One day in 2011, Steve Cronin had a financial epiphany.

He was driving down Sheikh Zayed Road with a friend when she advised him against starting an investment plan he recently came across. “I lost a lot of money in one of these plans,” she told him. “Don’t do it.”

Steve has a background in financial services and psychology, and knew the importance of investing, but didn’t yet understand why people were losing money.

“That moment was a real wake up call for me,” Steve remembers. “I vowed to myself that I had to take control of my own finances and stop blindly trusting people who on the face of it worked for legitimate institutions, yet maybe were driven more by commission than by my best interests.”

The challenge of investing was compounded by trying to access stocks and bonds from Dubai.

“That is when I discovered Vanguard,” says Steve, speaking of the world’s second-largest provider of ETFs, as well as the pioneer of the low-cost index fund industry.

Several years later, he realised that Dubai residents could access Vanguard funds as ETFs through an international brokerage, and the process could be very straightforward.

“It hit me like a thunderbolt,” he says. “Then I got quite emotional and realised that now I could finally help people.”

“You just need someone to show you how to do it. You can invest by yourself or use a low-cost robo advisor (such as Sarwa), but you certainly don’t need your bank or some fancy financial advisor to put you in actively-managed funds,” says Steve.

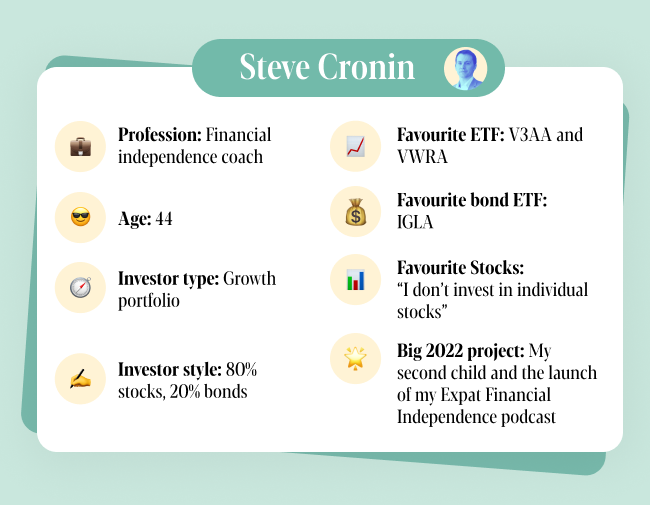

Today, Steve is a financial independence coach and the founder of DeadSimpleSaving.com, showing experienced and novice investors alike how to take control of their finances and invest for the long term.

Sarwa wanted to dig deeper into Steve’s approach to long-term investing.

We discovered that it very much mirrors many principles that are discussed on this blog.

Whether you are a conversative trader or active investor, you’ll have something to learn from how Steve helps steer the financial independence ship he sails, as well as how he is very much a person that practises what he preaches.

First off, let’s address the elephant in the room: Global inflation, rising interest rates and an ongoing war in Europe have sent markets down in 2022. How do you recommend navigating this turbulence?

Cronin: There’s always uncertainty in the stock market, and I think there’s always been uncertainty globally. Also, there is always a chance that there’ll be a big recession. With that, maybe the stock market will crash.

However, I think having a stock market crash early on in your investment career is fantastic because it toughens you up and instils a long-term mindset. You don’t want to just put a lump of money in the stock market and then never invest again. Hopefully, you’re putting in whatever you can and also investing from your salary every month or quarter, then it doesn’t matter when the stock market goes up and down. If you are investing on a regular basis and the market is going down and down and down, you’re buying those stocks more cheaply.

In the end, you’re buying those stocks cheaply to hold for the rest of your life, so I don’t think anyone has to fear the stock market going down if they have a long-term outlook.

However, if you are literally about to retire or you’re financially independent and taking money out regularly, then, yes, you need to invest more conservatively. But other than that, market volatility is nothing to be scared of.

I’d also be careful about people who claim to have a crystal ball. You need to get used to reading conflicting and scary reports in the media, which is essentially just clickbait to get you to read it. You will always see someone screaming that the market is going to shoot up and others screaming the market is going to go down.

Of course, in the short to medium term with high inflation and high interest rates, it is going to be a challenging time for government bonds and that may bleed over into the stock market potentially, if people think that there’s going to be a big fat recession.

But does that affect the way I invest? No. Because no one can time the market. No one can predict anything.

I’m not a great believer in active fund management, or even in active asset allocation between stocks and bonds, because I think – as 2020 shows – you can get completely wrong-footed. In March 2020, if you moved out of stocks and more into bonds or cash, you would have bitterly regretted that by April when the market shot back up again.

