Many altcoins have been created, some have died, and some have survived, but Ethereum continues to lead the pack. With a market capitalization of $450 billion, at the time of writing, it remains the most valuable altcoin.

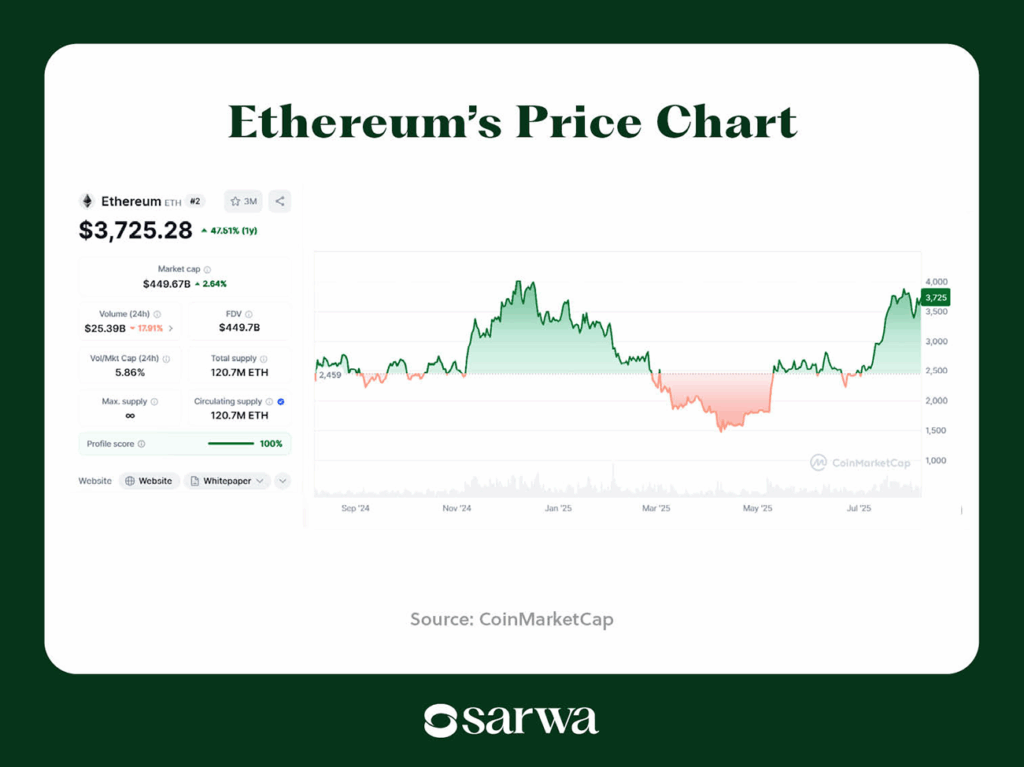

After staying below its $2,500 per ETH support line between February 26 and May 10, and consolidating in a territory just above it between May 10 and July 7, Ethereum embarked on a massive run between July 8 and July 28. During this period, there was a 52.4% increase in its price, crossing the $3,700 mark (though still far from its all-time high of $4,878).

Source: CoinMarketCap

This recent run is a result of the progress made on two crypto-friendly legislations (The Genius Act, governing stablecoins, and the Clarity Act, governing all digital assets) that are now up for discussion in the US Congress, according to The Motley Fool, a personal finance website.

Other reasons include the surge in on-chain activity, as Ethereum hit a monthly transaction volume of $238 million, and rising institutional demand for staking and liquid staking derivatives, according to AInvest. record number of transactions taking place on the platform

“Should I invest in Ethereum?” This is a question many have asked in recent weeks as the coin continues to outperform Bitcoin and dominate the altcoin market.

We answer that question in this article by considering whether Ethereum’s fundamentals are strong enough to sustain a continuous positive momentum.

In other words, we will evaluate whether there are good reasons to hold a positive outlook on Ethereum in the medium-to-long term. We’ll consider:

- 5 reasons it makes sense to invest in Ethereum

- The challenges with investing in Ethereum

- How to invest in Ethereum in the UAE

Do you want to learn more about the investment benefits of cryptocurrencies? Subscribe today to Sarwa’s Fully Invested newsletter for regular investment insights delivered to your inbox.

1. 5 reasons it makes sense to invest in Ethereum

Should you invest in Ethereum?

There are five reasons why a positive answer makes sense:

(Disclaimer: This is a market outlook overview, not financial advice.)

1. Smart contract leadership

Ethereum became the pioneer of smart contracts in 2015, and this remains one of its most important use cases.

Through a combination of first-mover advantage and technological advancements, it has maintained its market leadership position since then. In 2024, Ethereum’s market share was 50%, according to Precedence Research, a market research company.

