Congratulations! You are managing your monthly income so well that you save a part every month. What now? While it is true that savings are the engine of wealth, that process is not automatic. This is where creating a monthly investment plan in the UAE can help.

Consider a saver who puts his AED 2,000 monthly savings under the bed. At the end of five years, he has AED 120,000.

His friend who invests the same amount in the S&P 500 with an average return of 10% compounded quarterly (dividend payouts are reinvested) will have an extra AED 34,500. The longer this process goes on, the greater the gap.

This example leads us to an important point: To turn savings into wealth, you need a monthly investment plan in the UAE. An investment plan helps you earn better returns. But more than that, it ensures that your savings and your financial goals are properly aligned.

But you don’t need to pay a financial advisor or fund manager to create one. In this article, we will guide you through a do-it-yourself (DIY) process that will help you (whether you are an Emirati or expat) seamlessly create your monthly investment plan in the UAE.

- What is a monthly investment plan?

- How to create a monthly investment plan in the UAE

- Managing your investment plans and portfolios

[Do you want to know more about how to manage your finances and invest your savings? Subscribe to Sarwa’s Fully Invested newsletter today to receive weekly nuggets that will transform your finances.]

1. What is a monthly investment plan?

A monthly investment plan is a systematic investment plan that outlines how to use your monthly savings plan to achieve your investment goals.

This definition shows that a monthly investment plan is a subset of a systematic investment plan (SIP).

But what is a systematic investment plan? It is an investment plan that involves putting aside a certain amount of money regularly to achieve certain investment goals.

A monthly investment plan, then, is a SIP with a monthly regularity. That is, you are investing a certain amount of money monthly to achieve certain investment goals.

Both the monthly investment plan and the SIP are antidotes to the get-rich-quick mentality. In search of these schemes, many have lost money and ruined themselves. You probably know one or two of such people.

In one of Warren Buffett’s quotes, he said: “No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

The journey to wealth is slow and steady and a monthly investment plan is an example of that principle. By saving every month and allocating your savings towards your investment goals, you can build wealth over the years.

You may never win the lottery or an inheritance but following a sound monthly investment plan is a proven path to wealth that anyone can thread.

But how do you create one?

2. How to create a monthly investment plan in the UAE

There are six main processes you have to follow to create a monthly investment plan in the UAE:

1. Determine your monthly savings percentage

Every SIP depends on you setting aside a certain amount regularly. Therefore, for a monthly investment plan, the first step is determining what you will be saving every month.

Here we focus on a percentage instead of a number because your income will most likely increase in the coming years. A percentage allows you to increase the amount you are saving when your income increases.

The 50/30/20 rule makes this process easy. It states that you should save 20% of your income every month.

While this is a good rule of thumb that has helped many, you can tweak it to fit your current circumstances.

Perhaps your financial situation makes 20% too much of a burden. If so, start with 10%. On the other hand, if you have some freedom and can conveniently go up to 40% (for example), why not?

The key thing is to settle for a percentage and stick to it.

After deciding on a percentage, you can then translate it into an amount.

To make the whole thing clearer, let’s use an example. Suppose Ahmed earns AED 50,000 every month. Ahmed has prepared a 50/30/20 budget and is willing to save 20% of his income every year. This translates to AED 10,000 every month.

Task 1: Use this format for yourself and come up with a number for each month.

2. Identify and rank your investment goals

Blackrock, the number one provider of Exchange-traded funds (ETFs) in the world, has provided an easy way to identify and classify your investment goals: long-term, medium-term, and small to medium-term.

Retirement and saving towards property purchase are two examples of long-term investment goals (and we can add financial independence to that, too). Saving for the university education of your children is a medium-term goal and saving for a vacation or your dream car is a small-to-medium-term investment goal.

Whatever goals you have, ensure that they are SMART – specific, measurable, achievable, relevant, and time-bound. “I want to retire by 60” is specific and time-bound but it is not measurable.

A better goal statement is: “I want to retire by 60 and I need a nest egg of AED 2,000,000 to do this.” Whether this is relevant and achievable will then depend on your circumstances.

