Learning how to start an emergency fund helps prepare you to overcome unexpected events that could otherwise threaten your financial health.

The COVID-19 pandemic was a powerful reminder that there are larger forces in life that remain outside of our control. Without warning, emergencies can and do happen and put a strain on our finances.

However, wise financial planning, of which an emergency fund is a key part, can help you mitigate the negative impacts of these crises.

This is why it’s so important to start building an emergency fund as soon as possible, and why so many people are now following this sage advice.

In the UAE, residents have increasingly started to get on top of their savings.

According to a 2019 study from the National Bonds Savings Index, more UAE residents have started saving earlier in life. The pandemic also accelerated this trend as data from the UAE Central Bank showed.

Responding to this trend, Carol Glynn, founder of Conscious Finance Coaching, acknowledged that people are increasingly “looking to their savings to build a safety net.”

This is a welcome development that should be embraced by everyone.

In this article, we’ll explain everything you need to know about how to start an emergency fund, including how much money each individual should budget for it.

We’ll cover:

- What is an emergency fund?

- Advantages of an emergency fund

- How to start an emergency fund: A 4-step process

- The role of emergency funds in your overall financial plan

[Do you want to invest your money in a way that ensures that emergencies don’t disrupt your investment plan? Schedule a call with a Sarwa wealth advisor and we’ll help you create and execute your investment plan in a way that caters to your unique risk profile.]

1. What is an emergency fund?

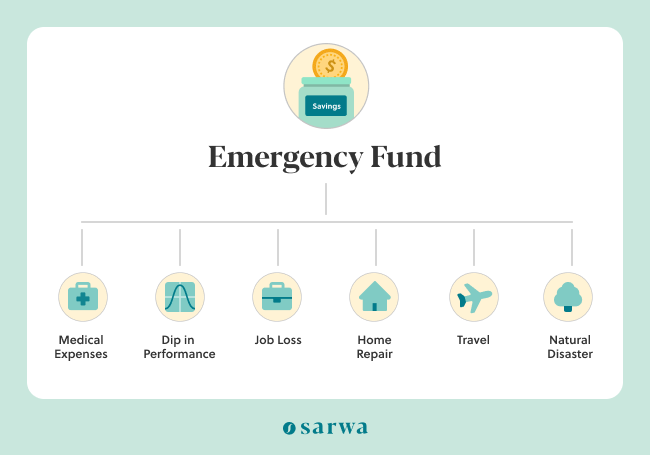

Simply put, an emergency fund is money that you set aside for unplanned and unexpected expenses.

According to Vanguard, an emergency fund is “a stash of money set aside to cover the financial surprises life throws your way. These unexpected events can be stressful and costly.”

These emergencies could include:

- Unplanned medical expenses

- Job loss

- Unexpected repairs

- Natural disasters

- An unexpected dip in business performance

- Unexpected travels

Any of these (usually unforeseen) life events could require a substantial outlay of cash outside of your monthly budget.

An emergency fund is designed to meet these unexpected expenses and avoid a possible financial disaster.

It helps to think of an emergency fund as a self-funded insurance policy.

Typically, a good emergency fund typically has these three features:

- It is accessible: An emergency fund should be liquid (easily convertible to cash). It must also be a source that is easy for you to get your hands on when emergencies arise. Later on, when we look at how to start an emergency fund, we’ll consider liquid sources that are appropriate for emergency funds.

- It is only designed for emergencies: An emergency fund has a single purpose — cater for emergencies. You should not use the cash for anything else. Hear it from Suze Orman, a veteran financial advisor, TV personality and founder of the Suze Orman Financial Group: “Never invest emergency savings in the stock market.” Not only the stock market. Never put your emergency funds where its value will reduce at any time you need it.

- It is readily replenishable: Once you have exhausted the cash on an emergency, you need to replenish it in preparation for another emergency. Emergencies are by nature unpredictable, so an effective emergency fund must be maintained.

Do I need an emergency fund?

Who exactly needs an emergency fund?

The simple answer is that everyone who does not have absolute control over how life events impact their financial circumstances should learn how to start an emergency fund.

In truth, even wealthy people should build an emergency fund. This is simply because life is unpredictable:

- Job losses do occur

- Unexpected travel can arise

- Natural disasters happen

- Major medical emergencies can become reality, etc.

