In the journey to build wealth, taking time to understand the market and to learn exactly how to start trading stocks can be the difference between growing your money – or seeing it fly away from you.

Popular estimates say that about 90% of all stock traders lose money in the market, according to Research and Ranking, a stock market research blog.

These loses are ultimately because a few common errors:

- Entering the stock market without a strategy

- The fear and greed cycle

- Following the crowd

- Using a trading platform that is wrong for you

- Failing to manage risk

Then there is this familiar story: A friend enters into the stock market after hearing about one successful trader or another without recognising that for one such successful and popular trader, there are at least nine others who are losing money in the market.

Just like smart investing – which requires staying in the market for the long term – smart trading has its own requirements and best practices. By landing on this page, you have already shown interest in spending the time to learn how to trade in the stock market – and that is an important first step.

In this article, we will cover all you need to know about stock trading by highlighting key practices you must embrace to improve your chances of success. We will cover:

- Understand how the stock market works

- Create a trading plan

- Practice and improve your trading plan

- Select a trading platform

- Open an account

- Create buy and sell orders based on your plan

- Measure your performance

[Do you want to start trading in the UAE? Sarwa Trade is a platform where you can buy and sell stocks, ETFs, and crypto with transfer funds from your bank to your trading account at zero fees. Register for Sarwa Trade now or learn more about the benefits it provides by getting in touch with us.]

1. Understand how the stock market works

Investment in knowledge, they say, pays the highest dividends. Or as Warren Buffett puts it, “The most important investment you can make is in yourself.”

Reading this article is a good first step towards equipping yourself about the inner workings of the stock market. However, this can only be a beginning.

The stock market is a world in and of itself and succeeding in it – through investing or trading – requires a deep knowledge of how it works. For example, you have to know what a stock is, what a stock exchange is, why the US is the most important stock market, what causes the stock price to move up or down, among other details. In this blog, you will find many articles answering these questions and many others.

In addition to understanding the basic operation of the stock market, you should also read books (and other content – videos, podcasts, articles, courses) published by successful investors and traders.

Nothing will replace this initial hard work of understanding how the stock market works and what characterises successful operators of the market in contrast to those who fail. Like a wise person once said, it is by digging deep that you will find gold.

2. Create a trading plan

Warren Buffett has attributed the failures of many investors to the fear and greed cycle.

That applies to traders as well. Many have the bad habit of buying stocks because everyone is making money off it at one point and they feel impelled to join the bandwagon (greed). Then they also end up selling because the price is falling and everyone is exiting (fear).

This group thus ends up buying at a high price (by the time the stock is popular, demand has already driven the price up) and selling at a lower price (once the bubble has burst). This is why Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund, has said that “the average man … tends to buy high and sell low.”

Jim Cranmer, the former manager of Cramer and Co., a hedge fund, and the popular host of Mad Money, has no mercy for such people, saying that “the people who are buying stocks because they’re going up and they don’t know what they do deserve to lose money.”

Therefore, learning how to trade in the stock market requires that you have a trading plan instead of just jumping on various bandwagons.

An ideal stock trading plan will have various components, including:

What stocks to buy (fundamental analysis)

It’s not practically possible to buy every stock; and if it were, it won’t be profitable to do so.

Consequently, you must decide on the criteria that a stock must meet before you can buy it.

This will include the level of liquidity that the stock needs to have (how many people buy and sell it within a period), the volatility (how slow or fast the price rises or falls), the earnings potential (whether the stock can significantly grow its share price in the future), and the condition of the company’s balance sheet (especially its debt in relation to its assets).

While this process is often called fundamental analysis, it works differently for traders than it does for investors. Investors tend to be more concerned about long-term factors that will affect the long-term price of the stock, while traders tend to be concerned about short-term movements (in an hour, a day, or few weeks from now).

However, not all traders have to have short-term perspectives, and it can pay to learn to trade individual stocks for their long term advantages just like investors do when they hold ETFs. The main difference here lies in buying strategy, which we’ll discuss next.

Nonetheless, the most common type of trader will be more concerned about the daily trading volume of a stock (liquidity) than its long-term debt as a proportion of its assets (debt-to-asset ratio), its volatility more than its long-term competitive advantage, where current news is driving the price rather than where earnings is driving it.

