In recent years, private companies have increasingly chosen to enter global stock markets through a process known as an initial public offering (IPO). But what is an IPO, and how can the average investor distill the hype of a newly listed company from the reality of its long-term performance?

The challenge here for new investors is that there is often an overwhelming amount of sensational news coverage for newly IPO’ed companies.

In fact, you’ve probably heard of one of the newly listed companies below. In 2021, unicorn companies (that is, companies valued at more than $1 billion) like Blend (a lending platform), Coursera (a massive open online courses platform), Robinhood (a stock trading platform), Duolingo (an education technology company) and UiPath (a robotics company) were among the popular IPOs in 2021, generating widespread global interest among investors and the media.

But what is really involved in an IPO, and how does it affect you as an average investor?

In this article, we’ll answer these questions and more. We’ll cover:

- What is an IPO: An introduction

- What is the purpose of an IPO?

- Understanding the IPO process

- Pros and cons of IPOs

- Should you invest in an IPO?

At the end of this article, you will have a thorough understanding of what IPOs are and what you should do – or not do – about them as an investor.

[Do you want to buy US stocks in the UAE? Create an account with Sarwa Trade to easily start buying and selling US stocks at zero commission, and with zero local transfer fees. You can start investing with as little as $1.]

1. What is an IPO: An introduction

An IPO (initial public offering) is a process whereby a private company starts to be publicly traded on a stock exchange.

The incentive for companies to go public is clear. Private companies cannot raise money from the general public (they are financed by founders, venture capitalists, angel investors, private equity firms, among others), while a public company can.

Therefore, an IPO is really a process through which a company becomes eligible to raise money from the general public by selling its shares. In essence, it’s often the first time that a company will offer its shares to the general public to begin raising more investment.

What is an IPO: A brief history of the initial public offering

The history of IPOs goes way back to Dutch East India Company, an exporting business that issued shares and bonds in 1602, and it is considered to be the first publicly traded company. In the late 1700s, many public companies were also formed in the US with the Bank of America raising $8 million in its 1791 IPO.

Since then, transformative companies like Goldman Sachs and Co., Ford Motor, Apple, Pepsi, AT&T have also raised significant amounts from IPOs.

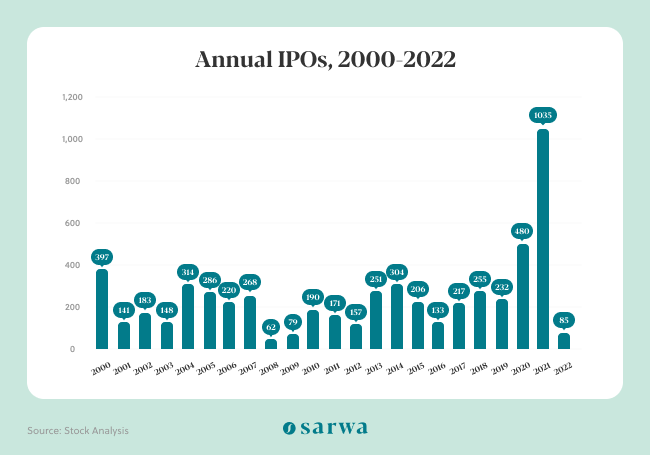

IPOs reached a fever pitch during the dot-com bubble of the late 1990s and the early 2000s, with many technology companies going public. However, many of these IPOs failed and the IPO craze slowed down until picking up again in 2004.

During the 2008/2009 financial crisis, interest in IPOs stumbled as individuals and companies struggled to deal with the crisis.

Nevertheless, following the recovery from the 2008-2009 financial crisis, IPOs have become popular again with many unicorn private companies going public, leading to increased public interest.

The IPO market reached a peak in 2021 when 1,035 companies went public, a 120.4% increase from the 480 IPOs in 2020, according to data by Stock Analysis, a company monitoring IPOs in the US.

Research by PwC also shows that globally there were 2,682 IPOs raising $608 billion in 2021.

This massive and sudden interest has also led to the creation of IPOs ETFs that combine many IPOs into a single basket to offer diversification and reduce risk.

However, not everyone is very excited about the surge of IPOs. According to Warren Buffett, IPOs amount to a negotiated deal since the seller is the one who decides when to come to the market and “negotiated transactions are very hard to get bargains” on. (Instead, Buffett prefers to wait until companies prove their maturity – as opposed to recently IPO’ed companies with no public track record.)

Also, research by Dimensional Fund Advisors showed that 6,000 IPOs between 1991-2008 had an average one-year return of less than 4%, which is 2% less than the average one-year return of the Russell 2000 Index, an index of the smallest 2000 stocks in the US equity market.