If you have ever faced any of the above circumstances, it’d be wise to build an emergency fund.

Why so? At the practical level, an emergency fund will “get you out of a potential jam” and at the psychological or emotional level, “it will ease your anxiety,” according to Jean Chatzy, a personal finance coach and columnist.

2. Advantages of an emergency fund

How will an emergency fund benefit your finances? To understand these benefits, you need to compare it with the other (unideal) alternatives for funding emergencies — debt purchasing and liquidating investments.

Below are three clear advantages of emergency funds:

It prevents the accumulation of debt

In the absence of an emergency fund, you may need to borrow money from a bank or credit union to cover emergency expenses.

What’s the problem with that?

High interest rates.

When you borrow money from a bank or credit union, you will pay back with interest (which can be high, depending on the circumstances). Nathan Morris, author of The Art of Getting Money, is right when he says, “every time you borrow money, you’re robbing your future self.”

An emergency fund provides you with an alternative (and better) solution. You can solve your emergencies with your money – no interest, no accumulated debt, no threatened relationships.

It protects your investments

An emergency fund is an essential part of a long-term investment strategy.

Without an emergency fund, you may be tempted to liquidate your investments (sell your stocks, bonds, mutual funds, or ETFs) to cater to emergencies.

The disadvantage is that the market might be on an upward trend when you sell. After the emergency, you might have to buy the stock/bond/ETF/mutual fund back at a higher cost, which reduces your potential returns.

Also, buying and selling stocks regularly increases the fees and commissions you pay to stockbrokers, further reducing your returns.

To protect your investments, you must avoid liquidating them because of emergencies.

If you are a passive investor (as long-term investors are advised to be), it is even more critical that you avoid liquidating your investments. Building wealth requires you to invest for the long term — not become a hostage to the whim of sudden, short-term events.

Here is one of our favorite Warren Buffet quotes on this issue: “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

True wealth accumulation is a long-term strategy. By starting an emergency fund, you can protect your long-term plan and avoid liquidating any investments because of emergencies.

It helps avoid financial disasters

People without a plan to deal with emergencies are more likely to succumb to financial disasters. And a growing debt profile is only one of the potential pitfalls.

Emergencies also can result in emotional problems – grief, sadness, depression. This occurs when you don’t have a prepared way to deal with crises (or the only available methods are also burdensome).

An emergency fund helps provide you financial stability and confidence to deal with unforeseen events and forestall and/or mitigate financial disasters (and the emotional baggage that accompany them).

3. How to start an emergency fund: A 4-step process

So, how can you start an emergency fund?

In truth, everyone wants to avoid debts, financial disasters, and the forced liquidation of their investments.

Here, we have outlined four essential steps to help get you on track.

Let’s look at them in turn.

A. Create your budget using the 50/30/20 rule

Budgeting is the heart and soul of a secure financial life. This is where it all begins.

But why do you need a budget?

Before you can save for an emergency fund, you need to keep a tab on your income and monthly expenses.

“A budget helps to instruct where your money will go, instead of wondering where it went” says John C. Maxwell, a best selling author and speaker.

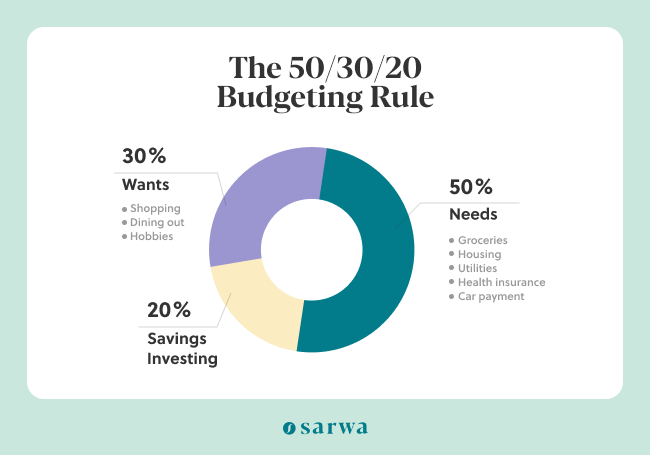

One of the most common budgeting systems is the 50/30/20 rule. According to this rule, you should spend 50% of your income on your needs, 30% on your wants and 20% on savings/investments. Let’s consider each of these elements.

