll provide you with all the information you need to successfully understand how much percentage of your savings you should invest.

We’ll consider:

- Determining how much to save

- Creating an emergency fund

- Differentiating between saving and investing

- Understanding your risk capacity and tolerance

- Determining how much of your savings you should invest

- Reducing risk with diversification

At the end, you’ll have the clarity you need to make wise investment choices and understand why Robert Allen, author of Cracking the Millionaire Code, asked this pertinent question: “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.”

1. Determining how much to save

Before answering the “how much percentage of savings should I invest” question, some preliminary points must be addressed.

First, you must have savings before you can decide how much of it to invest. To have consistent savings – the type that you need to build wealth – you need to have a monthly budget.

A budget helps you identify all your income sources so you can plan beforehand how much of that income you want to spend on what. Money can easily grow wings and fly in all directions; budgeting helps you to control where you want your money to fly to.

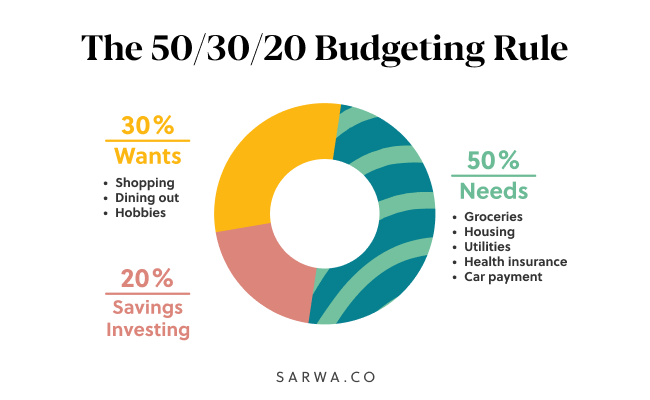

One basic budgeting system we have found useful is the 50:30:20 rule developed by Elizabeth Warren, a US senator. In this system, 50% of your income goes to basic needs or necessities (food, rent, utilities, transportation, etc.), 30% goes to wants (eating out, travel, entertainment, gifts, etc.), and 20% to savings.

This system is not meant to be concrete, but rather just a guideline, as your income and expenses may privilege you to save more than 20% of your income. Also, the nature of your financial goals may demand that you save more than 20%, as well.

The point of the system is to have a specific savings target (20% in this case) that you stick to every month. “I am saving 30% of my income every month” is a SMARTer goal than “I want to save money and become rich.” So, start with a budget and determine what portion of your monthly income you want to (or need to) save every month to achieve your financial goals.

[For more on how to create a budget and a monthly investment plan, read, “How To Create (And Stick To) A Monthly Investment Plan in the UAE”]

2. Creating an emergency fund

Second, before deciding how much of your savings to invest, ensure you have an emergency fund.

Dave Ramsey, a financial advisor, best summarises what an emergency fund is all about: “Your emergency fund is not an investment, it’s insurance with one purpose – to protect you and your family.”

Many people are one financial emergency away from going into debt or liquidating whatever investments they have. Infact, in the US, the most prosperous country in the world by GDP, 40% of the people are one financial emergency away from poverty, according to a report by Prosperity Now, an NGO advocating economic opportunity and justice.

To prevent such catastrophe, financial advisors suggest that everyone should build an emergency fund they can tap into when such emergencies (such as medical expenses not covered by insurance, car repairs, unplanned travels, temporary job loss, etc.) arise.

The rule of thumb is that you should keep between three months and six months’ worth of your living expenses (which can be basic necessities for some and basic necessities plus wants for others) in such a fund.

As Ramsey said, this fund is not an investment. It should be kept in a savings or money market account you can quickly access without any withdrawal charges. On the other hand, remember that the fund is for emergencies and not some extra leisure or luxury. You should not spend a dime from it if emergencies don’t arise. Stick to your budget!

[For more on how to create an emergency fund, read, “How To Start An Emergency Fund That Is Right For You: Smart Planning To Mitigate Financial Troubles”]

3. Differentiating between saving and investing

Once you have created a budget and set up an emergency fund, you can now determine how much of your savings you should invest.

