If you know anything about options, you probably know them as a risk management (or hedging) tool deployed by hedge funds and other genius investors and traders.

Though you are right to see options this way, they provide more value than this. Options are also a good way for retail traders to make money. If done right, you can consistently make money from trading options. Good news – you don’t have to be a genius to figure it out.

How much money can be made trading options? It depends on your initial capital (account size), trading strategy, and risk management strategy.

In this article, we consider the steps you can take to start making money from options and how much you can expect to make from trading options. We’ll cover:

- Understand what options are

- Choose between buying and selling options

- Decide on your preferred options trading strategy

- Create a trading account

- Conduct fundamental and technical analysis

- Choose the preferred account size and risk management strategy

- Understand the risks of options trading

Do you want to learn more about derivatives like options? Subscribe now to Sarwa’s Fully Invested newsletter for a better understanding of the financial markets.

1. Understand what options are

Warren Buffett once advised that no one should invest in a business they do not understand. That sage advice also applies to the financial markets – don’t invest in an asset or asset class you don’t understand.

Of course, no one can perfectly understand any asset. However, a basic knowledge of what the asset is about – how it works, how people make and lose money from it, and who it is appropriate for – is needed before plunging into it.

If you are new, you can start by learning what is options trading in the stock market and then move on to learning the major stock options trading strategies. With this basic knowledge, you will be ready to make money from the market.

For more regular updates about how options work and how you can profitably trade them, you can keep a tab on Sarwa’s blog and subscribe to our newsletter.

Don’t stop reading if you don’t understand the basics yet. This article is for beginners, so we have kept everything simple for anyone to understand.

2. Choose between buying and selling stock options

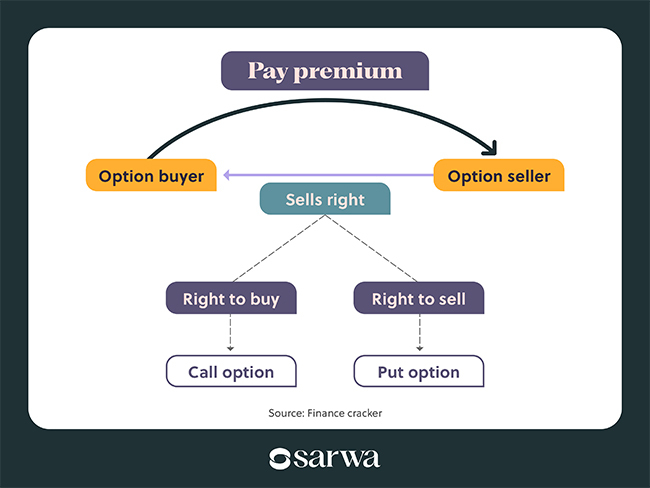

A stock contract is an agreement between two parties (the buyer and the seller) that gives the option buyer the right to buy or sell the underlying asset (in our case, stocks and ETFs) at a specific price on or before a given date.

For example, A and B can agree to an option contract that gives A the right to buy 100 shares of Apple at $210 on or before July 1, 2025. Let’s also assume that the option’s price is $1.50 per share.

In this case, A is the option buyer (the holder of the right), B is the option seller (option writer), $210 is the strike price, July 1 is the expiration date, and $1.50 per share is the option premium.

Also, note that 1 option contract represents 100 shares of the underlying asset. Thus, if A wants the right to buy 500 shares of Apple, he would purchase 5 option contracts.

How option sellers make money on the expiration date

The option seller or writer does not have any right. Also, whether he has an obligation or not depends on the option buyer’s decision to exercise the right or not.

Let’s continue with our example.

If the market price of Apple never goes above $210 until July 1, then it does not make sense for A to exercise the right to buy the stock at the strike price. Why buy at $210 when the stock is trading at or below $210 in the market?

In this case, A will not exercise the right, which means B does not have any obligation.

However, A’s decision not to exercise the right does not affect the option premium that B has already collected (option premiums are paid upfront). In other words, B can earn $150 (at $1.50 per share) in this option contract without doing anything (passive income).

If you have heard of people talking about how they earn consistent passive income from options trading, they are probably option writers. By understanding the trend of the market, you can make money selling option contracts.

How option buyers make money on the expiration date

Let’s turn the tables around and assume that the price of Apple went as high as $230 on July 1.

In this case, the option buyer will exercise his right and purchase the stock at $210 per share. He can then sell in the market for $230 with a gross profit of $20 per share and a net profit of $18.50 per share (after deducting the option premium of $1.50).

Two things remain to be said at this point:

Calls and puts options

The example above – where A has a right to buy Apple – is called a call option. There is another type of option – puts. With puts, the option buyer has the right to sell the option contract to the option seller.

Suppose C and D enter into a contract where C has the right to sell 100 shares of Meta to D for $700 on or before July 1 at an option premium of $1.50 per share.

