As the gold-silver ratio remains above its historical average, many have been advocating for silver as a cheaper or undervalued alternative to gold. This includes Adrian Ash, the director of research at BullionVault, a precious metals trading platform, and Marc Guberti, a personal finance expert at Money.com.

Like gold, silver has proven itself as a safe haven during economic downturns and market fluctuations. We saw the latest example of this during the market downturn that followed Trump’s tariffs.

When the S&P 500 Index and the NASDAQ Composite were down 3.77% and 7.16% yield-to-date (YTD), respectively, on May 14, silver was up 13.22%.

Even after the stock market recovered, silver continued to outperform. At the time of writing, its 27.16% YTD exceeds that of the S&P 500 (5.88%) and the NASDAQ Composite (5.60%).

If silver can serve as a portfolio hedge like gold, but it’s 92 times cheaper (at the time of writing), why not buy it instead? Many investors have wondered.

One way to gain exposure to silver is to buy silver stocks instead of physical silver. In this article, we will consider how to invest in silver stocks and why doing this makes sense for investors.

We’ll cover:

- How to invest in silver stocks in the UAE

- Why should you invest in silver stocks?

- 4 other ways to invest in silver

Do you want to learn more about precious metal investments? Subscribe today to Sarwa’s Fully Invested newsletter for regular educational materials and financial market updates that will make you a better investor.

1. How to invest in silver stocks in the UAE

What are silver stocks?

Silver stocks (also known as silver mining stocks) are the stocks of silver mining and silver streaming companies.

Though many mining companies produce silver, it is not usually a big part of their portfolio, compared to gold and other industrial metals like aluminium, copper, and iron ore. Thus, only a small portion of their revenue depends on silver.

Only those mining companies with large exposure to silver or significant silver reserves qualify as silver stocks. This is because they are the only ones whose earnings (and thus market price) will have a high correlation with the price of silver.

Precious metals streaming companies are financial partners to mining companies. They provide upfront cash to fund mining operations. In return, they get the right to purchase a portion of the mined metals at a discounted and predetermined price, which they then sell at the market price.

Some of these streaming companies also have significant silver exposure; thus, we also consider them silver stocks.

How to buy silver stocks in the UAE

Though the UAE has some precious metals companies that mine silver and gold, they are all private companies (not publicly listed). This means they are not available for purchase on the stock market.

However, there are a handful of silver stocks in the US stock market that UAE investors can purchase through Sarwa.

Silvercorp Metals Inc., a Canadian-based silver mining company operating in China and listed on the New York Stock Exchange (NYSE), is an example:

Other notable silver stocks include First Majestic Silver (a silver mining company), Pan American Silver (a silver mining company), and Wheaton Precious Metals (a silver streaming company).

2. Why should you invest in silver stocks?

Now that we know how to invest in silver stocks in the UAE, let’s consider why it makes sense for an investor to buy silver stocks instead of physical silver (silver bars and silver coins).

There are quite a few valid reasons:

- Cost: First, the price of physical silver includes a premium on the spot price listed online. This premium (markup) represents the cost of producing, packaging, and shipping them.

The price premium for bullion coins is even higher due to sophisticated design, desirability (the American Eagle silver coin being an example), and historical significance (some coins are collectibles).

Second, silver dealers will charge transaction costs (which can be exorbitant) to facilitate the purchase.

Third, storage fees (for safe protection) add an extra layer of cost.

Consequently, buying silver stocks is a more cost-effective alternative. Due to financial technology, the cost of purchasing stocks is now very cheap. Interestingly, Sarwa even charges less than the industry average, making it inexpensive to buy silver stocks in the UAE.

- Liquidity: Illiquidity is one of the challenges with gold (especially gold bars). But the silver market is even more illiquid since it has a lower market size, lower trading volume, and fewer institutional investors compared to gold.

Silver stocks don’t face the same problem. They are generally more liquid since they can be instantly traded on stock exchanges.

Furthermore, the fractional trading provided by companies like Sarwa ensures that you can buy and sell fractions of a share if you don’t want to (or can’t) buy/sell an entire share.

- Safety: Silver bullion can be stolen if not properly stored. But proper storage can be expensive.

On the other hand, you don’t have to worry about losing your silver stocks as long as you are using a secure platform.

- Convenience: If you prefer to buy silver bars and coins at a brick-and-mortar store, you will go through the inconvenience of making a round trip to the retailer.

Perhaps you choose to buy online instead. This will still require that you take physical delivery and arrange for storage.

Moreover, you will need to certify the purity and genuineness of the product.

All of these inconveniences don’t arise with silver stocks. All you need to do is tap your screen a few times to purchase a company’s stock.

- Passive income: One of the reasons some investors prefer stocks to physical metals is that the latter does not provide income. You can only profit from it by selling it for capital gains.

If you are big on earning passive income from your investments, silver stocks solve that problem. You can earn dividends from holding them.

This may even give you the confidence to hold your silver investment as a long-term hedge since you are not under pressure to sell it to make money.

