An understanding of what dividends are is important for investors that desire to earn regular income from their investments. So, what is a dividend and how should it affect your investment plan?

A dividend is basically a quarterly distribution of a company’s earnings to its shareholders.

It’s a reward to those who continue to hold the company’s stock. And it is also a useful financial management tool for companies.

For retirees who need regular income from their investments, dividend payments are essential. Similarly, many investors depend on dividends to meet certain expenses (e.g., the quarterly payment of school fees). Others see it as a form of passive income that is fundamental to financial independence.

For all these classes of investors, dividends are an important part of basic financial planning.

In this article, we will take a deeper look at what a dividend is and how an understanding of dividends could impact your investment plan. We’ll cover:

- What is a dividend: An introduction and explanation

- Why do companies pay dividends and how it impacts investors

- How do companies pay dividends

- Dividend investing 101: What you need to know

[Do you want to buy dividend stocks and ETFs that allow you to earn quarterly income from your investments? With Sarwa Trade, you can buy your favourite stocks and ETFs at zero commission and with zero local transfer fees. Sign up at Sarwa Trade to start trading, or contact one of our wealth advisors to learn about how we can help you set up a portfolio of ETFs to passively invest into, as well as automatically reinvest your dividends.]

1. What is a dividend: An introduction and explanation

As said above, a dividend is a portion of a company’s earnings that they distribute to their current shareholders.

The dividend paid by a company as a percentage of its net income (earnings) is called the dividend-payout (DPO) ratio. For example, if Company A earned $1,000,000 in Q1, 2022 and paid $400,000 as dividend, its dividend-payout ratio is 40%.

However, when companies announce dividend payments to the public, they do it on a per-share basis. For example, Coca-Cola has already announced a dividend payment of $0.44 per share for Q2, 2022. This figure is called dividend per share (DPS). So, if Mr. A has 1,000 shares in Coca-Cola, he can expect a dividend of $440.

Based on this, the DPO ratio of a company is its DPS divided by its EPS (earnings per share). It can be calculated on a quarterly or yearly basis.

But what is a good dividend per share, you may ask?

One way to figure this out is by simply comparing the DPS to another company. For example, Coca-Cola’s $0.44 DPS will be better than another company’s $0.24 DPS.

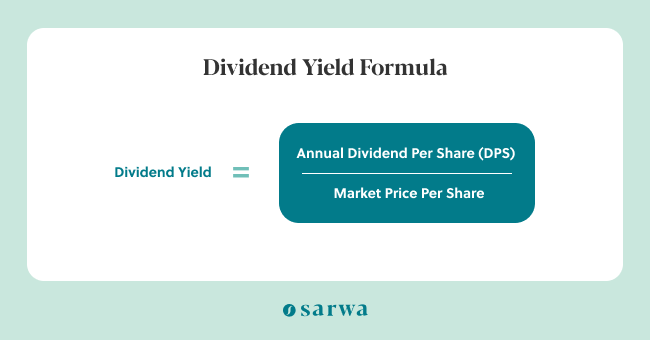

However, DPS is not even the best way to measure the benefit an investor earns from a company’s dividend payment. A better measurement is the dividend yield, which considers the dividend payment in relation to the stock price.

Simply put, the dividend yield is the DPS divided by the share price multiplied by 100. With Coca-Cola currently trading at $64.74, a dividend payment of $0.44 per share will give a dividend yield of 0.68%.

However, dividend yields are often calculated as an annual rather than a quarterly figure.

For Coca-Cola, the expected annual DPS in 2022 is $1.76. At the current share price, that is a dividend yield of 2.72%, which is higher than the 2% average dividend yield of the S&P 500.

This is the figure you want to be comparing with past years, other companies, and the industry average. It’s also the figure fund managers use to select the dividend stocks that will belong to a dividend fund (more on that later).

The payment of dividends is one way that companies choose to reward their shareholders (though companies may have many reasons for paying dividends). And for shareholders, it represents an opportunity to earn income from their investments in a company’s stock.

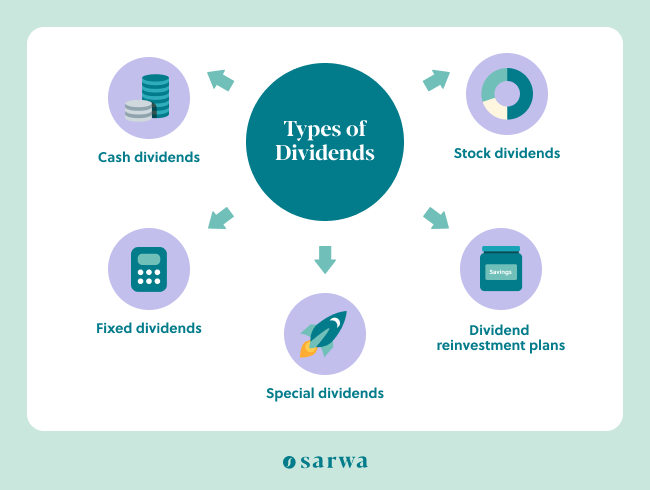

Keep in mind, however, that not all companies pay dividends; but for those that do pay, dividends payment can occur in the following ways:

- Cash dividend: Here, shareholders receive dividends as cash payments into their brokerage accounts, from where they can withdraw into their bank accounts.