If the price of Meta stays above $700 throughout the lifetime of the option, then it makes no sense for C to sell to D for $700 when she can go into the stock market and sell for more than $700 per share.

Rather, C would allow the option to expire worthless, which means D will pocket $150 in premium for doing nothing.

On the other hand, if the price stays below $700 in the market for the underlying, it will make sense for C to sell for $700 and make a profit. If the current price is $680, she can buy for that price and sell for $700 for a $20 per share gross profit or an $18.50 per share net profit.

It’s also possible that C already has 100 shares of Meta as of July 1. In that case, the profit will depend on how much she purchased those shares.

How option sellers and buyers make money before expiration

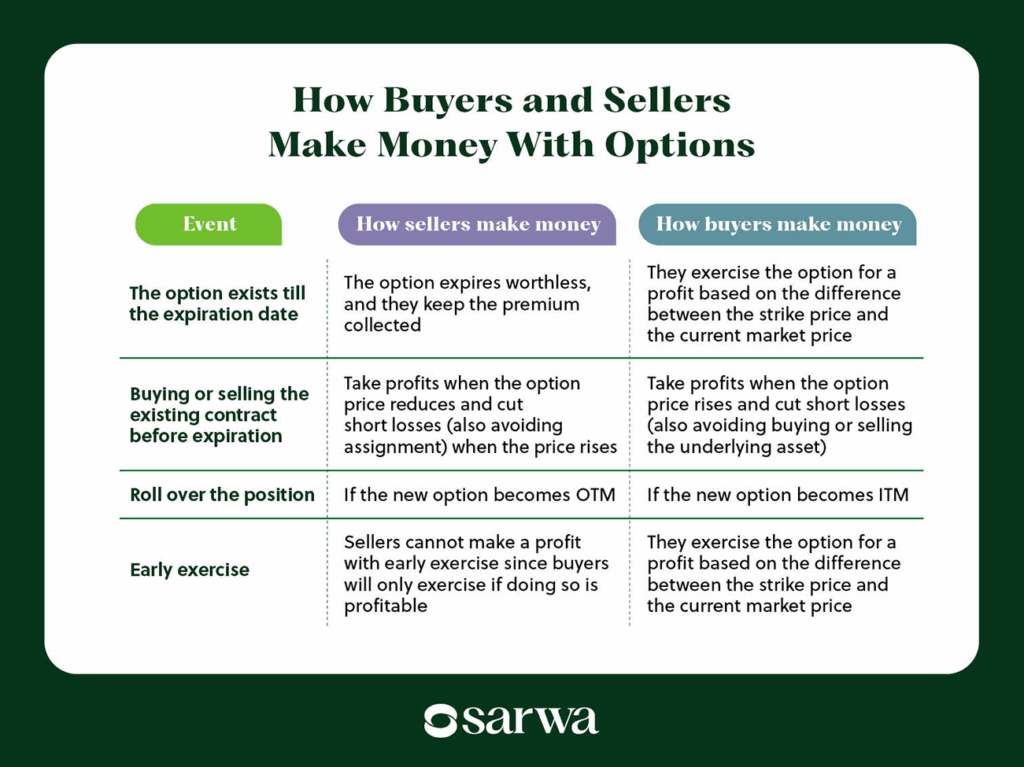

In actual practice, most option contracts don’t last until the expiration date. Sellers and buyers can decide to take profits or cut short their losses before expiry by closing their positions, rolling over their positions, or, in the case of buyers, exercising their right early.

Since all of the alternatives are still part of making money from option trading, we will consider them in turn.

However, some words on option pricing are necessary.

Options pricing and moneyness

The option premium (the $1.50 per share in the two examples above) is also known as the option price. There are two components to the option price – the option’s intrinsic value and its time value.

An option’s intrinsic value is the difference between its market price and its strike price.

A related concept is the moneyness of an option. An option’s moneyness determines if it has intrinsic value or not. When an option is in the money (ITM), it has intrinsic value; if it’s at the money (ATM), it has no intrinsic value (but could have time value, more on that in a bit); if it is out of the money (OTM), it has no intrinsic value.

Let’s consider how these terms work for call and put options:

- For call options (the first example we used), the contract is in the money (ITM) if the strike price is lower than the current market price. Remember that the right to buy at a strike price only makes sense for the option buyer when the current market price is higher than the strike price.

To go over the example we used, the option buyer would only exercise the option if the current market price is above $210. That’s the time it makes sense to buy at the strike price of $210 and then sell at the higher current market price ($230 in our example) for a profit ($18.50 net profit in our example).

If the strike price is equal to the current market price, the call option would be at the money, and if the strike price is higher than the current market price, it would be out of the money (since it would make no sense for the buyer to exercise the option).

