Learning how to build wealth from nothing might sound like “mission impossible”, especially if you have always believed that wealthy people either inherit their wealth or have benefited from powerful connections.

However, a 2019 report by Wealth-X showed that 67.7% of the world’s ultra-wealthy population (defined as those with $30m or more in assets) were actually self-made.

More interesting still is the rapid rise in this class of ultra rich. In the 2019 report, there were 265,490 ultra-wealthy individuals; in the 2020 report, that number increased by almost 10% to 290,720.

The above data reveals two things for us: first, it is possible to build wealth from nothing, and, second, those who are achieving the “impossible” are doing so with increasing frequency.

Today, instead of fantasising about the wealth you wish you inherited, we implore you to discover the many ways you can learn how to build wealth from nothing.

In this article, we will look at 10 actionable steps that you can start working on today to begin to build wealth from nothing and get on track to living a more financially free lifestyle.

- Educate yourself about money

- Get a regular income source

- Create a budget

- Have enough insurance (but don’t over-insure)

- Practice extreme savings from your income

- Build an emergency fund

- Improve your skill set

- Explore passive income ideas

- Embrace passive investing

- Use a robo-advisor

Before we start, take into consideration the thought that “rich people are committed to being rich,” according to T. Harv Eker, author of Secrets of the Millionaire Mind, while “poor people want to be rich.”

The difference between commitment and mere desire is an all-important one that you can start to distinguish right here and now.

[Need help investing in your future? Sarwa offers professional financial advisory that makes investing easy and affordable using smart technology. Schedule a free call with a wealth advisor that can help put your investment goals on track.]

1. Educate yourself about money

Our mindset is always the first thing that needs to change before we can truly approach any larger transformations in our lives.

“Everyone has the ability to build a financial ark to survive and flourish in the future,” said Robert Kiyosaki, business magnate and author of Rich Dad, Poor Dad. “But you must invest time in your financial education to build an ark with a solid foundation.”

The first step to building wealth from nothing is thus to invest time in your financial education. Become familiar with essential terms like income, expenses, net worth, return on investment, passive income, and financial independence, among others.

Read books, listen to podcasts and interviews, take courses, and follow financial education blogs like Sarwa’s.

Keep in mind that financial education, like every kind of education, must be a continuous activity. Never stop learning.

But a word of caution is important here. The democratisation of financial information means there is a lot of inaccurate information out there.

Ensure you only follow reputable blogs that will provide genuine information and direct you to resources from trusted and successful investors, business people, and financial advisors.

2. Get a regular income source

It’s hard to build wealth from nothing without a regular source of income. You cannot invest without saving money, and you can’t save money without a regular income.

This is to say that people don’t build sustainable wealth from multilevel marketing, Ponzi schemes, or betting.

Learn to ignore people who promote get-rich-quick schemes that build wealth just by working three hours a week. Sustainable wealth comes from creating value over the long term. If you are not creating intrinsic value and earning income from that good or service, it’s truly impossible to build sustainable wealth.

So get a good job if you don’t have one (here are 13 steps you can take) and keep your job if you do have one.

If you are a small business owner, continue to focus on creating more long-term value. “All wealth comes from adding value,” said Brian Tracy, a self-development expert, which includes establishing a business model that can “produce more, better, cheaper, faster, and easier than someone else.”

3. Create a budget

Creating a budget and sticking to it is crucial if you want to know how to build wealth from nothing.

Using that regular income source we just spoke of, now you need to create a budget to take control of how you are spending your money, usually set on a monthly basis.

A budget is a financial plan for a defined period that contains estimated income and expenditures for that period.

Every household and/or individual needs to create at least a monthly budget to identify your expected income and estimated expenditure. Living without a proper budget is like sailing without a compass, and you can guarantee that you’ll get lost in the seas of financial missteps.

A popular budgeting technique is the 50:30:20 rule. In this technique, you can formulate a budget where 50% of income goes to essential expenses (rent, mortgage, food, healthcare), 30% to non-essentials like shopping, vacation, entertainment, and 20% to savings and investments.

[Want to read more about the 50/30/20 rule in Arabic? Read this Arabic-language guide to the 50/30/20 rule.]

Why is budgeting important?

One main reason is that by understanding how you spend your money, it’s easier to identify the things that can be cut: the lower your expenses, the more you can add to your savings and investments.

By identifying and cutting unnecessary and avoidable costs, you can build wealth faster. It’s that simple

[For more on budgeting, read “How to Budget and Save Money”]

4. Have enough insurance (but don’t overinsure)

One core item you should have on your budget is insurance. Insuring yourself and your main assets (properties, cars, etc.) prevents you from incurring massive losses in the case of undesirable events.