Task 2: Identify your short-term, medium-term, and long-term investment goals and put them in the SMART format

The next step is to rank your goals on a scale of preference. In essence, which of these goals are most important and why?

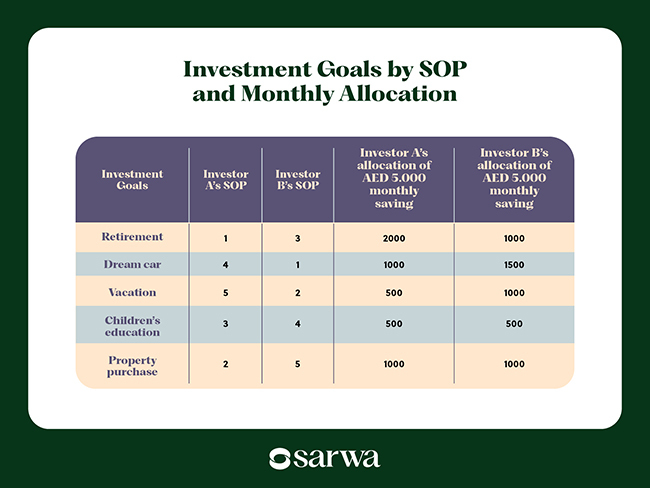

Below is an example of a scale of preference for two imaginary investors:

(Note: 1 represents the most important and 5 the least important)

What we see here is that retirement is the most important goal for Investor A while getting a dream car is the most important for B.

There is no right or wrong scale of preference; it all depends on your priorities and unique lifestyle choices. The key is to ensure that your scale of preference reflects your life’s goals and personality.

Task 3: Arrange your SMART goals in a scale of preference using the above format

3. Create or select savings platforms and investment portfolios for your goals

As we saw in the introduction, where you invest your money is as important as the fact that you are saving a part of your income.

There are two things to note from the title of this section: savings platforms and investment portfolios.

Why is this distinction important?

For your short-term and short-to-medium-term goals, capital preservation is the important objective so you should focus on low-risk savings products.

If you are saving for a vacation that is in six months or for your child who will go to school in two years, then putting the money in a savings account or an online money saving plan is the best choice.

However, for long-term goals like retirement and property purchase, the goal is capital growth (high returns). Therefore, you want to put your money in investment opportunities whose past performance shows they can deliver high returns. These include stocks, bonds (national bonds and corporate bonds), ETFs, mutual funds, real estate investment trusts (REITs), gold, and cryptocurrency.

The reason for this is that the longer the time you invest in the stock market, the lower the risk of losing money and the higher the probability of making money.

As the chart below shows, in the short term (one month, one year), the risk of losing money is high but over the long term (five, ten, and 15 years), it is far lower.

Thus, you don’t want to put money for short-term goals in the stock market (where you can lose them in the short term) just as you don’t want to put money for long-term goals in savings accounts (where they earn insignificant returns compared to other types of investments).

Choosing savings products

With savings accounts or products, the goal is to preserve your capital. So, choose reputable companies.

However, many savings products will provide capital preservation and yet offer higher returns than traditional banks. For example, Sarwa Save will offer up to 5.1% return and yet allow you to withdraw your money at any time (no lock-up period).

Creating or choosing investment portfolios

If you have the time and skills, you can build an investment portfolio from scratch.

This will involve selecting which of the safe investment options in Dubai to include (stocks, bonds, REITs, bitcoin, gold, etc.), the assets to buy under each asset class, and the weight of each asset in the portfolio.

[For more on why bitcoin and gold are included in this list, read “How to Invest in Gold in the UAE: 5 Accessible Ways to Consider” and “Why Invest in Bitcoin? Understanding The Value of “Digital Gold”]

You can purchase all these asset classes and create your portfolio(s) on the Sarwa Trade platform. Learning how to invest money in the UAE is a crucial prerequisite to this step.

Alternatively, you can outsource the whole process to a robo-advisor (digital wealth advisor) like Sarwa Invest.