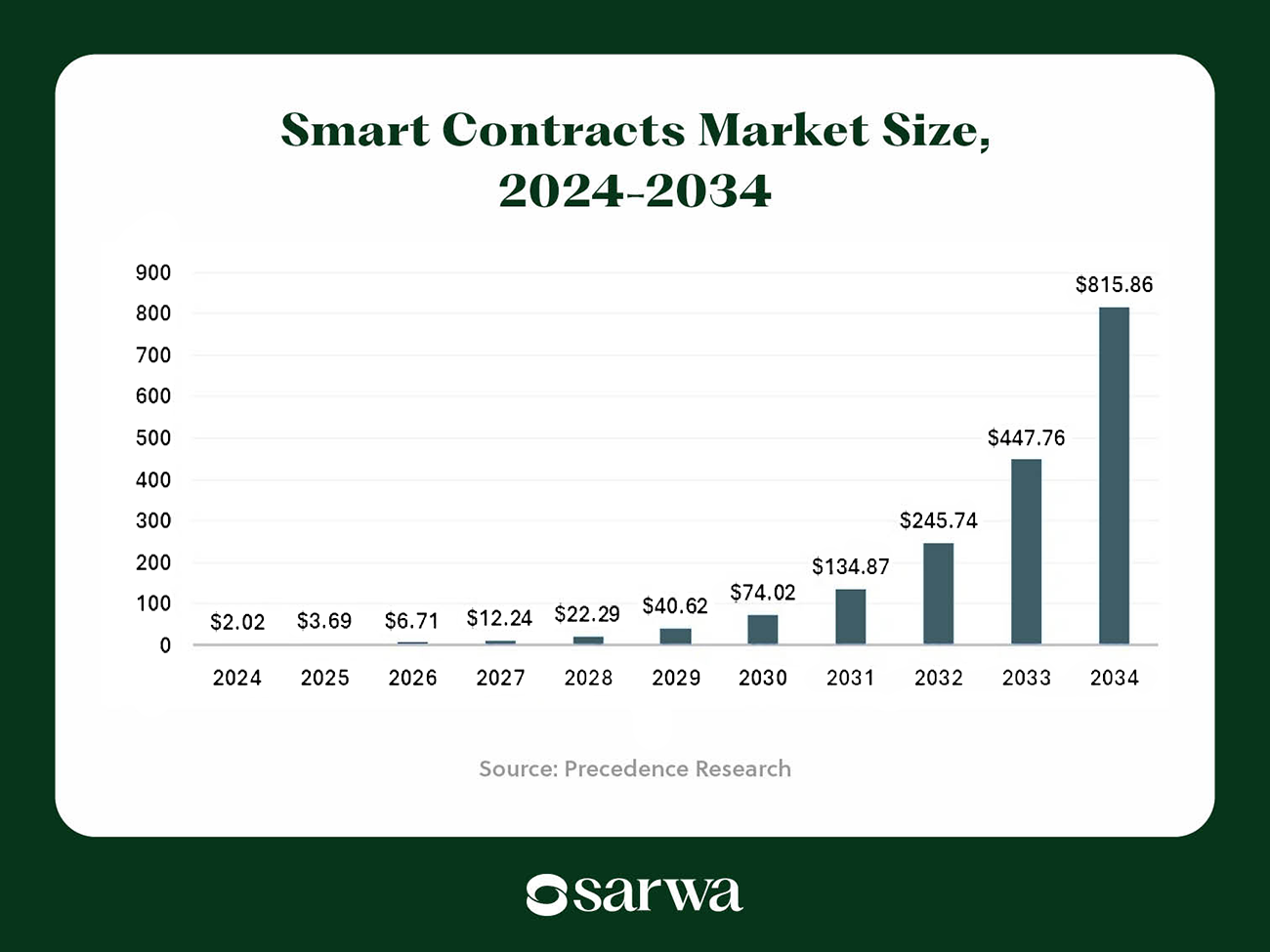

The smart contracts market has been growing massively. It experienced an 82.67% growth between 2024 (valued at $2.02 billion) and 2025 (valued at $3.69 billion), according to data from Precedence Research.

More importantly, they project that it will reach an $815.86 billion valuation by 2034, at a compounded annual growth rate (CAGR) of 82.1%.

Smart Contracts Market Size, 2024-2034

Source: Precedence Research

Some of the factors that are driving and will continue to drive this growth include:

- Growing use by organizations: Hitachi, a multinational, uses smart contracts for its procurements. IBM Food Trust and Walmart use them to track food supply chains, and Maersk, a shipping company, uses them to manage its supply chain.

- Government usage: Dubai Land Department, for example, uses smart contracts to automate title transfers. Sierra Leone piloted a blockchain-based voting system, and the UK developed a welfare payment system using blockchain.

- Growth in decentralized finance (which depends on smart contracts): More on this below.

- The expansion of blockchain technology itself: Major players like IBM, JP Morgan, and Microsoft are creating diverse blockchain solutions for their customers, including allowing them to create and launch smart contracts. Visa is also launching a tokenized asset platform, which will also use smart contracts.

As long as Ethereum continues to maintain its market leadership position, it should continue to benefit massively from the growing interest in smart contract functionality.

2. The growing popularity of stablecoins

The Motley Fool noted that the discussion about the Genius Act in Congress was one of the reasons for Ethereum’s recent upward trend. Why is that?

Ethereum is the main blockchain platform where developers issue and manage stablecoins. One reason for this is that most of the decentralized applications (dApps) that use these stablecoins are also created on the Ethereum platform.

