In the world of investing, there are countless options available to maximise your returns. Investors are usually spoiled for choice when it comes to assets, including stocks, ETFs, REITs, cryptocurrencies, and even CFDs.

But how do you know which asset is the right investment choice for you? In this article, we will primarily explore the key differences when it comes to CFDs vs stocks, helping investors make informed decisions about where to invest their hard-earned money.

Whether you are a seasoned investor or just starting out, it’s important to understand the risks and rewards of stocks and ETFs compared to CFDs.

Here, we’ll cover:

- Definition and understanding of CFDs vs stocks vs ETFs

- Volatility and risk

- Ownership

- Costs

- Liquidity and transparency

- Regulatory environment

- Making an informed investment decision

[Stay Informed! Don’t miss out on the latest updates, expert insights, and exclusive content. Subscribe to our newsletter now for a regular dose of valuable information delivered directly to your inbox.]

1. Definition and understanding of CFDs vs stocks vs ETFs

To understand the differences between CFDs vs stocks vs ETFs, we’ll first need to know exactly what each of these assets are.

- CFDs

A Contract for Difference (CFD) is a highly volatile and complex financial instrument that allows investors to speculate on the price movement of underlying assets, such as a stock, commodity, index, or currency, without actually owning the asset itself. When trading CFDs, investors enter into a contract agreement with a broker to exchange the difference in the asset’s value between the time the contract opens and closes. CFDs are commonly used by experienced investors looking to make bets for short-term trading strategies.

- Stocks

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company’s assets and earnings. The value of a stock is determined by the performance of the company, market conditions, and investor sentiment. Investors can profit from stocks through capital appreciation (when the stock’s price increases) and dividends (a portion of the company’s earnings distributed to shareholders).

[To know more about what is a stock, read our article “What are stocks and bonds?”]

- ETFs

ETFs, or Exchange Traded Funds, are investment funds that are traded on stock exchanges, similar to stocks. ETFs provide investors with exposure to a diversified portfolio of assets, such as stocks, bonds, commodities, or a combination of these. ETFs offer the convenience of trading like a stock while providing investors with diversification benefits. They are designed to track the performance of a specific index or sector, allowing investors to gain exposure to a broad market or specific industry without having to buy individual stocks.

2. Risks of CFDs vs stocks vs ETFs

- What are the risks of CFD trading?

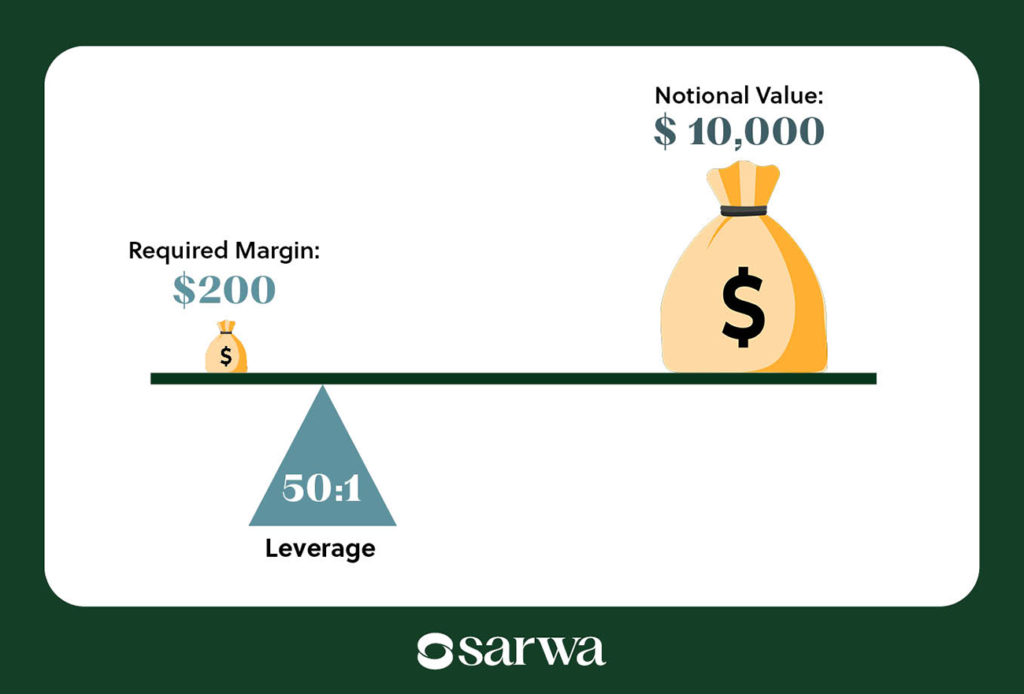

Many CFD brokers consider high leverage to be one of the main advantages of CFD trading.