Income

The first step is to identify all your income sources.

If you are a salary earner, how much is your monthly income? If you operate a small business, what is your average monthly profit? If you are a freelancer, what is your average monthly income?

Your income sources can also include interest and dividends from investments and income from part-time jobs.

Ensure you have a monthly figure for all your income sources. If the money comes in only once a year, you can divide it over twelve months to get a monthly figure.

Needs

Your needs are your basic necessities. They include groceries, rent or monthly mortgage payment, health insurance, utilities, etc.

In the 50/30/20 system, they constitute the major bulk of your expenses – 50%. Once you have identified your monthly income, commit 50% of that to your needs.

Wants

Your wants are non-essential expenses. They are important to your wellbeing but not your general survival. These include money spent on internet subscriptions, dining out, vacations, and your hobbies.

In this system, they take up 30% of your income.

Savings/Investments

The remaining 20% is what you have to save or invest. Saving here is used generally for a portion of your income that you have decided to keep. When you use this money to purchase investment assets like stocks, mutual funds, bonds, ETFs, or REITs, that’s investing.

While the 50/30/20 rule is simple and easy to implement, it’s not rigid. For example, there are people within the Financial Independence Retire Early (FIRE) movement that save up to 70% of their monthly income.

If your financial goals require you to step up your savings game, you can reduce your expenses (on needs or wants) and save more. As a Dubai resident, you can reduce your expenses and increase your savings by buying your groceries in bulk, increasing your room temperature by 1 degree, using a DIY workout program, among others.

[For more ideas on how to cut down cost and increase your savings, read “12 Hacks for How to Save Money in Dubai Like A Resident”]

B. Determine your emergency fund goals

So, what about the remaining 20% from the 50:30:20 rule?

We differentiated between saving and investing because not all of your savings will go into investments immediately.

Why not?

Part of that 20% will go to your emergency fund. As we said earlier, investing all your savings without an emergency fund means you will have to liquidate your investments to take care of emergencies. The problem is that you might have to sell your assets for a loss, miss out on potential future returns, and buy them back at a more expensive price.

Therefore, before committing all your savings to the stock market, creating an emergency fund is essential.

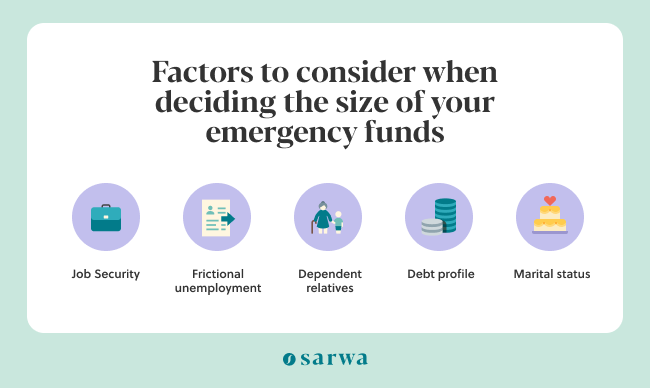

But how big should your emergency fund be? Is AED 5,000 okay? Maybe AED 10,000? Before deciding on the size of your emergency fund, consider the following factors:

Factors to consider when determining how to start an emergency fund and plan goals

Job Security

Some jobs are more secure than others. Some industries have more job security than others.

Yet, no matter the situation, job loss is considered the most likely of possible financial emergencies. Therefore, you need to understand your industry and the job security your current employment provides.

Frictional unemployment

Related to job security is frictional unemployment.

Frictional unemployment is unemployment caused by people moving from one job to another. The level of frictional unemployment in your industry will help you estimate how long you can expect to stay out of a job in the event of a job loss.

Dependent Relatives

If you have people that depend on you, their emergencies are most likely yours, too. You need to consider this when deciding on your emergency fund goals.

Debt Profile

If you have a large backlog of debt, you may need a smaller emergency fund at the beginning compared to someone without debt. Why is that? You should pay off your debt as soon as possible because of the interest expenses payable on them.

The interest your emergency fund will generate will almost always be lower than the interest on unpaid debt. Therefore, you must channel enough funds for debt repayment, which ends up rationalizing a smaller goal for your emergency fund at the beginning.