The key here is to decide on which factors are most important to you and then create a checklist that will show you whether a stock qualifies or not. In creating your checklist, you can glean insights from other successful traders. However, instead of just copying one person’s strategy, you should also learn from many and take what you consider to be their best ideas in creating your own strategy.

When to buy (technical analysis)

After deciding what to buy, you must have a strategy that tells you when to buy a stock.

This is at the heart of technical analysis, which is arguably the most important part of learning stock trading for beginners (as well as for advanced traders).

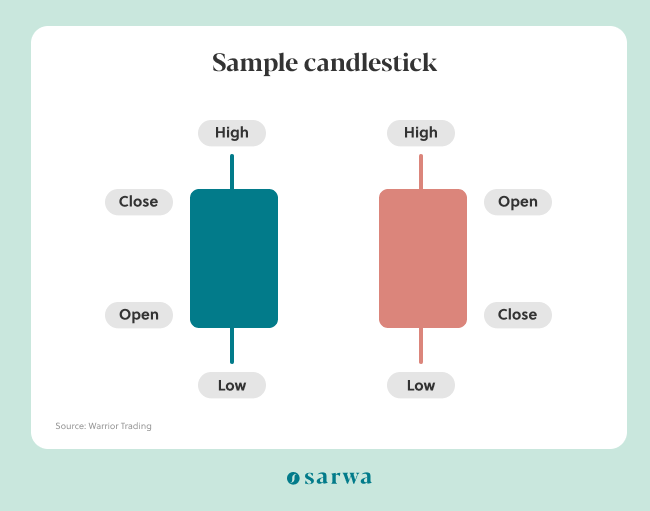

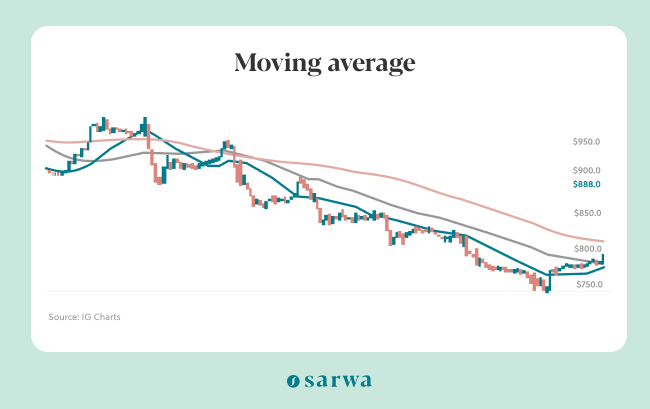

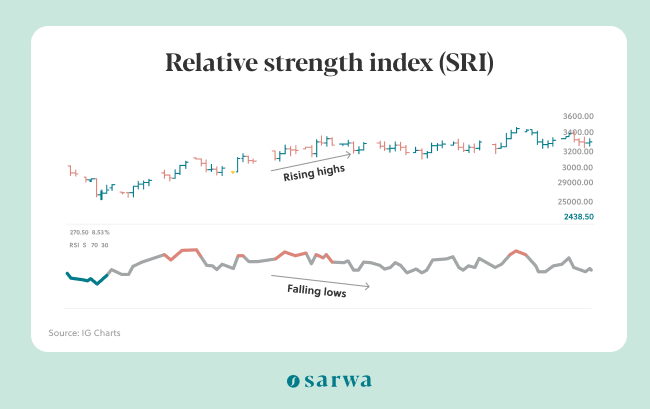

Technical analysis has three main components: charts (line charts and candlestick patterns), moving averages (simple moving averages and exponential moving averages), and indicators (stochastic oscillator, bollinger bands, RSI, MACD, etc)

Sample moving average

Sample indicator: Relative Strength Index (RSI)

[To learn more about technical analysis, read “How To Make Money Trading Stocks: The Ultimate Guide”]

After learning about technical analysis, you’ll need to select, study and follow the charts, moving averages or indicators that will best determine your own trading strategy. No one can use all this info. Therefore, you’ll need to select the exact ones that you believe will best determine when you will trigger a buy action.

While you should avoid being over-comprehensive (using too many charts, moving averages, and indicators), you must aim to be comprehensive enough in your studies.

