While many of us wouldn’t mind stepping into riches overnight — whether through the lottery, inheritance, a successful lawsuit, or the auction of some valuable item — research has shown that 70% of people who experience a financial windfall go broke within a few years because they simply didn’t know how to manage sudden wealth.

Another study found that one-third of lottery winners end up going bankrupt. Also, research by Jay Zagorsky, a lecturer at Boston University, found that the average person in their 20s, 30s, and 40s who receives an inheritance or large financial gift ends up losing half to bad spending habits and poor investments.

There are endless cases of people losing their financial windfall to scams, bad investment decisions, and bad spending habits.

For example, Callie Rodgers, “Britain’s youngest lottery winner,” who won a $3 million windfall when she was 16 years old, had only $2,580 after 10 years of wild spending on “cosmetic surgery, wild nights out, holidays and gifts.”

Consequently, learning how to manage sudden wealth is very important to protecting the nouveau riche. Without some basic understanding of financial planning and investing, that money can dry up quickly.

This journey begins with creating a plan, learning to put your emotions in check, and investing in a way that maximises your returns and minimises your risk.

In this article, we’ll look at six things you should do to manage your sudden wealth so it becomes a blessing rather than a curse. They include:

- Stay calm and create a plan

- Clear your debt and create an emergency fund

- Avoid savings accounts and active investing

- Create a diversified portfolio

- Prioritise lump-sum investing

- Remain calm and stay with your plan

At the end of this article, you will be able to manage any sudden wealth that comes your way.

1. Stay calm and create a plan

Receiving sudden wealth, whether through the lottery, inheritance, lawsuit, or auction, comes with a truckload of emotions that include excitement, fear, and anxiety.

These emotions are normal in those situations and you should not (indeed, it’s near impossible to) suppress them.

However, don’t let those emotions guide your actions. Emotions are fine but they need reason to guide them towards profitable ends.

Excitement can lead you to blow your money in reckless spending; fear of losing it can make you lock the money away in your wardrobe or a savings account (even though it ends up losing value due to inflation); anxiety can cause you to make many bad decisions that you might not recover from.

To be sure, emotions will come — but don’t decide based on them.

The first way to manage sudden wealth is to instead reach out to a digital financial advisor that will work with you to create a plan. Don’t make any life altering decisions about your finances without seeking professional help.

For example, Sarwa, a digital financial advisor in UAE, allows you to schedule a free call with their wealth advisors to design a customized financial plan.

Why should you use a digital financial advisor instead of a traditional one?

Digital financial advisors use the latest financial technology solutions to provide low-cost, automated, data-driven, and personalised financial advice. Moreover, they are easier to use because of streamlined processes that can be conveniently completed without stress, as well as the help of customer service that is available 24/7.

(To learn more about why digital financial advisors are better than traditional ones, read, “8 Things to Consider When Choosing a Digital Financial Advisor in Dubai“)

A digital financial advisor will help you create a financial plan to meet your life goals, which can include:

- Financial independence

- Retirement

- Leaving wealth for your family

- College education for your children

- Owning a home

- Gaining access to foreign capital markets, etc.

If you’ve never had any such plan, then the risk of losing your sudden wealth is exponentially higher.

So stay calm, schedule a free call with digital wealth advisors, and work with them to create a solid and comprehensive plan to achieve your financial goals.

As a foundation, a crucial part of your plan will include a budget.

A budget helps control your spending. Instead of unchecked spending, a budget helps you put a cap on your spending by ensuring that every amount spent is planned and accounted for.

Such accountability helps you avoid the spending spree that turns many rags-to-riches stories into riches-to-rags ones.

In the UAE, there is no federal income tax or inheritance tax, so your windfall won’t be taxable if you are a local or resident. If your case is an exception and you need the services of a lawyer or tax consultant, your digital financial advisor will let you know.

2. Clear your debt and create an emergency fund

Running into sudden wealth presents a perfect opportunity to clear your debts.

The interest that accumulates on debts can be a big parasite on your monthly income. Paying off your debt early can help you avoid the interest that would accrue on them in the future.

If you have any debt where interest is calculated on the unpaid portion of the debt and the interest rate is higher than the average return of the S&P 500, paying them off early will save you lots of interest expense and free up your future income.

Once you have cleared your debt (or if you don’t have any), create an emergency fund. An emergency fund is a self-funded insurance plan that you can fall back on when emergencies and unplanned expenses arise.