- Higher returns: Silver stocks can outperform silver itself due to other operational and financial factors driving price movements. For example, while silver has produced 27.16% YTD, First Majestic Silver has done 55.01% and Silvercorp Metals Inc. has done 54.67%.

3. Four other ways to invest in silver

Is investing in silver a good idea?

Well, the long answer is there’s been an increasing reliance on Silver over the past year, as retail investors have begun to recognise it as a compelling investment because it sits at the intersection of industry and scarcity. It’s both a precious metal and an essential industrial input: used in solar panels, electronics, EVs, medical tech, and emerging clean-energy infrastructure. The short answer is, it really depends on what you think is worth investing in. But let’s say for argument’s sake that you do think it’s a good idea, as it could be a good store of value, a safe haven asset, and a potential hedge against inflation.

Many retail investors believe that as its industrial uses expand, higher demand will drive prices up.

However, the big question remains how to invest in this good investment. If you are curious about how to invest in silver in general rather than just how to invest in silver stocks, this section is for you.

Apart from silver stocks, there are four other ways to invest in silver:

Silver bullion

Silver bullion (bars and coins) refers to physical gold that you can buy from silver retailers.

We have already seen the disadvantages of buying silver bullion. Yet, many prefer them for their tangibility; they want physical assets that they can touch and hold rather than paper assets in an online account.

Some popular players in the silver industry in the UAE include Mint Jewels, AB Metals, Bullion Mart DMCC, Kanak House Bullion, and APM Bullion, among others. Many of these dealers also have online stores where you can purchase physical silver.

Silver mutual funds

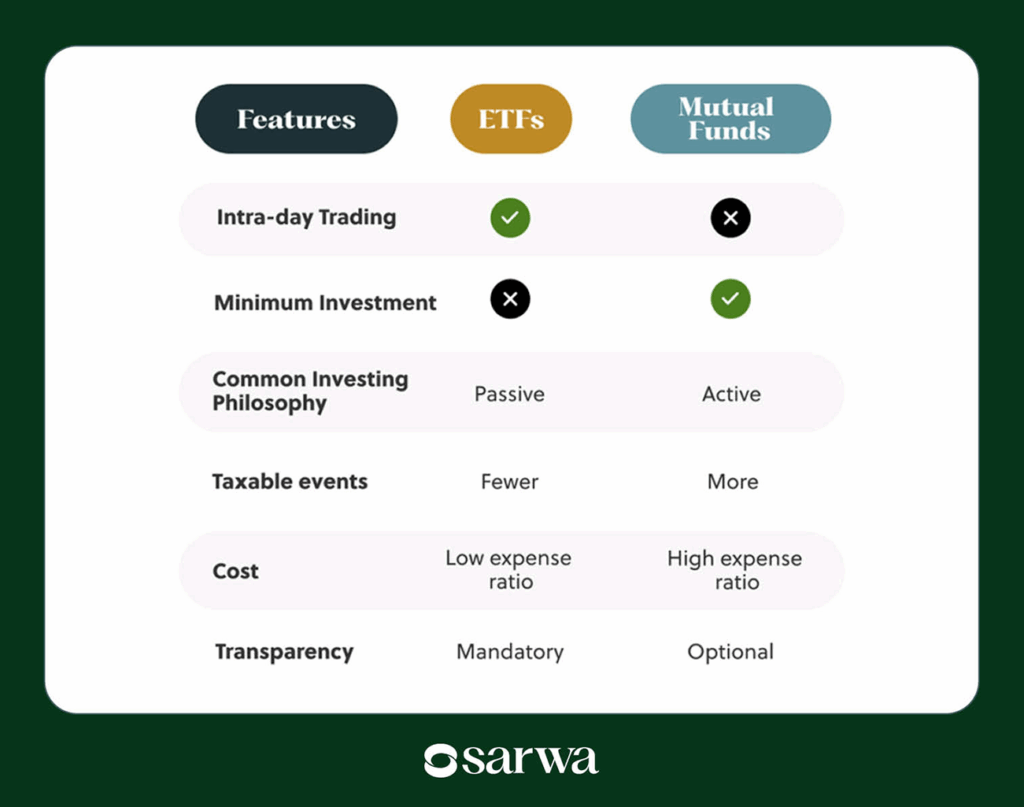

Silver mutual funds are funds that aggregate money from various investors and invest it in various silver stocks under professional management. Each investor will have a share in the mutual fund corresponding to the amount invested.

Diversification is one advantage of mutual funds. While $50 may get you only one share in one silver stock, the same amount may get you a share in a mutual fund, which means exposure to the multiple stocks held by the fund.

This is important because while factors like geopolitical developments, industrial demand, and general economic conditions (interest rates, inflation) can drag the silver industry down, company-specific risks (financial and operational) can also drive a particular silver stock down while others are up.

Diversification protects you from this latter situation. It reduces your exposure to such company-specific risks by ensuring that a single stock does not have too much allocation in your portfolio.

The professional management offered by mutual funds is another advantage. Investors who can’t do their own research (evaluating and choosing stocks) can benefit from experts who can do so.