- Stock dividend: A stock dividend is a dividend received in the form of new shares of the company. For example, a company can declare a dividend of 0.005 shares for every 1 share instead of say $2 per share.

- Dividend reinvestment plans/programs (DRIPs): A DRIP allows you to automatically reinvest your cash dividends into the company’s stock. Instead of the dividend settling down into your brokerage account, it is automatically used to purchase new shares at current market price (which is often lower immediately after dividend payment).

- Special dividends: Some non-dividend paying companies can decide to pay dividends once in a while (irregularly) for various reasons (more on this below). Such dividends can still be paid as cash dividend, stock, dividends, or a DRIP.

- Fixed dividend: Companies do vary their DPS depending on their earnings and their financial management goals. However, for preferred stocks, which combine elements of a stock and a bond, the dividend is fixed until maturity date.

[For more on preferred stocks and how they differ from common stocks, read “What are Stocks and Bonds? An Investor’s Guide”]

2. Why companies pay dividends and how it impacts investors

Why then do companies pay dividends, apart from the desire to reward their shareholders?

First, companies can pay dividends to give investors a measure of confidence about their stability and profitability. If a company is consistently paying a dividend (and even growing its DPS), it’s a signal to the shareholders that the company is doing well. Such signals will encourage current shareholders to hold on to their shares or even buy more and invite new shareholders.

This is also the reason why companies that already pay dividends find it hard to stop.

Doing so might send a signal that the company is in trouble even if it has other (good) reasons for stopping or skipping dividend payments. Nevertheless, there is no guarantee that a company that is paying regular dividends will keep doing so in the future since they are not under any legal requirement to do so.

Second, companies can pay dividends when they don’t have a better channel/outlet for their earnings. That is, companies pay dividends when they don’t have something better to invest their earnings on. This is especially true for companies that have reached the maturity stage of their lifecycle. At that stage, there is little potential for growth and earnings are better spent rewarding shareholders.

Companies that pay special dividends (irregular dividends) do it mostly for this second reason – no better channel to invest extra funds.

When you combine these two reasons, then it is no wonder that 400 of the 500 stocks in the S&P 500 Index, an index that tracks the largest 500 US stocks, pay regular dividends, according to Dividend.com, a website for all things dividends.

Also, companies in the basic materials, consumer goods, financial, healthcare, and industrials sectors are best known for consistent, regular, and growing dividend payments.

As said in our introduction, these dividend-paying companies are often attractive to retirees and other investors who desire regular passive income.

Given the reasons above, why then do some companies decide not to pay a dividend?

Many companies in the introduction or early-growth stage of their lifecycle choose not to pay dividends because they have numerous opportunities to invest their earnings for growth. Instead, they prefer to invest in these opportunities and grow their share price in the long term.

These companies are often attractive to growth investors who prefer long-term growth in share price over regular income from their investments. Alphabet, Amazon, and Meta Platforms Inc. are some top quality growth stocks that don’t pay dividends.

3. How do companies pay dividends

Once a company decides to pay a dividend (regularly or occasionally), how will it do it?

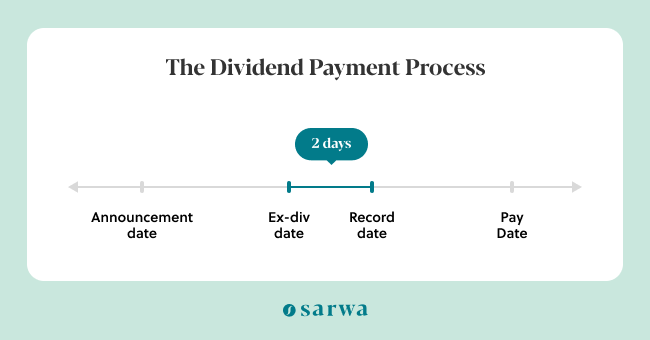

There are four important dates in the dividend payment process:

- Announcement or declaration date: This is the date that the company announces dividend payment for a particular quarter. The announcement includes the DPS, the record date, and the payment date.

- Ex-dividend date: This is the date that the purchase of a company’s share will no longer be subject to dividend payment for that quarter. That is, anyone who buys shares on or after the ex-div date cannot receive a dividend for those shares. The ex-dividend date is set by the stock exchange rather than the company.

[For more on the functions of stock exchanges, read “What is a Stock Exchange: Everything You Need to Know”]

- Record date: Only those who are recognised as the company’s shareholders by the record date or date of record are qualified for dividend payment. The record date is the same as the ex-div date except that the company sets the former while the stock exchange sets the latter as a day before the former.