- For put options, the contract is ITM if the strike price is higher than the current market price. Again, we saw from our example that it only makes sense for C to exercise the put option if the market price is lower than the strike price. This is when she can buy at a lower market price ($680 in our example) and sell at the higher strike price ($700 in our example) for a profit (net profit of $18.50 in our example).

A put contract becomes ATM when the strike price equals the market price and OTM when the strike price is lower than the current market price.

The second component of the option price is the time value. It represents the possibility that the option can become profitable (that an OTM option can turn ITM) before expiration.

Since the closer we are to expiration, the less time the option has to turn profitable, the time value of an option decreases over time (what is called time decay).

Another thing that affects time value is volatility. If the underlying asset is very volatile, the possibility of the option turning profitable is higher than if the underlying asset is stable.

When an option is ITM, far from expiration, and very volatile, its option premium will be high. If any of these factors turn around (becomes OTM, time decay sets in, volatility reduces), the option premium reduces.

One final point: when the price of an option increases (usually because it goes more ITM), it becomes more profitable for the buyer; on the other hand, if the price decreases, it becomes more profitable for the seller.

Now that we understand these concepts, let’s go back to closing option positions.

For sellers, the two options are:

- Buying the contract before expiration: If the price of an existing option contract decreases, the seller can buy back the option before it expires to take profit.

Let’s go back to our example.

For the call option, B received $1.50 as the option premium. If the call option’s price reduces to $1.20 (which means it is becoming less ITM and trending more towards OTM), the seller can buy back the contract at $1.20. This will lead to a net profit of $0.30 per share (he sold the contract and received $1.50 and bought it back by paying $1.20).

B can make this decision because he believes that the trend will soon change, and the option will become more ITM, which, as we said, is bad for the seller.

Sellers can also buy back the contract to cut short their losses or avoid assignment (having to buy or sell the underlying asset to fulfil the contract).

For example, if the price of the option rises from $1.50 to $2 (it becomes more ITM, which is favourable for buyers not sellers), B can decide to buy back the option and cap his losses at $0.50 per share and/or avoid having to sell 100 shares of Apple to A.

Sellers do this if they believe that the stock will continue to go deeper ITM.

- Rolling the position: Buying back an option contract means the seller is out of the deal for good. If they prefer to still have a position even while cutting losses, avoiding assignment, and taking profit, they can choose to roll over the position instead.

Rolling over a position means buying back an option and then selling a new one with a different strike price or expiration date.

For sellers taking profits, this is a good option if they want to take a little profit while still holding on for bigger ones. On the other hand, sellers cutting short losses and avoiding assignment can roll over if they believe that the current trend causing the option to go deeper ITM will soon reverse, and it will become OTM down the line.

For buyers, there are three options:

- Selling the position: Buyers can sell an option contract if its price rises (it is becoming more ITM) to take profits.

In the second example above (the put option example), C can sell the option if the price rises to $2. This means she will receive $2 per share after paying $1.50 per share for the original position, for a $0.50 profit per share. C can do this if she believes that the trend will soon change and the option will become OTM or less ITM.

On the other hand, a buyer can sell an option before expiration to cut off losses and ensure the contract does not expire worthless. For this example, if the price falls to $1.20, C can sell for a $0.30 loss per share. If she held on to it and it expired worthless, she would have lost $1.50 per share. This decision makes sense if C believes the current trend will continue and the option will only keep becoming more OTM.

- Rolling the position: Like sellers, option buyers can also choose to roll over their positions instead — by selling their contracts and then buying a new one with a later expiration date or different strike price.

They can do this if they only want to take little profits while waiting for bigger profits, or cut short temporary losses to enjoy some more fundamental profits that will still materialize. In essence, rolling over is a good strategy for buyers who believe the current trend is temporary and their initial forecast will still be fulfilled.

- Early exercise: For American options (in contrast to European options), buyers can exercise their rights to buy or sell within a time frame lasting from when the contract was purchased to the expiry date. If the deal is already favourable, the buyer can decide to exercise the right. This is often a good option if the buyer wants to own the underlying asset instead of just making money from the options market.