Why?

Because with leverage, investors can control a larger position in the market with a smaller initial investment. This allows for potentially higher returns on investment, as gains are calculated on the full value of the position, not just the initial investment.

Having a high degree of leverage is a double-edged sword though. While CFDs can amplify gains, that also means they can magnify losses- and in some instances, losses that surpass your initial investment amount.

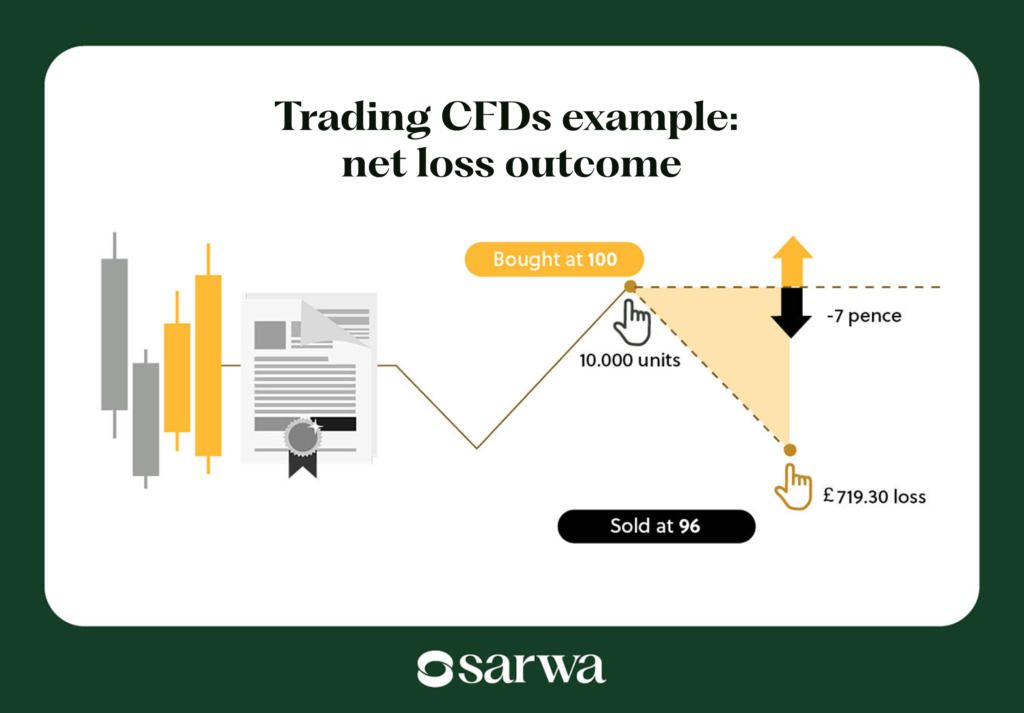

To understand this better, let’s take a look at how CFDs work.

So we know that CFDs work by creating an agreement between a trader and a broker to exchange the difference in the value of an asset from the time the contract opens to when it closes. This means that traders do not actually own the underlying asset, but rather speculate on its price movements.