Marital Status

If you are married to a working partner, you may need less cash for emergencies, ceteris paribus.

How many months to plan for: Pulling it all together

None of these factors should be considered in isolation when building an emergency fund. Every one interacts with the other to help us get the clearest picture of the financial needs our fund must provide for.

Financial advisors have talked about the size of emergency funds by considering the number of months the fund will be sufficient to take care of you without your income. For example, if your monthly needs and wants amount to AED 10,000, a two-month emergency fund will have AED 20,000 in it.

Generally, financial advisors advocate between a three-month or a six-month fund. Though a respected advisor like Suze Orman has advocated for an eight-month fund, and even a two-year or three-year fund, that is unusual, and most advisors will stick with a three-month or six-month fund.

The former might be appropriate for people with more secured jobs, lesser dependent relatives, among others while the latter might be appropriate for people with less secured jobs and more dependent relatives, among others.

However, we have found that a six-month emergency fund offers the best protection and everyone should aim at it. However, this largely depends on your personal financial profile, which the above has helped you determine.

To calculate the ideal value of your emergency fund, multiply your monthly essential expenses (needs and wants for some; needs only for others) by six and you will have your fund goals in a concrete number.

For a six-month fund, If your monthly expenses are AED 10,000, for example, you should save up about AED 60,000 in emergency funds.

C. Start building your emergency fund

Now you have a target – six months worth of your essential expenses. But how do you achieve that target?

As said above, the money for your emergency fund comes from your savings (the 20% of your 50/30/30 rule). You can commit all your savings to the emergency fund until you have met your emergency fund goal.

However, you also have to consider the relationship between debt repayments, emergency funds, and investing – the three possible destinations for your 20% savings. To this we’ll turn in just a moment.

D. Choose where to build your emergency fund

An essential part of learning how to start an emergency fund is deciding where to put your cash.

Once you kick start your savings plan for an emergency fund, where should the money go?

In the beginning, we outlined the three features of an emergency fund.

- It is accessible

- It is designed for emergencies

- It is readily replenishable

Accessibility is important when deciding where to stash your emergency fund since liquidity (rather than interest) is the priority.

A more accessible (liquid) account with low interest is better than a less accessible account with higher interest.

However, while liquidity is primary, you can still seek higher interest rates at the same liquidity level.

Below are some options to consider:

- Savings accounts: A savings account with a bank or credit union will offer a considerable interest rate and high liquidity. While some banks will require a minimum balance or charge monthly fees, others won’t. Shop around for high-yield savings accounts without monthly fees or a required minimum balance.

- Money market accounts: Money market accounts are similar to savings accounts. Though they offer higher interest rates, they also have a higher minimum deposit requirement. Shop around for money market accounts with little or no minimum deposit requirement.

- Money market mutual funds: They invest in liquid, near term securities. They are low-risk with high liquidity. They may be a good option for a part of your emergency fund.

4. The role of emergency funds in your overall financial plan

Emergency funds do not stand alone. While you should understand how to start an emergency fund, you should also know how it relates to your overall financial plan.

Two things are incredibly important to consider here:

Emergency fund and debt

If you have debts where interest accrues on the unpaid balance at the end of the month (e.g., credit cards, student loans), they should take precedence over building an emergency fund.

Clearing those debts through the debt snowballing system should be a priority. Again, this is important because of the interest expense they generate; the earlier you take them out of your books, the better.

Nevertheless, delaying your emergency fund (entirely) because of debt repayment is not advisable. If an emergency arises while you are paying off debt, you will only incur more debt.

Therefore, Jean Chatzky’s advice to “aim for three months of expenses to start, then boost it to six” seems to be the best in this situation.

Dave Ramsey, a financial advisor and founder of Ramsey Solutions, also advises a $1,000 emergency fund to begin with. Jean has also advised $2,000 beginning emergency funds at some point.

The important point here is that you should not wait until you pay off all your debts before you start your emergency fund. Instead, start with a portion of your emergency fund goals (as calculated in the previous section) – preferably half of it – then face your debts before coming back to complete your emergency fund.

To summarise: while you may not completely put your emergency fund on hold, repaying such debts should be a priority.

How can you apply all the information above?

- First, make all the minimum monthly payments on such debts (credit cards, student loans, etc.) from your monthly savings.