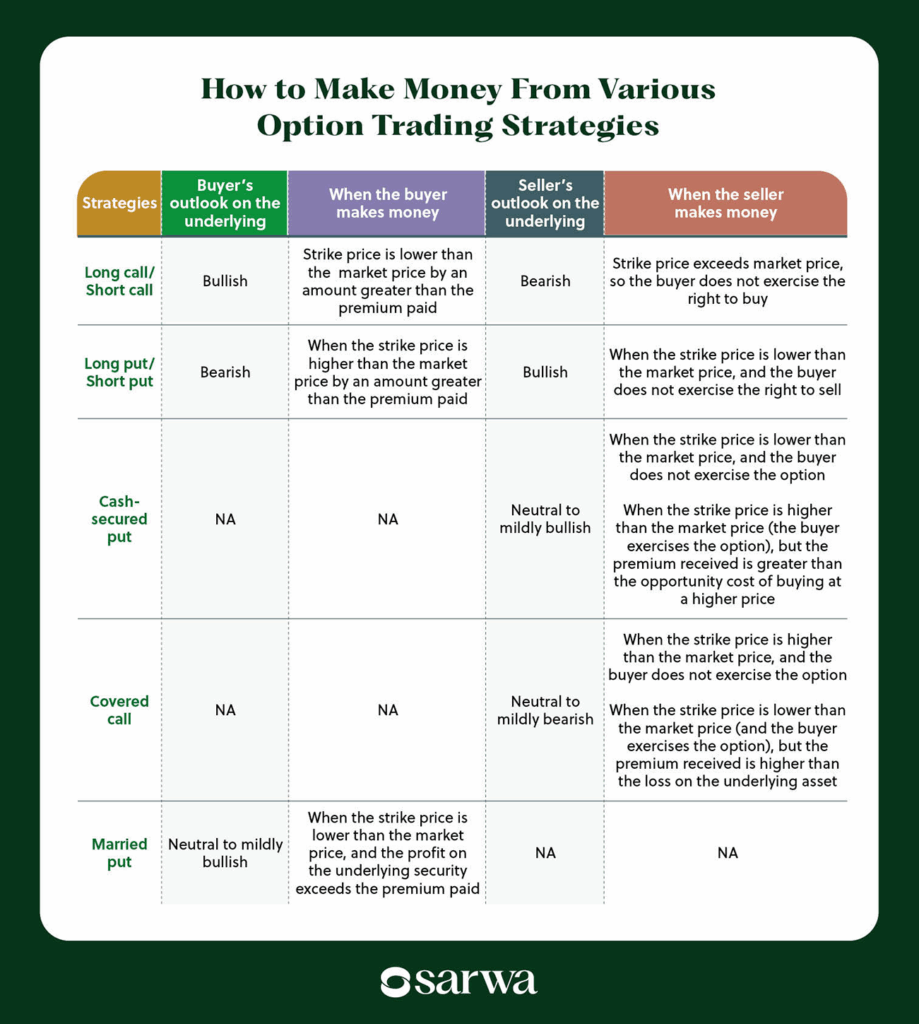

We have said a lot so far about how much money can be made trading options from the perspective of the buyer and the seller. To make the distinctions easier to grasp, we have summarized everything in the chart below:

Note, however, that nothing is stopping you from being both a buyer and a seller. You can be a buyer on some contracts and a seller on others. The point of these distinctions is to show the different things that must happen for you to make money if you are a buyer or a seller.

3. Decide on your preferred options trading strategy

As a beginner options trader, you should focus on making money from Level 1 (basic) and Level 2 (intermediate) strategies while leaving Level 3 (advanced strategies like straddles, iron condors, strangles, and naked options) to the more experienced guys and girls.

Below, we will explain the Level 1 and 2 strategies and how you can make money from them. With everything we have discussed so far, you should find it easy to grasp these strategies. We will continue with the two main examples we have used to ensure continuity and ease of understanding.

Level 1 strategy: Long call or short call

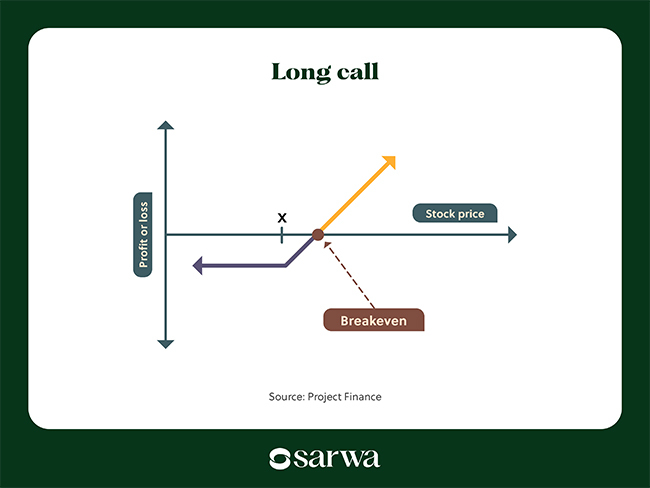

A long call is basically the first example we used, from the perspective of the buyer.