At the minimum, you should have health insurance, so you don’t break the bank in the unfortunate event of a costly disease. If you don’t have one, research and compare health insurance plans in the UAE and choose the one that is best for you.

If you own your home and a car, consider homeowner and auto insurance. Also, if you have kids and dependent relatives, consider subscribing to term life insurance.

Building wealth is good, but it will be excruciating if you lose your wealth to unforeseen circumstances and events. So be proactive and insure the things that are most valuable to you.

However, don’t overinsure. There are many insurance products out there that are useless. Stick to the four above, unless there is an absolutely good reason to get more.

“Buying insurance cannot change your life but it prevents your life from being changed,” said Jack Ma, founder of Alibaba and the richest man in China. “You will not turn bankrupt because of buying insurance but you will cause your loved ones to turn bankrupt if you don’t.”

5. Practice “extreme” savings from your income

While the 50:30:20 rule is a good place to start, you’ll find that you can save a lot more if you put in the effort.

Once you are committed to building wealth, there will be many items in your budget that you can reduce or cut. You won’t be alone in doing so. Today there is no shortage of communities that promote ways to practice “extreme” savings.

The “Financial Independence, Retire Early” movement, known as FIRE, is among the most popular.

They promote “extreme” savings strategies that encourage adherents to save a huge percentage of their monthly income.

Jacob Lunk Fisker, one of the FIRE movement’s founders, proposed (and practiced) a strategy that called for investing 60% to 80% of one’s monthly income. Fisker ended up retiring at the age of 33 and now lives on $7,000 per year outside of Chicago.

Fisker (and other leaders in the FIRE movement) have grown large communities based on the success of their personal finance experiments to cut down on expenses (and the consumerism that ratchets them up).

They do this in various ways, including building and creating things they need (e.g., baking bread, building tables) instead of always buying them. Apart from the financial benefits, Fisker also gets a sense of accomplishment, which he finds more rewarding than consumerism.

[Learn more about these extreme saving tips by reading Sarwa’s interview with Jacob Lunk Fisker]

While saving 60% to 80% of your income might be too lofty a goal for now, at least it tells you that there are many opportunities for cutting down on expenses that you probably have not yet explored.

Below are some simple ways to reduce your expenses and save more money in Dubai:

- Cook at home as much as possible and buy your groceries in bulk

- Reduce restaurant budget and use filters on food delivery apps to take advantage of various discounts

- Increase your room temperature by 1 degree to reduce utility bills

- Choose a DIY workout program

- Buy one-off items like computers, refrigerators, and TVs at GITEX or the Dubai Shopping Festival

- If your rent is more than 30% of your income (or more than 10-15% if you want to follow Jacob Fisker), renegotiate your rent or find better offers.

- Renegotiate the interest on your mortgage

[You can find a detailed explanation of the above points in the article, “12 Hacks for How to Save Money in Dubai Like A Resident”]

Apply these tips to increase your investable cash beyond the standard 20% of your income.

Remember, it is not about how much you make but how much you keep.

And if you think frugality is stifling, the words of Jeff Bezos, founder of Amazon, may provide food for thought: “I think frugality drives innovation, just like other constraints do. One of the only ways to get out of a tight box is to invent your way out.”

6. Build an emergency fund

Now that you have learned how to save a significant part of your income, the next course of action to build wealth from nothing is to create an emergency fund.

An emergency fund is like self-funded insurance. It’s money you set aside for unexpected expenses like car repairs and unforeseen circumstances like job loss or pandemic-induced lockdowns.

When unexpected expenses and unforeseen circumstances arise, there are ways to make matters worse: incur debt and/or sell your investment(s).

You pay interest on debt, and when you sell your investment(s), you lose both the amount you sold and the interest from the market exposure it could have earned if you didn’t sell.

Therefore, to avoid those two scenarios, we recommend you learn how to start an emergency fund right away. An emergency fund should hold between three to six months of your monthly expenses. Also, ensure those funds are in a savings account where you can easily access them when the need arises.

Like insurance, an emergency fund won’t make you wealthy, but it will prevent you from selling your investments or incurring debt during emergencies.

7. Improve your skill set

There are two ways to increase your savings and investments — lower your expenses or grow your income. While many financial advisors focus on the former, the latter deserves its fair share of attention.

If you are an employee, improve your skill set by taking professional courses and immersing yourself in continuous career development. By improving your skills (both hard and soft), you can earn promotions or get better job offers from other companies, which means higher income.