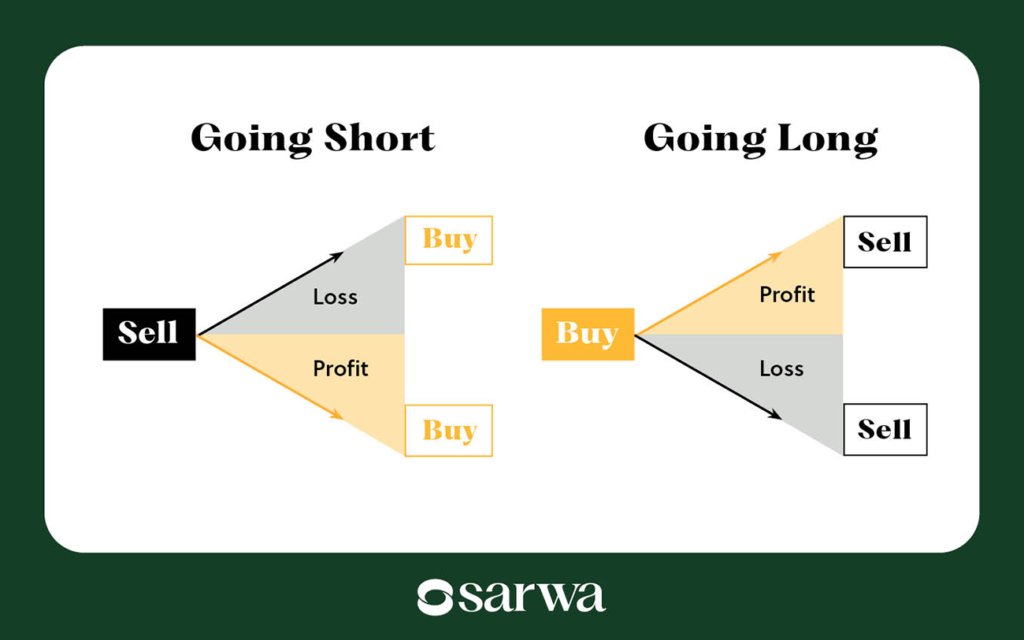

When trading CFDs, investors can take either a long (buy) or short (sell) position. A long position means that the trader expects the value of the asset to increase. While a short position means that they expect it to decrease. If the trader’s prediction is correct, they can profit from the price difference.

Consider this illustrative example:

Imagine you are a trader who decides to open a CFD position on a popular technology stock, XYZ Inc., which is currently trading at $100 per share. You invest $500 in XYZ, and you believe the stock’s price will increase.

However, since CFDs are leveraged products, you only need to deposit a fraction of the total position value as margin. Let’s say the margin requirement for this trade is 10%, meaning your $500 is a reflection of 100 CFDs at a total value of $10,000.

Scenario: The market moves 10% against your position

Unfortunately, your prediction doesn’t come true (womp, womp), and the market turns against you. The value of XYZ drops by 10% to $90 per share. Since you bought 100 CFDs your total position value is now $9,000 ($90 x 100 CFDs).

Now, let’s calculate the loss.

Initial investment: $500

Initial position value: $10,000

Position value at close: $9,000

Position value difference: -$1,000

Money you owe: $500

Here’s the important point to note: Since CFDs amplify your exposure to the market, your actual loss is not just limited to your initial investment of $500. Instead, you incur an additional loss of $500, double your initial investment, and you also now owe your CFD broker $500.

And yes, there is an alternative version of this where your price prediction is successful, and instead of the loss, you’ve made some big and rapid gains.

But keep in mind that high-leverage CFD trading is risky business. According to Finder UK, between 65%-84% of retail investor accounts lose money when trading CFDs.

Those odds are difficult to swallow, but it does get worse considering you could also lose more than just your initial investment because of how volatile CFDs are.

- Risks and volatility of stocks and ETFs

When trading stocks or ETFs, it’s important to note that you are not trading on margin. You buy the shares outright, and there are no margin requirements. This means that you have full control over your investments and don’t have to worry about margin calls or the risk of losing more than your initial investment.