More on that later on.

2. What is the purpose of an IPO?

Already we have seen that companies go through an IPO so that they can raise money from the general public. However, there are other reasons why companies may decide to go through an IPO.

So, what are the varying purposes of an IPO for companies?

- IPO as an exit strategy: A private company can go public when its founders and early investors are seeking to cash out on their investment and exit their stake (or a portion of their stake) in the company. They sell their stake in the company for profit in an IPO, leaving the general public as the new shareholders (that is, the owners).

- IPO as a way to raise more significant money: A private company can grow to the point where it requires more significant sums to grow and expand its operations. If such funds are not available through private channels, the company can decide to go public to raise them.

- IPO as a way to boost public image: Public companies have a certain image among the public that private companies don’t have. This is because they are more transparent (as per stock market legal requirements) in reporting their state of affairs. A private company can therefore go public to boost its image.

- IPO as a way to borrow money on better terms: A corollary of good public image is that banks and other financial institutions tend to give public companies better lending terms due to the transparency of their reporting. A private company in need of better lending terms can therefore consider going public.

3. Understanding the IPO process

Now that we know what an IPO is and some of the various reasons private companies make the decision to go public, let’s consider what the typical IPO process looks like.

Once a private company has decided to go public, these are the usual steps they will take:

Selecting an underwriter and other relevant parties

Since the IPO process is very complex, the company cannot usually go solo.

They often require the services of at least one underwriter, CPA (certified public accountant), legal advisor, and some experts associated with the organisation responsible for public companies in the country (the Securities and Exchange Commission [SEC] in the US, for example).

However, the underwriter is the most important party in the IPO process. Basically, an underwriter is a financial institution that agrees to take up the risk of another organisation.

In the IPO process, the underwriter (usually an investment bank) is responsible for setting the IPO price, the IPO date, and the number of shares to be issued. The underwriting institution will also be primarily involved in preparing necessary documentation, marketing the IPO (which includes looking for investors before the IPO date), and assigning shares to those investors.

The underwriter also “guarantees that a specific number of shares will be sold at that initial price and purchase any surplus,” according to Investopedia. In this way, the bank takes up the risk in the case that the private company does not sell all its shares on the IPO date.

However, not all underwriting arrangements involve this element. The Corporate Finance Institute differentiates between four types of underwriting arrangements:

- Firm commitment: Here, the underwriter guarantees the company that a certain amount will be raised from the IPO.

- Best efforts agreement: The underwriter is only required to do its best to sell all the shares; there is no guarantee that it will raise a certain amount.

- All or none agreement: The whole IPO is cancelled if the underwriter cannot raise a certain amount.

- Syndicate of underwriters: The lead underwriter works with other underwriters to make a firm commitment.

The nature of the agreement between the underwriter and the company will be contained in the engagement letter, letter of intent, and underwriting agreement.

Preparing and submitting necessary documentation

Next, the company works with the relevant parties above to prepare all the necessary documents required by the government agency in charge (such as the SEC in the US).

Relevant documents will typically include a prospectus (contains details about the offering), the company’s financial reports, and private fillings. Other relevant information include management background, insider holdings, the proposed ticker symbol for the company, among others.

In the US, all of these documents and fillings are done through a Registration Statement submitted to the SEC, who will verify the information contained therein.

Initial prospectus and marketing

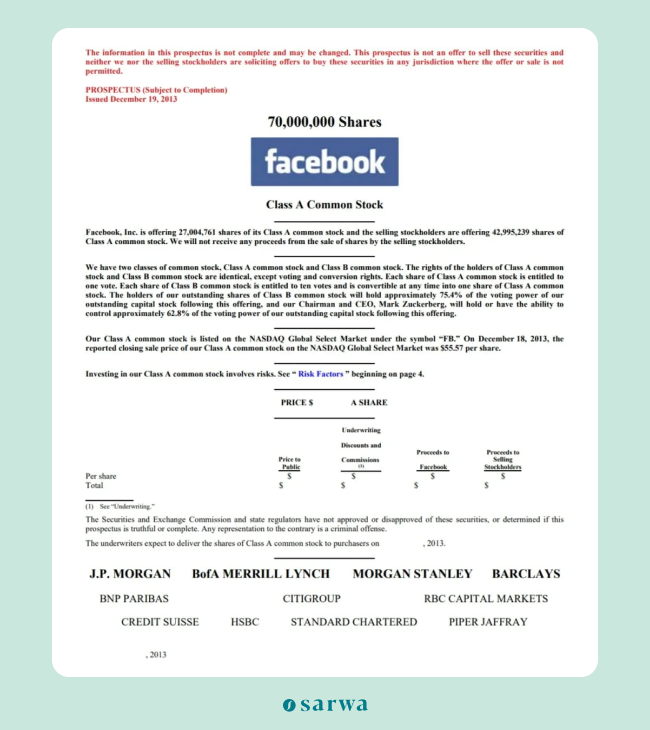

Once the SEC has approved the IPO, the company with its underwriter will create an initial prospectus (also called the Red Herring document) that includes the details of the company going public.