For example, both USDT (Tether) and USDC (USD Coin), the two largest stablecoins by market cap, were created on the Ethereum blockchain.

A total of 156 stablecoins, with a market cap of $135.52 billion, have been created on the network. These represent 55.52% of the total number of stablecoins and 50.43% of the total market cap of stablecoins.

As in the case with smart contracts, Ethereum will benefit from growth in the stablecoins market. But should such growth be anticipated?

“The total value of issued stablecoins has doubled to $250 billion today from $120 billion 18 months ago, and it is forecast to reach more than $400 billion by year-end and $2 trillion by 2028,” according to McKinsey and Co., a global consulting company.

There are three main demand sources for stablecoins, according to them.

First is for the settlement of crypto trading. They noted a study from the US Federal Reserve Board that shows that 80% of all trading volume on crypto exchanges comes from trading pairs that include one stablecoin.

Second, stablecoins provide faster and cheaper cross-border payments and remittances, which are especially useful for migrant workers and small businesses.

Third, they can act as a reserve currency for countries in emerging markets that are facing historic currency instability.

They also point out that stablecoins are now being adopted for institutional settlement and treasury management.

Banks, large financial institutions, and even central banks are experimenting with stablecoins in many innovative ways (tokenized deposits and cash, on-chain settlement between institutional clients, tokenized cash for cross-border foreign exchange and securities trades, and tokenized central bank money).

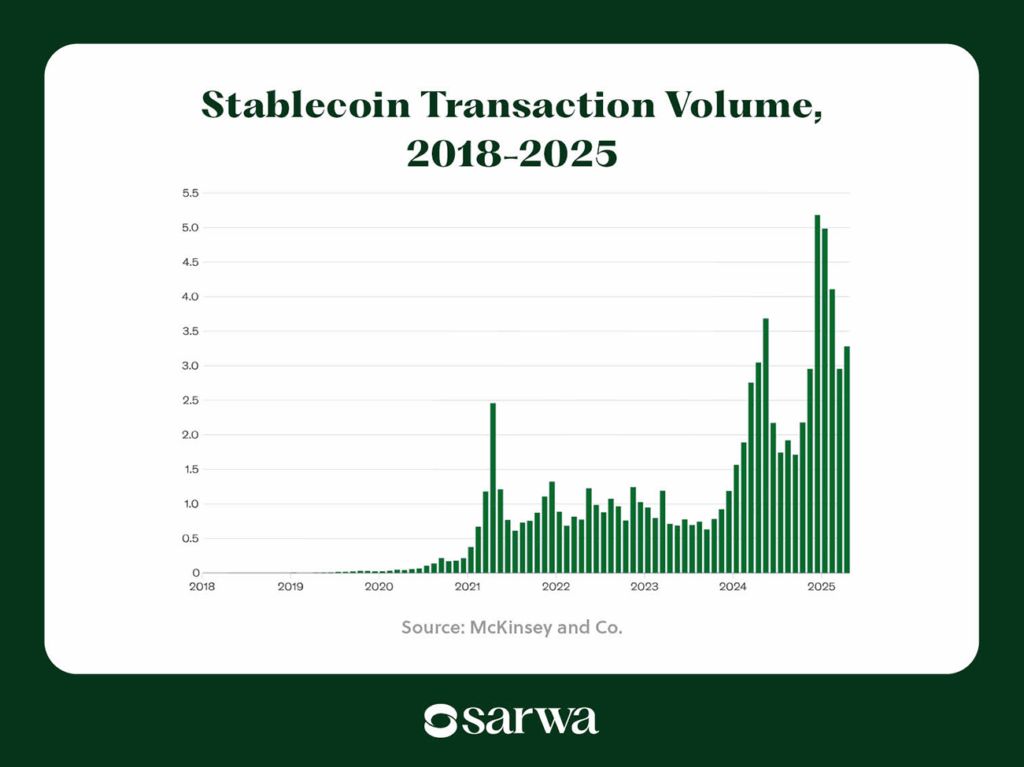

Stablecoin transaction volumes already exceeded $27 trillion per year, from their insignificant beginnings in 2018, as seen below:

Source: McKinsey and Co.

However, because of all these experiments, McKinsey and Co. believe that the future is even brighter. They predict that daily transaction volumes would reach $250 billion in the next three years.

But the impact could even be more massive. “If that rate of growth were to continue, stablecoin transactions could surpass legacy payment volumes in less than a decade—and potentially sooner, based on expanding applications,” they noted.

And all of these would be for the benefit of the powerhouse of stablecoins: Ethereum.

3. Decentralized apps leadership

dApps are software that run on blockchain networks and are powered by smart contracts. They have no centralized control, as they are independently run on the blockchain.

The most popular dApps are decentralized finance (DeFi) apps. These apps support different paths to profit from the cryptocurrency market: lending, staking, borrowing, and trading (especially on web3). However, there are also gaming, social media, music, art, identity, and governance dApps.

Most DeFi are built on the Ethereum blockchain. Of the 4,979 DeFi apps, 1,233 (24.76%) were built on Ethereum. More importantly, of the $139.84 billion total value locked (TVL) in DeFi, $84.01 billion (64.08%) was locked in Ethereum.