What chart pattern, moving average, indicator (or how many) you consider are all up to the individual trader – and every trader and trading house has their own method.

Again, traders typically learn from other successful traders, gain insights from them, and put all of that knowledge together when determining a strategy.

When to sell (risk management)

You can either sell a stock to make a profit or to cut off your loss. The process of determining when to take a profit or cut off your loss is part of what is called risk management.

Risk management is crucial because according to Buffett, “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.”

While it is near impossible not to lose money in trading, the important goal is to win more than you lose and to gain more money in a win than you will lose in a loss. In essence, good risk management can help you minimise your losses while maximising your gains.

The first component of risk management is deciding what portion of your overall capital will go into a particular trade.

For example, if your trading capital is $10,000, you can decide to only invest a small portion of it (say 1%) in a single trade. This will lead to what is called diversification. That is, instead of using $10,000 to execute say four big trades (at $2,500 each), you can use the same amount to do 100 trades (at $100 each, which is 1% of $10,000). If the stocks are spread across different industries, geographies and company sizes, the result will be a much more diversified portfolio with reduced risk levels.

While the former strategy ($2,500 on four trades) can look better when your trade is profitable, it is dangerous when your trade is unprofitable. And since, according to Buffett, preserving your capital is key, ensuring that you don’t lose it all when your trade goes south is more fundamental. Therefore, by executing 100 trades instead of 4, you minimise your risk (in the former, 4 losses means you are out; in the latter, there are still 96 trades to cover for the two losses).

The second component of risk management is knowing when to get out of a trade.

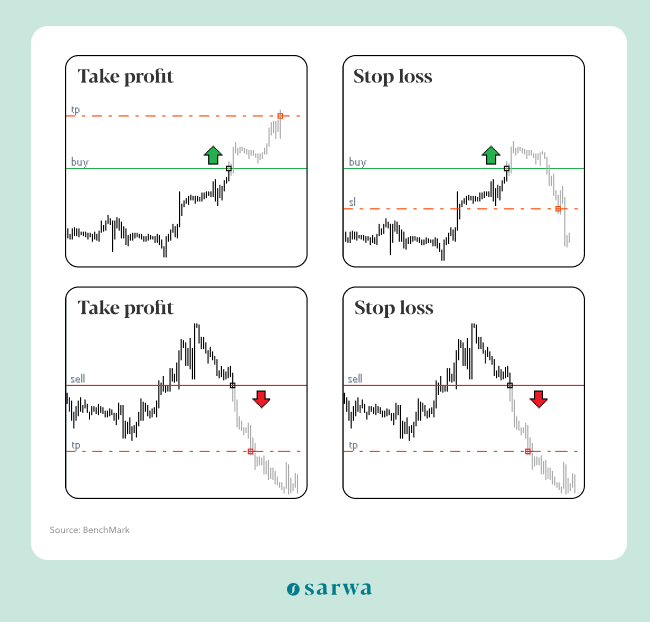

Even if you are making a profit, you might still need to get out of the trade if you believe the profit is unsustainable and the market is due for a correction. Greed in this situation can turn great profit to losses. Many traders decide to take profit (close a profitable trade) once they have made 150%-300% of the initial cost of entering the trade ($150-$300 for a $100 trade), according to The Balance.

Source: BenchMark

Conversely, you must also know when to get out of a losing trade to avoid further losses.

A heady belief that the losses will stop and the market will correct itself can lead to a total erosion of your capital. Therefore, you must know when to count (and cut) your losses on a losing trade.

Traders differ greatly in strategy when it comes to taking profit and cutting short their losses. Consequently, you must decide on your strategy by deriving wisdom from the experience of successful traders.

3. Practice and improve your trading plan

Once you have decided on your trading strategy, you must test its effectiveness before you put in large capital and start trading stocks. Learning how to start trading stocks successfully requires that you practice your trading strategy, analyse its profitability, and improve it where necessary.

You can practice by doing demo trading (trading with virtual money) or fractional trading (trading with small amounts real money). The former does not involve any risk or any profit or loss for you. However, this might discourage you from taking it seriously enough.