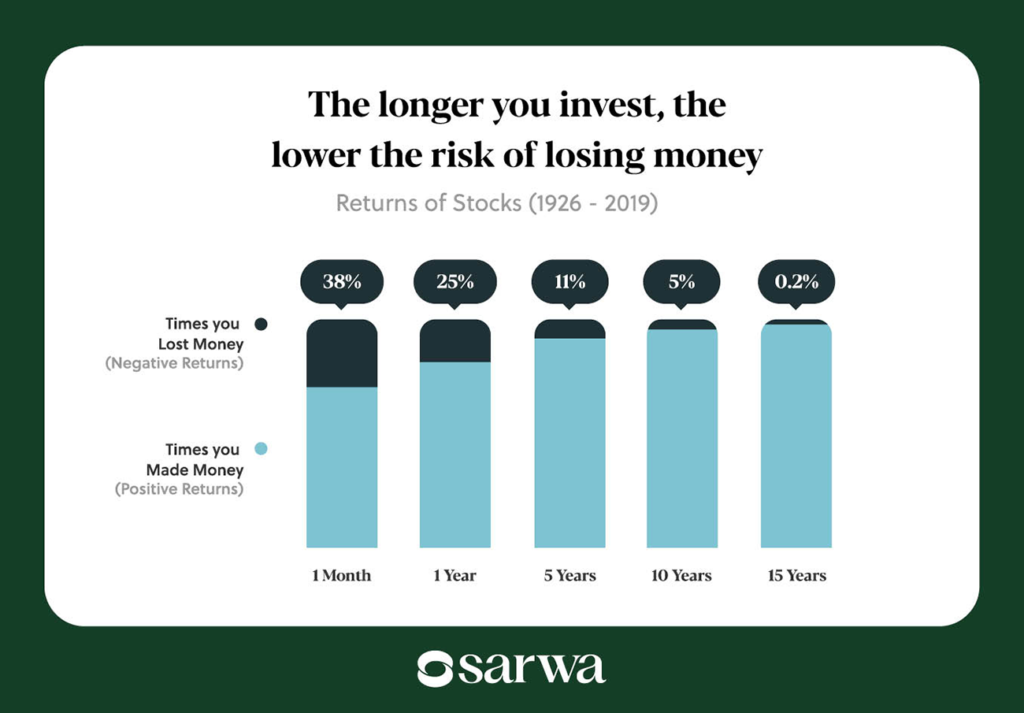

Time horizon

When comparing the risks and volatility of CFDs with other assets like stocks and ETFs, you should also consider an asset’s time horizon. CFDs are primarily designed for short-term trading, but is the same true for stocks or ETFs?

One of the key advantages of investing in stocks and ETFs is the flexibility they offer to cater to different investing time horizons. They can be utilised by a variety of investors for both the short-term and the long-term. Some investors may engage in day trading, taking advantage of short-term price fluctuations. On the other hand, many investors adopt different long-term approaches, holding stocks or ETFs for years. This diversity in investment strategies allows investors to tailor their approach based on their individual goals and risk tolerance.

[To learn more about how to make money trading, read our ultimate guide here.]

Employing short-term strategies for stocks comes with its own set of risks, including potential market volatility, sudden price fluctuations, and not to mention the stress of active monitoring and quick decision-making. However, long-term investing in these assets often diffuses risk over a longer timeline. By holding stocks for years, investors can take advantage of the benefits of compound interest and ride out short-term market fluctuations. Research shows that this allows for a more stable and potentially higher return on investment in the long run.

In simple terms, the more time you spend investing in the market through stocks, the higher the potential for wealth building. This can also be true for ETFs.

Diversification

When it comes to investing, diversification is often touted as a key strategy for minimising risk. It involves spreading investments across different asset classes, sectors, and regions to mitigate the impact of any single investment’s poor performance. One asset class that offers inherent diversification benefits is the Exchange-Traded Fund (ETF).

ETFs are investment funds that trade on stock exchanges, just like individual stocks. They are designed to track the performance of a specific index, such as the S&P 500 or the FTSE 100. What sets ETFs apart from other investment options is their ability to provide instant diversification. By investing in an ETF, you gain exposure to a basket of different stocks, bonds, or other assets, depending on the fund’s objective.

This diversification inherent in ETFs acts as a potential safeguard against volatility. Since an ETF holds a range of assets, any negative impact on one particular stock or sector is likely to be offset by the positive performance of others within the same fund.

To help you understand this better, think of the idiom “Don’t put all your eggs in one basket.” If one basket carries all your eggs, then there’s a higher chance you could “break” all of them, say if you trip and fall. An ETF means putting your eggs in different types of baskets, thereby helping you diversify, and reducing your risk of losing all your “eggs” so to speak.

This diversification helps smooth out an investment’s overall returns and reduces the risk of significant losses due to the poor performance of a single investment.

So while ETFs create more of a hedge against the volatility of the market than stocks, both of these assets aren’t in the same ballpark as CFDs. Stocks and ETFs offer a wide range of investment opportunities and diversification options. With CFDs, the investment options are limited to the assets offered by the CFD provider.

Furthermore, CFDs carry lots of risk in ways that aren’t readily seen by retail investors. But, for some seasoned investors who do choose to make trades with CFDs, they must be willing to lose the money they are “betting.”