The market size of the dApps development market in 2024 (revenue and economic activity of DeFi businesses) was estimated to be $30 billion by Virtue Market Research, a market research company. They expect the market to grow by 18.74% CAGR to become a $70.82 billion market in 2030.

The demand for simplified supply chain management, reliable data security, and cost-effective management of transactions and payment processes will continue to drive demand for dApps.

They also expect DeFi to continue to take the lead, especially in the areas of decentralized exchanges (DEXs), lending platforms, and automated investment products. But demand for gaming, web3, NFTs, and social media dApps is also expected to strengthen.

4. Adoption by institutional investors

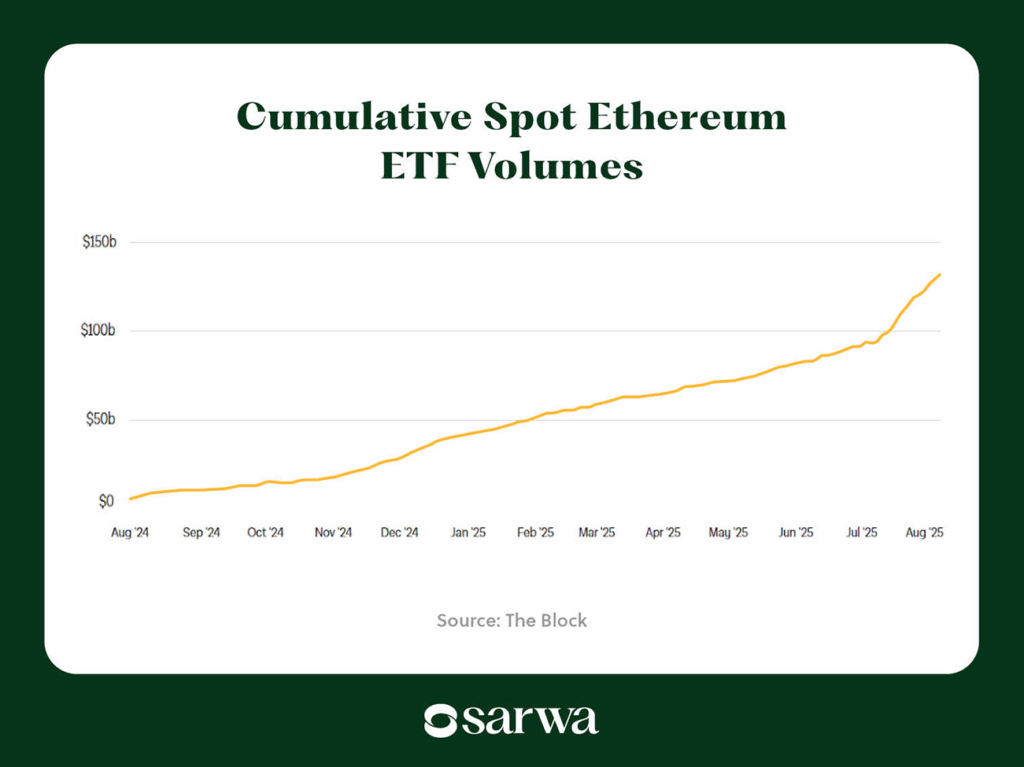

Given Ethereum’s consistency as the most dominant altcoin, it came as no surprise that the Securities and Exchange Commission accepted Ethereum ETFs in 2024. This was a major step in the acceptance of Ethereum by traditional financial institutions (TradFi).

BlackRock, Fidelity, VanEck, Franklin Templeton, Invesco, and Grayscale have all created Ethereum ETFs.

As seen below, the cumulative trading volume of Ethereum ETFs has been on a steady upward trend since then:

Source: The Block

That’s not all.

BlackRock (money market funds), Franklin Templeton (US Treasury fund), and VanEck (US Treasury bills) have all tokenized real-world assets (RWA) on the Ethereum network.