Fractional trading, which is available on Sarwa Trade, is another way to test run a strategy, but with some skin in the game. With this app, you can buy and sell actual stocks with actual money but instead of buying say 10 shares of a stock, you can buy only a small fraction (say 0.1). Since any profit or loss made involves actual money, you might be more serious with the whole process of testing and improving your trading strategy.

Whichever one you choose, the key is to get feedback on the profitability of your trading plan and improve upon it. Remember that the goal is to win more than you lose and to ensure that a win brings in more money than your losses will take.

4. Select a trading platform

The trading platform you use will also affect the success of your stock trading plan.

How so?

The first point to consider is fees/commissions. Commissions over 1% that any trading platform charges you for buying or selling is a reduction in your profit. A 5% trading fee means a 10% reduction on your profit for every profitable trade (buying and selling) or a 10% increase in your loss for a losing trade.

According to Investopedia, the average online brokerage charges $10 for an average trade. If you open and close 20 trades in a month, that’s $400 commission for 40 transactions.

Therefore, you are better off with a trading platform with as low a commission as possible.

At Sarwa Trade, you can buy and sell stocks and ETFs at 0.25% commission. Unlike other platforms, you can save money on fees and trade as frequently as your trading strategy requires.

In addition to fees, trading platforms also differ by local transfer fees (the cost of transferring funds from your local bank account to the trading platform), security (of money and data), trading aids (stock market news and reports, information about stocks), number of stocks on offer, and the type of orders you can create (market, limit, stop).

A platform like Sarwa Trade has zero local transfer fees; uses bank-level security; provides news, reports, and comprehensive stock profiles; provides access to more than 5,000 stocks, ETFs, and crypto; and allows all three types of stock orders.

The goal here is to choose a trading platform that provides the best value for money for your unique strategy.

5. Open an account

Once you have decided on a trading platform, the next step to start stock trading for beginners is to open an account with that platform.

This process should be as seamless as possible so you can quickly get to start trading stocks.

This – seamless account opening – is exactly what Sarwa Trade provides.

You can easily download the app on Google or Apple, register an account in a few minutes, and start stock trading in no time. Stock trading for beginners should not be stressful and Sarwa Trade ensures that it is not.

6. Create buy and sell orders based on your plan

Now that you have a stock trading account and have funded it with the necessary capital, you can start creating buy and sell orders based on your trading strategy.

There are three buy and sell orders you can create:

- Market order: With this, you buy or sell a stock at the current price at which it is trading.

- Limit order: With a limit order, you will set the maximum price beyond which you are not willing to buy or a minimum price below which you are not willing to sell. Once the price is at that maximum (or less) or minimum (or more) price, the order will be completed.

- Stop order: Here, the price you set is a fixed (rather than maximum or minimum price). The order will only be completed when the market price equals the price you have set.

Because of the need to take profit or cut losses at specific prices or range of prices, traders generally use more limit and stop orders rather than market orders.

Again, everything you do in stock trading should follow from your trading plan. This is the key lesson to take away in learning how to trade in the stock market.

7. Measure your performance

What is not measured does not get improved.

So, keep an eye on the performance of your portfolio as a way to evaluate your current trading strategy. If it’s making more profit than losses, keep it and look for ways to improve it without reducing its performance. On the other hand, if it is making more losses than profit, you might need to tweak it or abandon it completely.

Performance should always be the standard by which you evaluate every trading plan. Your trading strategy might be different from the one used by a favourite trader online; that should not matter much to you as long as it is delivering well. The goal is not to be like someone else but to do what works best for you consistently.

Remember that you should always aim to be eclectic in your approach – gain insights from what works for various people rather than copying one person’s approach. That insights-gathering instinct must never cease in the quest to learn how to start trading.

[Are you ready to create wealth by trading stocks successfully in the UAE? Register for a Sarwa Trade account for free and secured stock trading or get in touch with us to learn more about how to start trading stocks.]

Takeaways

- To succeed at stock trading, you must understand the fundamentals about the stock market.

- To avoid the failures of those who fall into the fear-greed cycle, you must have a tested and trusted trading plan before you commit your funds to stock trading.

- The trading platform that you select will also have impacts on your ability to succeed at trading.

- Successful stock trading requires measuring your performance and adjusting your trading strategy to improve performance.