Compound interest, often referred to as the 8th wonder of the world, is the process of earning interest on your interest. Thanks to compounding, someone who is starting to save the same exact amount in their 20s is going to have significantly more money than someone who started to save a substantial amount more in their 30s.

Compound Interest Formula and Compound interest Calculator

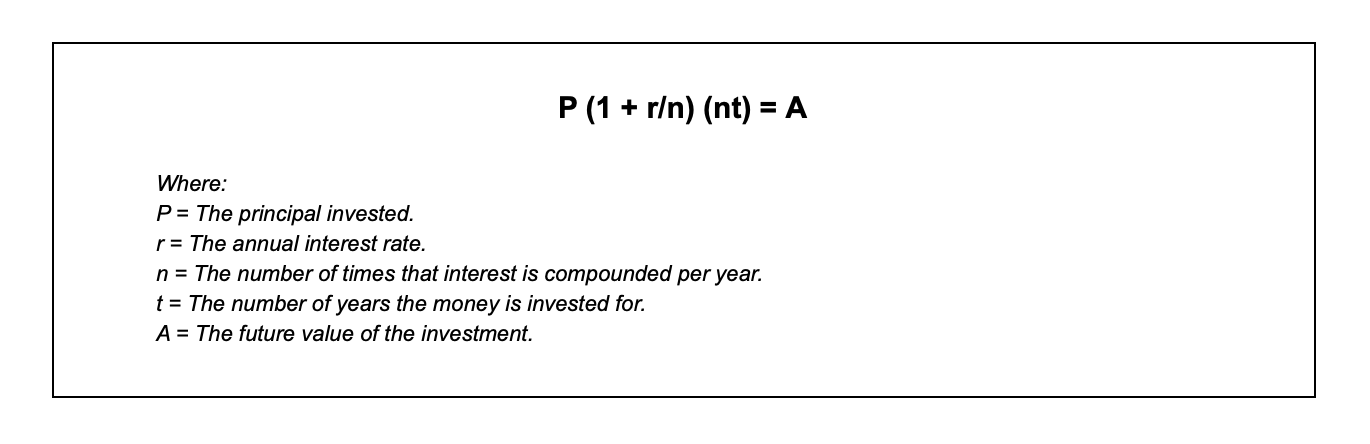

Right. Deep breath. Here goes. This is the formula to calculate how compound interest affects your money:

If you don’t understand that on first glance, no problem, we didn’t either! But one man who did understand complicated equations was Albert Einstein, and he said that compound interest was, “the most powerful force in the universe.”

Compound Interest Calculator:

How compounds interest really works

To explain its magic, and to decipher the equation above, let’s look at how compound interest works using an example:

You receive a $1,000 bonus. You’re sensible and choose to invest your $1,000 bonus into a diversified portfolio.

1 year from now, that portfolio has returned 10% or $100. You now have your $1,000 principle plus $100 profit. So you have a total of $1,100.

You now have a larger principle than at the start and, rather than withdrawing your profit, you reinvest all $1,100. If the stock returns 10% in year 2, you’ll earn $110 profit.

The magic of compound interest lies in reinvesting returns (interest, dividends, capital growth) and not making withdrawals. And it doesn’t matter if your bonus is $100 or $100,000, there is no amount too small. What’s important is getting into the habit of putting aside money when you can afford to, like at bonus time. Compound interest will then give you a great return over time.

How to start investing and generating Compound Interest

At this time of year, in the bustling offices and tower blocks at the heart of Dubai, hard working professionals hope for an extra payday. That’s right. It’s bonus season and those lucky to be on the receiving end will be thinking hard about putting their cash to work.

How to spend it…

Of course, a bonus should be an opportunity for a little fun. After all, it’s a reward for 12 months of hard work and you should treat it as such. So a little should be spent on something that makes you feel a little special. A holiday? New items for the wardrobe? Gifts for loved ones? Absolutely, they’re all sensible ways to spend some of what’s received.

Your employer will pay you your bonus in addition to a salary. So you should use it to reach your long term financial goals, rather than just for everyday expenses. A bonus is as an opportunity to save and invest and it can be a foundation stone upon which to build for the future.

…and how to save it

At Sarwa, be believe that saving and investing shouldn’t be daunting or complicated. In fact, you don’t have to know much about finance at all. Sound investing relies on a simple trick: start as soon as possible, even if the amount you’re putting aside is small. Starting means you can access the magic of compound interest as soon as possible and that can pay huge dividends.