Before that, some quick words on the way we differentiate saving from investing.

Saving is keeping your money in a savings account or money market account with a bank where they earn a small amount of interest (the best interest rate on a UAE savings account is 1.75%) but have low or zero risk (in countries where customer deposits and savings accounts are insured, risk is basically zero).

For investing, investors are willing to take on more risk to earn greater returns. However, we also want to distinguish between saving-like investments and high-return, high-risk (HRHR) investments. The former are fixed-income securities like treasury bills, bonds, and CDs (certificate of deposits) that also offer low returns (though higher than savings accounts) and low risk (risk comparable to that of savings accounts).

Assets like stocks, REITs (real estate investment trusts), and cryptocurrencies are riskier but they tend to yield higher returns for investors. For example, while the S&P 500 Index (an index of the 500 largest US stocks) has grown by 109% in the last five years, the yield on the US Treasury 5-Year bond is 1.24%. Corporate bonds, which are riskier than government bonds, returned 7.8% between November 10, 2020 to November 10, 2021 (through the S&P Corporate High Yield Bonds Index), while the S&P 500 Index returned 33% in the same period.

When answering the common “how much percentage of savings should I invest” question, we’ll keep these three distinctions in mind: savings, saving-like investments, and HRHR investments.

4. Understanding your risk capacity and tolerance

What will determine how much of your savings you should invest (in saving-like investments and high-return, high-risk investments) is your risk capacity and tolerance.

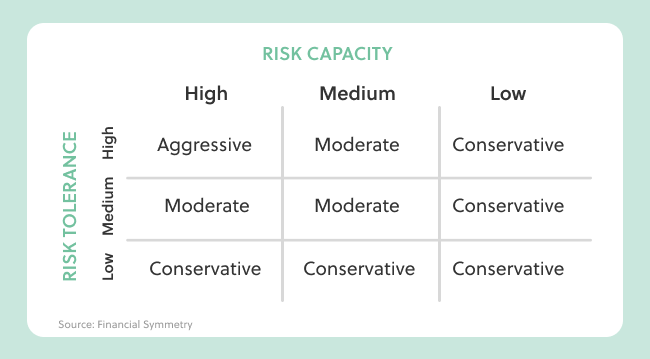

Risk capacity is how much risk you can take up based on your time horizon (roughly defined as how close you are to retirement), income requirements, among others while risk tolerance is how much risk you want to take on based on your risk appetite.

A 20-year old professional has high risk capacity while a 50-year old, who will retire soon has low risk capacity. Similarly, a 20-year professional in a job with high job security has greater risk capacity than his peer in a low-security job.

Normally, people with high risk capacity should have high risk tolerance. However, risk appetites differ and people who can take up much risk can also decide to take on less. Conversely, some people with low risk capacity can also have more appetite for risk (that is, more risk tolerance).

The combination of risk tolerance and risk capacity levels leads to three types of investors: conservative, moderate, and aggressive (growth) investors.

A conservative investor is someone who has low risk capacity. Even if he/she has high risk tolerance, prudence might force his/her hands to be conservative.

However, people with a medium level of risk capacity are moderate investors though some of them have low risk tolerance and prefer to stay with the conservatives. Some with high risk capacity are aggressive/growth investors because they also have high risk appetite while some with low risk tolerance will be conservative and others with medium risk tolerance will be moderate investors.

Look at the chart above and identify the type of investor you are based on your risk capacity and tolerance.

5. Determining how much of your savings you should invest

We have now come to the crux of our discussion.

So, how much of your savings should you invest? First, we must reiterate that after setting up your emergency fund, you should be investing at least 20% of your monthly income (based on the 50:30:20 budgeting system).

Of course, you can do more than 20% if you are able.

However, where you will place that 20% of your income (in savings accounts, in saving-like investments, or in HRHR investments) will greatly depend on the type of investor you are based on your risk capacity and tolerance.