This initial prospectus is the document upon which the underwriter will base its marketing efforts.

Marketing here is a process by which the underwriter looks for institutional investors (financial institutions) that are interested in the IPO. The interested institutions will bid for a certain number of shares at a particular price.

Through this process, the company can gauge the demand for its shares and find the best IPO price (issue price or offer price) that will maximise sale on the IPO date. IPOs are often underpriced (priced below the actual value of the company) to encourage more sales and compensate the investors who are taking the risk to buy at the IPO date.

Before the IPO date, the company will agree with the underwriter on a particular offer price and the number of shares to be issued.

Below is a sample IPO prospectus from a company you’ve probably heard of – Facebook (now known as Meta Platforms).

Sample Prospectus: Facebook

Source: Corporate Finance Institute

The IPO date

On the IPO date, the company issues its shares at the offer price and waits for those who have shown interest (mostly institutional investors) to purchase them.

The number of shares sold and the offer price will now determine what will be included as Shareholders’ Equity on the company’s Balance Sheet.

- The pros and cons of IPOs

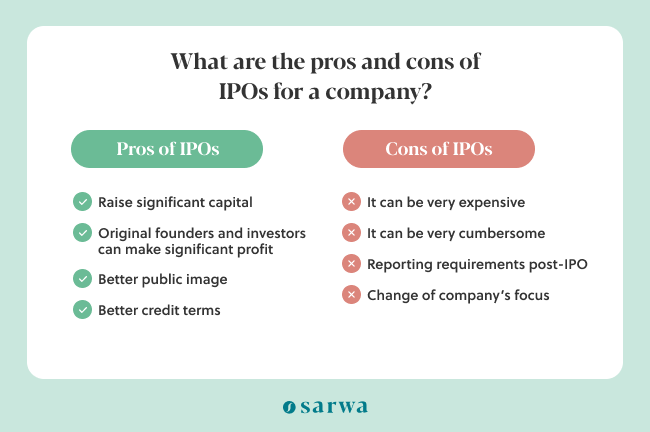

Before considering whether you should invest in an IPO or not, let’s briefly look at the pros and cons of IPOs from the perspective of the company.

Pros of IPOs

- Raise significant capital: An IPO is an opportunity to raise more capital than would have been possible through private channels.

- Original founders and investors can make significant profit: It can also offer opportunities for initial founders, investors, and employees to make significant profit from the work they have done when the company was still private.

- Better public image: Due to the better transparency of public companies, investors and the general public tend to attribute a higher level of prestige to them compared to private companies. This better public image can be good for business.

- Better credit terms: One way this occurs is that the company, with better public image, can negotiate better credit or lending terms.

Cons of IPOs

- It can be very expensive: Putting together a team of experts to undertake an IPO can be very expensive.

- It can be very cumbersome: An IPO requires so much documentation. Also, a new public company has to form a board of directors (BOD) chosen by the shareholders. All of these can be cumbersome.

- Reporting requirement post-IPO: Public companies need to prepare quarterly and yearly financial statements that must adhere to essential financial reporting standards. This will require more expensive and extensive accounting than the private company is used to.

- Change of company’s focus to shareholders: The public company might start focusing more on share price and what the shareholders want in the short term rather than the mission and vision behind the company and its long-term goals. This can even lead to conflict between the company’s managers and the board.

5. Should you invest in an IPO?

So now that you know what an IPO is, you are probably asking how all this information above is relevant to the average investor.

It’s simple.

As mentioned above, companies tend to reduce their offer price in order to sell more shares and compensate early investors who are taking the risk of investing in them. Consequently, investors who are seeking high returns buy companies at IPO price as a way to maximise returns.

For example, Facebook (now Meta) went public on May 17, 2012 at an IPO price of $38. Currently (at the time of writing), Meta is now worth $231.84 per share, a 510% return from its IPO price.

However, as an investor, buying stocks at an IPO also has its cons.

First, if the stock plummets after the IPO and ends up failing, you lose your investment. This the product of the inherent risk of investing in a company that just entered the market.

For example, in the dot-com bubble, Webvan, a grocery delivery service, launched an IPO in 1999 at an offer price of $15. On the IPO day, the stock went as high as $34. However, the stock began to plummet until it reached $0.06 per share. The company went out of business in 2001.