Sarwa and compound interest

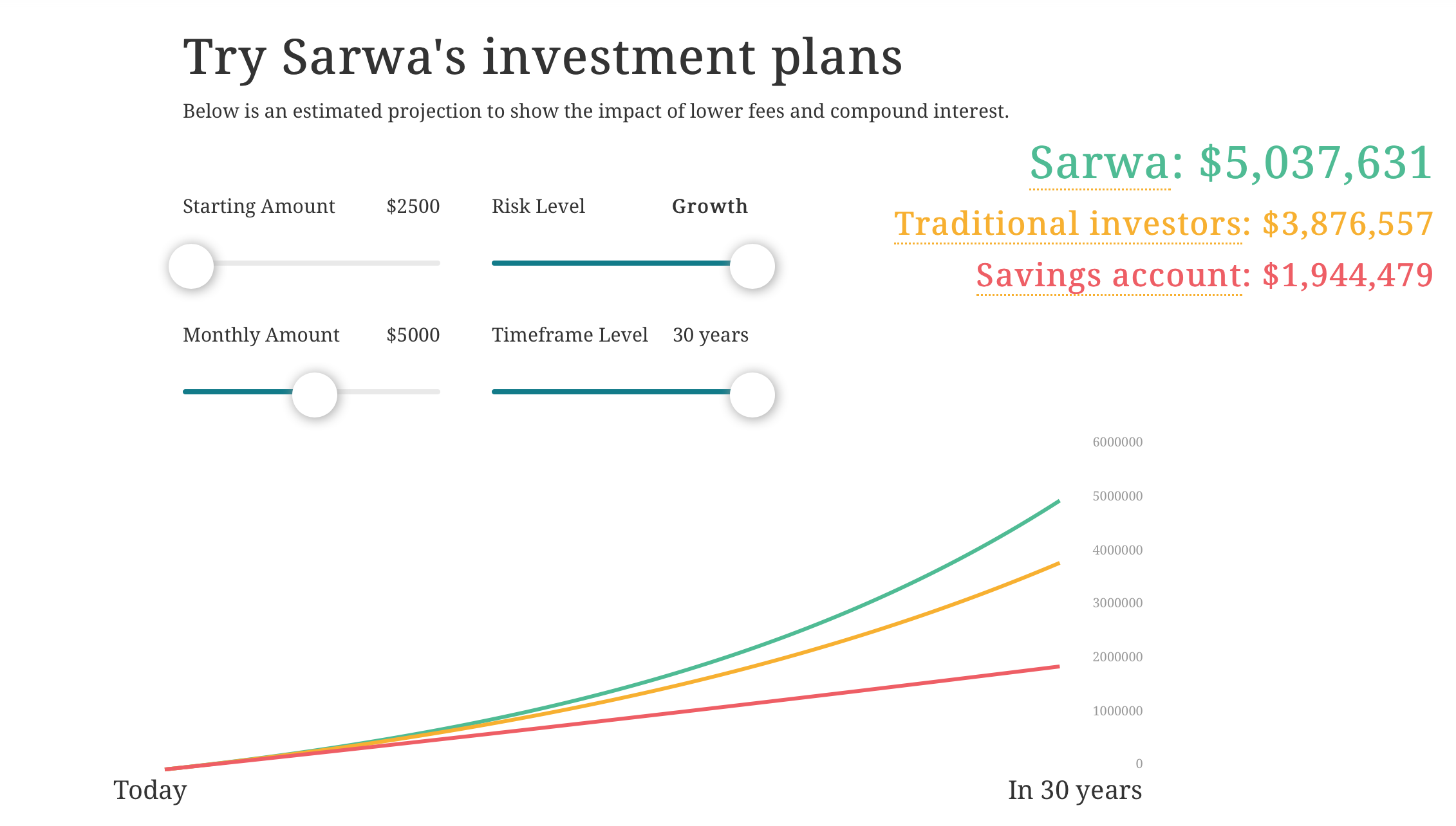

The easiest way to access the magic of compound interest is by investing in a multi-asset portfolio with Sarwa.

We make investing easy by getting to know you and your goals, offering you a personalized, low-cost investment portfolio, and letting you create and fund your account in minutes. With our platform, you can watch your wealth grow slowly over time, as we reinvest your interest and returns, leveraging the power of compound interest on your behalf.

And there’s no better time to start thinking about saving for the long term than around bonus time. Now is the time of year when you might have a little excess capital that you can put to work in a savings portfolio. And the sooner you start, the higher the chance you will have of your money grow into something significant.

Ready to invest in your future?