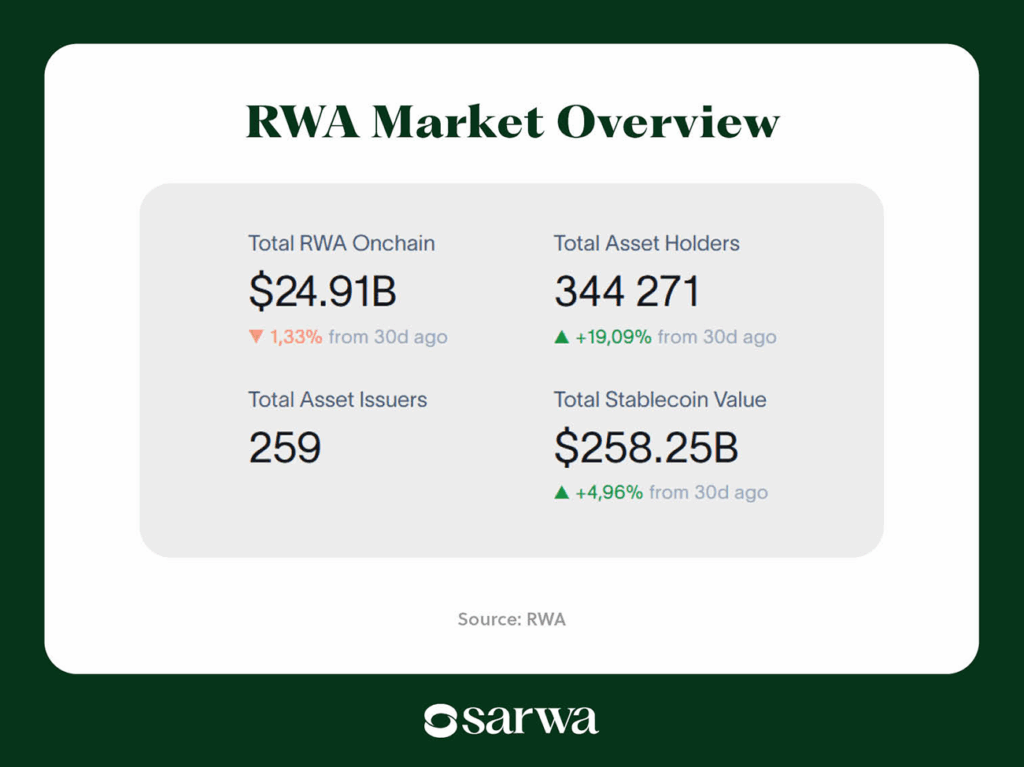

The tokenization market is growing. In early 2024, the market was valued (TLV) at $10 billion, according to Forbes. It’s now worth more than $24 billion, according to RWA, an analytics platform.

Source: RWA

The market share of Ethereum in this tokenized RWA market is 54.02%, according to RWA. As Forbes said, “Ethereum still dominates the tokenized asset landscape, hosting the majority of Real-World Asset value.”

More importantly, Forbes projects that the RWA market will reach $50 billion by the end of the year. It also has the potential to become a $30 trillion market, according to Colin Butler, the global head of institutional capital at Polygon, a layer 2 blockchain.

We also saw above that banks, investment management firms, and central banks are experimenting with stablecoins. Since Ethereum is the preferred network for the issuance and management of stablecoins, more of them will further embrace Ethereum.

Furthermore, governments across the globe are embracing blockchain technologies where Ethereum dominates. These include Ethereum-based stablecoins, cross-border Central Bank Digital Currencies (CBDC) transactions, and smart contracts for voting, identity, governance, and public procurement purposes.

5. Technological advancements

Should you invest in Ethereum?

A final reason for a positive answer lies in the platform’s commitment to constant improvements.

“The transition to proof-of-stake (PoS) and ongoing improvements (like sharding and rollups) aim to reduce energy consumption, lower gas fees, and improve transaction throughput,” according to Capital.com, a financial services firm. “These upgrades directly impact investor confidence and adoption.”

Also, the EIP-1559 update, which was introduced as an overhaul of its transaction fee system, has set Ethereum on the path to becoming a deflationary asset.

“With the introduction of the EIP-1559 update, Ethereum adopted a mechanism that burns a portion of the transaction fees, which can potentially make the asset deflationary,” according to Cryptomus, a cryptocurrency payment platform. “This feature adds scarcity to ETH over time.”

Also, Ethereum has lined up three updates that will improve its efficiency.

“Over the next few years, Ethereum will go through three more upgrades: The Verge, The Purge, and The Splurge,” according to The Motley Fool. “The Verge will improve Ethereum’s scalability without compromising its decentralization. The Purge will clear out its historical data and technical debt to reduce its network congestion and gas fees. The Splurge will provide additional optimizations and minor improvements to ensure its blockchain is running as efficiently as possible.”

There is reason to believe that such a commitment to continuous improvements means Ethereum will continue to be valuable in the ecosystem.

2. The challenges with investing in Ethereum

Should you invest in Ethereum? Well, there are some issues to consider before pressing the “buy” button.

Growing and serious competition

The most important one is that there is a question mark on Ethereum’s ability to maintain its current market share.

It is not for nothing that its competitors are referred to as “Ethereum Killers.” They include Solana (SOL), Cardano (ADA), Avalanche (AVAX), Polkadot (DOT), NEAR Protocol (NEAR), among others.

Most of these blockchain networks were created to remedy certain downsides to Ethereum usage. Thus, they tend to offer lower fees, higher transaction throughput, simpler onboarding, and faster confirmation times. Some of them also operate in certain niches (Solana in gaming), which makes it easier for them to unseat Ethereum in that niche.