If you own a small business, improve your understanding of the market, commit more resources to innovation, and provide more value to your customers. By doing this, you can increase your market share and earn more revenue.

8. Explore passive income ideas

In addition to increasing the income from your job or business, you should be exploring various opportunities to earn passive income.

Passive income describes income you generate that does not require your continuous presence or labour, unlike your job or business.

Passive income is crucial for those of us learning how to build wealth from nothing. “If you don’t find a way to make money while you sleep, you will work until you die,” famously said Warren Buffett, the legendary investor, and CEO of Berkshire Hattaway.

There are two types of passive income — investment passive income (your money does all the work) and non-investment passive income (you do some work on the side). Since the next section focuses on the former, we’ll stick with the latter right here.

In today’s global and digital economy, there are many opportunities to earn money on the side. However, while exploring these opportunities, be wary of get-rich-quick proposals such as Ponzi schemes and betting sites.

Some reliable and proven passive income ideas include:

- Selling digital products: If you are an expert in a niche, create digital products — books, video courses, email courses, or paid webinars — on topics that interest people. The advantage of digital products is that you only need to create them once (except for later updates). The single product you make can keep generating income for a long time.

- Blogging: Instead of selling your idea as a digital product, you can do it through a series of regular blog posts. Once you generate sufficient traffic on your blog, you can monetise it through Google Adsense, digital products, paid membership, sponsorships, guest posts, among others.

- Affiliate marketing: Instead of selling your digital products on your blog, you can sell other merchants’ products and earn a commission for every sale. Affiliate marketing removes the need to create your own product.

- Dropshipping: With dropshipping, you sell the products of various merchants without taking stock of those products yourself. Consumers place an order with you, and you process that order with the producer, who then delivers to the customer. The difference between the retail price (the customer pays) and the purchase price (you pay to the merchant) is your income.

9. Embrace passive investing

To build wealth, you need to save and then invest. If you have followed the above steps, you are now saving at least 20% of your income and earning more income through other side hustles.

Now is the time to combine the two and start seriously investing.

Without exception, all of the millionaires that you know and admire built their fortunes through wise and profitable investments on the stock market. If you don’t make money to do the work, you will have to do it instead. The problem is that your ability to earn money is limited, and you can’t earn money while you sleep (as Buffett advised).

But investing your money in the market means that money is working for you and you are profiting from the labours of others.

So what are the best ways to turn your money into sustainable wealth?

First, putting your money in a savings account is not an investment. The only money you should leave there is your emergency fund. Apart from that, your money should be in profitable investments that earn good returns while minimising risk.

Money in savings accounts earns low-interest rates (less than 1% APR in most cases), and can depreciate when the inflation rate exceeds the interest rate on your savings.

Second, timing the market is not a good strategy. It is best to nurture a long-term perspective to investing rather than a short-term obsession with market movements. The good news is that the market rises more than it falls (74% to 26%), and long-term investors are almost always guaranteed to win.

“More people lose money waiting for corrections and anticipating corrections than the actual corrections,” said Peter Lynch, a retired investment manager.

[Read more on the problems of market timing in this article, “Does Market Timing Work?]

Third, because market timing is not the best way to grow long-term wealth, embrace passive investing rather than active investing, especially when it comes to the bulk of your savings!

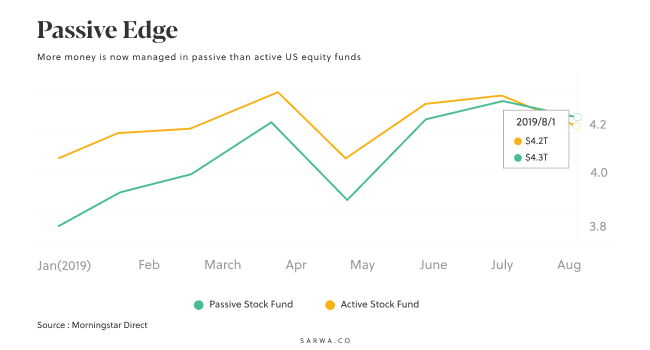

The active vs. passive investing debate is an old one. However, more investors are recognizing the benefits of passive investing. Furthermore, passively managed funds now exceed their actively traded counterparts.

Passive investment is cheaper (fewer fees and taxes), less risky (with diversification), more transparent (you know what you hold), and more profitable in the long-run (they mirror the performance of an index rather than underperforming it like the active investors).