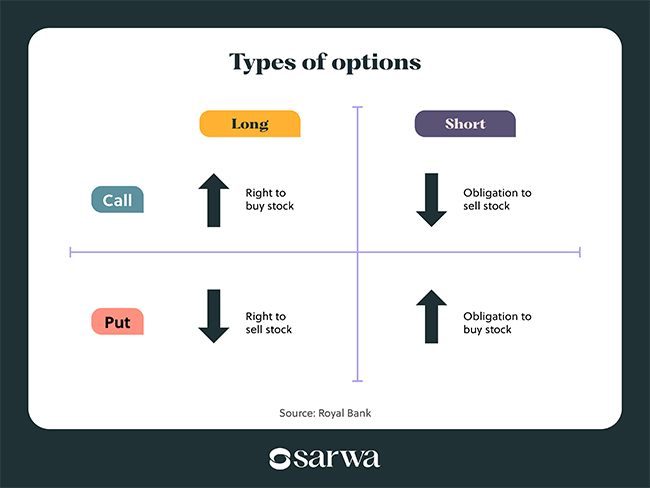

It’s a call option because it confers on the buyer the right to buy Apple. The “long” versus “short” distinction is used in options strategy to differentiate the buyer from the seller’s perspective, respectively.

Buyers purchase a call option because they expect the market price to rise. Remember that call options will be ITM (which favours the buyer) only if the strike price is less than the market price.

To go back to our example, A expects that B will rise above $210. It is only then that he can buy Apple at $210 (the strike price) and sell it for a price above the strike price ($230 in the example).

As the chart below shows, whenever the stock price exceeds the strike price (denoted by “x”) by an amount greater than the premium paid (the distance between the strike price and the breakeven point), the buyer is in profit (the yellow part of the arrow):

To use a more familiar term, a long call makes sense when you are bullish about a stock or an ETF. You will make money once the market price exceeds the strike price by an amount greater than the premium.

If we shift to the seller’s perspective, we can call this strategy a short call.

As a seller of a short call, you will be in profit (equal to the premium already paid by the buyer) if it doesn’t make sense for the buyer to exercise the contract. And that will happen when the market price stays below the strike price (which means it is OTM).

Thus, selling a short call only makes sense if you are bearish about the stock or ETF.

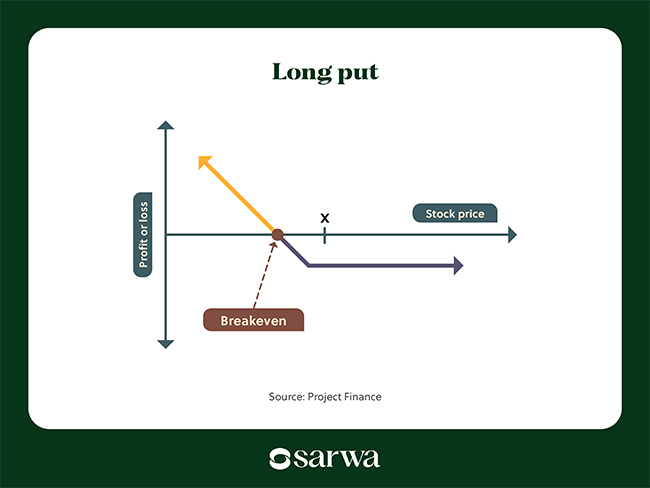

Level 1 strategy: Long put

A long put is a strategy where the option buyer purchases the right to sell an underlying asset.

Buying a put option makes sense if you are bearish on the stock or ETF. As our example shows, a put option with a strike price of $700 will only be ITM if the current market price falls below $700 by an amount greater than the option premium.

As seen below, the buyer is in profit when the price is lower than the strike price (denoted by “x”) by an amount greater than the premium paid (the distance between x and the breakeven point).

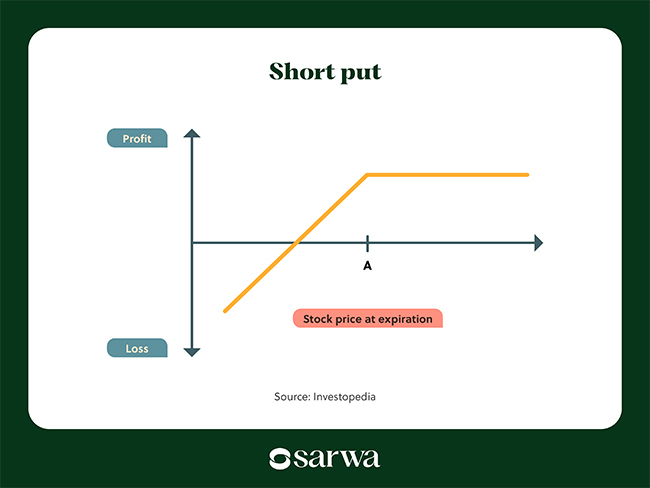

From a seller’s perspective, this is a short put strategy.

Again, the seller will make money from this strategy if the buyer does not exercise the option. This will happen if the price stays above the strike price (making the option OTM). Thus, selling puts makes sense if you are bullish about the market.

Level 2 strategy: Cash-covered or cash-secured put

This is a seller’s strategy, and it involves selling a put option while ensuring there is enough cash in the brokerage account to purchase the underlying stock or ETF if the buyer exercises the option.