Having an emergency fund saves you from incurring debt to meet emergency and unplanned expenses. Instead of accruing interest on debt, you can use money that you have previously saved.

If you don’t have one already, use your sudden wealth to create an emergency fund with six months’ worth of your living expenses.

One advantage of an emergency fund is that it helps you overcome fear. Hearing stories of those who have lost their sudden wealth can discourage you from investing yours. With an emergency fund, you have some money set aside to cater for any emergencies, and that gives you some level of security and piece of mind.

(To learn how to create an emergency fund, read “How To Start An Emergency Fund That Is Right For You: Smart Planning To Mitigate Financial Troubles“)

3. Avoid savings accounts and active investing

Learning how to manage your sudden wealth includes ensuring you don’t lose it to inflation or bad investment choices.

Putting all of your windfall in a savings account is a poor choice. Of course, you need to save some as a form of security. But that’s what the emergency fund is all about.

The security the emergency fund provides is sufficient.

Putting your sudden wealth in a savings account is a poor choice because savings accounts pay paltry interest. Many banks in the UAE offer less than 1% annual interest on savings accounts, with only a few offering up to 2%.

As Warren Buffet has said, “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.”

Rising inflation means that money left in a savings account can depreciate rather than appreciate in value.

Instead of allowing inflation to eat into the value of your money, let the money work for you by earning compound interest that runs ahead of inflation.

However, many people have lost money in a bid to make their capital grow faster than inflation.

This is where the importance of a financial plan surfaces again. Just investing in a stock that you think will become the next Amazon or a new cryptocurrency that your friends think will be the next bitcoin or buying real estate in a location your neighbor thinks will be the next industrial hub is poor financial stewardship.

Indeed, your sudden wealth means people will probably pitch lots of different investment ideas to you, legitimate or otherwise. They will promise outrageous returns in no time.

Avoid all those investment pitches.

In the same way, avoid active investing — a strategy whereby you try to time and outperform the market by picking individual stocks.

Active investing is very expensive — higher fees and taxes. And most active investors fail to outperform the market. Not even active mutual funds outperform the market, with 87.2% of active mutual funds failing to beat the market over a 15-year period.

“Timing the market is a fool’s game,” said Nick Murray, author of Simple Wealth, Inevitable Wealth, “whereas time in the market is your greatest natural advantage.”

“The key is to get in the market,” said Ann Wilson, author of The Wealth Chef, “as it is not about timing the market but time in the market that matters.”

Instead of trying to look for quick ways to profit from the market (and lose your money in the process) you need to play the long-term game — staying invested in the market.

(To learn more about why timing the market is a bad investment, read “Does Market Timing Work”)

4. Create a diversified portfolio

Instead of all these investment pitches that promise much and deliver little, putting your money at huge risk, a digital financial advisor will help you create a diversified portfolio to grow your money over the long-term, where your returns are maximised and your risk minimised.

Diversification ensures that you are not putting all your money in one basket.

Why not?

Putting your money in one basket means once the basket is lost all your money is lost.

If you bought that one stock that you thought will be the next Amazon with all your windfall and it fails, all your money is gone. What if you bought a house in that location that will be the next industrial hub and a sudden flood leads to mass emigration instead? All your windfall is gone. What if you invested in that crypto that was supposed to be the next bitcoin but it doesn’t even last beyond ICO (initial coin offering)? All your money is, also, gone.

In contrast, diversification helps you spread your wealth in reputable assets that have made money for investors consistently over many decades — stocks, bonds, and real estate investment trusts (REITs).

By investing in a diversified portfolio of uncorrelated and negatively correlated assets, your overall risk is less than the risk of investing in any one single asset. In other words, when one of these assets is losing money, another asset is compensating for that loss (benefit of negative correlation), reducing the risk of losing your money.

Sarwa, for example, creates a diversified portfolio of stock ETFs, bond ETFs, and REIT ETFs that takes into account your risk tolerance, financial goals, and time horizon. By combining these three elements, we are able to create an efficient portfolio for every investor with the Modern Portfolio Theory.

(To learn more about why portfolio diversification is an important investment strategy, read “Learning The Importance of Portfolio Diversification Can Prevent Huge Loss. Here’s Why.“)

Instead of buying individual stocks, bonds, and REITs, Sarwa invests in ETFs because they are low-cost (low fees and low taxes), flexible, transparent, and provide an incredible level of diversification.

Each ETF already contains an incredible amount of diversification. Combining many ETFs in a diversified portfolio leads to even a more incredible level of diversification.