Just stick to an allocation that you can stomach and that is appropriate for your investment time horizon.

How do you know when to change allocations, or, equally as challenging, when to sell?

Cronin: I think there’s a good and a bad reason for changing allocation.

A bad reason would be trying to predict that there’s a recession around the corner, or a boom around the corner. Then you’re just timing and you’re kind of gambling.

A better reason is if you say, “Wow, I’ve gone into 100% stocks (which I don’t recommend) and it’s much scarier than I thought.” You may then need to be more conservative.

Conversely, you may have gone through 2020 when there was a massive crash — the fastest stock market crash in US history – and you were just fine. In which case, maybe you didn’t need a 60/40 allocation because you didn’t panic and you didn’t sell.

In terms of when to sell, I don’t think you should sell unless you need the money. Of course, if stocks are doing well and you suddenly need to buy a house and you take money out, that’s no problem.

But generally you should be investing for the long term and so you should only sell when you are retired or you need to take a chunk of money out for a specific purpose. In that case, you would have a mix of stocks and bonds, so if stocks are way down, then you could rely on your cash buffer for a bit, or you could sell your bonds which are hopefully up or at least not down as much as stocks.

What’s your portfolio allocation for stocks and bonds? And what does it look like?

Cronin: I invest in 80% stocks, 20% bonds, which is very straightforward. I always say for anyone who’s under 45 and not imminently about to retire that this portfolio allocation should be fine.

I like globally-diversified stock ETFs, and I like global government bond ETFs. The only changes I’ve made are because, at first, there was only a distributing version available for these ETFs, then I moved to the accumulating version that automatically reinvests dividends.

Now ESG (environmental, social and corporate governance) versions have come along that strip out tobacco stocks, gun manufacturers and things like that, so I have moved my and my family’s investments into ESG ETFs.

However, with my clients this is not something that I push. I give them the option. Some people feel strongly about ESG investing and others say, “Well, you know, I’m living in an oil economy, and I don’t really care.” In between are people who say, “I just want to get started, so I’ll start with the vanilla basics and then after a year or two I’ll start thinking about optimising around ESG.”

How would you label your investing style?

Cronin: It’s a growth portfolio, and I have a super-long time horizon. If I live to 100, then I’ve got 56 years of investing to look forward to, so I’m comfortable with taking risk, but I don’t want to do anything crazy.

I’m all about sensible long-term growth. Sensible is not a sexy word, but that means I’m happy to take my 6- to 7-plus percent returns a year.

I don’t believe in being 50/50 stocks and bonds, and I certainly don’t believe in moving towards 80% bonds as you age. I think that is far too conservative. So I don’t recommend anyone goes below 60% stocks, because I think you need growth from stocks – especially if you are under 45 – and therefore what you need to work on most is your risk appetite and mindset.

What is your opinion of property investing and home ownership?

Cronin: I would only buy a house to live in if you’re planning to be in the country for over 7 years.

The market is volatile and many people own houses that are still, years later, worth less than they paid for them and can have high service charges also. Buy-to-let real estate is a valid investment class offering a fairly stable return, but it is certainly not risk-free. You are putting a lot of money into one property in one location in one country and hoping nothing goes wrong for any of these. You have to deal with changing government regulations, endless forms, banks, mortgages, solicitors, tenants, contractors, exploding boilers etc. You also cannot sell quickly if you need the money.

So, personally, I prefer a diversified stock index fund, as the ‘return on hassle’ is much better.

Finally, what is the most common piece of advice you give to investors in Dubai?

Cronin: The most common challenges my clients face are learning how to save enough money, what to invest it in, and how to invest it.

Now, you can teach the what and how of investing fairly easily, but saving is really down to the person taking action. You can show them what to do, but they have to do it. People have to learn how to control their lifestyles to save.

In Dubai, I think people struggle with either having too much cash or not enough cash. They need to learn how to get their finances ready for investing, first by having a cash buffer of six months’ expenses as an emergency fund and then some sinking funds for any major things coming up in the next one to five years, such as a wedding, MBA or new car.

Then they have to do the difficult bit, which is to try and boost their income and reduce their expenses. I think an element of moderate frugality and really understanding what you value is so important here. That means if you love playing golf, spend money on golf; spend money on things that you value. If not, then don’t spend so much on that.

This is easier said than done, of course. The way I help people with saving is to show them that to be financially independent they have to really understand all aspects of their finances – debt, credit cards, cash and investing, they’re all interconnected. Importantly, the more you can invest, the faster you’ll get to financial independence, the better and more resilient your life will be.