As we said above, selling a put option makes sense if you are bullish about the market. However, the presence of a cover or security (the cash in the account) means you are also willing to buy the stock (since the buyer has a right to sell) if the price falls.

This strategy is thus appropriate, compared to a short put, where you are both willing to make money from the bullish movement of a stock and also buy it at a discount if the movement is bearish instead.

Investors often use it for a stock that they would ordinarily love to own for the medium-to-long term. From this perspective, it is a win-win situation – earning passive income from the stock’s short-term bullish movement and then buying it up when its price falls.

As the chart below shows, if the market price exceeds the strike price (denoted by “A”), the contract will be OTM and the buyer will not exercise it. Thus, the seller will have a profit equal to the premium received. Since this premium is the same amount irrespective of the gap between the market price and the strike price, the profit is the same (represented by the flat yellow line).

However, if the market price is below the strike price, the buyer will exercise the option. The seller will then have an obligation to buy at the strike price instead of the lower market price. This purchase will have an opportunity cost (the difference between the strike price and the market price).

If this opportunity cost exceeds the premium received, the seller will have a net loss (represented by the sloping part of the yellow line below the x-axis).

However, if the premium received equals the opportunity cost, the seller will break even (represented by the intersection of the x-axis and the yellow line). Finally, the part of the yellow line above the x-axis but before the flat portion represents where the premium received exceeds the opportunity cost.

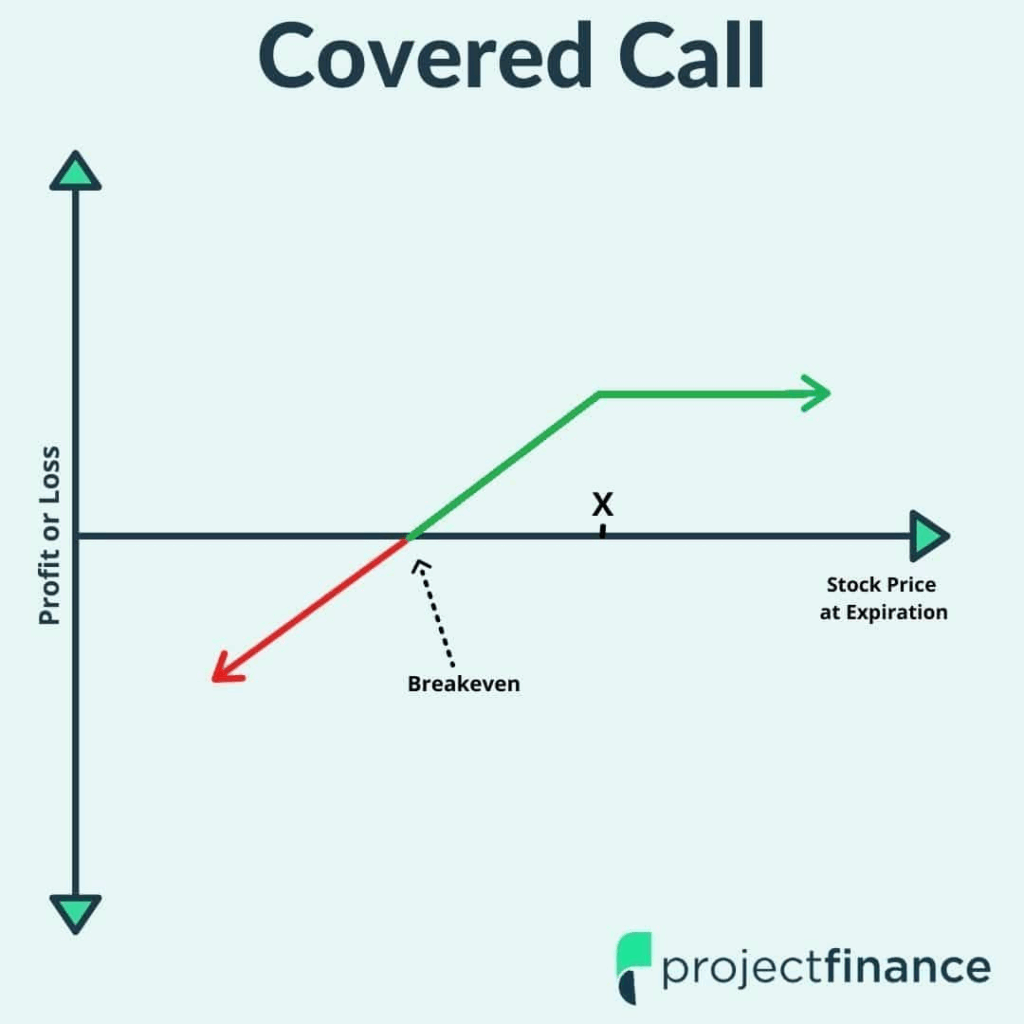

Level 2 strategy: Covered call

The covered call strategy is the opposite of the cash-secured put strategy. Here, traders sell the right to buy an underlying asset they already own.