The advantage of all these is that your windfall grows over the long-term with maximised returns and minimised risk.

(To learn more about ETFs and why even the US Federal Reserve is buying them, read “Why Invest in ETFs? Explaining the Popularity of The Go-To Fund“)

5. Prioritise lump-sum investing

If Ann Wilson is correct and time in the market is more important than timing the market, then the more time your money spends in the market, the better.

This is why we encourage you to invest all your investable sudden wealth (after clearing debts and starting an emergency fund) in the market immediately — what is called lump-sum investing.

The more time your money spends in the market, the more compound returns it can earn.

Some people who come into sudden wealth prefer another method called dollar-cost averaging, whereby they invest a certain portion of the money over a period — for example, instead of investing $100,000 at once, they will invest $20,000 over five months.

However, a study by Vanguard shows that in a 60/40 portfolio of stocks and bonds from 1926-2011, a lump-sum investing strategy outperformed the dollar-cost averaging strategy two-thirds of the time over any 10-year period.

Another report by Richard Williams and Peter shows that two-thirds of the time, $120,000 invested at the beginning of the year outperformed $10,000 invested every month.

Of course, if you can’t get over the emotions of putting all of your windfall in the market at once, you can use dollar-cost averaging. You can even use Sarwa’s automatic investing feature that allows you to automatically invest a specific amount at a particular date over a defined period. The platform will then use fintech to automatically distribute the money across all of the portfolio’s ETFS, while maintaining the correct allocations.

Time and again, research has shown that lump-sum investing is more profitable. And if that lump-sum investing is done through a diversified portfolio, you don’t have to worry about high risk.

(For more on how lump-sum investing compares with dollar-cost averaging, read “Dollar-Cost Averaging vs Lump-Sum Investing: How Should You Invest“)

6. Remain calm and stay with your plan

Once you have invested your sudden wealth in a diversified portfolio, all you need to do is sit back and allow it to grow and achieve the financial goals you have identified with your digital financial advisor.

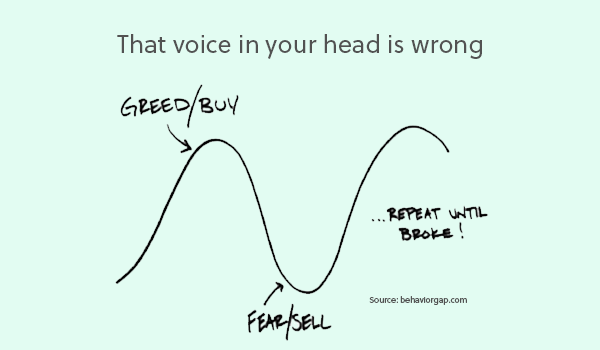

Just as you had to resist the temptation to act on emotions at the beginning, you will also need to avoid acting on emotions at this point.

In essence, knowing how to manage sudden wealth comes down to emotions.

The market will rise and fall in the short term and you might become fearful.

Try not to let this get to you. Over the long-term, the market rises more than it falls (74%-26%). Don’t play the short term game that causes many to lose their windfalls. Focus on the long term.

Also, the voices of your friends and neighbors pitching some investment products that will double your money in six months will grow louder and you will be tempted to be greedy. They may even have some products to show you. Resist the urge. Keep playing the long-term game with sharp-eyed focus on your financial goals.

In essence, avoid the fear-greed cycle.

Or as Warren Buffet puts it, “Be fearful when others are greedy. Be greedy when others are fearful.” When everybody is queuing to buy the next big thing (that is, when others are greedy), be fearful and stick with your plan. When others are fearful because the market is down, be greedy and focus on long-term growth.

As your money grows in a diversified portfolio, you will be well poised to achieve all of those goals one by one while your friends and neighbors are still trying to identify the next real estate hub, bitcoin, or Amazon.

“The best way to measure your investing success is not by whether you’re beating the market, said Benjamin Graham, Warren Buffet’s teacher and father of value Investing, “but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

Takeaways

- When you come into a windfall, stay calm, contact a digital financial advisor and create a financial plan that will help you achieve your financial goals.

- Clear those debts that accrue on unpaid balance and whose interest rates exceed the average return of the S&P 500, and start an emergency fund.

- Instead of putting your windfall in savings accounts or trying to outperform the market by active investing, invest in a diversified portfolio of ETFs.

- Invest your windfall at once to earn more compound returns or use dollar-cost averaging if you are the more cautious type.

- Stay with your plan and avoid the fear and greed cycle.