Digital wealth advisors will use artificial intelligence and the latest insights in portfolio management theory to create a personalized portfolio for you.

This portfolio will take into account your:

- Time horizon: The time between today and when you want to achieve your goals

- Risk appetite (risk tolerance): Whether you are risk averse, risk neutral, or risk seeking

- Risk capacity: How much risk you can reasonably take on based on your situation

- Investment goals

They will choose the asset classes, the assets under each class, and the allocation formula in a bid to maximize your returns and reduce your risk through diversification.

Task 4: Select savings accounts or online money saving plans for your short-term and short-to-medium-term goals and select or create investment portfolios for your long-term goals.

4. Allocate your monthly savings to investment goals

Now that you have created your goals and where the money for those goals will be saved or invested, you need to decide how much you are allocating to each goal.

This is where the scale of preference will come in handy. Remember that this scale is a measure of priority. It makes sense then that you should allocate more money to goals with higher priority and importance to you.

Suppose Investors A and B (hope you still remember them from where we learned how to rank goals) are saving AED 5,000 every month. Since their scale of preference differs, their allocation of this money will also differ.

Below is a sample allocation for them.

Investment Goals by SOP and Monthly Allocation

Just as there is no right or wrong scale of preference, there is no right or wrong allocation formula. The only rule is that your allocation formula reflects your scale of preference.

Task 5: Allocate your monthly savings to your investment goals based on your scale of preference

5. Create an emergency fund

By now, you have successfully created a SIP in the UAE. The best investment plan is one that accurately reflects your current financial situation and investment goals.

As long as you have followed each of the steps we have highlighted, what you have created is as good as what any financial advisor will charge you to create.

However, we need to make a detour to make an important point that we cannot assume you know.

Since life is unpredictable, some emergencies (unplanned events) will arise (take COVID-19 lockdowns as an example). It could be unexpected medical expenses, job loss, lockdown, unplanned travel, etc. Though you have not budgeted for any of these, you must meet them somehow.

The path that many thread is to take a consumer loan (especially credit cards). But consumer loans are often expensive and they might create a bad money habit – spending beyond your means.

A better option that financial advisers have always emphasized is creating an emergency fund.

An emergency fund is a stash of money you access when emergencies — medical payments, car repairs, unexpected travel, etc. — arise. The popular rule of thumb among experts is that you need to save between three to six months’ worth of your living expenses (some will take this as the 50% part of the 50/30/20 rule and others will take it as both the 50% and 30%) as an emergency fund.

Your emergency fund should also be in a savings account or product, preferably one that is liquid – no lock up – and offers higher interest rates. Fixed-income securities and fixed-deposit accounts are not appropriate.

With it, you don’t have to take a loan to meet unplanned expenses.

Why are we talking about this here?

It makes more sense to know how to start an emergency fund before you start implementing your monthly investment plan.

If you don’t have an emergency fund, emergencies may force you to sell your assets at a loss. Even if you have money in a savings account, some banks will impose withdrawal limits on such accounts. When you go beyond the limit, you will sacrifice some interest payments.

Though online money saving plans like Sarwa Save don’t have such limits (thus providing more liquidity), having to use the money saved for a vacation to settle some emergencies a month to the vacation date, can be devastating.

Therefore, to avoid the financial (and emotional) cost, you should have the emergency fund settled before you start implementing your monthly investment plan.

6. Start executing your monthly investment plan

Once you have received your monthly salary, you can start transferring money to the savings platforms and investment portfolios you have created for your goals.

In the above example, Investor A will have to transfer

- AED 2,000 to the retirement investment portfolio

- AED 1,000 to a savings product for a dream car

- AED 500 to a savings product for vacation

- AED 500 to a savings product for the child’s education

- AED 1,000 to an investment portfolio for property purchase.

Some platforms like Sarwa Invest can help you automate this process. You can instruct them to automatically deduct a certain amount from your checking account to your investment portfolio at the end of every month.

In addition to the convenience such automation affords, it can also help you stick to your budget.