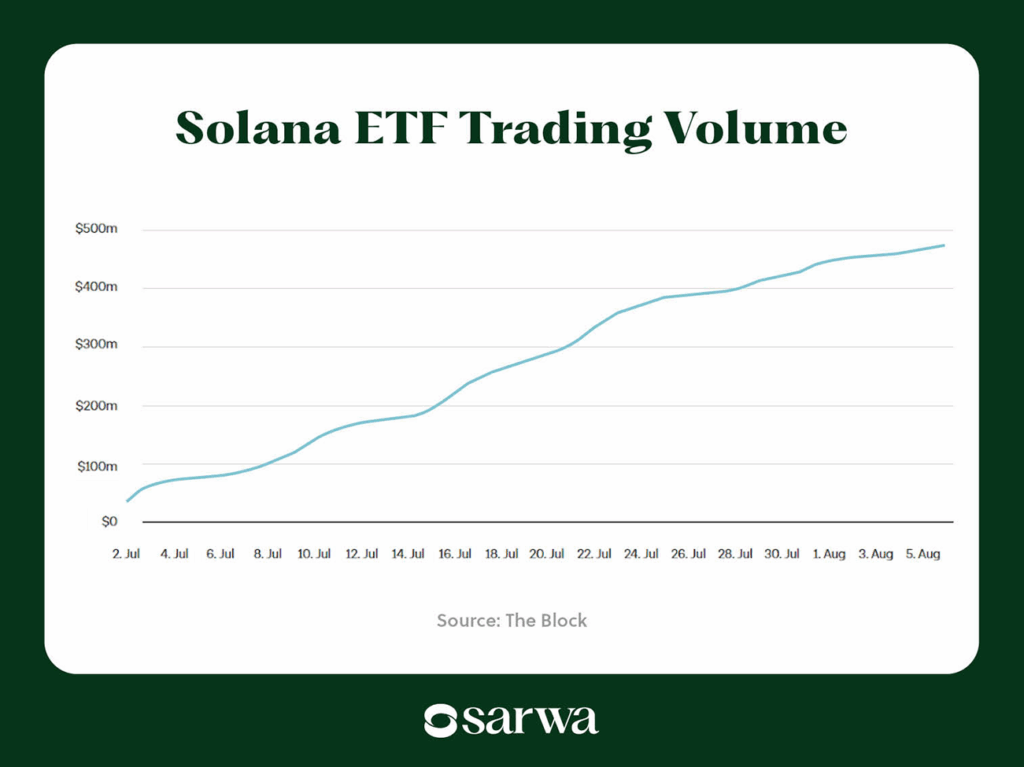

The impact of this competition is already evident in the ETF market. Though there is only a single spot Solana ETF, its cumulative trading volume of $475.34 billion far exceeds that of the Ethereum ETFs ($131.13 billion).

Source: The Block

Of course, Ethereum has been responding to the challenge.

“Ethereum’s Layer 1 blockchain is slower than other PoS blockchains like Solana and Cardano,” according to The Motley Fool. “To keep up with those speedier competitors, Ethereum hosts Layer 2 solutions which bundle together its transactions and processes them off-chain at higher speeds before returning them to its L1 blockchain.”

We have also seen that they make regular network upgrades designed to improve the ecosystem. Three are already lined up, as we saw above.

But no one can be certain how things will play out in the coming months.

“While Ethereum still leads the total value locked (TVL) market with a 51.7% share, it has notably decreased from 61.2% in February 2024,” wrote AInvest in April 2025. “In contrast, Solana’s TVL dominance skyrocketed by 172% within the same timeframe, signifying a shift in investor sentiment towards competing platforms. This trend highlights a pivotal shift within the crypto landscape, where Ethereum is finding it increasingly challenging to attract new users and retain existing ones amid rising competition.”

General macroeconomic situation

Everyone is still waiting for the Fed to reduce the interest rate. If this happens, crypto assets should soar.

However, the Fed is still monitoring the inflation situation. Given that it worsened in June compared to May, it makes sense that they are cautious.

If inflation persists (especially from the impacts of Trump’s tariffs), the Fed may continue to hold the current interest rate or even reduce it.