3. Ownership

Ownership of assets is an important consideration for investors, as it determines their rights and control over the investments they make. One of the key differences between CFDs vs stocks vs ETFs is this ownership. In the following section, we will explore the concept of ownership and its implications.

When trading CFDs, you do not actually own the underlying assets. Instead, you enter into a contract with a CFD provider to speculate on the price movement of the asset.

In contrast, when you buy stocks or ETFs, you actually become a partial owner of the company. This ownership grants you certain rights, such as voting rights and the potential to receive dividends. Additionally, you have the ability to hold the stocks for the long term, benefiting from any potential growth in the company’s value over time.

Since investors do not own the underlying assets of CFDs, they are left to rely on the financial stability of unregulated brokers and providers. Very often, these exchanges are not regulated and have no way to account for the protection of retail investors’ assets in the case they become insolvent. Meaning that many investors can suffer losses. The risk of this lack of ownership is called counterparty risk.

Stocks and ETFs do not carry the same counterparty risk since you become a shareholder in a company or a fund. Your investment is not dependent on the financial stability of a specific provider. This provides a level of security and peace of mind for investors.

4. Costs

When comparing the costs of trading CFDs with stocks or ETFs, it’s important to consider several factors. Here are some key points to keep in mind:

- Spread and Commission Fees:

When trading CFDs, one of the main costs to consider is the spread, which is the difference between the buying and selling price of an asset. CFD providers typically charge a spread on each trade, and this can vary depending on the asset and market conditions. In addition to the spread, some providers may also charge commission fees for each trade. These rising costs can add up and significantly change the overall cost of trading, reducing the potential profitability of the overall investment.

On the other hand, when trading stocks or ETFs, you may also encounter spread costs, but they are generally much lower compared to CFDs. Some brokers may charge a fixed commission fee per trade, over or under 1%, but they typically have lower costs associated with them, making them a more cost-effective option for investors. It’s important to compare the costs among different brokers to find the most cost-effective option.

- Overnight Financing Charges:

Another cost to consider with CFD trading is overnight financing charges. If you hold a CFD position overnight, you may be charged a fee for the financing of the leveraged position. These charges can eat into your profits if you keep your positions open for an extended period.

With stocks and ETFs, there are typically no overnight financing charges. Once you buy the shares, you own them outright, and there are no additional costs for holding them long-term.

This, in addition to the high leverage of CFDs that we went over earlier, can make for quite a pricey investment, sometimes forcing investors to pay for unaccounted costs and losses.

5. Liquidity and transparency

- Liquidity and Market Access (CFDs vs stocks)

Stocks are generally more liquid than CFDs. This means that it is easier to buy or sell stocks at any given time as there is usually a large pool of buyers and sellers in the market. On the other hand, the liquidity of CFDs can vary depending on the specific contract and the underlying asset. Some CFD markets may be less liquid, making it harder to enter or exit positions quickly.

In terms of market access, stocks are typically traded on regulated exchanges, such as the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE), which provide transparency and oversight. CFDs, conversely, are usually traded over-the-counter (OTC) through brokers. While this may provide some flexibility in terms of trading hours and access to a wide range of markets, it also means that there is less regulatory oversight and transparency compared to stocks.

- Liquidity and Transparency (CFDs vs ETFs)

Another advantage of ETFs over CFDs is their liquidity and transparency. ETFs are traded on stock exchanges, just like individual stocks, which means they can be easily bought or sold at market prices throughout the trading day. This provides investors with flexibility and the ability to enter or exit their positions whenever they choose.

In contrast, CFDs are traded through brokers, and the liquidity of these contracts can vary. Depending on the broker and the specific CFD, liquidity may be limited, especially for less popular or illiquid assets. This can result in wider bid-ask spreads and potentially higher trading costs compared to ETFs.

Furthermore, ETFs are required to disclose their holdings on a daily basis, allowing investors to know exactly what assets they own. This transparency provides investors with the ability to make informed decisions based on the underlying assets of the ETFs.

Moreover, the lack of transparency in CFDs and their complex and opaque pricing structure can make it difficult for investors to assess the true value of the asset. Unlike stocks or ETFs, where investors can analyze financial statements and company performance to determine the intrinsic value of the asset, CFDs rely solely on price speculation. This speculative nature of CFDs can make it challenging for investors to make informed decisions based on fundamental analysis.

