When we built and recommended your portfolio, we did so based on several inputs: the answers you provided in your survey, the Sarwa Investment Methodology that is rooted in proper diversification based on the Modern Portfolio Theory, and the right choices of ETFs to achieve it.

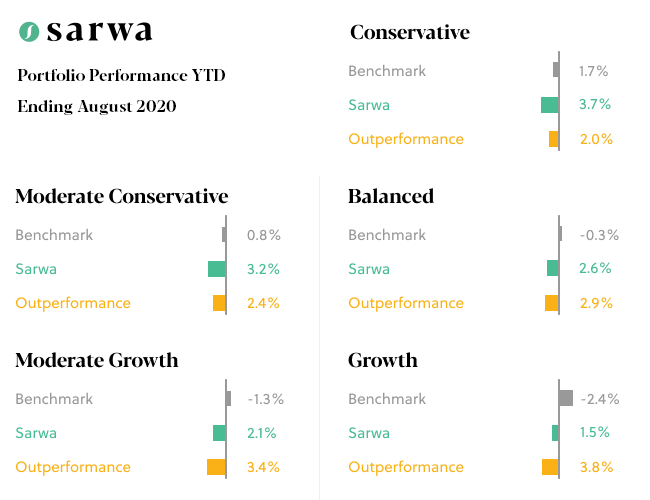

Despite extreme market volatility especially in Q1 of this year, our portfolios held up really well and outperformed their benchmark that has the same level of exposure. Our data-driven approach and our diversification strategy have paid off and kept the drawdowns in control.

Passive investing does not involve impulsive decisions based on market movement. It is built around research and data on what works for our clients over the long term. We did not change our sound advice with new tactical target allocations. We simply followed the plan we said we would when these things happen. We continuously monitor and periodically rebalance portfolios to ensure they remain optimally diversified.

Markets upswing and downswings can have a big emotional impact on some investors. That is why we want to share with you the performance of the portfolio this year.

Here is a snapshot:

We use time-tested and cutting edge techniques based on Nobel Prize-winning academic research to optimize the risk and return of your portfolio. While we cover the nuts and bolts of this approach in our white paper, the practical takeaway is simple: this portfolio optimization helps you lower your portfolio risk while maintaining a similar expected return. By holding our diversified portfolio – which invests in a broad base of US equities, developed market equities, emerging market equities, real estate, and a variety of fixed income instruments – you can achieve a comparable return to a portfolio solely invested in US equities while reducing the total risk of your portfolio.

This level of risk reduction is even higher when compared to portfolios that invest in a smaller number of individual stocks. Put simply, our portfolios allow you to preserve the benefits of investing while maximizing your peace of mind with respect to investment risk.

Our Investment Methodology Is Built Around Risk Management

We designed our portfolios with drawdowns in mind. We recommended the right level of risk for you based on the answers you provided and your own financial goals.

We also weigh larger cap stocks a bit higher than “market cap” weighted allocations. These stocks tend to be less volatile during market downturns and research suggests that large-cap has materially outperformed small-cap post-2010. As you know by now, we never “chase alpha”- the active return on investment. The statistics however matched with our portfolio optimization approach. This led to portfolios that are consistent with taking small (not major) bets on the above.

We are happy to report that our portfolios did what we designed them to do.

Many active advisors chase returns, but in doing so, expose their clients’ assets to unnecessary risk. As a result, their clients feel big losses when they see sharp market movements. Proper risk management, the principle of not overexposing investments to risk in pursuit of returns, is what protects your investments.

You are probably watching all the movements in the markets and wondering what all this means for you. If you’re in the right portfolio for your financial goals, you should not be making any changes to your plan – unless some emergency came along. As you know, investing is not without risk and if you feel more comfortable with the lower risk level, you can always talk to your advisor and plan it properly. We are always here to help.

Should you be sitting in Cash?

Data suggests over and over again that financial assets like stocks and bonds will continue to outperform cash over the long term, as they have throughout the history of financial markets. To be a good investor you should have no attachment to any short term movement of the markets at all. What you do not want to do is to pull out and sell on the low. You also don’t want to try to time when to move in and out. Let’s look into a recent example: Between March 23 and 26, the market returned an average of 19%. If you were out of the market for these 3 days, you would have missed out on the rebound!

Studies have shown that even bad timing in investing pays off more than not being in the market. For those already invested, selling investments during times of market volatility is likely to do more harm than good -and to derail sound financial strategies. According to Dr. Jiro Kindo, our Head of Portfolio Construction and MIT Ph.D. in Financial Economy, not being in the market investing in stocks and other financial assets, is the biggest mistake people make.

Dr. Jiro looked into the impact of pulling out of the market and sitting in cash, even for days, and only re-entering once there is a certain level of recovery. There is no cherry-picking. The data showed that you lose your growth percentage by moving in and out of the market. In some cases, the difference in performance is substantial. For instance, the market timing strategy that exits when the market drops by 30% and re-enters following a run-up of 10%, you would earn 21.5% less. This major shortfall occurs despite only being out of the market for 33 days!

Focus on the long run

The path to growth can be a bit of a rollercoaster, and negative returns can make some investors feel uncomfortable. But, staying disciplined and sticking to your plan can pay off. it’s important to remember that a slow down in the markets doesn’t mean that that it will continue forever.

With this in mind, know that you are well-positioned to take advantage of market upturns over the long run if you stay the course. If your goals have not changed, you shouldn’t react to market movement and make any changes to a sound financial plan.

While we don’t know when exactly a market drop will happen, we’ve already prepared for it and we hope you did too! Stay clam. Stay invested.