Volatility

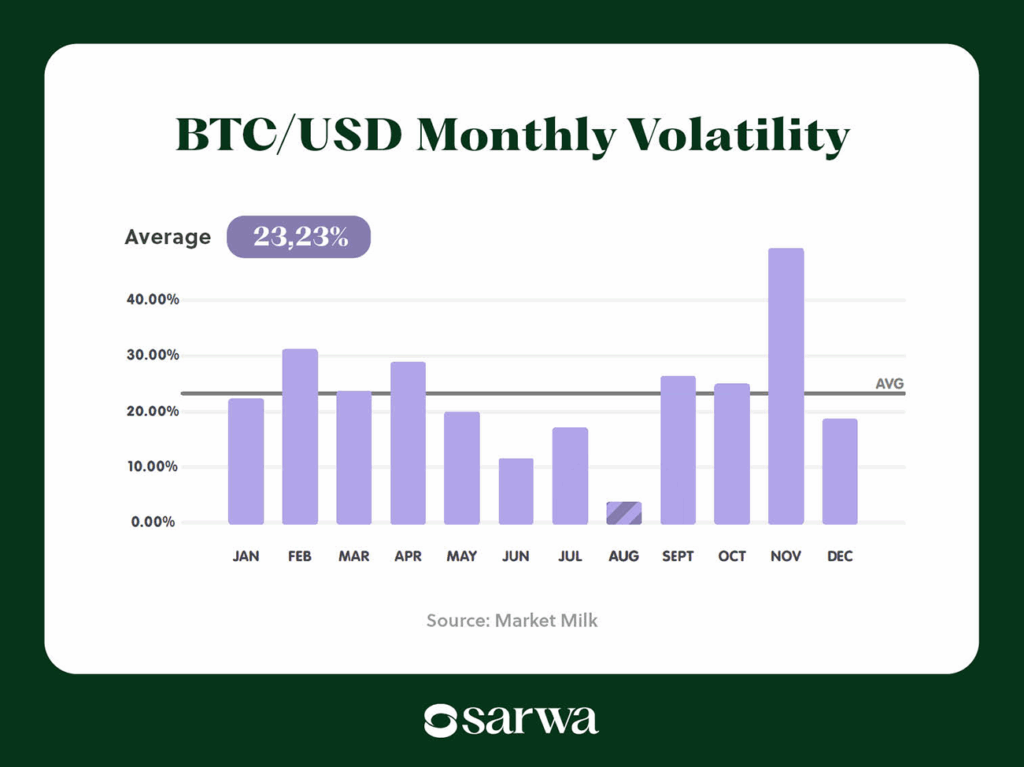

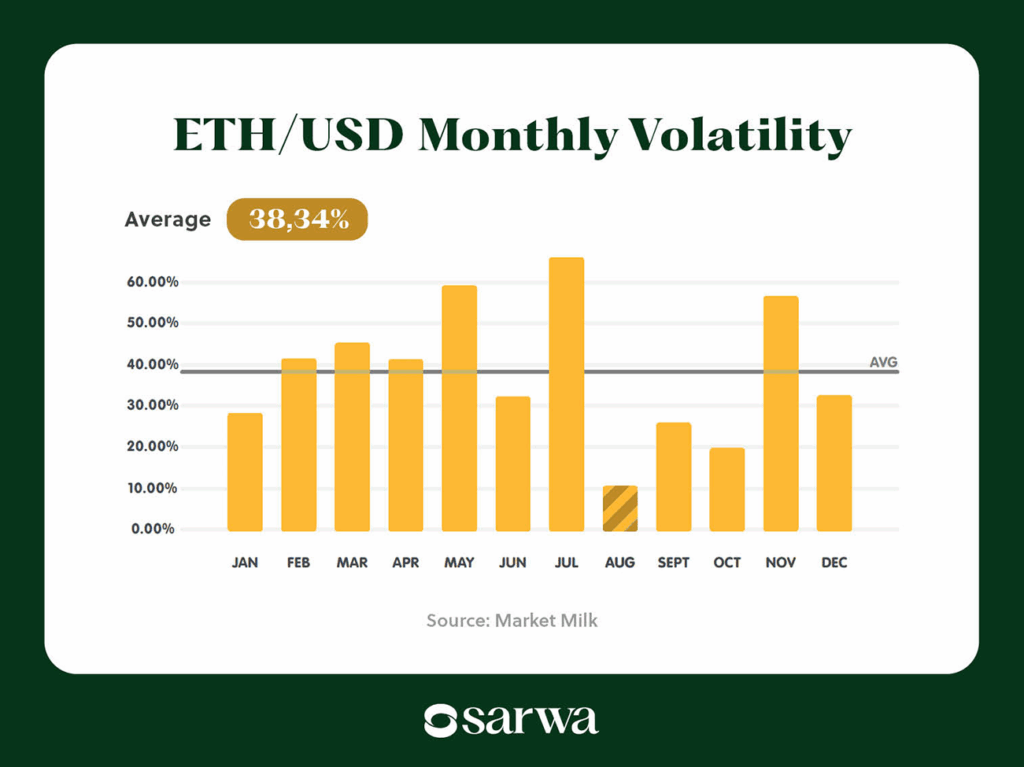

If you are concerned about Bitcoin’s price volatility, then it is worth pointing out that Ethereum can be more volatile than Bitcoin (which makes sense given that Bitcoin is a currency and a store of value).

Over the past 12 months, Bitcoin’s average monthly volatility is 23.23%.

Source: Market Milk

In contrast, that of Ethereum is 38.34%.

Source: Market Milk

Of course, some investors don’t bother about volatility. What matters is that an asset has a higher risk-adjusted return than another. At the time of writing, Bitcoin also has higher risk-adjusted returns. For example, the former’s Sharpe ratio is 2.05, while the latter’s is 0.52.

However, it remains to be seen how these dynamics will change in the coming months. Will there be an alt season (when the price of other types of cryptocurrencies outside Bitcoin, including meme coins, surges), and if so, for how long will it last? If a long-lasting alt season ensues, Ethereum’s risk-adjusted returns can exceed Bitcoin’s.

Interestingly, it is speculation about such alt seasons that add to Ethereum’s volatile price movements.

3. How to invest in Ethereum in the UAE

In the end, a medium-to-long-term investment in Ethereum depends primarily on the safety of its market dominance position. The other concerns we have raised are likely to matter more in the short term.

So, should you invest in Ethereum? Ultimately, it depends on your view of Ethereum’s capacity to retain its market dominance and shrug off competition from other blockchain networks.

If you are confident, then buying Ethereum makes sense.

Even if you are not fully assured, you can reduce your risk by having a diversified crypto portfolio that includes other fundamentally sound crypto investments (some of which are Ethereum’s competitors).