The first thing to do when you receive your income is to pay yourself, according to George Clason, author of The Richest Man In Babylon.

That is, saving should come before spending. Instead of overspending and then cutting from your savings, you should save first and then force yourself to spend what you already budgeted. Warren Buffett crystallized this idea into one important statement: “Do not save what is left after spending, but spend what is left after saving.”

Instead of relying on pure willpower to save before you spend, you can allow technology to do the heavy lifting for you while you focus on sticking to your budget.

Task 6: Automate the transfer of money from your checking account to your investment portfolios and savings products.

3. Managing your investment plans and portfolios

Since your financial situation and goals are not static, your monthly investment plan cannot be static. The best investment plan in the UAE will have to adjust to meet changing realities.

This is one of the advantages of a DIY SIP investment in the UAE. If you pay an advisor for it, they will just create one for your current situation. If your situation changes in two years, you might have to pay for another plan.

By knowing how to create it for yourself, you can make adjustments on the go.

So, what adjustments may be needed?

Let your savings grow with your income

We recommended moving from a percentage of income to a fixed amount to cater for times when income will increase.

Once your income increases, the same percentage will give you a different amount as your monthly savings.

You can use this extra amount in at least three ways:

- Spread it across the board equally: So, if you have five goals and the extra amount is AED 1,000, that will be an extra AED 200 for each goal.

- Spread it across the board based on the existing allocation formula: The same scale of preference will apply to the extra amount so that the allocation formula remains unchanged.

- Use it for selected goal(s) only: If you think some goals are lagging (it will be hard to reach the desired amount at the current pace), you can commit the extra amount to those to the exclusion of others.

Your scale of preference can change

Priorities can change along the way. Getting a dream car can dim in importance while saving for your child’s university education can become more important.

When your scale of preference changes, then your allocation must reflect that change. Remember that the best investment plan is one that takes your current situation into account.

What happens when some goals are accomplished

If you have achieved a short-term goal, you can decide to replace it with another or divert that allocation to other existing goals (in any of the three ways we mentioned above).

Rebalancing your portfolio

If the investment portfolio you are using is efficient, then you need to keep the weight of the assets to maintain that efficiency. For example, if an S&P 500 ETF is 10% of your portfolio and a gold ETF is 5%, you need to keep that weight even as prices change.

This process is called portfolio rebalancing.

If you create your portfolios, you have to rebalance them periodically yourself. However, if you use digital wealth advisors like the Sarwa Invest platform, it will be automatically done for you periodically.

Don’t despise the days of little beginning

Many young people don’t like the idea of saving consistently for years before they can build wealth. This is why get-rich-quick schemes appeal to them.

Investing AED 2,000 every month, for example, seems insignificant in the scheme of things. So they would rather gamble that amount in the hope of turning it into AED 100,000 overnight. Well, five years go by and they have still not hit the jackpot as they go from one trending scheme to the other.

On the other hand, those who understand compound interest and choose to be patient now have AED 154,500 in their account from the measly AED 2,000. Now their income has even increased and they are now investing AED 5,000 instead of AED 2,000.

Guess what? In another five years, the gamblers are still complaining about how difficult it is to become wealthy if you were not born into it while the patient investors now have AED 639,500.

Sticking to a monthly investment plan and making efforts to increase your income remain the two simplest ways for ordinary people who were not born to wealth to change their fortunes and build wealth for themselves and their families.

In essence, don’t despise the days of little beginnings. You may not have a lump-sum amount to invest with but your little dirhams invested consistently can turn into something big with compounding.

[Are you ready to achieve your investment goals in the UAE? Create an account with Sarwa and download the mobile app to access Sarwa Save, Sarwa Trade, and Sarwa Invest and create savings plans and investment portfolios.]

Takeaways

- Saving money is not enough, you need a systematic plan to get the most out of your savings.

- You can create a monthly investment plan for yourself in the United Arab Emirates without paying a financial advisor for it.

- A monthly investment plan should be dynamic, responding to changes in your financial situation.

- Before implementing your monthly investment plan, ensure you have created an emergency fund.