6. Regulatory environment: CFDs vs stocks vs ETFs

One crucial aspect to consider when investing in any asset is the regulatory environment surrounding it. In this regard, there are notable differences between CFDs, stocks, and ETFs.

Stock Regulation

Stocks, being traded on regulated exchanges like the New York Stock Exchange or London Stock Exchange, are subject to stringent regulatory oversight. These exchanges ensure transparency, fairness, and investor protection. Companies listed on these exchanges must adhere to strict reporting and disclosure requirements, providing investors with valuable information to make informed decisions.

ETF Regulation

ETFs, being traded on stock exchanges as well, also benefit from the regulatory framework that governs stock trading. They are subject to similar transparency and reporting requirements, and their holdings are disclosed daily. This allows investors to have a clear understanding of the underlying assets held by the ETF and make informed investment choices.

CFD Regulation

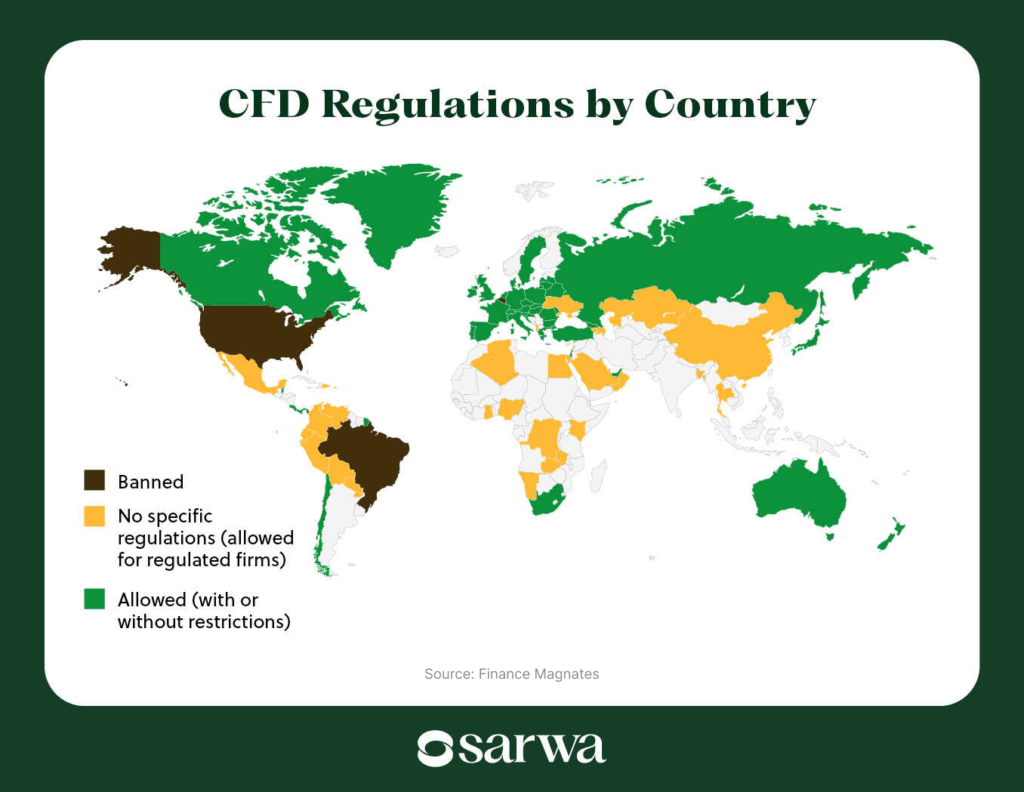

CFDs are predominantly traded over-the-counter (OTC) through brokers. The lack of a centralised exchange for CFD trading can expose investors to potential risks, such as counterparty risk and price manipulation. The regulation of CFDs varies across different jurisdictions, and in some regions, there may be a lack of robust regulatory frameworks. This can leave investors vulnerable to fraudulent practices or inadequate investor protection measures.

Important to note: The US Securities and Exchange Commission (SEC) has restricted the trading of CFDs in the US.