This diversification especially makes sense for investors with low risk tolerance. You can include as many crypto assets as fit with your investment strategy.

If you are in the UAE, you can invest in Ethereum and also create a crypto investment portfolio on Sarwa.

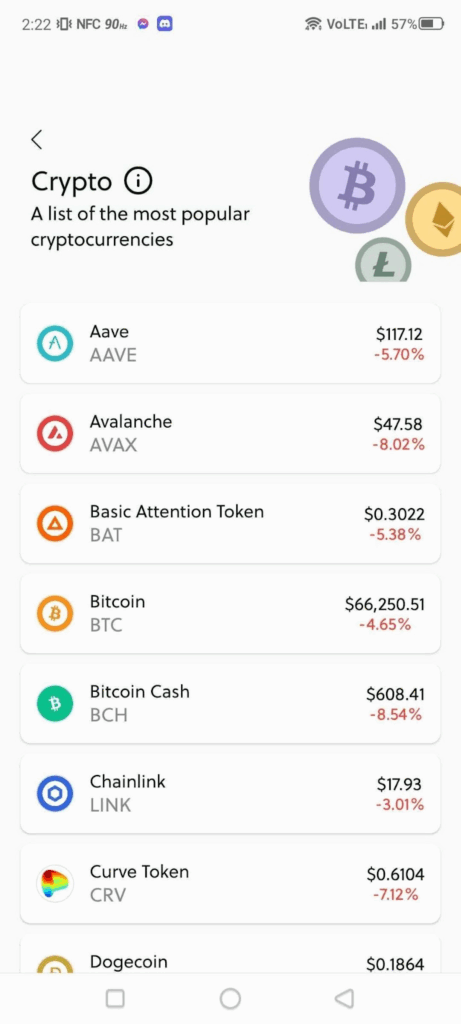

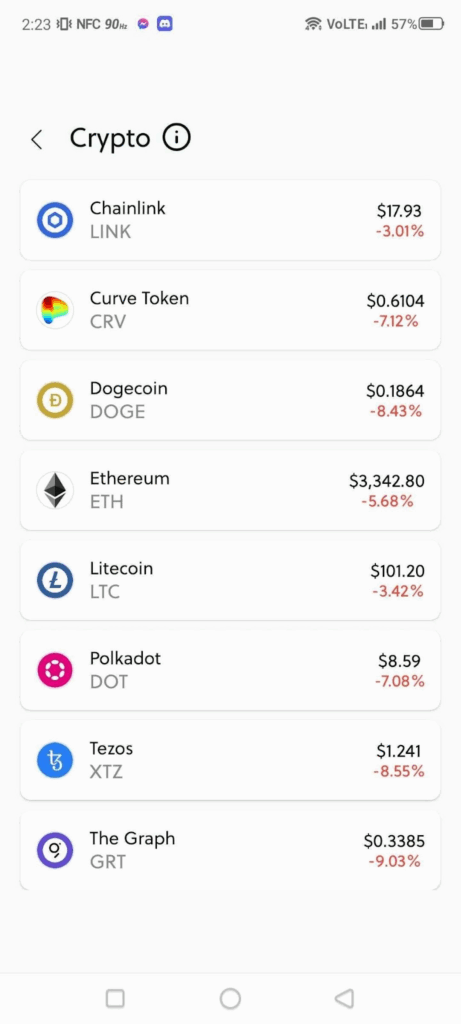

Sarwa provides you with access to the top assets in the crypto market, including Bitcoin, Ethereum, Ripple (XRP), Dogecoin (DOGE), Polkadot, Cardano, Chainlink, among others:

You can purchase these assets without creating a wallet or safekeeping your assets by yourself. With Sarwa, you will buy with fiat and withdraw into fiat. This system protects you from the risk of transferring your assets to external wallets or receiving assets from them.

Deposits to your Sarwa account from your local UAE bank are free, and you can also withdraw to your bank account for free.

Sarwa does not charge any commissions on your trades. There is only a 1.5% spread on the price you see on the platform. We also process deposits immediately, so you can start investing as soon as possible.

You don’t have to be rich to invest in crypto on Sarwa. Also, you can buy a fraction of a share of a coin or token if you can’t afford a share.

We protect your data and money with bank-level SSL security.

Finally, our platform has an excellent user interface, which makes it easy for any beginner to seamlessly invest in any crypto of their choice.

Are you ready to invest in cryptocurrencies in the UAE? Sign up now for Sarwa for seamless, cost-effective, and secure access to the top cryptocurrencies.

Takeaways

- Ethereum dominates DeFi, smart contracts, and stablecoins, making it the most valuable altcoin.

- Institutional support is growing, with major players backing Ethereum ETFs and tokenized assets. Advancements like the switch from a proof-of-work to a proof-of-stake mining system and the EIP-1559 update have made Ethereum more efficient.

- However, it faces stiff competition from other blockchain networks providing lower fees, higher transaction throughput, simpler onboarding, and faster confirmation times. Its high volatility also remains an issue.

- Whether Ethereum will thrive in the medium-to-long term depends on whether it can shrug off competition and maintain its market dominance.