As we now know, a call option will be OTM (which is what favours the seller) when the strike price is higher than the market price. Since the buyer can buy the underlying asset at a cheaper price, they won’t bother exercising the option, and the seller keeps the premium.

Like a short call, this strategy makes sense if you are bearish about the stock or ETF.

However, the buyer will exercise the call option if the market trend goes against you and the stock is bullish instead. Since you already own the stock, you don’t have to buy at the higher market price to meet your obligation to sell the buyer at a lower strike price. Depending on the price you bought the shares you already own, you can even be in profit when you sell at the strike price.

In the end, it is a good strategy if you are bearish but also want to hedge against the market turning bullish.

As the chart below shows, if the market price exceeds the strike price, the buyer will exercise the right to buy. But since you already own the stock (which we assume you bought at a price equal to the strike price), there is no loss from the resulting sale. Total profit will thus equal the premium received for the call option.

Source: Project Finance

Alternatively, if the market price is below the strike price, the buyer will not exercise the right, and you will keep the premium. However, there is an unrealized loss on the stock (since the market price is now lower than the price you purchased it).

If the unrealized loss is lower than the premium received, there is a net profit, represented by the sloping part of the green line. However, if the unrealized loss exceeds the premium received, there is a net loss, represented by the red line.

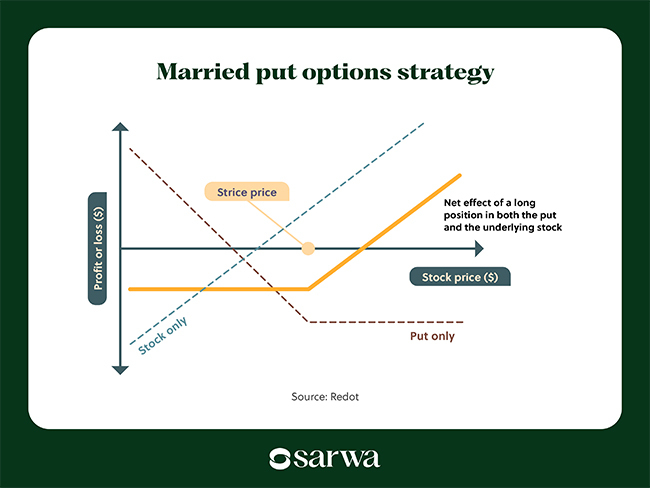

Level 2 strategy: Married or protective put

This is a buyer’s strategy that involves going long on the underlying security and also purchasing a put option at the same time.

If the market price exceeds the strike price, the buyer will not exercise this option, resulting in a loss equal to the premium paid. However, the buyer earns a profit on the underlying security as long as the current market price exceeds the stock’s purchase price (which is usually assumed to be the strike price).

On the other hand, if the strike price exceeds the market price, the buyer will exercise the option by selling the underlying security to the option seller at the strike price. If the strike price is equal to the stock’s purchase price, then the buyer breaks even, and the net loss is limited to the premium paid.

This is a useful strategy if you are bullish about the stock but still want to hedge against the stock turning bearish (by capping losses to the premium paid).

As seen below, when the market price exceeds the strike price, there can be a net loss or profit. A net loss will result when the premium paid exceeds the profit on the underlying security (the portion of the yellow line between the strike price and the break-even). On the other hand, there will be a net profit if the profit on the underlying security exceeds the premium paid.

If the strike price exceeds the market price, the loss will be capped at the premium paid (represented by the flat line below the x-axis).

For a better understanding of this section, we summarize the various ways to make money from Level 1 and 2 strategies below:

4. Create a trading account

The next step is to create an account on a trading platform that allows options trading.

As every trader knows, the trading platform you choose can make or mar your trading experience. How much money can be made trading options also depends on the trading platform.

Some non-negotiables to look out for include:

- Exposure to a variety of stocks and ETFs: A good trading platform will not limit your exposure to popular stocks like the FAANG. Rather, it will provide you with a variety of stocks and ETFs so you can choose the ones to focus on.

Also, it will not limit you to buying calls and puts, but also allow you to sell them.

- Simple and intuitive user experience: The user interface (UI) and user experience (UX) are important. When it is easy to navigate a platform, your trading experience improves dramatically.

- Performance charts: A good trading platform should also have charts where you can see the moneyness of the option contract, its historical price, values for the Greeks, maximum profit and loss, as well as how the price of the underlying must move for you to break even and turn a profit.

- Competitive commissions: The commission you pay will affect your net profit. While low commission is not everything (which is why there are six other items in this list), a good trading platform will have a competitive commission (comparable to other platforms).

- Security: The more digitized the world, the greater the need for cybersecurity. A good trading platform will have security protocols that will protect your data and money.