7. Making an informed investment decision

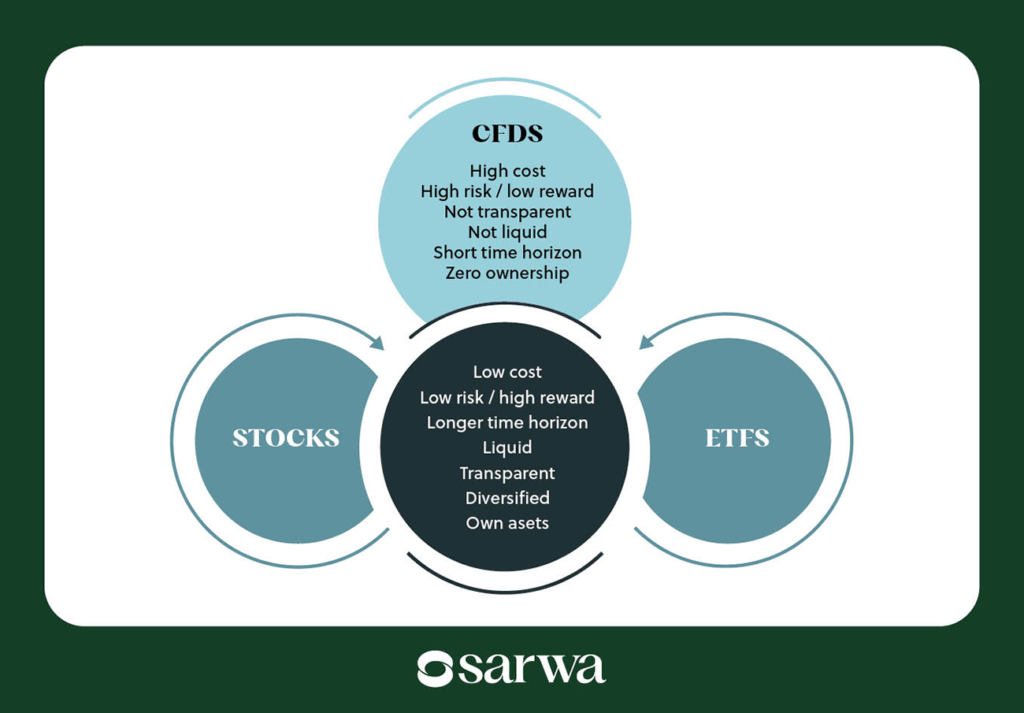

In conclusion, while CFDs offer certain advantages such as leverage and the ability to trade on various markets, they also come with significant disadvantages compared to other assets like stocks or ETFs. It is important for investors in and outside of the MENA region to be aware of these risks before engaging in CFD trading.

One of the main disadvantages of CFDs is the high level of risk involved.

Due to the leverage factor, investors can potentially lose more than their initial investment. This is particularly concerning for inexperienced or small investors who may not fully understand the risks or have the financial capacity to absorb potential losses.

Another disadvantage is the lack of ownership or voting rights in the underlying asset. Unlike stocks or ETFs where investors have ownership in a company or a basket of assets, CFDs are merely contracts which derive their value from an underlying asset. This means that investors do not have the same rights and benefits as traditional shareholders, such as receiving dividends or participating in company decisions.

Moreover, CFDs are often subject to higher fees and commissions compared to other assets. Brokers may charge additional fees for holding positions overnight or for executing trades, which can eat into potential profits. In contrast, stocks and ETFs generally have lower transaction costs, making them more cost-effective for long-term investors.

Lastly, CFDs are highly influenced by market volatility and can be affected by factors such as economic news, political events, or even rumours. This volatility can lead to sudden and significant price fluctuations, making it difficult

[Now that you know the advantages and disadvantages of CFDs compared to stocks and ETFs, maybe it’s time to start your own investment journey. Register on Sarwa or learn more about how we meet all your investment needs in one platform.]

Key Takeaways:

- CFDs offer certain advantages like leverage and market variety, but these advantages also come with significant risks compared to stocks or ETFs.

- The high level of risk in CFD trading can lead to potential and even unaccounted losses.

- CFDs do not provide ownership or voting rights in the underlying asset, unlike stocks or ETFs.

- CFDs often have higher fees and commissions, while stocks and ETFs generally have lower transaction costs.

- CFDs are highly influenced by market volatility and can be affected by economic news, political events, or even rumours.