- Second, start building half of your emergency fund from what remains after making these minimum monthly payments.

- Third, once you have set up half of your emergency fund, start snowballing the unpaid balances on these debts.

- Fourth, always replenish your emergency fund from the next paycheck whenever you withdraw from the account.

- Fifth, complete your emergency fund once you have paid off all your debts.

In a situation of massive debt, you might not be able to build your emergency fund as quickly as you would have preferred. Do not despair. “It may take you months or even a few years to build up an adequate emergency savings fund,” according to Suze Orman. “That’s okay.”

The important thing is to keep on at it and ensure that you don’t use the one you have already built on anything else.

Emergency fund and long-term investment

In addition to a plan for your emergency funds, you need a monthly investment plan. A monthly investment plan shows how you intend to invest your savings in the market through stocks, bonds, mutual funds, REITs, ETFs, among others.

But what should be the relationship between your emergency fund and your long-term investment?

It’s preferable to build a complete emergency fund before you start investing because if emergencies occur without it, you will need to liquidate your investments (and that has disadvantages, as already explained).

However, on the flip side, there is an opportunity cost to putting too much money in an emergency fund: emergency fund accounts (savings accounts, money market accounts, and money market mutual funds) have very low returns compared to stocks or ETFs, for example.

This is why we generally discourage emergency funds that go beyond six months’ worth of essential expenses. When you go beyond that, you are leaving money on the table.

Nevertheless, if you think your situation requires that level of emergency funds (beyond six months), it’s better to pause at a six-month fund, activate your monthly investment plan, then continue building your emergency fund while also investing in the market at the same time.

Generally, this relationship between emergency fund and investing is adequate for everyone:

- First, build your six-month (maximum) emergency fund

- Activate your monthly investment plan

But if you think, for reasons due to your unique financial situation, that you need more than a six-month emergency fund, then:

- First, build your six-month emergency fund

- Second, activate your monthly investment plan and build your emergency fund alongside in a ratio you are comfortable with: 50/50, 60/40, 80/20, whatever.

- Third, once you have enough in your emergency fund, commit all your savings to your monthly investment plan.

To summarise: you cannot create a monthly investment plan without thinking about emergency funds, vice versa.

[For more on what portion of your savings you should be investing, read “How Much Percentage of Savings Should You Invest In The Market?”]

Executing your investment plan

Your emergency fund is an aid to your investing. It does this by ensuring that no emergencies distracts you from allowing your money to grow in the market. The best way to profit from the market is to stay long in the market.

You can execute your monthly investment plan by buying stocks and ETFs yourself. Sarwa Trade is a platform that allows you to buy and sell US stocks and ETFs (the most profitable companies in the world are in the US stock market) in the UAE.

[To see why you are better off buying US stocks and ETFs, read, “How to Buy US Stocks in the UAE (The Easy and Commission Free Way)”]

With Sarwa Trade, you can buy and sell stocks and ETFs at zero commission and transfer money from your local bank account to the platform at zero transfer fee. The platform also allows fractional trading (where you buy a fraction of a share if you can’t afford a single one) and you can start trading with just $1.

On the other hand, you can execute your monthly investment plan by investing in a Sarwa investment portfolio. At Sarwa, we use Modern Portfolio Theory to create a diversified portfolio of passive ETFs that seek to minimise your risk and maximise your returns (given your time horizon, risk tolerance, and financial goals).

With these passive portfolios, you can automate your investments and watch your money grow over the long term without the need to be driven here and there by any short-term movement in the stock market.

Are you seeking to invest your money to achieve your financial goals? You can buy stocks and ETFs yourself through Sarwa Trade or invest in a passive and diversified portfolio of ETFs specially created for you.

Schedule a call with a Sarwa wealth advisor if you are unsure of the best way to move forward and we’ll answer all your questions.

Takeaways

- Emergencies do happen.

- Preparing for emergencies with a sound financial plan can help you navigate them successfully when they arise.

- An emergency fund will help prevent debt accumulation, protect your savings, and avoid a financial disaster.

- A six-month emergency fund will offer you greater protection

- Starting an emergency fund begins with good budgeting practices (the 50:30:20 rule)

- Emergency funds play a crucial role in your long-term investment strategy and overall financial plan