The ex-div date is earlier than the record date because stocks purchased on the ex-div date may take some time to settle to meet up with the record date.

- Payment date: This is when dividends are paid either as cash, stocks, DRIPs, or fixed dividends.

4. Dividend investing 101: What you need to know

Having considered what is a dividend, let’s now look at dividend investing as an investment strategy.

Dividend stocks and dividend funds

The first task is to look at the different ways to invest in dividend-paying companies.

A dividend stock is the stock of a company that regularly pays dividends. Note that the stock of a company that pays dividends once in a while does not qualify as a dividend stock.

The key difference is regular and consistent payment of dividends.

Popular dividend stocks include Target Corp (TGT), CitiGroup Inc., Walmart (WMT), JPMorgan Chase and Co (JPM), ExxonMobil (XOM), and PepsiCo Inc (PEP).

There are also ETFs, mutual funds, and index funds that combine many dividend stocks into one basket of securities. These can be a basket of dividend stocks in the US market (e.g., Vanguard High Dividend Yield Index ETF), in the global market (e.g., Vanguard International High Dividend Yield ETF), emerging markets (e.g., iShares Emerging Markets Dividend ETF), or the developed markets (e.g., Global X MSCI SuperDividend® EAFE ETF).

[For a look at the best performing international dividends ETFs of recent, read “The 10 Best International Dividend ETFs.”]

Also, they can be a basket of dividend stocks with certain characteristics. For example, there is a class of dividend stocks called dividend aristocrats. These are dividend stocks that:

- Have raised dividends consistently for the past 25 years

- Belong to the S&P 500 index

- Have a market cap exceeding $3 billion (optional for some investors).

ProShares S&P 500® Dividend Aristocrats ETF is an example of a dividend fund that invests in only these dividend aristocrats.

Some funds also filter dividend stocks based on DPS and dividend yield (e.g., iShares Select Dividend ETF) and only include those that meet certain criteria while others only include dividend stocks that also meet certain value criteria (e.g, Vanguard High Dividend Yield Index ETF) or growth criteria (e.g., Vanguard Dividend Appreciation ETF)

Dividend funds help investors to minimise risk by combining various individual stocks into a diversified portfolio. They are also valuable for investors who can’t research and select dividend stocks themselves.

What is dividend investing?

Dividend investing is an investment strategy where investors prioritise dividend stocks and dividend funds. The goal of dividend investing is to earn regular, consistent, and growing (in terms of DPS or dividend yield) dividend payments.

To reiterate, dividend investing is often the preference of retirees and other shareholders who need regular passive income to meet certain expenses or achieve financial independence.

Dividend investing is often contrasted with growth investing where investors prioritise growth stocks and funds that can deliver the best price appreciation over the long term. Growth investing is the preference of investors who don’t care about earning income from their holdings, even though some of them might like to see dividend payments as evidence of a company’s stability.

However, it should be said that this distinction is not absolute.

Many growth stocks pay dividends and many dividend stocks grow as much as growth stocks. Also, as we saw above, Vanguard High Dividend Yield Index ETF contains dividend stocks that are also value stocks while Vanguard Dividend Appreciation ETF contains dividend stocks that are also growth stocks.

Should you use a dividend investing strategy?

If you require a regular and consistent income from your investments, a dividend investing strategy is right for you.

However, an absolute dividend investing strategy might have the disadvantage of low long-term growth in share price (many dividend stocks won’t have better-than-average returns since they are paying dividends with money they could be using to grow the company).

Moreover, there is no guarantee that a company currently paying a dividend will keep doing so.

Nevertheless, you can minimise the impacts of these cons by choosing dividend stocks that also have higher-than-average returns or buying dividend ETFs that also include a criteria of growth or value.

However, if you don’t require a regular payment and your priority is to maximise growth, it’s better to stick to a growth investing strategy.

Are you a dividend investor who wants to buy dividend stocks and ETFs that will provide you with consistent and regular income? With Sarwa Trade, you can buy the stocks and ETFs you want at zero commission fee.

Are you unsure if a dividend investing strategy is the best for you? Schedule a call with a Sarwa Wealth Advisor and we’ll help you make the best choice. And if you prefer to apply a passive investing strategy, we’ll help you set up a customized portfolio that automatically reinvests your dividends.

Takeaways

- A dividend is a portion of a company’s earnings that they distribute to shareholders.

- Companies pay dividends to reward shareholders, to show that everything is going on fine in the company, and when there are little opportunities for business-expanding investments.

- Dividends can be paid as cash, stock, or as a dividend reinvestment program. They can also be variable or fixed, and regular or special.

- Dividend investors seek to earn a consistent and growing income by investing in dividend stocks or dividend funds (ETFs, index funds, and mutual funds).