- Various order types: There are times you only want to buy or sell an options contract when it hits a certain price. Your trading platform should allow you to set limit orders in addition to market orders.

- Other perks: Some common perks offered by serious trading platforms include free deposits, free withdrawals, educational resources, and 24/7 customer support, among others.

5. Conduct fundamental and technical analysis

Stock market fundamental and technical analysis are both necessary for options trading.

While you may understand the importance of the second part, you may be surprised at the first part. Isn’t fundamental analysis for long-term investors, the disciples of Warren Buffett?

Not true.

Even traders must know how to screen stocks for trading. When looking for stock options to trade, consider underlying stocks with high liquidity, high volatility (remember that high volatility increases time value), and responsiveness to market news. Also, you can reduce the risk of your overall exposure by trading stocks across various sectors and industries.

What is the role of technical analysis in all of this?

If you go to the summary table on trading strategies, you will notice that you need to have a particular outlook on a stock (bullish, bearish, neutral to mildly bullish, and neutral to mildly bearish) before selecting a strategy that fits that outlook.

As a trader, technical analysis is the set of tools that help you predict or forecast future price movements based on past movements (even if past performance does not guarantee future performance, it is still a reliable guide). Therefore, an understanding of price charts (especially candlesticks), chart patterns, candlestick patterns, and top technical indicators for day trading is fundamental.

6. Choose the preferred account size and risk management strategy

How much money can be made trading options depends on your account size and risk management strategy.

Your account size is the initial capital you are committing to options trading. Risk management includes things like position sizing (what % of your account can you risk on a single trade) and trade closing (by setting a stop loss order and a take profit order).

Account size depends mostly on your financial capacity. The interesting thing about options trading is that you don’t need a lot of money to get started, since you are not always required to buy the underlying security or even have the cash to buy it. As we have seen, only certain strategies (cash-secured put and covered call) require this.

Even with small accounts, you can get started with other strategies.

Position sizing helps determine the number of contracts you should buy based on your risk tolerance. For example, if you have a $8,000 account, and you are willing to risk 5% for a single trade, the total amount you can lose on the trade is $400. Suppose you are purchasing an options contract with a price of $2 per share (total premium of $200), then you can buy a maximum of two contracts.

However, given that you don’t have to max out the losses on a trade, you can purchase more contracts by setting a stop-loss order. For example, if you sell the position when the price falls to $1, then your maximum loss is $100, which is lower than the $400 you are willing to lose. In this example, your maximum number of contracts with stop loss is four.

You can also set take-profit orders to quickly realize profits when you forecast that the trend is about to go against you.

This ties back to what we said about closing an options contract. Recall that sellers can close by buying up the contract or rolling it over, while buyers can sell the contract, roll it over, or exercise before expiry.

7. Understand the risks of options trading

In one of Warren Buffett quotes, he called derivatives weapons of mass destruction. Some financial advisors also preach against them. This is because while they can amplify profits, they can also magnify losses.

However, it all depends on the strategy you employ. As the charts show, potential losses on strategies like long put and long call are limited to the premium paid. If you can’t cope with the potential losses of the other strategies, you can concentrate on these two.

More importantly, we have seen that you don’t need to hold an option until expiration. You can always cut your losses by closing the contract.

Complexity is another risk. Options can be difficult to understand, and newbies can make mistakes that will burn their fingers. Again, this is not a knock-out argument. Beginners can start with Level 1 and 2 trading strategies, and they can rely on simple-to-understand resources from Sarwa (among other trading courses) to get a better grasp of options.

Some also point to the volatility risk of options (more volatile than stock trading). If volatility is too little or too much, your forecast may not be realized, leading to losses on your account. But as we have seen, losses can be cut short with proper risk management, and some strategies absolutely cap losses to the premium paid.

If you are in the UAE and you want to trade options, Sarwa is a great trading platform to explore. We provide a simple and intuitive platform that is easy to navigate, performance charts that will help you understand historical prices as well as potential profit and losses, and bank-level SSL security that will protect your money and data.

Furthermore, we charge competitive commissions, and offer free transfers from your local bank account to your Sarwa brokerage account, and vice versa. You will also enjoy 24/7 customer support, easy-to-understand educational resources, and access to the options of a wide variety of US stocks and ETFs.

What then are you waiting for? Sign up today for Sarwa to start trading option contracts on US stocks and ETFs in the UAE.

Takeaways

- How much money can be made trading options depends on whether you are a buyer or a seller, and the options trading strategy you employ.

- The trading platform you use will also affect your trading experience and how much money you can make buying options.

- You need fundamental analysis to determine the stocks or ETFs to select when trading options, and technical analysis to predict future price movements.

- Like all types of trading, options trading requires a solid risk management strategy. Beginners should start with Level 1 and 2 strategies and make judicious use of stop-loss and take-profit orders.