In a now-famous and oft-quoted 2007 Shareholder Letter, Buffett commented, “the active investors will have their returns diminished by a far greater percentage than will their inactive brethren. That means that the passive group – the “know-nothings” – must win.”

[Read “What is the Difference Between Active and Passive Investment” to learn more]

Best investment opportunities

Given the above, what are the best investment opportunities to build wealth from nothing?

1. Stock ETFs

Buying the shares of companies is one of the best ways to build wealth. As a shareholder, you benefit from the growth in the company’s value; the company is working for you.

The best way to buy stocks is through ETFs (exchange-traded funds). ETFs are passive funds that are cheaper, less risky, more transparent, and more profitable in the long run.

Instead of buying individual stocks (and exposing yourself to a lot of risk), ETFs help you diversify your investment without the fees, taxes, and market timing of mutual funds.

Stock ETFs also allow you to diversify your equities. You can buy stock ETFs that focus on developed markets, emerging markets, and the United States. You can also diversify by market cap (large cap, medium cap, and small cap) as well as industry (finance, technology, etc.)

A place to start learning about ETFs is Vanguard, which provides more than 81 low-cost and transparent ETFs designed to complement one another in a diversified portfolio. There is no level of diversification that you can’t achieve with Vanguard ETFs.

Though stocks are riskier than other asset classes, they produce the best returns on investment. With a good diversification strategy, you can minimize the risk and earn higher returns.

2. Bond ETFs

A bond is a debt instrument used by governments and corporations to raise money. Bonds can be corporate (issued by companies), federal (issued by the federal government), or municipal (issued by government agencies). When they borrow money from you, they pay it back with interest.

Like stocks, the best way to buy bonds is through ETFs.

Bonds are less risky but they offer lower returns compared to stocks. However, when combined with stocks in a portfolio, they reduce the overall risk of that portfolio

3. REIT ETFs

Instead of renting or buying and selling real estate properties, which is very risky, REITs (real estate investment trusts) provide an alternative way to profit from the real estate industry.

REITs are stocks of real estate companies that purchase and sell properties and mortgage companies that provide the finance to customers.

When the value of the real estate or mortgage company rises, your money grows in value; those companies are working for you. REITs pay a very high dividend (they are mandated to pay at least 90% of income as dividends), which provides extra investable income for you.

Like stocks and bonds, ETFs are the best way to buy REITs.

10. Use a robo-advisor

How do you create and manage your portfolio of investments?

When they start investing, investors have to decide how to create a portfolio of stock ETFs, bond ETFs, and REIT ETFs. How many should they buy and at what time? Which ETFs should they choose first? All of this can be confusing for new investors.

However, with the rise of robo-advisors, investors can now easily automate their investments in a pre-built diversified portfolio of ETFs that matches their risk tolerance.

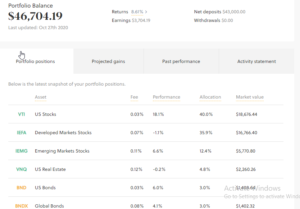

A robo-advisor like Sarwa uses the Modern Portfolio Theory to create a diversified portfolio that contains stock ETFs, bond ETFs, and REITs ETFs.

Every investor gets a customized portfolio that matches their risk tolerance. Thanks to new financial technology, Sarwa’s platform also allows you to automatically deposit more money, reinvest your dividends, and periodically rebalance your portfolio.

Below is a sample portfolio that Sarwa creates for investors. This portfolio contains stock ETFs diversified across markets (US, developed, and emerging), bond ETFs diversified across markets (US, global), and REITs ETF.

Each portfolio also has an allocation formula (in this case, 88.3% in stocks, 6% in bonds, and 4.8% in REITs) which reflects the risk tolerance level of the investor (in this case, a growth investor).

Importantly, Robo-advisors help investors practice passive investing while overcoming the temptation to time the market, thus avoiding emotional investing.

With Robo-advisors, you’ll have ready access to a structured portfolio that maximizes your return and minimizes your risk.

All you need is to keep adding more money into that portfolio and watch your money grow within your chosen ETF allocation. This is how to build wealth from nothing.

[Learn more about investment portfolios by reading “Building an Investment Portfolio from Scratch: The Ultimate Guide]

Takeaways

If you have ever wondered how to build wealth from nothing, understand that it is not rocket science. You can do it. Just focus on:

- Educating yourself about money

- Getting a stable income and earning passive income on the side

- Minimizing your expenses so you can save more money

- Protecting your money with insurance and emergency fund

- Passively investing your savings in stock ETFs, bond ETFs, and REITs ETFs

- Automating your investments in a diversified portfolio with a Robo-advisor