It is important for new investors to know that there are many IPO stories just like this. Even when the company does not go out of business, they might never reach their IPO price again.

Second, if the stock plummets after the IPO and ends up rising, it means you did not maximise your returns since someone else who bought at lower prices after the IPO will earn more returns if they hold it for the same period.

For example, Facebook fell below its IPO price and was less than $38 for the next 15 months. Anyone who purchased during that period would have earned higher returns than the person who took more risk buying during the IPO. If Mr. B bought Facebook at $15 months after IPO, he would have earned 1,445.6% compared to the 510% return of Mr. A who bought at IPO.

In essence, IPOs are risky.

There is the risk of business failure and of the stock price never rising beyond IPO price in the long term, and the potential returns can even be less than those enjoyed by people who don’t buy at IPO price.

In fact, Warren Buffet compared them to lotteries and cautioned investors against them: “You don’t have to really worry about what’s really going on in IPOs. People win lotteries every day but there’s no reason to let that affect [your investing strategy] at all … You don’t want to get into a (foolish) game just because it’s available.”

Consequently, before investing in a recently IPO’ed company, keep two things in mind:

- Ensure the company is truly a good company beyond the IPO noise: Nothing can beat doing your own research and evaluating the fundamentals of the company. Though private companies don’t have published financial reports, you can still learn about the business and consider if it has a durable competitive advantage (or economic moat) in its industry.

In simple terms, what does it do better than its competitors (that is relevant to its earnings potential) and can it continue to do it better?

You can also evaluate the team’s management and consider if they are the kinds of people (based on their history) you can trust to steer the company towards increasing profitability.

[For more on how to evaluate companies, read, “What You Can Learn From Warren Buffett’s Top Stock Holdings”]

- Ensure the company is not overvalued because of IPO hype: One of the lasting legacy of Benjamin Graham, Warren Buffet’s mentor, is the principle of value investing. This principle states that you should not pay more for a company than it’s actually worth.

It’s harder to value a recently IPO’ed company simply because they have only been public for a short time, but you can still gain some insight by comparing similar companies who are already public. If Company A is trading at $45 and it is better in the industry than Company B, who is offering an IPO price of $80, then Company B is likely overvalued.

In that case, wait until the price falls to what you consider a fair price. And like Mr. B in the example above, you can end up earning more than Mr. A who bought at the IPO price.

How to purchase at IPO

If after this analysis, you have decided to purchase a company at IPO, how do you do it?

As a retail investor, you can’t get in on an IPO directly. You have to place an order through a financial institution (stock brokers in this case) who have placed a bid with the underwriter during the marketing stage.

However, placing an order is not a guarantee that you will get in at IPO price.

If you don’t, be patient. Remember the fair price you have determined and don’t buy above it because of anxiety to get in as soon as possible. This is called the Fear of Missing Out, and it can be dangerous for new investors.

Getting in at IPO price at all cost should only be for traders who are seeking quick gains at high risk. As a new investor, you should instead stick to your investment plan and buy when the company’s stock price becomes less volatile.

This is specifically why investors like Buffett do not like investing in recently IPO’ed companies.

However, there are still ways for investors to easily gain access to newly IPO’ed companies.

Recently, some companies have started creating ETFs of companies that have been purchased at the IPO (we have Renaissance IPO ETF [IPO] and First Trust US-Equity Opportunities ETF [FPX]). By combining many IPOs in one fund, these ETF providers hope to reduce the risk of investing at IPO through diversification.

[For more on the benefits of ETFs over individual stocks and mutual funds, read, “Why Invest in ETFs? Explaining the Popularity of The Go-To Fund”]

However, though an ETF of IPOs can reduce risk through diversification (and even increase returns), it does not remove the underlying risk of purchasing stocks at IPO price.

And with an ETF, you don’t have control over the basket of stocks that are being put in there.

As a smart investor, you’ll need to compare the return and risk of such ETFs and decide if you are willing to take on the extra risk.

[Do you want to buy US stocks and ETFs from the UAE? Register an account with Sarwa Trade and you can buy your favourite stocks and ETFs at zero commission, and with zero local transfer fees.]

Takeaways

- An IPO is a process whereby a private company becomes a publicly traded company.

- An IPO allows a company to issue shares to the general public

- Companies decide to go public to raise more capital, improve public image, get better credit terms, and as an exit strategy for founders and investors.

- IPOs can be very expensive and cumbersome. And becoming a public company also comes with various cons.

- Before investing in an IPO, ensure you consider if the company has good long-term potential to grow and that the IPO price is right.

- You can purchase shares at an IPO through a broker or you can buy an IPO ETF.