Conservative investors

Conservative investors are those with low or medium risk capacity and low risk tolerance, or high risk capacity but low risk tolerance.

If you are a conservative investor (with an emergency fund already, of course), the following is a good investment structure:

- Saving: 0%

- Saving-like investments: 60-70%

- HRHR investments: 30-40%

Why do we have 0% for saving? If you already have a fully funded emergency fund, you don’t need extra money in savings or money market accounts. You can earn higher interest (with comparable risk) in saving-like investments like government and corporate bonds.

Moderate investors

Moderate investors are also called balanced investors. These investors have medium risk capacity with high or low risk tolerance, or high risk capacity with medium risk tolerance.

If you are a moderate investor (with an emergency fund already), the following is a good investment structure:

- Saving: 0%

- Saving-like investments: 40-50%

- High-risk, high-return investments: 50-60%

Growth investors

Growth or aggressive investors have high risk capacity and high risk tolerance.

If you are a growth investor (with an emergency fund already), the following is a good investment structure:

- Saving: 0%

- Saving-like investments: 0-30%

- High-risk, high-return investments: 70-100%

As is evident from the above, two people can be the same type of investor and still have different portfolios: one growth investor can have a 70:30 allocation while another has a 90:10 allocation.

Therefore, in addition to identifying what type of investor you are and what is typical for people like you, you need to talk with a financial advisor to decide on the specifics: Is it 70% or 90% in HRHR investments.

A digital financial advisor like Sarwa will identify the type of investor you are and then use the Nobel-prize-winning Modern Portfolio Theory to construct an efficient portfolio that will help you achieve your financial goals.

[For more on how to build an investment portfolio from scratch, read, “Building an Investment Portfolio from Scratch: The Ultimate Guide”]

6. Reducing risk with diversification

Now we are back to the dilemma we opened with: how to ensure you are getting high returns while also protecting your money.

As we have seen, HRHR investments tend to provide those high returns but they also come with higher risk that can discourage some people.

However, while holding some saving-like investments can help reduce overall risk, there is also a way to reduce the risk of these HRHR investments themselves.

It’s called diversification.

Within high-risk and high-return assets, you can diversify your investments by asset class (stocks, REITs, some crypto [Sarwa allows you to also include up to 5% of crypto if you so desire]), by market cap (low-cap, mid-cap, large-cap stocks), market (developed markets, emerging markets, US markets, international markets), and industry (tech, energy, basic materials, etc.).

By putting your money in assets that are not positively correlated (they don’t move in the same way), a fall in the value of one asset will not cause the other to fall. Instead, the other asset will either retain its value or rise. Consequently, the overall risk of your portfolio will be reduced.

Buying ETFs (exchange-traded funds) instead of individual stocks or REITs is one great way to achieve a broad level of diversification (and further risk risk). A single ETF already has some level of diversification (for example, VOO, an S&P 500 index ETF by The Vanguard Group, is already diversified by industry while VTI, a total stock market ETF by the same company, is already diversified by industry and market cap). When you add many already-diversified ETFs into a portfolio, the overall risk is very low.

[For more on ETFs, read, “Why Invest in ETFs? Explaining the Popularity of The Go-To Fund.” And for more on diversification, read, “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why.”]

This is why Sarwa uses ETFs to construct their efficient portfolios. In a diversified portfolio of ETFs, your risk is minimised and your return is maximised.

Schedule a free call with a Sarwa Wealth Advisor to set up your own portfolio of ETFs that aligns with your financial goals, risk tolerance, and risk capacity.

Takeaways

- To build wealth, you need to create a budget so you can save consistently.

- Before investing your money, ensure you have an emergency fund.

- Once you have an emergency fund, you can invest in saving-like investments like bonds and CDs and high-risk and high-return assets like stocks, REITs, and cryptocurrencies.

- Your risk tolerance and capacity will determine how much percentage of your savings you should invest.

- Use diversification to reduce the risk of your investment in high-risk and high-return investments.