However, there are certain cons with mutual funds:

- High cost: Professional management doesn’t come cheap. Mutual funds often have higher expense ratios, which eat into the net returns of investors.

- Liquidity issues: Unlike stocks, mutual funds can only be purchased at the end of the trading day and not during regular trading hours.

- Performance issues: While charging high management fees, most mutual funds fail to outperform their relevant indices. This means that passively investing in a fund that mirrors an index has been more profitable than buying mutual funds.

- Minimum investment: Most mutual funds will require that you have a minimum amount to invest before they can take you on. This is unlike stocks, where you even buy a fraction of a share.

Since there are no silver stocks in the UAE, there are no local silver mutual funds. However, companies like Abu Dhabi Commercial Bank and Mashreeq Capital may provide access to foreign mutual funds.

Silver ETFs/ETCs

Silver exchange-traded funds (ETFs) are funds that track the performance of an index of silver stocks. That is, they invest in a variety of silver stocks by mirroring the holdings of a given index.

Silver exchange-traded commodities are like silver ETFs except that they invest in silver bullion instead of silver stocks.

These funds purchase and safely store physical gold on behalf of their investors. Each investor will then have a share of the ETC that corresponds to the amount they invested.

Also, when an investor sells his silver investment, he will receive cash (fiat currency) rather than physical silver. This is a great option if you want direct investment in silver but without the hassle of taking physical delivery of it.

You can purchase silver ETCs on Sarwa. For example, you can purchase iShares Silver Trust (SLV), a silver ETC listed on the New York Stock Exchange:

What are the advantages of silver ETFs/ETCs over silver mutual funds? Quite a few:

- Lower cost: ETFs and ETCs have lower expense ratios than mutual funds. Most of them are passively managed, which makes them incur lower management expenses.

- Improved liquidity: ETFs and ETCs can be traded during regular trading hours. You don’t need to wait till the end of the day.

- No minimum investment: Like stocks, you can buy a fraction of a share of an ETF/ETC.

- Transparency: While some mutual funds are not fully transparent about their holdings (in a bid to hide their “trade secrets”), ETFs and ETCs are mandated to fully disclose their holdings.

Silver derivatives

Silver derivatives include silver options and silver futures.

Silver options are contracts that give the buyer the right to buy or sell silver for a predetermined price on or before a given expiration date. If the buyer decides to exercise the right, the seller takes on the ensuing obligation.

Silver futures are standardized contracts that impose on the buyer an obligation to buy silver at a future date for a predetermined price. Since there is an obligation on the buyer, the seller also has an obligation to sell.

Long-term investors and short-term traders use silver options and futures to “bet” on the future value of silver. Some also use them to generate income, while others employ them as a risk management tool.

One advantage of silver derivatives is that you don’t have to buy and sell silver to make money from it. You can trade derivatives for a fraction of what it takes to trade the underlying asset. If the trade goes against it, you can close the contract without having to buy or sell physical silver.

Silver options and futures contracts are available on the Dubai Gold and Commodities Exchange. A platform like Interactive Markets also provides exposure to international commodity derivatives markets.

However, financial advisors often suggest that beginner investors should stay away from derivatives or approach them carefully. For one, they are complex and highly volatile. Second, while the use of leverage can amplify your profits, it can also magnify your losses. No wonder Warren Buffett called these financial instruments weapons of mass destruction.

Buying silver stocks and ETCs on Sarwa

If you are ready to start investing in silver to hedge your investment portfolio, Sarwa provides you with a cost-effective, accessible, secure, and simple access to silver stocks and ETCs (among other investment products) in the UAE:

- Cost-effective: We provide free transfers from your local bank account to your brokerage account (and vice versa). Our commission – the greater of $1 or 0.25% of the traded value of stocks, ETFs, and ETCs – is lower than the average fee charged by brokers.

- Accessible: We provide fractional trading, and you can start buying stocks, ETFs, and ETCs with as little as $1.

- Secure: We protect your data and money with bank-level SSL security

- Simple: Our mobile apps are easy to navigate due to our top-notch user interface and user experience.

Furthermore, we provide educational materials through our blog and newsletter that will make you a better investor.

You can also get investment advice and a financial plan (based on your investment goals, time horizon, and risk tolerance) by talking to one of Sarwa’s digital financial advisors.

What then are you waiting for? Sign up now for Sarwa to invest in silver stocks and ETCs in the UAE and hedge your portfolio against market downturns and economic uncertainty.

Takeaways

- Though it is far cheaper than gold, silver also performs some of gold’s duties: store of value, safe-haven asset, and portfolio diversification tool.

- You can gain exposure to silver as a long-term investment by buying silver stocks instead of physical silver.

- Silver stocks eliminate the high premiums, storage costs, and liquidity challenges of physical silver. They are cheaper to buy, easier to sell, and safer to hold via secure trading platforms like Sarwa.

- You can also gain exposure to silver through silver mutual funds, ETFs, ETCs, and derivatives.